Rick Mills – “MAX Resource: Why a joint venture at Cesar with Freeport? Why DSO iron ore?”

When a junior resource company’s project becomes too big or too expensive for it to handle, it’s better to bring in a partner.

This is the case with Max Resource’s (TSX–V:MAX) (OTC:MXROF) (Fra:M1D2) Cesar copper-silver project in Colombia, an enormous district scale property on which Max has just cut an 80/20 earn in deal with US-based copper miner Freeport McMoRan (NYSE:FCX).

The company is the world’s largest publicly traded copper producer and the fifth largest miner by market cap.

FCX’s portfolio includes the Morenci mine in Arizona, Cerro Verde in Peru, El Abra in Chile, and the huge Grasberg mine in Indonesia.

The Cesar Project is situated along the copper-silver-rich Cesar Basin. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejon, the largest coal mine in South America held by Glencore.

Despite the Spanish being there centuries ago, tunnelling into the mountains looking for high grade silver, and the equally long known about massive outcrops exposing high grade copper and silver mineralization pretty much up and down the entire basin, Vancouver-based Max Resource, led by CEO Brett Matich, was the first to explore and discover its potential.

The Cesar project land package now spans more than 1,150 km of geology prospective for sedimentary-hosted copper and silver deposits and includes 20 mining concessions covering over 188 square km.

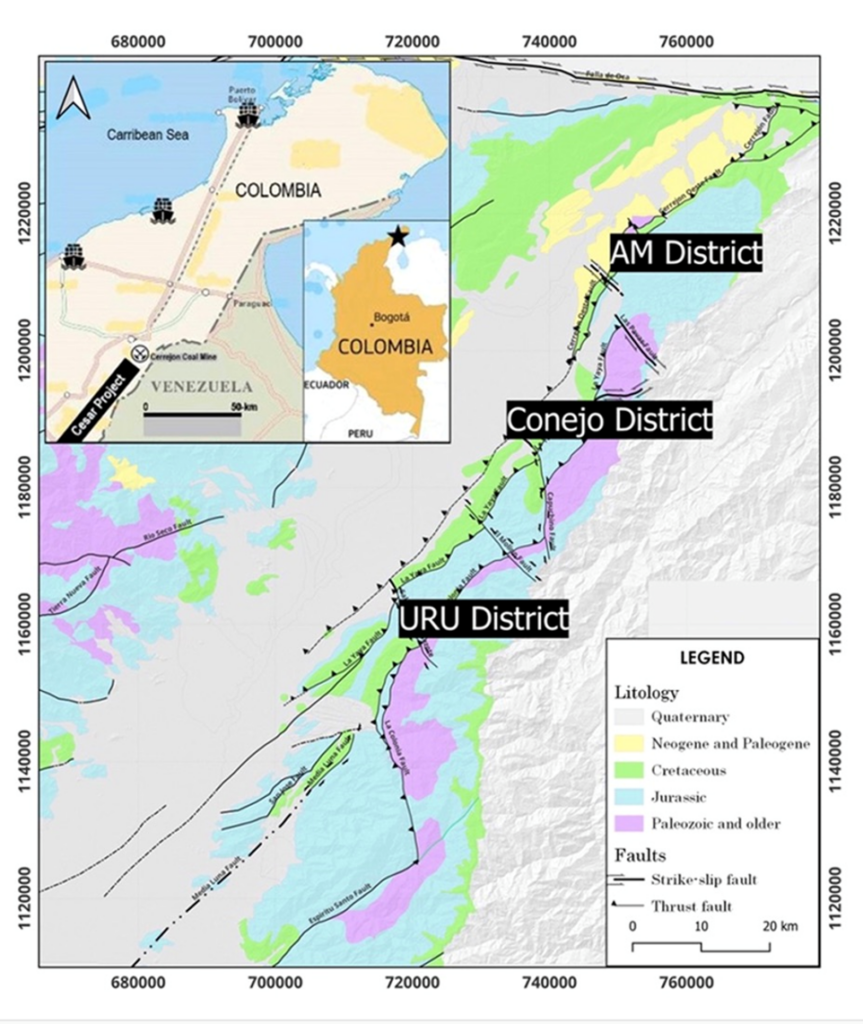

Max has made significant progress at Cesar, its field teams have so far identified 28 high-priority targets across the three districts of the 120-km Cesar copper-silver belt: AM, Conejo and URU.

Location and scale of the Cesar copper-silver project, NE Colombia

Earn-in agreement

Max spent two years negotiating behind closed doors with global major miners interested in partnering with Max. There was a long due diligence process with Freeport McMoRan in particular, they are entering an unfamiliar jurisdiction. Due to confidentially obligations, Max was limited in what it could say publicly about the deal, leaving unanswered one of the most asked questions: Will Max go it alone in developing Cesar, meaning raising the money, drilling and calculating a maiden resource estimate? Or would it be financed by a major partner?

Max Resource’s Inks Earn-In Deal With Freeport-McMoRan

Under the earn-in agreement, announced on May 13, 2024, Arizona-based Freeport has an option to acquire up to 80% of Cesar by spending CAD$50 million to explore the property, and making a series of cash payments totaling CAD$1.55 million.

To earn an initial 51% interest, Freeport is required to fund $20 million of exploration expenditures at Cesar over five years and make staged cash payments to Max totalling $0.8 million. Max remains the operator of Cesar during this initial stage.

Once Freeport earns its initial 51% interest, Freeport can increase its interest to 80% by funding a further $30 million in exploration expenditures at Cesar over five years and making staged cash payments totalling $0.75 million.

There are several points to be made here:

- If Freeport fulfills its obligations under the JV, by spending $50 million, plus paying Max $1.55 million in cash, FCX would own 80% of Cesar and Max’s portion would be reduced to 20%.

- Last year Max bought out royalties on Cesar owned by Bay Street Mineral Corp. Bay Street held an underlying 3% net smelter royalty over 19 mining concessions covering 184 km² and 31 mining concession applications covering 796 km².

- Freeport liked what it saw in Max’s data room and made the deal due to the potential of discovering economically viable deposits along this important corridor.

- The fear among some investors regarding joint ventures, is the major mining company “sits” on the project, the news flow dries up and nothing happens until the major either decides to work the project or sell it. This does not appear to be the case here. According to Max’s CEO Brett Matich, who AOTH talked to earlier this week, Freeport has opened an office in Bogota and is gearing up for an aggressive exploration program at Cesar. A sedimentary deposit expert was on site for two weeks in April, followed up by visits from Freeport geologists in May.

- Max’s 2024 Cesar exploration plan has not yet been released but we anticipate an aggressive exploration budget. Freeport agrees with Max that the highest priority targets are currently in the AM District located in the north where surface exploration has been concentrated. The plan will be to work their way south through Conejo and URU, where Max has completed a small amount of drilling.

- It’s also important to consider the basin as a whole. In August 2023, over 10,000 line-km of high-resolution airborne magnetic and radiometric survey was collected using a fixed-wing aircraft. Results from the data analysis will be important in refining existing targets and identifying new ones.

- Like Max, Freeport will target the feeder structures responsible for transporting copper and silver-bearing fluids, which resulted in multiple mineralized surface outcrops. Matich says Freeport believes the feeder structures are there.

- Under the JV, Max will remain the operator of the project for the first five years, and the first $20m of exploration expenses by Freeport. Why is this important? As the operator, Max has partnered with the Freeport technical team and will take part in reviewing data and contributing to each stage of exploration in real time.

- As operator, Max will retain and expand significantly its exploration team and related infrastructure. In fact, exploration programs are expected to increase during Freeport’s earn-in period, effectively fast tracking the Cesar Project.

- Having Freeport as an earn-in partner brings tremendous benefits to advancing the Cesar Project including their expertise in permitting, environmental, socialization and governance in Colombia. They have a specialized team that is spearheading exploration by putting ESG efforts front and center.

Why Iron Ore and Why Brazil?

While the Cesar copper silver project remains a priority for Max, the company has acquired a high grade iron ore deposit within a world class mining jurisdiction.

Earlier this month, Max signed a Letter of Intent (LOI) to purchase 100% of the Florália hematite iron ore property located 120 km east of Belo Horizonte, in the Brazilian state of Minas Gerais, from gold miner Jaguar Mining (TSX: JAG),

Under the LOI, Max will pay Jaguar USD $1 million for Florália, starting with a $100,000 deposit, followed by staged payments totaling $900,000.

The Florália deposit contains four distinct bodies of iron ore mineralization along a southeastern trend. Mapping has traced iron ore along 1 kilometer of strike to the north and a further 822m to the southwest, with the largest body located at the southeastern end of the trend.

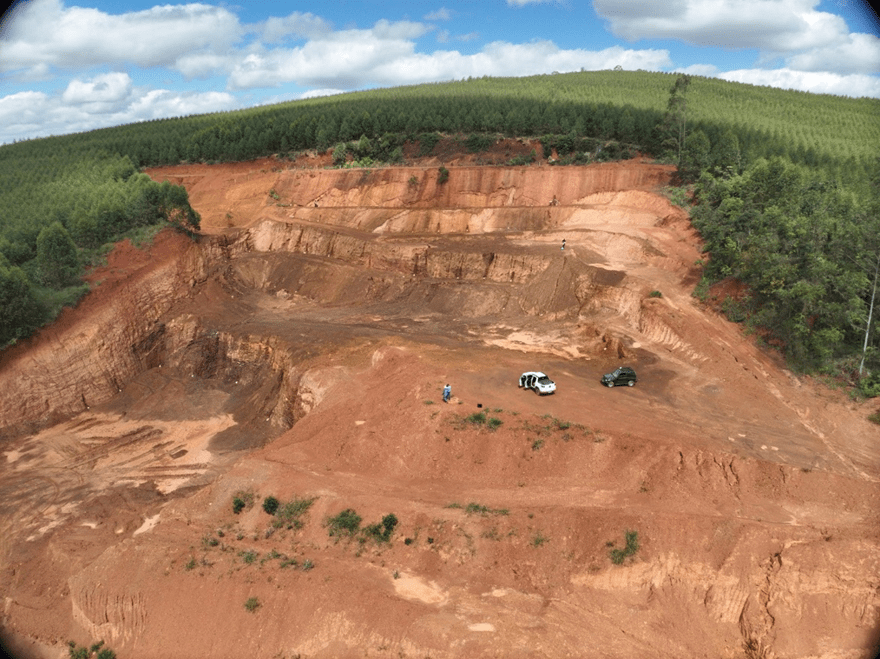

The hematite iron ore mineralization is exposed by an historic open pit mine 80m wide and 40m deep revealing a three-dimensional view of the mineralized body. The pit benches reveal a plunging band of iron ore at the base and sub-horizontal banding at the top of the pit.

During a mapping and sampling program, 41 channel samples were collected across the mineralization exposed by the historic mining benches over a 151m accumulated length. The samples averaged 58% Fe. This work has resulted in the definition of an estimated target (non 43-101 and is not to be relied on for investment purposes) containing 8,052,041 tonnes to 12,184,160 tonnes with an average grade of 58%Fe with a 6% LOI (loss of ignition).

One of the most important aspects of Florália, and what first caught Matich’s eye as a chief executive with extensive iron ore mining experience, was the project’s high grade. At ~58% iron content prior to screening, with minimal impurities like silica, aluminum and phosphorus, Florália is considered appropriate for Direct Shipping Ore (DSO) which is in demand by nearby steel mills.

The term ‘Direct Shipping Ore’ aptly captures the simplicity of the DSO mining process and the streamlined pathway this ore takes from mine to market. DSO stands out as a premium product, a cut above in a world demanding efficiency and environmental sensitivity.

From a geological standpoint, DSO deposits are relatively rare, often formed through the chemical alteration of banded iron formations (BIFs) under specific environmental conditions. Brazil and Australia are by far the worlds largest producers and exporters of DSO.

Even after the DSO has been mined, crushed and screened, the mining company then transport the ore by truck or railcar to a port (typically 100’s of kilometres), where it is then shipped to overseas steel mills.

If infrastructure doesn’t already exist, the mining company must build it. This requires significant capital for ports, roads, railways, haul truck fleet, etc., plus increased operating costs and additional permits lengthening the time to make the mine operational.

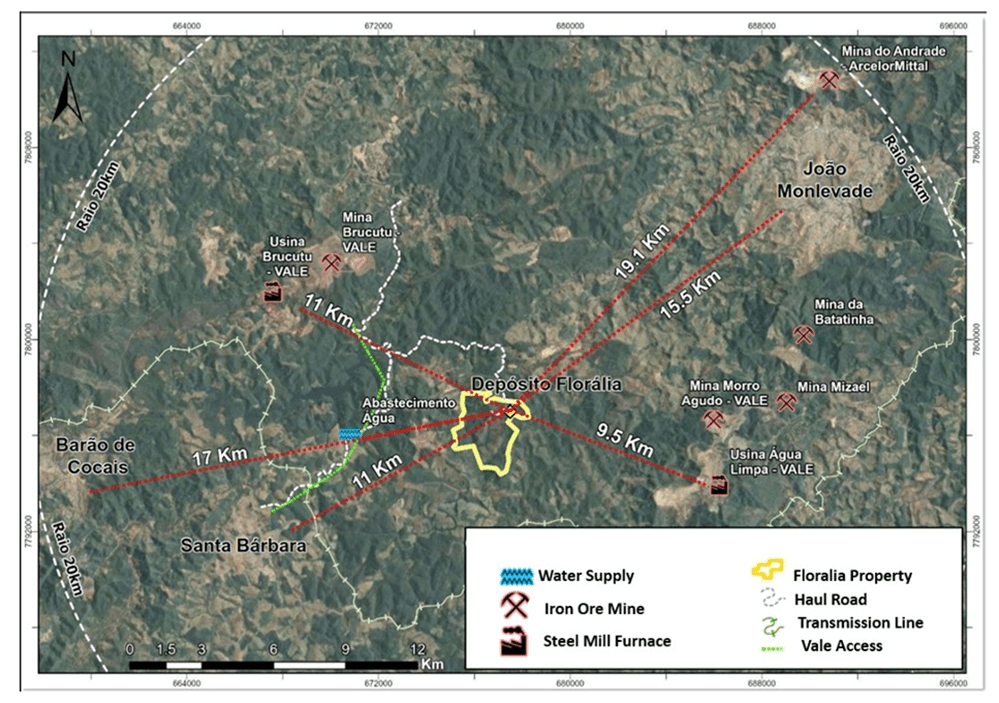

Contrast this scenario to the one envisaged by Matich for Max’s Florália acquisition. The property is within 20 km of major iron ore mines and steel mills, as seen on the map below. Local mining infrastructure includes railways, haul roads, mining services and personnel.

The Florália hematite property is located within a prolific iron ore mining district and nearby major iron ore mines, steel mills, railways, haul roads and mining services.

The local market for iron ore in the region is already set up for small miners, and Florália is in that category — too small for big players like Vale, who need a minimum 20Mtpa. But Vale is happy to let small miners operate and ship their ore directly to their local steel mills.

Most of the iron ore mines are spoken for, the land is tied up, almost all of it owned by private landowners/ wealthy families.

Florália was minimally explored by previous operator Jaguar Mining, but Jaguar was more interested in gold. Things started to change when the landowners started mining it for gravel – a banded iron formation (BIF) was discovered.

According to a recent technical report:

The Florália Property is underlain by mafic to ultramafic volcanic rocks of the Nova Lima Group, forming a Greenstone Belt-type sequence and hosting gold deposits related to iron formations (Jaguar 2024).

…which can reach up to 40 meters in thickness and are traced up to 1 km in strike.

“All the indications are that Florália is very typical of the ore mined in the area and that’s been delivered to Vale and other steel mills,” Matich told me over the phone this week.

This iron ore project is well within Matich’s expertise. Before joining Max, Matich was CEO of ASX-listed Aztec Resources, where he oversaw the development of the Koolan DSO hematite deposit (29 million ton at 64%Fe resource).

Also, as CEO of TSXV-listed Cap-Ex Ventures, Matich developed an un-drilled magnetite prospect into an 7.8 billion ton at 29%Fe resource.

