ORENINC INDEX up as financings increase

ORENINC INDEX – Monday, December 14th 2020

North America’s leading junior mining finance data provider

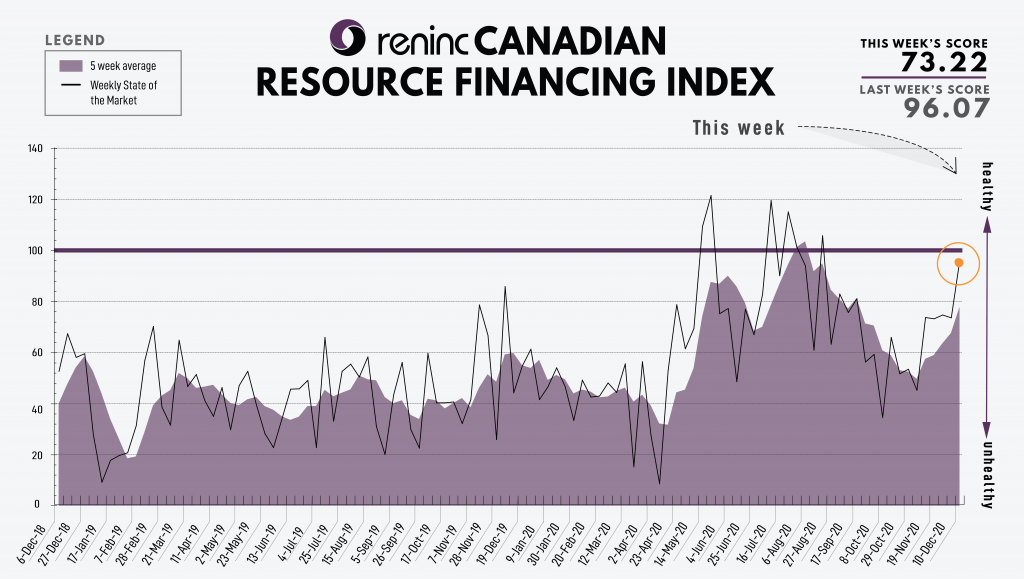

Last Week: 73.22 (Updated)

This week: 96.07

The Oreninc Index increased in the week ending December 11th, 2020 to 96.07 from 73.22 a week ago as financings increased.

The major indices fell as a stimulus deal was shutdown and 850,000 American filed for first-time unemployment signaling that economic recovery and the labor market are still under pressure

The COVID-19 virus global death toll is approaching 1.64 million with almost 74 million cases reported worldwide. More and more countries are announcing a hard lockdown with increasing cases.

On to the money: the aggregate financings announced increased to $179.2 million, a 1-week high, which included eight brokered financings for $91.5 million, a three-week low, and no bought deal financings. The average offer size increased to $3.1 million, a two-week high, while the number of financings increased to 58.

Gold is consolidating around the $1,850 level. The yellow metal closed the week more or less flat at $1,843/oz from $1,840/oz a week ago. The US dollar index also remained flat as it closed at 90.98 from 90.70 a week ago.

The widely followed junior mining index, the VanEck managed GDXJ, closed the weekly slightly lower at $51.07 from $51.62 a week ago. The index is now up 21.47%. The HUI Arca Gold BUGS Index, which follows the major gold miners, also closed the week lower at 291.68 from 292.47 last week. The SPDR GLD ETF inventory closed the week almost flat at 1,170.15 tonnes, or 37.62 million ounces, from 1,182.70 tonnes last week.

In other commodities, Silver also seems to consolidate around the $25/oz level and closed the week at $24.04/oz from $25.24/oz a week ago. Copper continued to its strength and closed up at $3.52/lb from $3.52/lb a week ago. Oil remained flat as WTI closed up at $46.57 a barrel from $46.26 a barrel a week ago.

The Dow Jones Industrial Average closed up at 30,218 from 29,910 a week ago. Canada’s S&P/TSX Composite Index closed up at 17,520 from 17,396 the previous week. The S&P/TSX Venture Composite Index closed up at 769.11 from 749.20 a week ago.

Last Week: 73.22 (Updated)

This week: 96.07

Summary:

- Number of financings increased to 58.

- Eight brokered financings were announced this week for $91.5m, a 4-week high.

- Four bought-deal financing were announced this week for $46.5m, a 4-week high.

- Total dollars heightened to $179m, a 2-week high.

- Average offer upped to $3.1m, a 2-week high.

Major Financing Openings:

- Osisko Development Corp. (TSX-V:ODV) opened a $30 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a bought deal The deal is expected to close on or about December 30, 2020.

- Eclipse Gold Mining Corp. (TSX-V:EGLD) opened a $20 million offering underwritten by a syndicate led by Stifel GMP on a best efforts

- Northern Vertex Mining Corp. (TSX-V:NEE) opened a $20 million offering underwritten by a syndicate led by Stifel GMP on a best efforts

- Oroco Resource Corp. (TSX-V:OCO) opened a $48 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

Major Financing Closings:

- Oroco Resource Corp. (TSX-V:OCO) closed a $48 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- Fosterville South Exploration Ltd. (TSX-V:FSX) closed a $91 million offering underwritten by a syndicate led by Leviathan Gold Finance Ltd. on a best efforts basis. The deal is expected to close on or about December 8, 2020.

- Niobay Metals Inc. (TSX-V:NBY) closed a $59 million offering underwritten by a syndicate led by Canaccord Genuity Corp. on a best efforts basis. The deal is expected to close on or about Decemeber 8, 2020.

- Marathon Gold Corp. (TSX:MOZ) closed a $66 million offering on a best efforts basis. The deal is expected to close on or about December 7, 2020.

MORE or "UNCATEGORIZED"

First Phosphate Confirms Another High Grade Intersect of 11.85% Igneous Phosphate Across 84 Metres Starting from Surface at Its Begin-Lamarche Project in Saguenay-Lac-St-Jean, Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is plea... READ MORE

MAG Silver Reports First Quarter Financial Results

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) announces the Com... READ MORE

Troilus Announces Feasibility Study Results for the Gold-Copper Troilus Project: Outlines a Large Scale, 22-Year Open Pit Project in Tier-One Jurisdiction With USD$884.5 Million NPV(5%)

Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF) reports results from... READ MORE

Alamos Gold Intersects Higher-Grade Mineralization within a New Zone Near Existing Infrastructure at Young-Davidson

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported new results from i... READ MORE

Titan Reports First Quarter 2024 Results; National Safety Recognition Award

Titan Mining Corporation (TSX: TI) announces the results for the... READ MORE