Titan Mining Announces Phase III Metallurgy Results and Outlines Plans for Natural Flake Graphite Processing Facility in New York State

Titan Mining Corporation (TSX: TI) is pleased to announce the Phase III metallurgy results conducted at SGS Lakefield for the Kilbourne graphite project. The Company is also excited to be outlining parameters of a processing facility for Kilbourne natural graphite mineralized material, to be co-located with the Company’s existing zinc operations at Empire State Mines. This initiative aims to fast-track development of Kilbourne and make ESM the first end to end producer of natural flake graphite in the United States since the 1950s.

Highlights:

- Process optimization completed indicating favorable characteristics of material with low impurities, high recoveries, final concentrate of 98.8% C(t) and saleable product

- Simplified process sheet developed which provides potential synergies with existing ESM mill circuit

- Size fraction analysis shows good flake size distribution with the potential to deliver to available US domestic segments and value-added products. Ability to meaningfully meet current US natural graphite demands

- Engineering for the Facility is in final stages of completion targeting 1,000-1,200t per annum of concentrate production for product qualification and to be used as path towards commercialization. The Facility aims for modular expansion to baseline production of 40,000t per annum with further growth capability

- Goal to make ESM the first end to end producer of natural flake graphite in the USA with target Facility start in 2025. Significant ability to leverage existing ESM infrastructure and work force lowering capital and operating costs

- Key product group applications identified ranging from core areas such as semiconductors, batteries (CSPG anodes), military specification graphite and battery storage to mainstream applications such as lubricants, polymers and coatings

Don Taylor, CEO of Titan commented: “We are pleased with the Phase III test results demonstrating potential closed-circuit recoveries of 90%+ and high-grade concentrate product from Kilbourne. The current resource outlined at Kilbourne represents only 8,300 ft of strike length tested of a total strike length of 25,000 ft. Kilbourne has significant resource expansion potential to meet the demands of US natural flake graphite over a long- term period and we are excited to be moving towards the next phase of development”.

Rita Adiani, President of Titan commented: “The Phase III test results and size fraction analysis provides us with useful product data as we commence scoping out pricing and relevant US customer base for Kilbourne graphite. The Facility is the first step towards ESM becoming the first end to end producer of natural flake graphite in the United States and having the ability to secure supply chain resilience for our core industries such as semiconductors, military spec graphite and batteries whilst having domestic resources to support industrial uses which currently rely fully on imports. We are excited by current developments as we surface more shareholder value through organic growth”.

Phase III Metallurgy Results and Proposed Flow Sheet

A process optimization program was recently completed at SGS Minerals in Lakefield, Ontario. The samples that were used for the optimization program included a total of 118 mineralized intervals from drill holes KX23-001, KX24-002, KX24-003, and KX24-004. The drill core intervals were divided to generate four (4) variability composites, namely North Shallow, North Deep, South Shallow, and South Deep. Further, sub-samples of all 118 drill core intervals were combined to produce a Master composite for optimization testing. Once optimization testing was completed, the variability samples were subjected to the optimized flowsheet and conditions to confirm its robustness.

Total grade and graphitic head grade for the Master composite and the four variability composites are presented in Table 1. Graphitic carbon grades were only slightly lower than total carbon grades, which suggests low concentrations of organic and carbonate carbon in the samples.

Table 1: Head Grades of Master and Variability Composites

| Composite | Assays (%) | |

| C(t) | C(g) | |

| Master | 3.48 | 3.14 |

| North Shallow | 3.38 | 3.21 |

| South Shallow | 3.51 | 3.28 |

| North Deep | 2.87 | 2.68 |

| South Deep | 3.57 | 3.25 |

Notes: C(t): Total Carbon C(g): Graphitic Carbon

A total of eight (8) cleaner flotation tests were completed. Process variables that were evaluated included flash/rougher circuit configuration, primary grind size, regrind technologies and the number of regrind steps. A standard reagent suite consisting of diesel and methyl isobutyl carbinol (MIBC) was chosen since it was effective in previous programs.

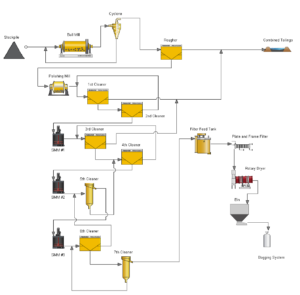

The optimization program produced the flowsheet that is depicted in Figure 1. The flowsheet comprised a primary grind to P80 = 100 microns followed by rougher flotation. The rougher concentrate is upgraded in a cleaning circuit consisting of one polishing mill and three stirred media mills (SMM) followed by cleaner flotation after each regrind step. The final concentrate is dewatered, dried, and then bagged.

Figure 1: Simplified Facility Flowsheet

The last master composite test with the optimized conditions (Test F8) produced a final concentrate of 98.8% C(t) at an open circuit graphite recovery of 87.3%. This recovery is expected to increase during commercial operation since intermediate tailings streams are cycled rather than being treated as final tailings. A closed-circuit graphite recovery of 90-91% is projected based on the graphite losses to intermediate tailings streams.

The four variability flotation tests produced concentrate grades between 97.6% C(t) for the North Shallow and 99.3% C(t) for the South Deep composite. The open circuit graphite recovery ranged between 82.3% for the North Shallow composite and 92.4% for the North Deep composite. These results are well aligned with the Master composite and confirm the consistent metallurgical performance of the Kilbourne graphite mineralization and the robustness of the proposed flowsheet and conditions.

The final concentrates were submitted for a size fraction analysis to quantify the flake size distribution and total carbon grade profile. The results are summarized in Table 2.

Table 2: Size Fraction Analysis of Final Concentrate of the Master and Variability Composites

| Product Size (Mesh) |

Master | North Shallow | North Deep | South Shallow | South Deep | |||||

| Mass (%) |

% C(t) |

Mass (%) |

% C(t) |

Mass (%) |

% C(t) |

Mass (%) |

% C(t) |

Mass (%) |

% C(t) |

|

| 100 | 8.2 | 98.1 | 2.2 | 95.1 | 8.3 | 96.9 | 3.8 | 96.5 | 9.2 | 97.4 |

| 150 | 11.7 | 98.9 | 6.9 | 97.9 | 12.4 | 99.2 | 9.5 | 99.7 | 10.1 | 99.4 |

| 200 | 26.0 | 99.1 | 22.7 | 97.8 | 24.3 | 99.0 | 24.2 | 98.2 | 22.1 | 99.3 |

| -200 | 54.1 | 99.2 | 68.2 | 97.7 | 55.1 | 99.1 | 62.5 | 98.6 | 58.6 | 99.3 |

The Facility

Titan is in the final phases of completing engineering in respect of the Facility. The Facility is expected to produce 1,000-1,200t per annum of graphite concentrate and aims for modular expansion to baseline production of 40,000t per annum with further growth capability. The Facility will be fed Kilbourne mineralized material and will be co-located in the ESM mill area. It will benefit from leveraging personnel and infrastructure from the existing zinc ESM mill operations thereby reducing capital and operating costs.

The key objectives of the commercial demonstration facility are:

- Product qualification: Graphite concentrate being produced on a continuous basis will be used towards product qualification across various industry segments (as outlined below) and will form the basis for offtake discussions with potential US customers.

- Path to full scale commercialization: The Facility is the first step towards obtaining product at full run time which will allow ESM to establish customer demand and pricing thresholds. Subject to available product demand and funding, ESM is targeting a modular expansion to a 40,000t per annum facility.

As of 2024, the global market for natural flake graphite across the product segments the Company is targeting, was assessed to be 1.7 mt per annum. ESM is therefore well positioned to service global demands of natural flake graphite.

Based on available operating cost data for the Facility and pricing metrics across various targeted product groups, ESM is targeting a 40-45% operating margin for its full production facility of 40,000t per annum (based on an average sales price of US$2350/t).

Equipment for the Facility together with associated installation costs and working capital is likely to cost US$6.0-7.5 million. Titan has commenced work on various funding initiatives for this project.

Kilbourne Graphite Market Applications

The market applications for natural flake graphite production from the Facility comprise of the below key product groups. Strategic introduction timelines will be coordinated with the Facility production ramp up and customer qualifications. Micronized STD Purity (95.0% LOI MIN) products are planned to expand progressive qualifications and add to revenues and margins. Future high purity (99.9% LOI MIN) micronized graphite products are anticipated to further enhance both revenues and margins to the Company targeting primary and secondary batteries, medical device, military specifications and nuclear grade graphite.

Initial concentrate product applications from the facility will target thermal management, engineered products and lubricants followed by high-purity engineered products (including nuclear graphite) and energy storage products (battery- CSPG anode grades and primary alkaline).

Key customers for Micronized STD Purity graphite are expected to comprise producers of the following:

- Engineered Products: Ceramics, Friction, Carbon Brush, Seals, Bearings, Powdered Metal, Semiconductor –Siliconized Graphite Powders, MIL-SPEC Friction; SiC Armor, SiC Optics (SiC Grain Growth Surface Management)

- Lubricants / Dispersions: Grease, Dry Lubricants, HMF Dispersions, Nuclear Lubricants, MIL-SPEC

- Polymers, Plastics, Rubber: Automotive, Seals, Adhesives

- Energy Storage: Conductive Coatings, Solid Oxide Fuel Cells (SOFC / Pore Former Ceramic Surface)

Quality Assurance and Quality Control

All work and chemical analysis was conducted at SGS Lakefield in Canada, which is independent of the Company. This laboratory is ISO/IEC 17025 accredited, which ensures that the laboratory produces high-quality, accurate, and timely results. Repeat analyses of flotation products were completed as per the internal SGS QA/QC protocol. The QP is not aware of any factors that could materially affect the accuracy or reliability of the data referred to herein.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Mr. Oliver Peters, a Principal Metallurgist and President of Metpro Management Inc., with over 25 years of mineral processing experience. He is a Qualified Person within the meaning of NI 43-101 and is independent of the Company. Mr. Peters is satisfied that the metallurgical testing procedures and associated assay methods used are standard industry operating procedures and methodologies. He has reviewed, approved and verified the technical information disclosed in this news release, including core sampling, analytical and test data underlying the technical information.

About Titan Mining Corporation

Titan is an Augusta Group company which produces zinc concentrate at its 100%-owned Empire State Mine located in New York state. The Company is focused on value creation and operating excellence, with a strong commitment to developing critical mineral assets that enhance the security of the U.S. supply chain. For more information on the Company, please visit our website at www.titanminingcorp.com.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE