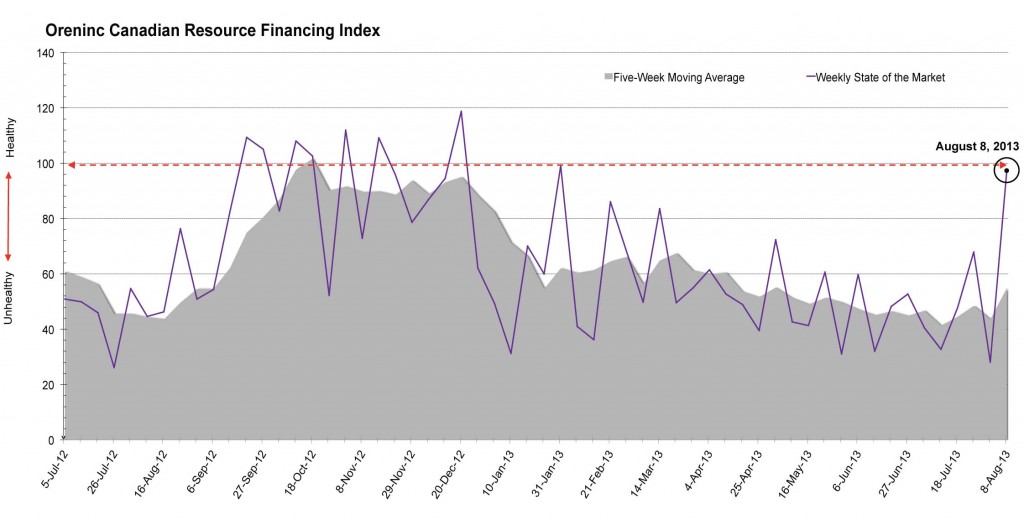

Oreninc Index Explodes to Second Highest Level of 2013

The Oreninc Index exploded to its highest level since January for the week ending August 8, 2013. Two $80m+ brokered offerings led the way, marking the first time more than one $50m+ brokered offering has occurred in a single week in 21 weeks. Broker activity was up all around, with brokered vs. total deals over 93%, its highest level since 2011. While the financing market may still be on shaky ground, this week’s heights along with a 14-week high for the five-week moving average gives us optimism that we are moving away from 2013’s summer financing lull.

Summary:

- Total deals announced climbed to 26, a two-week high.

- Seven brokered deals were announced for $190m, a 28-week high.

- One bought deal was announced for $99.6m, a 28-week high.

- Dollars announced rose to $204m, a 21-week high.

- Average deal size climbed to $7.8m, a 21-week high.

Major Financing Openings:

- Kelt Exploration Ltd. (TSX:KEL) opened a $99.6 million offering underwritten by a syndicate led by Peters & Co. Ltd. on a bought deal basis. The deal is expected to close on or about August 27, 2013.

- Paladin Energy Ltd. (TSX:PDN) opened a $81 million offering underwritten by a syndicate led by UBS AG on a best efforts basis.

- Veris Gold Corp. (TSX:VG) opened a $7.88 million offering underwritten by a syndicate led by Secutor Capital on a best efforts basis. Each unit includes a 1/2 warrant that expires in 36 months. The deal is expected to close on or about August 15, 2013.

- Artisan Energy Corporation (TSX-V:AEC) opened a $4 million offering on a best efforts basis. The deal is expected to close on or about September 13, 2013.

Major Financing Closings:

- Gold Standard Ventures Corp. (TSX-V:GSV) closed a $5 million offering underwritten by a syndicate led by Macquarie Capital Markets Canada Ltd. on a best efforts basis.

- Contact Exploration Inc. (TSX-V:CEX) closed a $6.49 million offering underwritten by a syndicate led by Integral Wealth Securities on a best efforts basis.

- High North Resources Ltd (TSX:HN) closed a $3.38 million offering on a best efforts basis. Each unit includes a 1/2 warrant that expires in 24 months.

- Gold Canyon Resources (TSX-V:GCU) closed a $1.95 million offering on a best efforts basis.

Oreninc also publishes the Oreninc Deal Log, a daily list of all financing activity in the TSX resource sectors. Visit http://oreninc.com to see which companies and sectors to watch. Oreninc also writes custom reports for companies on effective capital raising strategies to help companies maintain long-term shareholder value.

MORE or "INDUSTRY ANALYSTS"

Mickey Fulp - Mercenary Alert: Is Zinc Still a Four-Letter Word?

Read the Report Here Mercenary Alert: Is Zinc Still a Four-Letter Word? ... READ MORE

Top 10 Financings of May 2017

May saw 125 financings close in the Canadian financial markets for C$366.5 million including 64 fina... READ MORE

ORENINC INDEX jumps as gold gets political again

ORENINC INDEX – Monday, June 12, 2017 North America’s leading junior mining finance data provide... READ MORE

The Week of June 5th to June 11th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday June 5th with... READ MORE

The Week of May 29th to June 4th, 2017 "A Brief Look Back Into Tomorrow"

The new North American trading week began on Monday, May 29th wit... READ MORE