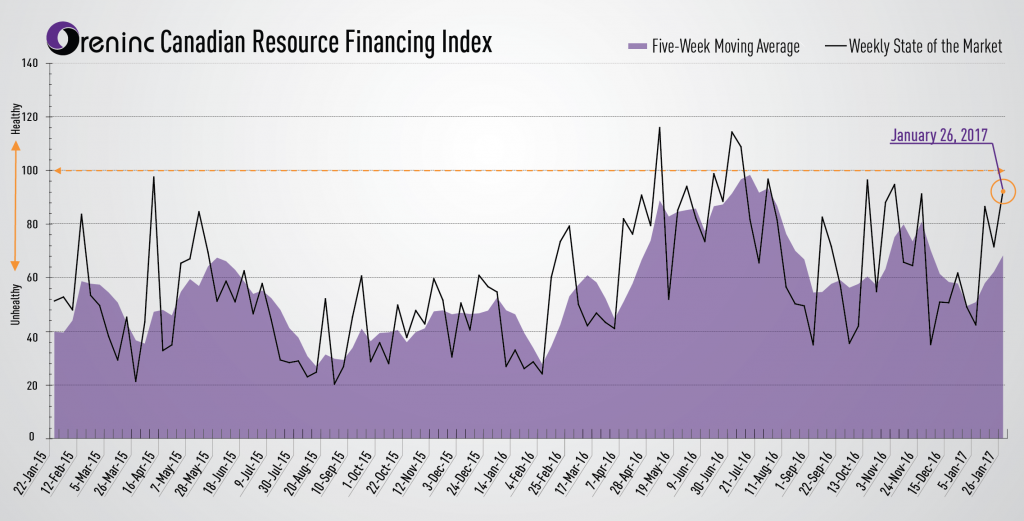

Oreninc Index rises as gold pulls back below $1,200 USD

The Oreninc Index rose in the week ending January 26, 2017 although gold pulled back from recent highs and moved back under USD $1,200 per ounce, closing the week at USD $1,191. Total fund raising dollars announced increased to C$233.5m from C$191.8m, which included seven brokered financings for a total of $177.2m within which were two bought-deal financings for $119.7m. The average offer size increased from $5.2m to $6.5m.

Whilst the average dollar value per raise increased, the total number of financings fell to 36. Reflecting the gold pull back, the industry’s leading benchmark index, the van Eck managed GDXJ also pulled back slightly and it is up 16.86% so far in 2017 from 18.76% a week ago.

The first week of Donald Trump’s presidency saw a raft of executive orders fly out of the Oval Office including approvals for the Keystone XL and Dakota Access pipelines that will move Canadian oil sands production to the US Gulf Coast. The markets liked what they saw and the Dow Jones Industrial Average passed 20,000 for the first time whilst the S&P/TSX Composite Index hit a record 15,657.

Last week saw the start of the conference season with the Vancouver Resource Investment Conference where Oreninc CEO Kai Hoffmann presented on The True State of the Junior Resource Market. Oreninc also caught up with The Mercenary Geologist Mickey Fulp to record a short interview on his thoughts on the financial markets, which will be available on the Oreninc website soon.

Financial news highlights

Of particular note this week, Fortuna Silver Mines Inc. (TSX: FVI) announced a USD $65 million bought deal financing without entering into more detail other than for general working capital purposes, but much of that will be spent on development work at its San Jose mine in Mexico and its Caylloma mine in Peru, as well as continuing with the optimization of the 2016 feasibility study for the Lindero gold project in Argentina that has proven and probable reserves of 1.684 million ounces.

Also of note, Northern Dynasty Minerals Ltd. (TSX: NDM), that owns the massive Pebble deposit in Alaska, closed a bought deal financing for gross proceeds of USD $37.444 million. Pebble has been held up by what the company terms pre-emptive regulatory action by the U.S. Environmental Protection Agency that has prevented the project from entering the permitting process, but with President Trump in the Whitehouse—who is pro-resource development—the expectation is that Pebble could start moving forward again. Northern Dynasty has posted some of the strongest stock price gains over the last twelve months and is up 41.52% so far in 2017.

Summary:

- Number of financings decreased to 36.

- Seven brokered financings were announced for $177.2m, a two-week high.

- Two bought-deal financings were announced for $119.7m, a 26-week high.

- Total dollars jumped to $233.5m, a two-week high.

- Average offer size increased to $6.5m, a two-week high.

Major Financing Openings:

- Fortuna Silver Mines Inc. (TSX:FVI) opened an $86.45 million offering underwritten by a syndicate led by Raymond James Ltd. on a bought deal basis. The deal is expected to close on or about February 9, 2017.

- SDX Energy Inc. (TSX-V:SDX) opened a $52.88 million offering underwritten by a syndicate led by Cantor Fitzgerald on a best efforts basis. The deal is expected to close on or about January 27, 2017.

- Platinum Group Metals (TSX:PTM) opened a $33.23 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about January 31, 2017.

- Stratton Resources Inc. (TSX-V:SI) opened a $13 million offering on a best efforts basis. The deal is expected to close on or about February 20, 2017.

Major Financing Closings:

- SDX Energy Inc. (TSX-V:SDX) closed a $52.92 million offering underwritten by a syndicate led by Cantor Fitzgerald on a best efforts basis. The deal was expected to close on or about January 27, 2017.

- Northern Dynasty Minerals Ltd. (TSX:NDM) closed a $48.99 million offering underwritten by a syndicate led by Cantor Fitzgerald on a bought deal basis. The deal was expected to close on or about January 26, 2017.

- Dundee Precious Metals Inc. (TSX:DPM) closed a $43.72 million offering on a strategic deal basis. The deal was expected to close on or about January 23, 2017.

- Auryn Resources Inc. (TSX-V:AUG) closed a $35.02 million offering on a strategic deal basis. The deal is expected to close on or about January 31, 2017.

MORE or "INDUSTRY ANALYSTS"

Mickey Fulp - Mercenary Alert: Is Zinc Still a Four-Letter Word?

Read the Report Here Mercenary Alert: Is Zinc Still a Four-Letter Word? ... READ MORE

Top 10 Financings of May 2017

May saw 125 financings close in the Canadian financial markets for C$366.5 million including 64 fina... READ MORE

ORENINC INDEX jumps as gold gets political again

ORENINC INDEX – Monday, June 12, 2017 North America’s leading junior mining finance data provide... READ MORE

The Week of June 5th to June 11th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday June 5th with... READ MORE

The Week of May 29th to June 4th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday, May 29th wit... READ MORE