Jordan Roy-Byrne – “Near-Term Risk in Gold is Increasing”

Last week was another strong one for the precious metals sector.

Gold gained a whopping $51/oz or 3.5%. The gold stocks (GDX, GDXJ) advanced by roughly 6%. Silver gained 4%.

Momentum in the sector began to build once Gold surpassed resistance at $1420-$1425/oz. We had noted the lack of resistance from $1425 to $1525-$1550/oz.

Gold has not reached $1550/oz yet but as it inches higher, some technical and sentiment indicators are urging caution.

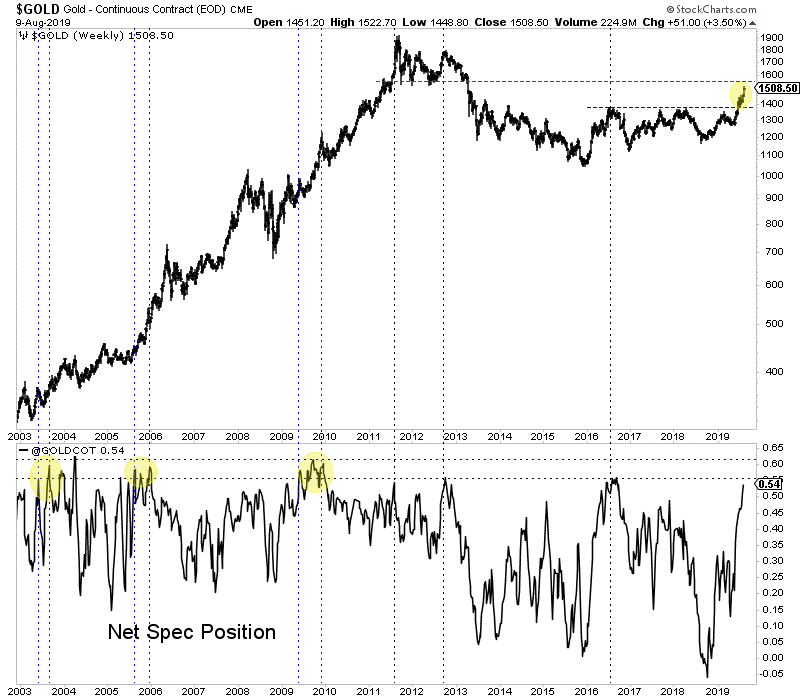

Gold’s net speculative position of 54% is very close to the peaks of 55% to 60% seen since 2000. It’s possible the commercial hedgers will start covering at somepoint like they did in 2006 and 2010 but for now we have to assume they won’t if $1550/oz holds as resistance.

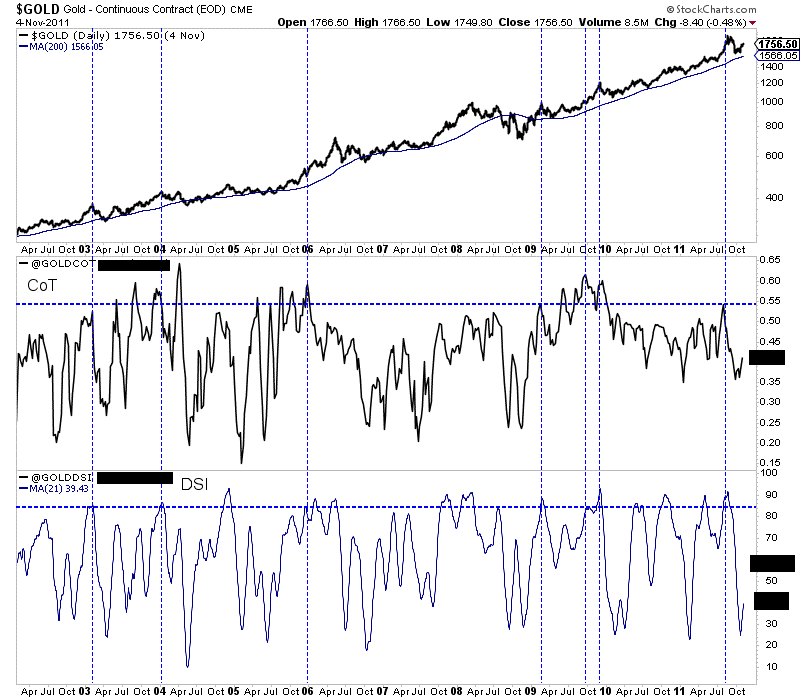

In the next chart we plot Gold’s net speculative position (51%) and the 21-day average of the daily sentiment index (DSI) from 2002 to 2011 (84%).

During that strong 10-year period, those figures of 51% and 84% were reached seven times. Five of those seven times Gold corrected or consolidated for at least a few months.

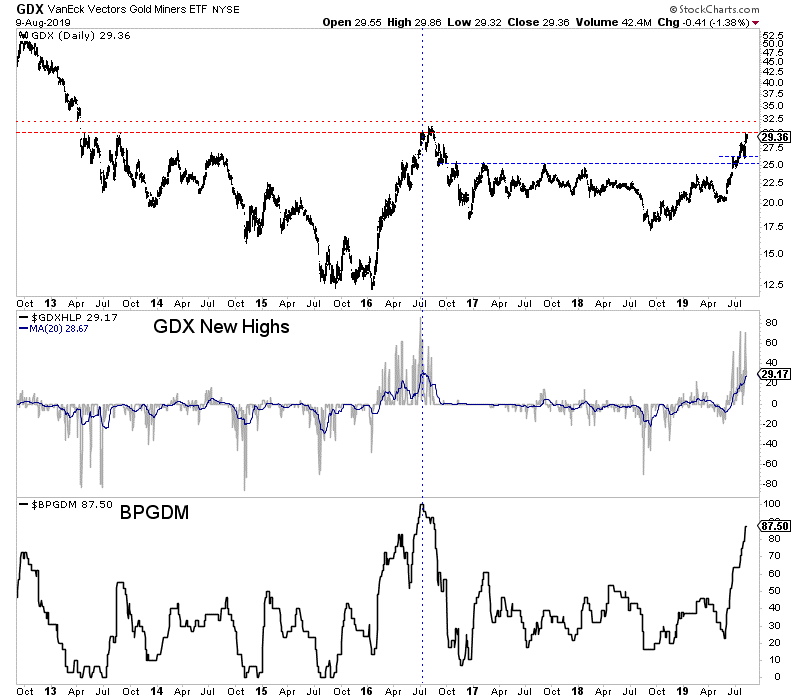

Turning to the gold stocks (and GDX specifically), we find a fairly overbought condition while the market approaches multi-year resistance at $31-$32.

The bullish percentage index (BPGDM) and a 20-day moving average of new highs in GDX are approaching the levels they peaked at in July 2016.

The trend in precious metals is strong and the fundamentals are bullish but there can obviously be corrections and consolidations within strong trends.

Sentiment indicators are becoming a concern and Gold and gold stocks (GDX) are approaching obvious resistance levels at $1550/oz and $31-$32.

This is not the time to be placing aggressive bets on Gold or the senior gold stocks. If there is a sector correction, those areas figure to be hit harder than Silver or junior mining stocks which are not as extended.

If you missed the recent run then it is best to be patient, buy value and wait for weakness in anything that is strong but too extended. New opportunities will emerge. To learn the stocks we own and intend to buy during the next correction that have 3x to 5x potential, consider learning more about our premium service.

MORE or "UNCATEGORIZED"

First Phosphate Confirms Another High Grade Intersect of 11.85% Igneous Phosphate Across 84 Metres Starting from Surface at Its Begin-Lamarche Project in Saguenay-Lac-St-Jean, Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is plea... READ MORE

MAG Silver Reports First Quarter Financial Results

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) announces the Com... READ MORE

Troilus Announces Feasibility Study Results for the Gold-Copper Troilus Project: Outlines a Large Scale, 22-Year Open Pit Project in Tier-One Jurisdiction With USD$884.5 Million NPV(5%)

Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF) reports results from... READ MORE

Alamos Gold Intersects Higher-Grade Mineralization within a New Zone Near Existing Infrastructure at Young-Davidson

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported new results from i... READ MORE

Titan Reports First Quarter 2024 Results; National Safety Recognition Award

Titan Mining Corporation (TSX: TI) announces the results for the... READ MORE