Troilus Announces Feasibility Study Results for the Gold-Copper Troilus Project: Outlines a Large Scale, 22-Year Open Pit Project in Tier-One Jurisdiction With USD$884.5 Million NPV(5%)

Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF) reports results from a Feasibility Study completed on the gold-copper Troilus Project located in northcentral Quebec, Canada. The Study incorporates an initial mineral reserve estimate that supports a long life, large scale, 50,000 tonnes per day open-pit mining operation; a project in a tier-one mining jurisdiction that stands out in the Quebec and Canadian mining landscapes.

Troilus has taken a focused and conservative approach to all costs and inputs to deliver a realistic and compelling Feasibility Study that we believe maximizes the scope and scale of this mineral asset over the long term. All amounts are in United States dollars, unless otherwise stated.

2024 FEASIBILITY STUDY HIGHLIGHTS

Large Scale Open-Pit Project

- Open pit mine life of 22 years with the potential for future underground development.

- Life-of-mine average payable gold production of 244,600 ounces annually, 17.3 million pounds of copper and 446,700 ounces of silver annually.

- Peak annual payable gold production of 456,100 ounces, 31.8 million pounds of copper and 613,600 ounces of silver in year 7.

- Open pit mine, processing 50,000 tonnes-per-day (“tpd”); a 43% larger scale operation than the 35,000 tpd processing rate contemplated in the Preliminary Economic Assessment from 2020.

- An economical and energy-efficient process to produce a desirable gold-rich copper concentrate for sale to smelters, with a cyanide-free gravity concentration circuit to produce doré after Year 1.

- Supported by an initial Mineral Reserve estimate of 380Mt grading 0.59 g/t gold equivalent (0.49 g/t Au, 0.058% Cu and 1.0 g/t Ag) for a contained 7.26Moz AuEq (6.02 Moz Au, 484 Mlbs Cu and 12.2 Moz Ag).1

- LOM total payable gold of 5.4 million ounces, 382 million lbs of copper and 9.9 million ounces of silver.

- Average LOM strip ratio of 3.1:1.

Low-Cost Production2

- All-in sustaining cash operating costs of $1,109/oz.

- Average operating costs of $19.06/t milled ore.

Strong Economic Results

- Base Case after-tax NPV5% of USD$884.5 million and IRR of 14%, reflecting long-term forecast prices of US$1,975/oz Au, $4.05/lb Cu, $23/oz Ag and $0.74 USD/CAD exchange rate.

- After-tax NPV5% of USD$1.55 billion and IRR of 19.5% at April 2024 average metal prices (Au: $2,332/oz; Cu: $4.30/lb; Ag: $27.50/oz).

- Cumulative after-tax cashflow of $2.2 billion on base case assumptions; increasing to $3.4 billion using average metal prices for April 2024.

Attractive Capital Intensity Given Inflationary Environment and Scale of Operation

- Initial development capital of of $1,074 million, including all mine pre-production costs, net of existing infrastructure.

- Existing and upgraded infrastructure, including powerlines and 50MW substation, all-weather access roads and tailings facility among other infrastructure, reduce capital requirements for the project and overall capital intensity.

Exploration Upside:

- Numerous targets ranging from grass roots geochemical anomalies to early-stage drill targets are actively being explored and advanced, both near mine and regionally, representing significant future upside potential.

_______________________________

1 AuEq was calculated using metal prices of $1,550/oz Au; $3.50/lb Cu and $20.00/oz Ag.

2 See Non-IFRS Measures at the end of this news release.

Justin Reid, CEO of Troilus, commented, “The entire Troilus team is proud to present results that clearly demonstrate the potential for our project to become a major North American copper and gold producer. The FS outlines a generational-scale asset, with a 22-year mine life and compelling economics, both at discounted and current metal prices. The project has reasonable CAPEX and capital intensity, including bottom quartile operating costs among the major Canadian gold mines. With a life-of-mine average payable gold production of nearly 245,000 ounces annually, more than 17 million pounds of copper and nearly 447,000 ounces of silver, Troilus stands not only as a strategically significant project that aligns with the Province of Quebec’s priority on the production of strategic metals but is also positioned to be amongst the largest scale, lowest cost gold and copper projects across Canada.

In today’s challenging market, the value of our existing infrastructure has become even more critical, reducing the capital intensity required to build project infrastructure and providing ongoing access to low-cost renewable energy supplied by Hydro-Quebec. The Troilus Project has been designed to minimize the environmental footprint of the future operation including using a cyanide free process, engaging in progressive reclamation, making use of the existing tailings facility and minimizing GHG emissions through reliance on sustainable energy sources.

The Study provides a strong foundation to continue building and growing the Company. Our geology team has proven their ability to identify new targets and rapidly add significant ounces, and we believe there is strong potential to further expand the scale of this project and extend the mine life beyond the 22 years presented in this Study with further exploration and drilling.

With the FS now complete, Troilus is focused on next steps, namely the finalization of the Environmental & Social Impact Assessment and ongoing exploration of the geological potential of the 435 km² Troilus property. We look forward to working with our partners in the Eeyou Istchee James Bay region, including the Cree Nation of Mistissini, the Cree Nation Government and Grand Council of the Crees, the local communities of Chibougamau and Chapais, as well as the governments of the Province of Quebec and Canada, to advance the Troilus Project.”

2024 Feasibility Study Summary

| PRODUCTION | |||

| Mine Life | 22 years | ||

| Daily Mill Throughput | 50,000 tpd | ||

| Annual Mill Throughput | 18.3Mt/year | ||

| Average Annual Metal Production (Payable) | Gold (oz) | Copper (Mlbs) | Silver (oz) |

| Years 1-5 | 256,200 | 16.1 | 475,200 |

| Years 6-22 | 241,200 | 17.7 | 438,300 |

| Life of Mine | 244,600 | 17.3 | 446,700 |

| Proven & Probable Reserves | 380 Mt containing 7.26 Moz AuEq (6.02 Moz Au, 484 Mlbs Cu, 12.2 Moz Ag) |

||

| Proven & Probable Average Grades | 0.59 g/t AuEq (0.49 g/t Au, 0.058% Cu, 1.0 g/t Ag) |

||

| Strip Ratio | 3.1:1 | ||

| Average LOM Gold/Copper/Silver Recoveries | 92.7% / 91.8% / 91.9% | ||

| COST METRICS | |||

| Initial Capital Expenditure | $1,074 million | ||

| Sustaining Capital Expenditure | $276.6 million | ||

| All-in-sustaining-cost (life-of-mine)¹ | $1,109/oz | ||

| ECONOMIC RESULTS | |||

| Base Case (Au: $1,975/oz; Cu: $4.05/lb; Ag: $23/oz) | |||

| After-tax NPV @ 5% discount rate | $884 million (C$1,208 million) | ||

| After-tax IRR | 14% | ||

| Payback (years) | 5.7 years | ||

| April 2024 Average (Au: $2,332/oz; Cu: $4.30/lb; Ag: $27.50/oz) | |||

| After-tax NPV @ 5% discount rate | $1,553 million (C$2,121 million) | ||

| After-tax IRR | 19.5% | ||

| Payback (years) | 4.7 years | ||

*Assuming a US$:C$ exchange of $0.74.

¹ See Non-IFRS Measures at the end of this news release.

Project Overview

The Troilus Project is comprised of four main zones of mineralization, which are located on a NE-SW trend covering approximately seven kilometres. These deposits will be mined using conventional open pit mining methods over a 22-year period. Ore will be processed in a flotation mill to produce gold-rich copper concentrate for sale to a smelter, with provision for gravity gold recovery to produce doré after Year 1.

The projected payable gold production averages 256,200 oz per year over the first 5 years, 241,200 oz per year for the remaining 17 years, for a LOM average of 244,600 oz per year. Copper payable annual production averages 16.1 million pounds per year for the first five years, 17.7 million pounds per year for the remaining 17 years and 17.3 million pounds for the life of mine average. Silver payable annual production is 475,200 oz per year for the first five years, 438,300 oz per year for the remaining 17 years with a life of mine annual average of 446,700 oz per year. The production profile is shown in Figure 1.

Total payable metal over the 22-year mine life is estimated at 5.4 million ounces of gold, 381.8 million pounds of copper, and 9.9 million ounces of silver.

Figure 1: Production Profile – Payable Gold, Silver, and Copper

Economic Analysis

The Troilus Project’s estimated Base Case after-tax NPV (5%) is $884 million and IRR is 14%, assuming metal prices of $1,975 per ounce gold, $4.05 per pound copper, $23 per ounce silver and a USD:CAD foreign exchange rate of $0.74:1. Payback on initial capital is expected to be achieved in 5.7 years under the base case scenario.

Assuming April 2024 average gold price of $2,333 per ounce, the after-tax NPV(5%) increases to $1.55 billion and IRR increases to 19.5%, with the payback decreasing to 4.7 years.

| Base Case | April 2024 Avg. | |

| Gold Price (per oz) | $1,975 | $2,332 |

| Copper Price (per lb) | $4.05 | $4.30 |

| Silver Price (per oz) | $23.00 | $27.50 |

| Pre-Tax NPV (5%) | $1,564 MM | $2,670 MM |

| Pre-Tax IRR | 18.1% | 25.0% |

| Post-Tax NPV (5%) | $884 MM | $1,553 MM |

| Post-Tax IRR (%) | 14.0% | 19.5% |

| Post-Tax Payback | 5.7 | 4.7 |

Table 1: Troilus Project NPV and IRR Sensitivity to Metal Prices

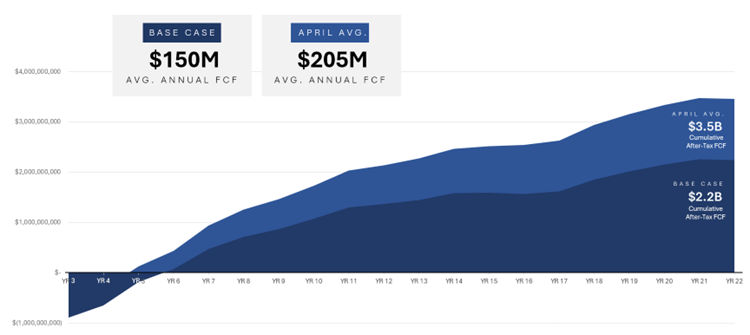

Under the base case scenario, the Project generates cumulative cash flow of $2.2 billion on a post-tax basis and $3.5 billion on a pre-tax, based on a throughput of 50,000 tpd over 22 years (see Figure 2).

Figure 2: Cumulative After-Tax Free Cash Flow After Repayment of Capital at Base Case and April 2024 Average Metal Prices

Capital Costs

The initial CAPEX for the Troilus Project is $1,075 million, net of existing infrastructure that includes all-weather access roads, power lines and a 50MW substation, a tailings facility, water treatment plants and site roads. Sustaining CAPEX over the life of the mine is an additional $276.6 million. A breakdown of the capital requirements is presented in Table 2.

Table 2: Troilus Project Capital Expenditure Estimates Breakdown (US$)

| Capital Costs ($ million) | |

| Mining | $258.3 |

| Process Plant | $443.0 |

| Infrastructure | $100.3 |

| Indirects | $173.0 |

| Contingency | $89.3 |

| Subtotal – Initial Capital | $1,063.9 |

| Environmental | $10.7 |

| Total – Initial Capital | $1,074.6 |

| Sustaining Capital | $209.1 |

| Closure Costs | $67.4 |

| Total Sustaining Capital | $276.6 |

*Net of existing infrastructure (access road, power line, substation, tailings facility, water treatment plant, site roads)

Operating Costs

Total all-in-sustaining costs of $1,109 per ounce. Total operating costs are expected to average $19.06 per tonne of ore processed. A breakdown of the operating costs is presented in Table 3.

Table 3: Troilus Project Operating Cost Estimates (US$)

| Average Life-of-Mine Operating Costs | |

| Mining | $11.60/t |

| Processing | $5.64/t |

| G&A, Trucking, Port, Shipping | $1.82/t |

| Total Operating Cost/Tonne Ore | $19.06/t |

| All-in Sustaining Cost | $1,109/oz |

Mining

The Study considers a conventional open pit mining operation using a 100% owner-operated equipment fleet peaking at 41–227 tonne trucks, electric hydraulic shovels, wheel loaders and drills.

The mine has been designed to deliver 18.3 million tonnes per year (50,000 tonnes per day) of mill feed. The FS contemplates a mine that delivers 379.5 million tonnes with an average head grade of 0.49 g/t Au, 0.058% Cu, 1.0 g/t Ag.

The process plant is expected to have three months of commissioning in pre-production, followed by nine months of production ramp-up during the first year of production.

The project will mine four areas: Z87, J Zone, Southwest (SW) Zone and X22. Mining commences in the Z87 pit area in the pre-production period and will be mined continuously until Year 8. The final phase of the 87 Zone pit area will be mined from Year 12 until Year 19. The SW Zone pit area starts production in Year 1 and is mined continuously until completion in Year 9 and will then be used for deposition of tailings from year 10 to 16. The J Zone pit area starts production in Year 5 and is mined continuously until early Year 15. The X22 pit will be mined from Year 18 to 21. Waste from the Z87 and X22 open pits will be backfilled over the SW tails from Year 16 onward. When Z87 pit area is completed in Year 19, waste is also backfilled into it from the X22 pit area, reducing the overall size of the waste storage facilities.

The average strip ratio for the open pit life of the mine is estimated at 3.1:1. Material movement averages 86 million tonnes (feed and waste) in the first 5 years with the peak at 86 million tonnes in Year 5. The open pit will provide 379.5 million tonnes of feed to the process plant over the 22-year mine life. Open pit bench heights of 10 metres will be mined and ore hauled with 227-tonne haul trucks and matching loading equipment including electric hydraulic shovels. The open pit mining fleet will be leased. Best practice grade control drilling will be done with reverse circulation drilling and rock sampling on mine benches prior to blasting. This provides the greatest flexibility for grade control during operations while maintaining reasonable mine operating costs and production capability.

During the mining operation a stockpile will be maintained adjacent to the primary crushing plant to be used as supplemental feed as required to meet production targets, weather events, and as mill feed in the later years of the operation. Waste rock will be hauled to dedicated waste management facilities near the open pits, backfilled into the 87 Zone pit, placed in lifts over the tails in SW Zone pit, and also used for lifts of the tailings management facility. Concurrent reclamation of the waste management facilities is planned.

Metallurgy

The flowsheet, similar to the original Troilus Mill operated by Inmet, has been developed based on testwork completed at Eriez, FLS/Knelson, Base Met and Kappes Cassidy. The process plant consists of primary and secondary crushing, HPGR and ball milling, copper/gold flotation with a regrind circuit, concentrate filtration and tailings thickening and disposal. Copper concentrate, enriched with gold, will be sent to a smelter for refining. Provision has been made to install gravity gold concentration for the primary and regrind circuit in Year 1 where gold dorés will be produced. Overall recovery is estimated to be 92.7% for gold, 91.8% for silver, and 91.9% for copper based on the LOM average head grades.

Figure 3: Troilus Project Process Flowsheet

Location and Infrastructure

The Troilus Gold Project is located in Quebec, Canada, approximately 120 kilometres north of Chibougamau, where Inmet Mining Corporation operated a large mine/concentrator complex from 1996 to 2010. Access to the mine site from Chibougamau is by the Route du Nord.

The Troilus Project benefits greatly from the upgraded, and substantial infrastructure on site, which includes:

- Power line and 50MW substation sufficient for project power requirements,

- All-weather access road,

- Tailings facility and water treatment plant,

- Camp facilities,

- Site roads,

- Water supply,

- Septic system.

As part of the design, it is proposed to develop the tailings dyke as a downstream raise constructed containment from the existing tailings management facility which will limit the overall footprint disturbance. This structure will have the capacity to accommodate the first 10.5-year life of mine production and then from years 11-22, the tailings will be disposed subsequently into the mined-out SW pit, J pit and 87 pit as described in this FS. Waste rock from the mine operation placed along the tailings facility’s containment dyke will enhance the facility’s stability and safety and will also limit the footprint disturbance.

Figure 4: Troilus Project Location

Figure 5: Troilus Project Mine Site Layout (Year 22)

Mineral Reserve Estimate

The FS is based on an inaugural Proven and Probable Mineral Reserve estimate totaling 380 million tonnes, grading 0.59g/t AuEq (0.49 g/t Au, 0.058 % Cu and 1.0 g/t Ag) and containing 7.26 million ounces of gold equivalent (6.02 Moz Au, 484 Mlb Cu and 12.15 Moz Ag), reflecting the successful conversion of Indicated and Inferred Mineral Resources (see Table 4).

Table 4: Troilus Project Mineral Reserve Estimate

| Tonnage | Grades | Contained Metal | |||||||||

| Au | Cu | Ag | AuEq | CuEq | Au | Cu | Ag | AuEq | CuEq | ||

| Class | (Mt) | (g/t) | (%) | (g/t) | (g/t) | (%) | (Moz) | (Mlb) | (Moz) | (Moz) | (Blbs) |

| Proven | – | – | – | – | – | – | – | – | – | – | – |

| Probable | 380 | 0.49 | 0.058 | 1.00 | 0.59 | 0.39 | 6.02 | 484 | 12.15 | 7.26 | 3.24 |

| P&P | 380 | 0.49 | 0.058 | 1.00 | 0.59 | 0.39 | 6.02 | 484 | 12.15 | 7.26 | 3.24 |

Note: This mineral reserve estimate has an effective date of January 15, 2024, and is based on the mineral resource estimate dated October 2, 2023, for Troilus Gold by AGP Mining Consultants Inc. The Mineral Reserve estimate was completed under the supervision of Willie Hamilton, P.Eng. of AGP, who is a Qualified Person as defined under NI 43-101. Mineral Reserves are stated within the final pit designs based on a US$1,550/oz gold price, US$20.00/oz silver price and US$3.50/lb copper price. An NSR cut-off of C$9.96/t was used to define reserves. The life-of-mine mining cost averaged C$3.99/t mined, preliminary processing costs were C$8.02/t ore and G&A was C$1.94/t ore placed. The metallurgical recoveries were varied according to gold head grade and concentrate grades. 87 pit recoveries for equivalent grades were 95.5%, 94.7% and 98.2% for gold, copper, and silver respectively. J pit recoveries for equivalent grades were 93.1%, 89.3% and 88.9% for gold, copper, and silver respectively. X22 pit recoveries for equivalent grades were 95.5%, 94.7% and 98.2% for gold, copper, and silver respectively. SW pit recoveries for equivalent grades were 85.7%, 91.5% and 85.6% for gold, copper, and silver respectively. The formulas used to calculate equivalent values are as follows, for 87 Pit AuEq = Au + 1.5361*Cu +0.0133 *Ag, for J Pit AuEq = Au + 1.4849*Cu +0.0123 *Ag, for SW Pit AuEq = Au + 1.6535*Cu +0.0129 *Ag, for X22 Pit AuEq = Au + 1.5361*Cu +0.0133 *Ag. Please refer to the identified risks in the Company’s Annual Information Form available under the Company’s profile at www.sedarplus.ca for known legal, political, environmental, and other risks that could materially affect the potential development of the mineral resources and mineral reserves.

Exploration Upside

The Troilus Project is held within a large exploration land package totaling 435 km² within the prospective Frôtet-Evans Greenstone Belt. Numerous targets ranging from grass roots geochemical anomalies to early-stage drill targets are actively being explored and advanced by the Company, both near mine and regionally.

In late 2022, the ‘X22 Zone’ was discovered along an oblique structural trend immediately adjacent to the previously mined Z87 pit, and now hosts 1.19M ounces AuEq Indicated mineral resources, highlighting the prospectivity and continued opportunity for discovery at both the mine site and within the belt. X22 remains open, particularly at depth, and has previously not been drill tested below 250 metres from surface.

A 25,000m drill program is underway, largely focused across the ‘Gap Zone’ between Z87 and the SW zones, and at depth at the X22 Zone. Using multiple layers of geoscientific data and the latest understanding of the deposit genetics, a spectrum of targets were developed that range from strategic resource expansion to those more conceptual in nature.

Next Steps

The Company will be focused on the following activities over the next 24 months:

- Completion and submission of the Environmental and Social Impact Assessment (“ESIA”) by the end of 2024.

- Progressing the Federal and Provincial permitting processes, which were initiated in May 2022, and obtaining all final permits to commence construction.

- Initiate detailed engineering in preparation for construction.

- Project Financing: The Company has engaged Auramet International, Inc (“Auramet”) as Financial Advisor in conjunction with project financing for the Troilus Project.

- Ongoing exploration both near the mine and regionally.

Feasibility Study Consultants

The Troilus Project Feasibility Study is being prepared and compiled by AGP Mining Consultants Inc. and supported by independent consulting firms, Lycopodium Limited and WSP Canada Inc. in collaboration with Troilus’ technical team and the completed NI 43-101 technical report associated with the Troilus Project FS will be available on SEDAR+ at www.sedarplus.ca under the Company’s issuer profile, as well as the Company’s website at www.troilusgold.com within 45 calendar days.

Qualified Persons

The FS is prepared by independent representatives of AGP, Lycopodium and WSP, each of whom are Qualified Person as defined by NI 43-101 Standards of Disclosure for Mineral. Each of the QPs are independent of Troilus Gold Corp. and have reviewed and confirmed that this news release fairly and accurately reflects, in the form and context in which it appears, the information contained in the respective sections of the Troilus FS for which they are responsible. The affiliation and areas of responsibility for each QP involved in preparing the Troilus FS are provided below.

AGP QPs

Paul Daigle, P.Geo. – Mineral Resources estimate.

Willie Hamilton, P.Eng. – Mineral Reserves, Mine design and scheduling.

Gordon Zurowski, P.Eng – Mine Costing and financial analysis.

Lycopodium QP

Ryda Peung, P.Eng. – Metallurgical review, process design and operating cost estimate.

Balvinder Singh, P. Eng. – Process plant and associated infrastructure cost estimates.

Zuned Shaikh, P. Eng.- Design and material take off for the process plant related infrastructure.

WSP QPs

Vlad Rojanschi, P.Eng. – Design and material takeoff for the surface water management infrastructure (not including electromechanical treatment or pumping equipment), hydrogeology, and mine site water balance prediction.

Laurent Gareau, P.Eng. – Geotechnical design and material takeoff for the Tailings Storage Facility.

Pierre Primeau, P.Eng. – Design and costs for TSF water treatment for suspended solids removal, and selected surface water conveyance pipelines and pumping.

Marc Rougier, P.Eng. – Mine geotechnical aspects of open pits slopes design.

Non-IFRS Financial Measures

The Company has included certain non-IFRS financial measures or ratios in this news release, such as Initial Capital Cost, All-In Sustaining Cost, Sustaining Capital and Capital Intensity, which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. As a result, these measures may not be comparable to similar measures reported by other corporations. Each of these measures used are intended to provide additional information to the user and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Non-IFRS financial measures used in this news release and common to the gold mining industry are defined below. As construction and operation of the Project are at the study stage, the Company does not have historical non-IFRS financial measures nor historical comparable measures under IFRS, and therefore the foregoing prospective non-IFRS financial measures or ratios may not be reconciled to the nearest comparable measures under IFRS.

All-in Sustaining Costs and AISC per Ounce

AISC is reflective of all of the expenditures that are required to produce an ounce of gold from operations. AISC reported in the FS includes total cash costs, sustaining capital, expansion capital and closure costs, but excludes corporate general and administrative costs and salvage. AISC per Ounce is calculated as AISC divided by payable gold ounces and copper/silver credits.

About Troilus Gold Corp.

Troilus Gold Corp. is a Canadian development-stage mining company focused on the systematic advancement of the former gold and copper Troilus Mine towards production. Troilus is located in the tier-one mining jurisdiction of Quebec, Canada, where is holds a large land position of 435 km² in the Frôtet-Evans Greenstone Belt. A Feasibility Study completed in May 2024 supports a large-scale 22-year, 50ktpd open-pit mining operation, positioning it as a cornerstone project in North America.

MORE or "UNCATEGORIZED"

Ascot Announces Closing of C$34 Million Bought Deal Financing

Ascot Resources Ltd. (TSX: AOT) (OTCQX: AOTVF) is pleased to anno... READ MORE

RUA GOLD Closes C$8 Million Brokered Offering and Announces Commencement of Trading on the TSX Venture Exchange

Highlights Closing the fully subscribed brokered offering for C$8... READ MORE

Mosaic Acquires 100% of the Amanda Project

Mosaic Minerals Corporation (CSE: MOC) announces that it has sign... READ MORE

First Phosphate Confirms Significant High-Quality Igneous Phosphate Deposit at Its Bégin-Lamarche Project in the Saguenay-Lac-St-Jean Region, Quebec au Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is ple... READ MORE

PROSPECT RIDGE ANNOUNCES FINAL CLOSING OF ITS OVERSUBSCRIBED PRIVATE PLACEMENT

Prospect Ridge Resources Corp. (CSE: PRR) (OTC: PRRSF) (FRA: OE... READ MORE