Aztec rose from an AUD$2 million market capitalization to a $300 million merger in 2007 (Aztec share price increased 1,500%) with Aztec shareholders receiving ASX-listed Mount Gibson Iron Ore shares in the merger. In addition, Mount Gibson shares, then returned a 300% share price increase within 12 months of the completion of the merger.

The Koolan Island mine is still in operation with three years of life left. In a presentation, Mount Gibson describes Koolan Island as “Australia’s highest grade hematite Direct Shipping Ore (DSO) with direct port access to market (1HFY24 sales of 2.5 Mwmt @ 65.4% Fe).”

“Florália looks very similar, the same type of plan to Koolan Island, but the mining and capital costs are just so much less. In addition the Florália Property has the potential for multiple DSO deposits” Matich said.

It’s worth comparing Florália to a project that is not near steel mills.

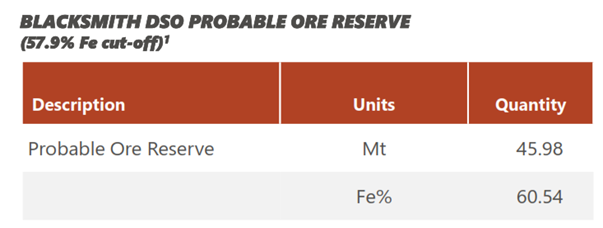

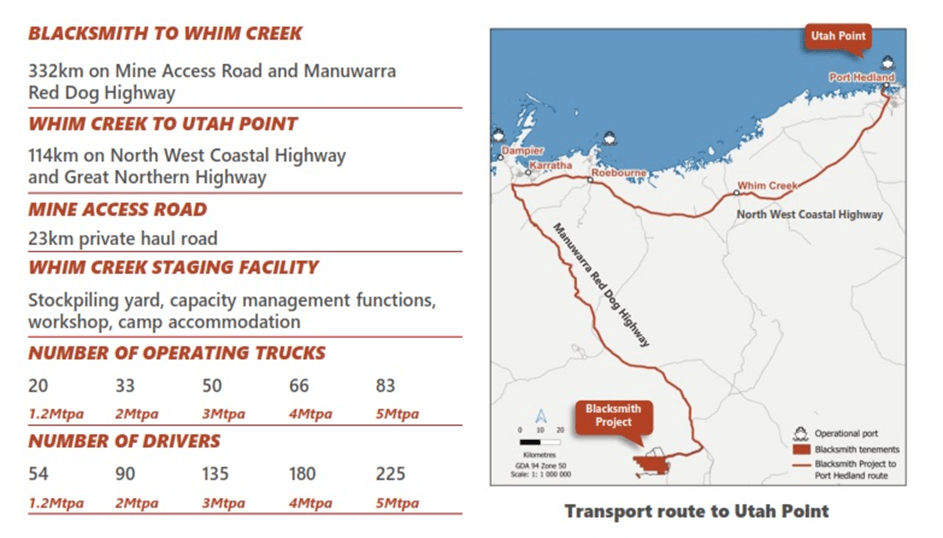

Red Hawk Mining released a prefeasibility study on its Blacksmith iron ore project located in the Pilbara region of Western Australia.

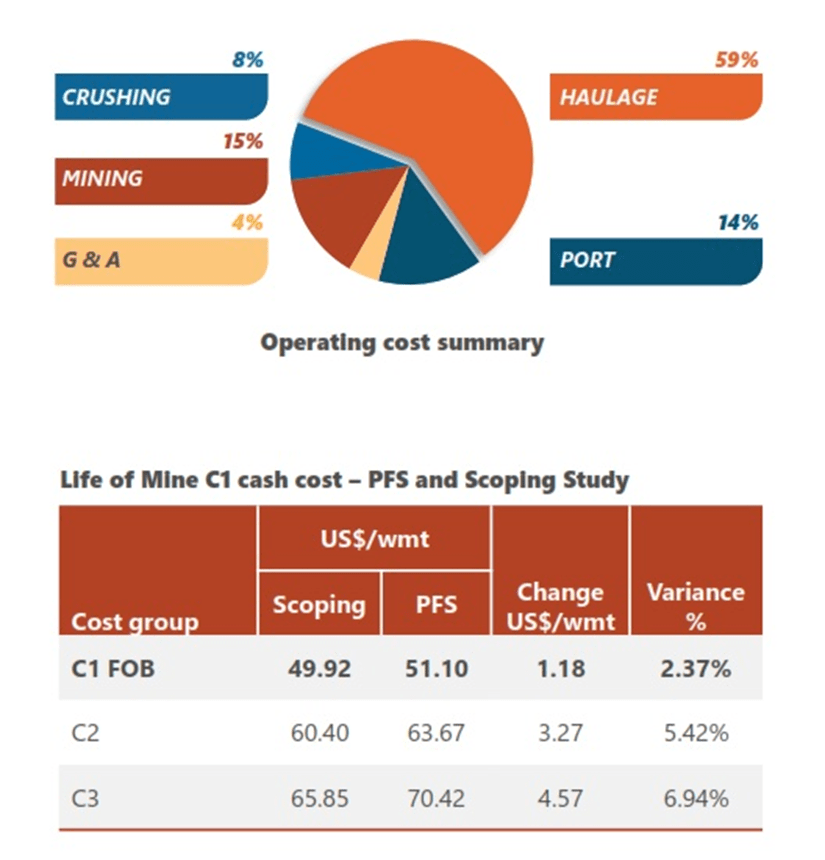

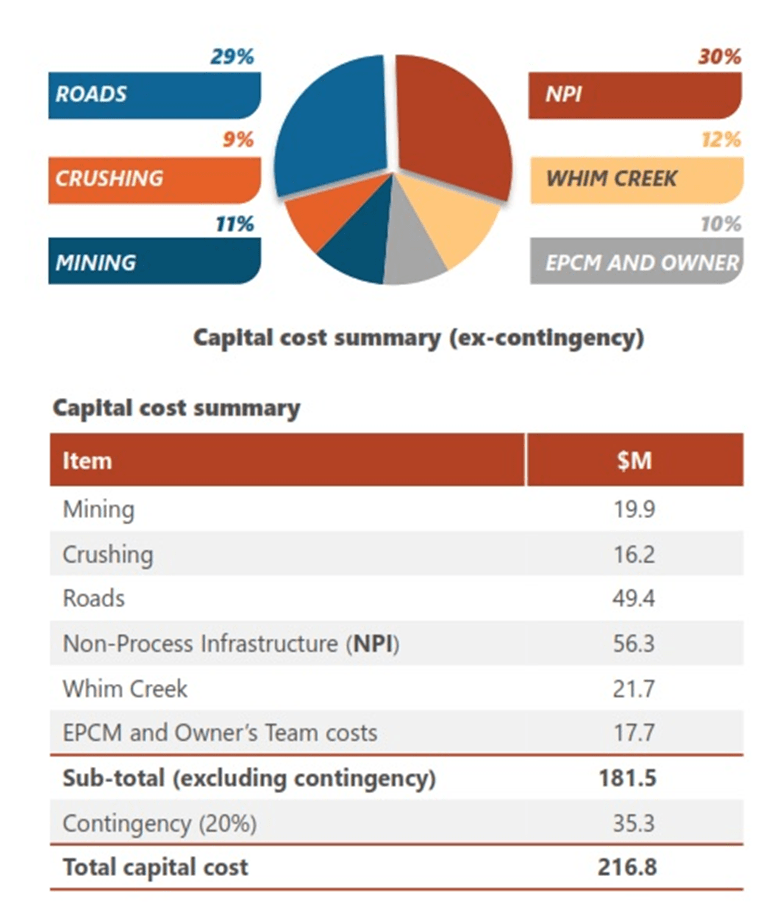

The ~$200 million market cap company with typical Australian DSO hematite needs at least 40 million tonnes of reserves to work, because its capital costs are estimated at $216 million. (The mineral reserve is pegged at 46Mt @ 60.5% Fe.) Out of this capex, 59% is for haulage and 14% is for port costs.

New infrastructure is not necessary at Max’s Florália project because it is within 20 km of major iron ore mines and steel mills.

As the images below show, Red Hawk must truck the ore 332 km from Blacksmith to Whim Creek (23 km on a private haul road and over 300 km on the Manuwarra Red Dog Highway), and a further 114 km from Whim Creek to Utah Point/ Port Hedland. The haul fleet ranges from 20 to 83 trucks, with 1.2Mtpa on the low end and 5Mtpa on the high end.

The difference becomes more acute when we get to the profit margins.

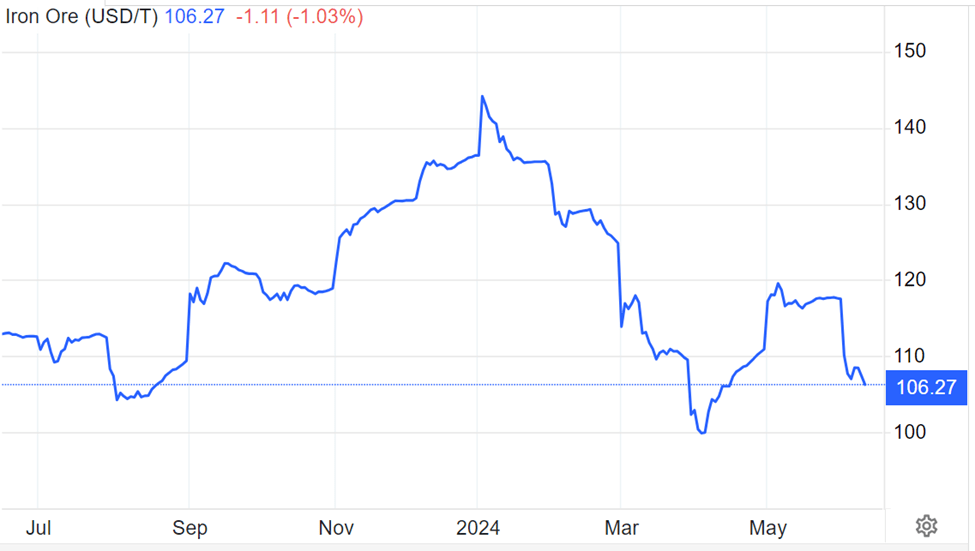

If Red Hawk produces 3 million tonnes a year, it is looking at all-in cash costs of $75 per tonne at $105 iron ore, netting a USD$90 million profit. At $85, the company’s margin shrinks to $30 million a year.

While at Florália, if Max is successful in building a mine, operating costs would be less, because it does not require a large haul truck fleet and Max will not be stuck with the cost of having to build a port. Its all-in-costs per tonne could be a fraction of Red Hawk’s.

Moreover, the projects with higher profit margins can more often continue operations when impacted by a potential drop in the price, as often happens within the volatile iron ore market.

Conclusion

Florália is a great fit for a junior and is an excellent project for Max because it fits so well into Matich’s wheelhouse. This is a high-grade iron ore deposit with potential for expansion, and due to its location infrastructure costs will be just a fraction of a typical Australian hematite mine like Blacksmith.

Previous work had defined a geological target (non 43-101 compliant and not to be relied on for investment purposes) estimated at 2,971,233 m3 to 4,496,333 m3 or 8,052,041 tonnes to 12,184,160 tonnes using a density of 2.71 g/cm3 at an average grade of 58% Fe with a 6% LOI.

The mineralization at Florália is high grade, near surface, and there may not be a lot of drilling required to bring it into a 43-101 compliant resource.

Much of the iron ore is exposed in benches and can be bulk sampled. Max plans to start drilling in the fourth quarter of this year, and according to Matich, has the money to do so.

Regarding the earn-in agreement with Freeport McMoRan at Cesar

Freeport is the world’s largest copper miner, and the world’s 5th largest miner by MC. Of course, they are not here for anything less than a mine that will make a difference to their bottom line, which means, like every other mine FCX owns or has an interest in, a massive scalable mine with extended LOM spanning many decades.

What if Max had decided to try and fund all their own exploration, development, drilling, resource estimates, enviro studies/ permitting and dealing with the government on their own by arranging a financing?

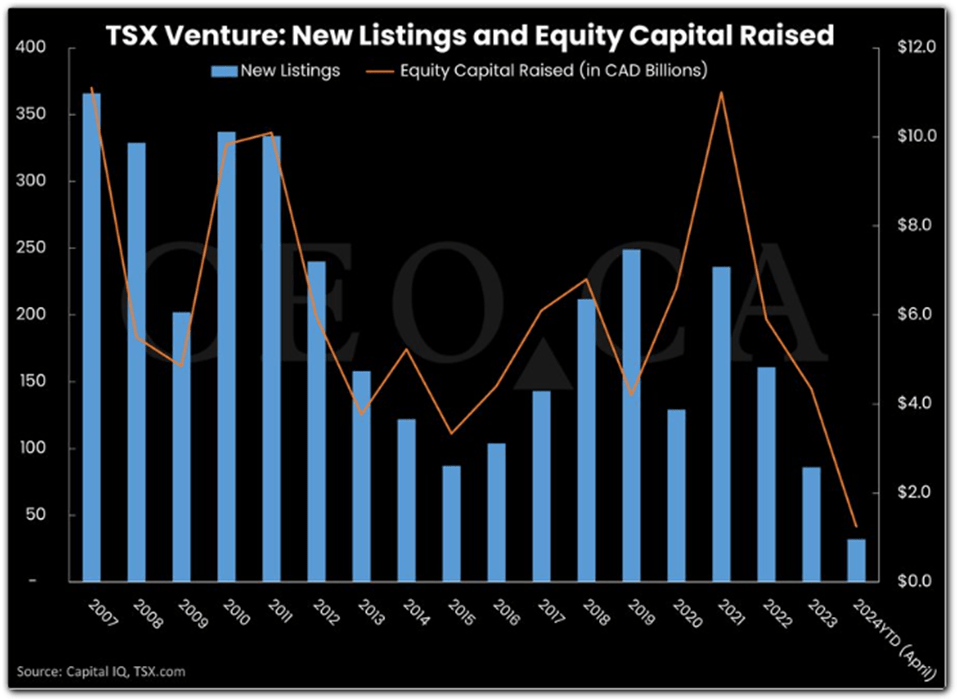

Financings are still extremely hard to arrange, and the amount of money raised, even with peak gold/ silver/ copper prices, is miserly low. As of April 2024, only $1.25B has been raised through all avenues available to juniors on the TSX Venture Exchange. Money raising is pretty much at the same level as this time last year.

But Max’s shareholders can look forward to an initial $20 million commitment from FCX for what should soon be the start of a very aggressive exploration/drill program.

Scenario’s

What’s the worst-case scenario? Obviously if FCX finds nothing they walk. But in this case Max hasn’t raised any money and there has been no dilution to the stock.

A second scenario is if FCX finds a deposit, but it doesn’t meet their criteria. What if its too small? Will FCX be interested in trying to build a mine that will not have the desired effect on their bottom line.

If Freeport doesn’t find it’s criteria, and walks, the project remains Max’s. Again, Max hasn’t raised any money and there has been no dilution to the stock. But there are a lot of companies that might be interested in what FCX found. Consider the deposit (if one is found), will have been evaluated by Freeport (pretty good street cred), so we’ll have some understanding of it’s potential.

But let’s say best case, FCX, which is concentrating on finding the feeder systems (they are NOT interested in chasing 1.5 to 4m of mineralization) finds one – and it meets Freeport’s criteria.

Max owns 20% of what FCX finds, plus the 3% royalty they bought from Bay Street Mineral Corp.

To put it another way – in the FCX/80 MAX/20 earn in deal, every US$1 billion (= to 103,000 tons Cu @ today’s US$9,694.00t) of value Freeport prices into CESAR is US$200 million that has to be attributed to Max.

Between Florália and Cesar, I’m expecting a lot of news over the next 12 months.

Max Resource Corp.

TSX-V:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.065 2024.06.11

Shares Outstanding 176m

Market cap Cdn$11.4m

MAX website

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does own shares of Max Resource Corp. MAX is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of MAX

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE