Rick Mills – “Max Reports High-Grade Assays From Florália DSO Iron Ore Project”

Max Resource (TSX-V:MAX) (OTC:MXROF) (Frankfurt:M1D2) has reported successful iron ore and recovery results from dry magnetic test work at its Florália Direct Shipping Ore (DSO) Iron Ore Project.

The project is located 67 kilometers east of Belo Horizonte, in the state of Minas Gerais, Brazil.

Florália DSO Iron Ore Project

In May 2024 Max announced the acquisition of the Florália DSO Iron Ore Project hoping to create new shareholder value. The project appears to have significant potential with a possible pathway to near-term cash flow.

Max has created a unique way to protect its capital structure while building significant leverage to project for its shareholders.

After rapidly advancing exploration efforts at Florália and demonstrating the near-term viability of advancing to production, management put in place a plan to finance the project.

On Nov. 15, 2024, Max announced the addition of a wholly owned Australian entity, Max Iron Brazil Ltd., which will hold the Florália Brazilian assets. The company plans to list on the ASX and has completed a pre-listing financing to fund the proposed transaction and to advance drilling.

Max Brazil conducted a non-brokered private placement of 27 million shares at a price of AUD$0.10 per share for proceeds of AUD$2.7 million.

As a next step Max Brazil intends to undertake an initial public offering (IPO) and list its shares on the ASX.

Max Resource will own approximately 55% of Max Brazil. Max Brazil is expected to start trading on the ASX in June of this year and will have the financial potential to bring the project to match production approvals for 1.5 million tonnes per annum (1.5Mtpa).

The term “Direct Shipping Ore” aptly captures the simplicity of the DSO mining process and the streamlined pathway this iron ore takes from mine to market. DSO stands out as a premium product, a cut above in a world demanding efficiency and environmental sensitivity.

From a geological standpoint, DSO deposits are relatively rare, often formed through the chemical alteration of banded iron formations (BIFs) under specific environmental conditions. Brazil and Australia are by far the world’s largest producers and exporters of DSO.

DSO is high-grade hematite that can be shipped directly to refineries, circumventing the need for costly processing facilities and large operations, translating to significant cost savings and a smaller carbon footprint.

The energy consumed by processing DSO hematite (benchmark 58-62% Fe) is 50% less than magnetite. Magnetite (35% Fe) requires large-scale, high-cost beneficiation.

An even smaller footprint can be achieved if the DSO mine and crushing facilities are close to buyers and rail terminal. Often this is not the case.

Usually, after the DSO has been mined, crushed and screen classification, the mining company transports the ore by truck or rail to a port (typically 100’s of kilometers), where it is shipped to overseas steel mills.

If infrastructure doesn’t already exist, the mining company must build it. This requires significant capital for ports, roads, railways, haul truck fleet, etc., plus increased operating costs and additional permits, lengthening the time to make the mine operational.

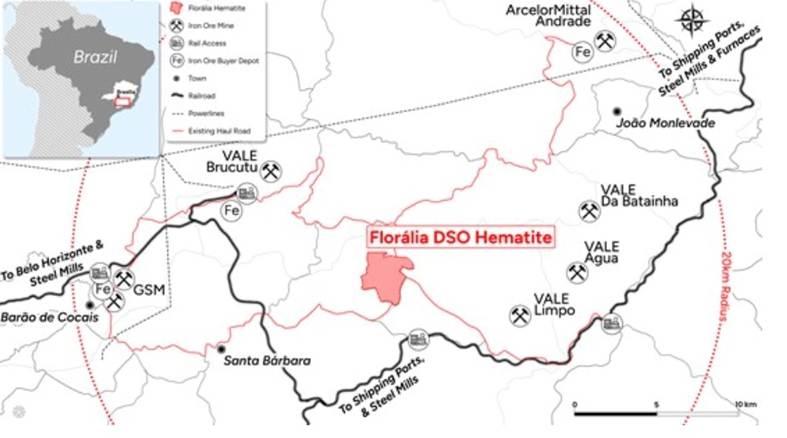

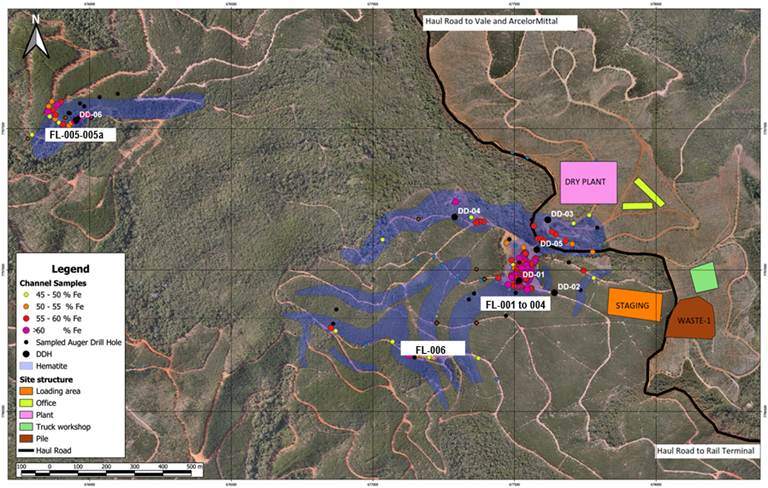

Florália location and infrastructure map.

The Florália DSO Project is strategically located with an existing 20 km road SE to a railway terminal and there are existing roads to potential DSO buyers Vale (16 km NW) and Arcelor Mittal (26 km NE). Local mining infrastructure includes railway networks, haul roads, mining services and personnel.

Florália is within Brazil’s Iron Quadrangle, which hosts some of the largest iron mines in the world.

A lot of work has already been accomplished and the results from the various surveys undertaken are impressive.

Max reports high-resolution drone magnetics at Florália has identified a large anomalous zone of surficial outcropping high-grade mineralization associated with hematite/itabirite-type iron formation. The size of the anomalous area has far exceeded the approximate 160m by 160m historical open cut to around 1,500m by 1,000m, based on drone magnetics, field activities and 58 channel samples.

Max’s technical team has reviewed the new drone magnetics and channel sampling data and has significantly expanded the Florália DSO geological target from 8 to 12 million tons at 58% Fe to 50 to 70 million tonnes at 55% to 61% Fe.

Analysis indicates a highly deformed structural geological environment that is fundamental to the increase in iron ore grades and tonnages, a consequence of secondary crystallization of hematite and the development of supergene enrichment.

The magnetometric geophysical survey utilized drones over the project area located in the Florália region of Santa Bárbara, Minas Gerais, Brazil, within the “Quadrilátero Ferrífero” region. The geophysical survey maps were generated with multiple filters along with a 3D inversion that provided a high-resolution block model and ISO-value surfaces from the interpreted source of the anomalies.

This data has been fundamental in confirming the principal target area and the true potential of the Florália DSO project.

Max has also completed ore tests and commenced environment studies and other components of the Feasibility Study the company plans to complete by Q1 2026. There is no native title on the property, no tailings dam is necessary hence no water permits are required, and workers/ contractors will not need accommodation on site.

Channel sampling and dry magnetic test work

In magnetic separation, the most vital part is the preparation of the ore. It must be crushed so that the crystals of magnetite are sufficiently freed from rock to bring the percentage of iron up to the standard set for Direct Shipping Ore. On the other hand, it must not be crushed too fine, otherwise the blast does not pass through readily in the furnace, or the ore blows over the top. (911 Metallurgist)

The size of the crushed ore is referred to as fractions.

Magnetic drums are used in iron ore separation to separate magnetic iron ore, like magnetite, from non-magnetic materials. The separator consists of a rotating drum with a magnet inside, which attracts and holds the magnetic iron ore while non-magnetic materials fall away.

A total of 174 channel samples were taken across the banded iron formation, with 131 returning values from 50-61% Fe (iron). The best value was 64.7% Fe from a 19-mm fraction. Phosphorous values were low, ranging from 0.01% to 0.05%.

(Phosphorus is one of the most deleterious elements in iron ore as it follows iron during downstream reduction processes, forming iron phosphides that make steel brittle. Excess phosphorus increases the cost of steelmaking and the steel industry has placed an upper limit of 0.07–0.08 wt-% P on the iron ore feed. (Science Direct). Other impurities include silicon dioxide (SiO2) and alumina (Al203).)

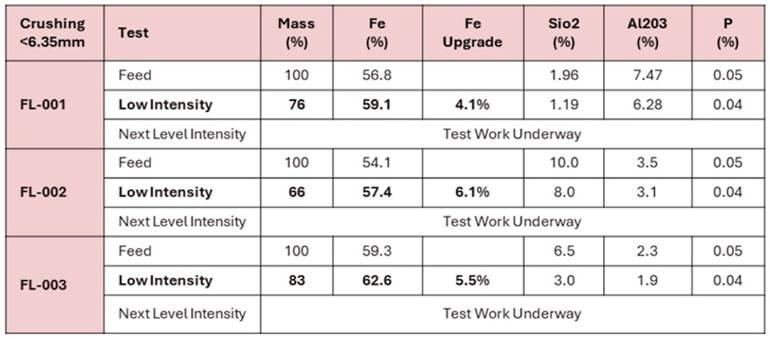

In addition, dry magnetic tests of three bulk (200 kg) samples, coarse-crushed (<6.35mm), with a single pass, in a simple low magnetic drum circuit successfully increased Fe values from 4 to >6%. Typical next- level magnetic intensity test work is underway with the objective of further increasing Fe values (refer to Table 1 and Figure 3 below).

(In iron ore processing, magnetic separation techniques can be either low-intensity or high-intensity. Low-intensity magnetic separation is typically used for ores with high magnetic susceptibility, like magnetite, while high-intensity separation is employed for ores with lower magnetic susceptibility, such as some hematite-rich ores. The choice depends on factors like particle size, solids content, and the specific iron mineral composition.

Table 1: 200-kg samples were collected and delivered to Fundação Gorceix é uma Instituição, Ouro Preto, Minas Gerais, Brazil for dry magnetic test work.

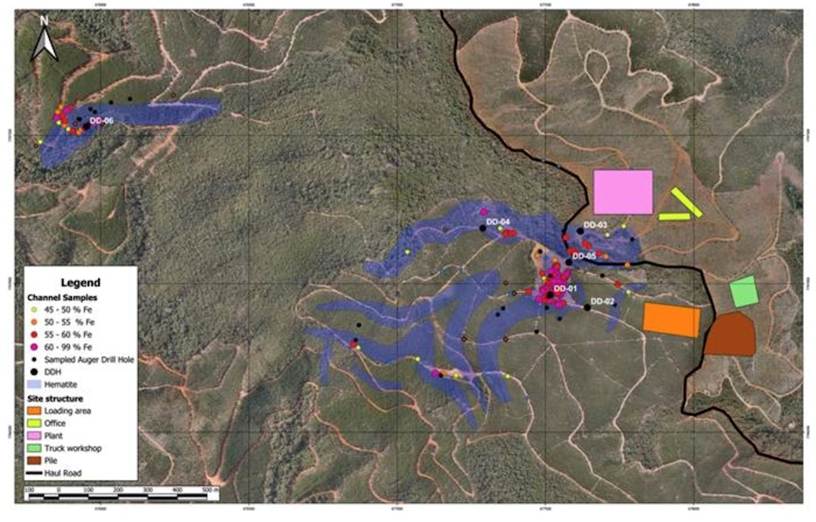

Figure 2: Florália geochemistry, logistics & drill hole locations.

Figure 3: Florália DSO historic open cut; diamond drill hole DH-001 and drill core. Dry magnetic bulk (200 kg) sample locations FL-001, FL-002 and FL-003.

The company’s inaugural 2025 drilling program, consisting of approximately 800m of auger and 800m of diamond drilling, is nearing completion.

Preliminary results are due shortly (refer to Figures 2 and 3 above). Max’s inaugural 2024 exploration program resulted in the technical team significantly increasing the Florália DSO geological target from 8-12 million tonnes at 58% Fe to 50 to 70Mt at 55%-61% Fe.

“The channel assay results confirm the presence of high-grade iron ore (DSO) at Florália, with increased Fe grades through a dry magnetic circuit. Based on success, Florália could potentially supply superior DSO for local, domestic and overseas buyers,” Max’s CEO Brett Matich commented in the March 30, 2025 news release.

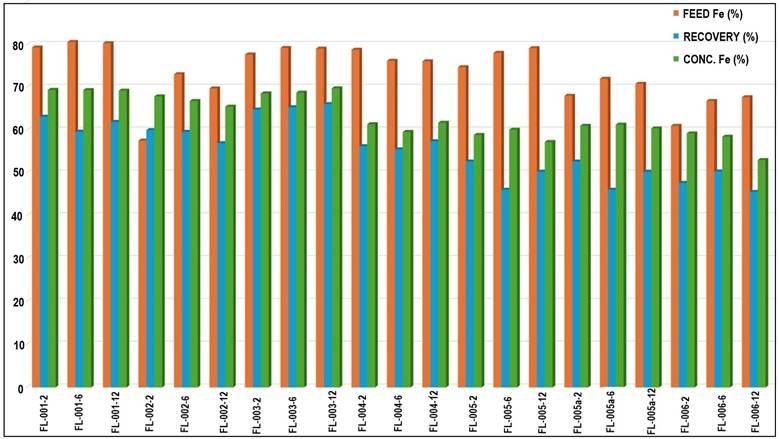

Based on positive results from the preliminary dry magnetic tests, Max collected six bedrock 80-kg samples (FL-001 to 006) from across the property. Each sample was crushed into three fractions: 12mm, 6mm and 2mm for dry magnetic test work. Sample FL-005 was split into two equal portions as an internal check (refer to Figures 1 & 3, Table 1 below).

Highlights:

FL-001: 69.5% Fe at 81% recovery from 59.7% 6mm fraction sample (1500, 2500, 7500 Gauss)

FL-002: 66.9% Fe at 73% recovery from 59.7% 6mm fraction sample (1500, 2500, 7500 Gauss)

FL-003: 68.7% Fe at 78% recovery from 64.9% 2mm fraction sample (1500, 2500, 7500 Gauss)

FL-004: 61.8% Fe at 76% recovery from 57.5% 12mm fraction sample (2500, 7500 Gauss)

FL-005: 60.2% Fe at 78% recovery from 46.2% 6mm fraction sample (1500, 2500, 7500 Gauss)

FL-006: 59.3% Fe at 67% recovery from 47.8% 2mm fraction sample (1500, 2500, 7500 Gauss)

Figure 1: Florália dry magnetic test work, XRF and recovery results

Figure 3: Florália dry magnetic sample locations. Florália channel geochemistry, logistics, diamond and auger drill hole locations.

Methodology

Each sample was split into three sub-samples and crushed, yielding a 12mm, 6mm and 2mm sub-sample, which were subsequently dried to an approximate moisture content of 0.3% H₂O.

After removing a 600-gram cut, each crushed sub-sample was exposed to first a 1400 Gauss magnetic drum, then a 2500 Gauss magnetic drum and finally a 7500 Gauss magnetic drum resulting in three concentrates and final tails. (Gauss is a unit of measurement of magnetic induction, also known as magnetic flux density.)

In addition, potential Fe recovery of tailings with further test work resulted in five splits from each sub-sample: 600-gram cut, 1400 Gauss concentrate, 2500 Gauss concentrate, 7500 Gauss concentrate, and final tails. The 600-gram cut, each of the three concentrates and the final tails were then read with an Olympus Vanta Series M portable XRF unit for the percentage of iron (Fe).

The 1400 Gauss concentrates ran 63.46% to 69.99% iron in the 2mm fraction, 65.81% to 69.99% iron in the 6mm fraction and 58.47% to 69.99% iron in the 12mm fraction. The 2500 Gauss concentrates ran 51.18% to 69.99% iron in the 2mm fraction, 52.22% to 69.99% iron in the 6mm fraction and 51.44% to 69.99% iron in the 12mm fraction. The 7500 Gauss concentrates ran 44.45% to 62.90% iron in the 2mm fraction, 48.24% to 64.58% iron in the 6mm fraction and 45.20% to 69.80% iron in the 12mm fraction.

All but two of the 21 splits returned concentrate recoveries above 65%, with 15 returning in excess of 70% and 11 returning greater than 76%.

Conclusion

“The dry magnetic test work was a great success delivering high-grade iron ore (Fe) results well above the benchmark of 62% Fe. The previously announced channel sampling results were significant, taken across banded iron formation, 131 of 174 returning values from 50 to 61% Fe. We look forward to the initial drilling results due shortly,” said Matich.

Max Resource Corp.

TSX-V:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.05 2025.04.22

Shares Outstanding 180m

Market cap Cdn$8.9m

MAX website

Subscribe to AOTH’s free newsletter

Richard owns shares of Max Resource Corp. (TSX-V:MA). MAX is a paid advertiser on his site aheadoftheherd.com. This article is issued on behalf of MAX

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE