ORENINC INDEX down as financings dry up for holidays

ORENINC INDEX – Monday, January 6th 2020

North America’s leading junior mining finance data provider

Subscribe to our weekly updates at oreninc.com/subscribe

Oreninc will be attending the Vancouver Resource Investment Conference 19-20 January 2020. Find us at booth #1117. Please contact us if you would like a meeting.

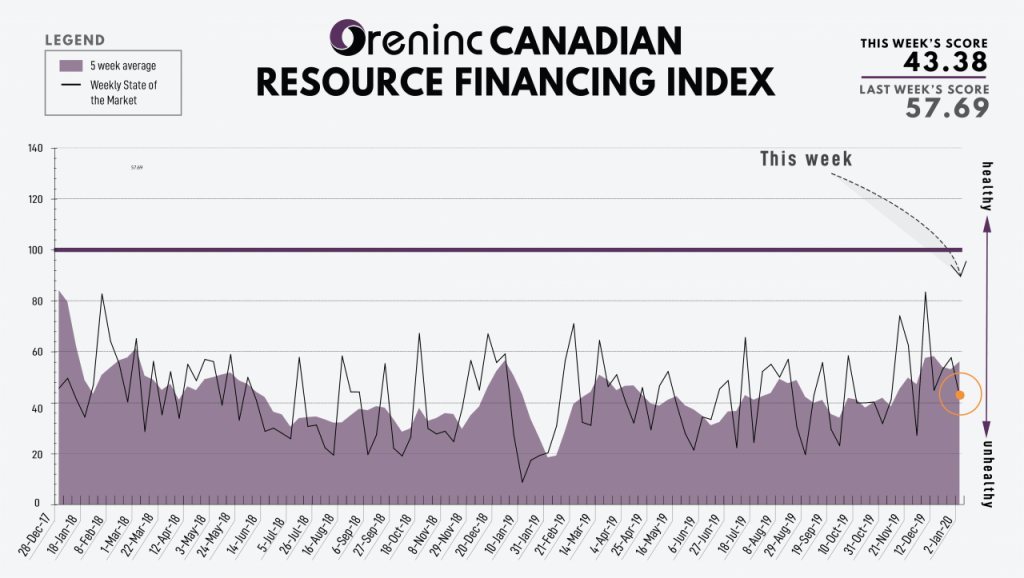

Last Week: 57.69

This week: 43.38

Happy New Year!

The Oreninc Index fell in the short trading week ending January 2nd, 2020 to 43.38 from 57.69 a week ago as markets were closed for New Year’s Day.

A dramatic start to what promises to be a good year for precious and base metals with easing global trade tensions counterbalanced by increasing geopolitical tensions in the Middle East and Asia.

Tensions in the Middle East spiked after the US assassinated Iranian General Qassem Suleimani in a drone strike at Baghdad airport in Iraq. Suleimani, the second-most powerful person in Iran, was the leader of its elite Quds military organization and the director of its foreign policy in the region which has spread the country’s influence throughout several countries. Iran has said it will retaliate.

Immediate effects include the international coalition fighting Islamic State suspending anti-terrorist operations to focus on protecting the US, UK and other troops at bases in Iraq. The Iraqi parliament also passed a motion calling for the expulsion of some 6,000 US troops, which would effectively mean the country would come under the influence of Iran.

Iran also indicated it could resume work on its nuclear program and abandon the Iranian Nuclear trade deal, which Russia and the European Union have spent months trying to salvage, despite the US earlier walking away from it in favour of tighter economic sanctions.

The nuclear threat also ratcheted-up a notch in Asia, as North Korea threatened to resume nuclear and ICBM testing after its leader Kim Jong-un said he would end the suspension of nuclear and long-range missile tests put in place during talks with the US. Kim also said his country would soon introduce “a new strategic weapon”.

On the trade front, the US and China have agreed on a phase one deal to resolve their tariff war with a signing to occur in mid-January. The deal requires China to purchase some $200 billion worth of US products over the next two years, as well as stepping up efforts to counter intellectual property theft and technology transfer. For its part, the US agreed to reduce tariffs on Chinese goods although duties will continue to be levied against $380 billion of its products.

The central bank in China also reduced the reserve ratio for commercial banks by 50 basis points to improve liquidity, which released about 800 billion yuan (US$115 billion) for lending.

On to the money: total fund raises announced increased to $25.61 million, a one-week high, which included no brokered financings and no bought-deal financings. The average offer size increased to $0.77 million, a one-week high, while the number of financings decreased to 33.

Gold received a strong boost in an otherwise quiet trading week jumping to close up at US$1,552/oz from $1,510/oz a week ago. The yellow metal is up 2.3% so far this year. The US dollar index continued to track downwards as it closed the week slightly down at 96.83 from 96.91 last week. The VanEck managed GDXJ closed up at US$41.91 from $41.38 a week ago. The index is down 0.83% so far in 2020. The US Global Go Gold ETF closed up at US$17.36 from $17.19 a week ago. It is down 1.14% so far in 2020. The HUI Arca Gold BUGS Index closed up at 238.26 from 237.45 last week. The SPDR GLD ETF saw its inventory get a boost as it closed up at 895.3 tonnes from 893.25 tonnes a week ago.

In other commodities, silver closed up at US$18.06/oz from $17.77/oz a week ago. The recent copper price run ran out of steam as it closed down at US$2.78/lb from $2.82/lb. The oil price also gained again as WTI closed up at US$63.05 a barrel from $61.72 a barrel a week ago.

The Dow Jones Industrial Average closed slightly down at 28,634 from 28,645 a week ago. Canada’s S&P/TSX Composite Index also closed down at 17,066 from 17,168 the previous week. The S&P/TSX Venture Composite Index closed up again at 587.44 from 563.58 last week.

Summary

- Number of financings decreased to 33.

- No brokered financings were announced this week.

- No bought-deal financings were announced this week.

- Total dollars increased to $25.61m, a one-week high.

- Average offer up to $0.77m, a one-week high.

Financing Highlights

Para Resources (TSX-V:PBR) arranged a non-brokered private placement for gross proceeds of up to C$5 million.

- 50 million units @ $0.10.

- Each unit is comprised of one share and a warrant exercisable @ $0.15 for two years.

- Proceeds will be used for general corporate and working capital purposes and work related to its projects.

Major Financing Openings

- Para Resources (TSX-V:PBR) opened a $5 million offering on a best efforts basis. Each unit includes a warrant that expires in two years.

- Telson Mining (TSX-V:TSN) opened a $3 million offering on a best efforts basis. Each unit includes half a warrant that expires in two years.

- Manitou Gold (TSX-V:MTU) opened a $3 million offering on a best efforts basis.

- Tudor Gold (TSX-V:TUD) opened a $2.93 million offering on a best efforts basis.

Major Financing Closings

- Regulus Resources (TSX-V:REG) closed a $11.5 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. Each unit included half a warrant that expires in two years.

- Benchmark Metals (TSX-V:BNCH) closed a $6.15 million offering underwritten by a syndicate led by Sprott Capital Partners on a best efforts basis. Each unit included half a warrant that expires in two years.

- Terrax Minerals (TSX-V:TXR) closed a $5 million offering underwritten by a syndicate led by BMO Capital Markets on a best efforts basis.

- Balmoral Resources (TSX:BAR) closed a $4.55 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

First Phosphate Confirms Another High Grade Intersect of 11.85% Igneous Phosphate Across 84 Metres Starting from Surface at Its Begin-Lamarche Project in Saguenay-Lac-St-Jean, Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is plea... READ MORE

MAG Silver Reports First Quarter Financial Results

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) announces the Com... READ MORE

Troilus Announces Feasibility Study Results for the Gold-Copper Troilus Project: Outlines a Large Scale, 22-Year Open Pit Project in Tier-One Jurisdiction With USD$884.5 Million NPV(5%)

Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF) reports results from... READ MORE

Alamos Gold Intersects Higher-Grade Mineralization within a New Zone Near Existing Infrastructure at Young-Davidson

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported new results from i... READ MORE

Titan Reports First Quarter 2024 Results; National Safety Recognition Award

Titan Mining Corporation (TSX: TI) announces the results for the... READ MORE