Gwen Preston – “Uranium Market Update”

There are no large event to report on the uranium front. But there are a good number of developments that collectively pack a bullish punch.

The bottom line is that political support for nuclear power is now clearly snowballing, pushing demand significantly higher over the next decade just as supply is set to fall off.

Uranium bulls have been talking about a pending supply deficit for years but it was always very hard to know when and how hard it would hit, as it was impossible to gauge undisclosed stockpiles and utilities long stayed complacent. Now those stockpiles are becoming clearer – Japan is not chock-a-block with uranium, for instance – and utilities are starting to sign long-term supply contracts with urgency, as they compete with each other and with an ever-growing group of funds buying uranium to hold for the bull market gains. Add in major political support from countries around the world for nuclear power large and small and you have a uranium sector that feels, finally, like it might be gearing up to go.

Of course, the frustrating thing is this is happening when investors are generally cautious. Fear of recession hangs over everything, casting a shadow over even the most bullish setups. And fair enough, in that real assets that are levers to economic growth are not the place to be when a recession hits.

Those opposing forces – increasingly bullish uranium fundamentals and cautious investors – have created this situation.

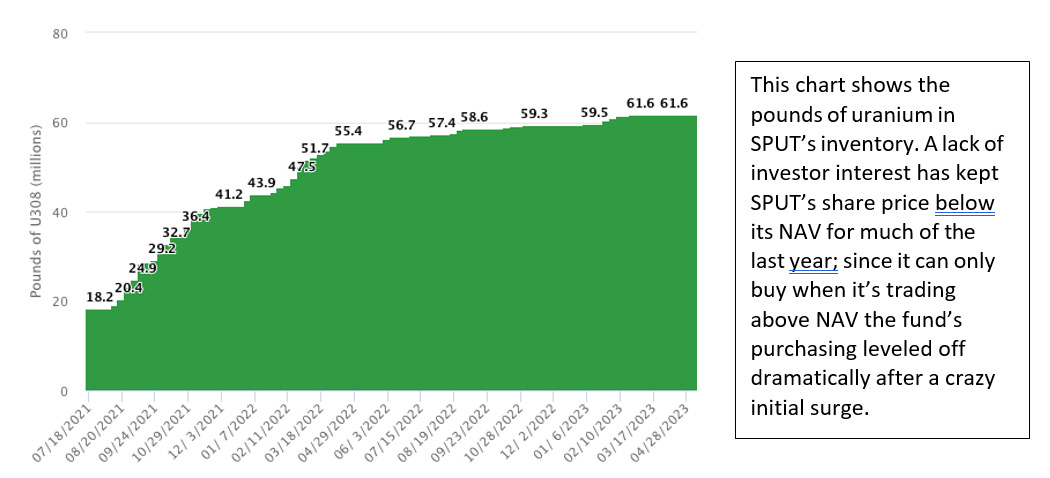

This chart shows the Sprott Physical Uranium Trust, with share price in green and per-share net asset value in yellow. In the last year, investors have rarely traded SPUT up to the value of the uranium it holds. And the divergence has been particularly wide and long in the last few months, though is perhaps closing now.

This showcases the investor interest challenge facing uranium. And there’s a compounding factor at play here: SPUT can only buy uranium when its share price trades at a premium to its NAV (when the green line is above the yellow line). Since that’s happened only rarely in the last year, SPUT has not bought much, which means the big new buyer that sparked an 80% gain in the spot price in late 2021 has been sidelined.

Other physical uranium funds are lining up. The largest is called ANU Energy; it’s a Kazakh- based fund that is currently marketing a $500-million raise to debut and buy uranium. When they come to trade and start buying, it could inject some new life into the spot market.

That said, the spot market hasn’t been dead of late. The spot price held as steady as could be over the last year, sticking with a few percent of $50 per lb. Since mid-March the price has been trending higher, moving from $49.70 to $53.40 per lb. In the volatile uranium world it’s not enough of a move to matter yet, but a few dollars more and it would start to matter, as that would take it above the rising trendline from early 2018.

Spot price notwithstanding, the same investor sentiment challenge that’s held SPUT back has also held uranium equities down. Many lost 15% or more in 2022 despite the uranium price holding steady.

So the questions are:

- Is growing momentum for nuclear energy combined with shrinking spot supplies enough to keep prompting utilities to contract? If so, will contracting start to get noticeably competitive?That would amplify the pressure, which would send utilities into the spot market to buy instead, which would boost the spot price.

- Will uranium equities benefit if the above happens? Notable contracting at high prices, which producers would demand in a competitive market, would fortify the outlook for those miners. They should trade higher as a result and might then feel they have the share capital and financial confidence to make buy and/or build new projects, which would lift smaller uranium stocks.

These questions matter because the reasons to be bullish uranium keep getting stronger but investors are not acting. If recession risk were to evaporate, I think uranium would take off – investors would look for real assets with bullish fundamentals to ride as growth resumes and uranium would fit that bill perfectly, alongside metals like copper and silver.

But recession risk isn’t going to simply evaporate. So can uranium get going while recession risk still hangs over everything? Perhaps. It feels like pressure is starting to build in the uranium space, the kind of pressure that will motivate utilities to start competing for pounds.

We got a good taste of that a few weeks ago, when the World Nuclear Fuel Cycle conference took place in the Netherlands. It’s one of the key annual gatherings of uranium industry folks. I read multiple accounts of the event from people who participated. Here are some quotes from those accounts.

“We’ve never been in a time like this… We’ve gone from ‘can we build it?’ to ‘can we build it fast enough?’ Nuclear is receiving unprecedented levels of bipartisan support at the national level, while more than 200 bills to support or advance nuclear energy are currently before state legislatures. Nuclear energy is the puzzle piece that makes it all work.” – Nuclear Energy Institute President/CEO Maria Korsnick

“The WNFC conference has the industry buzzing. All attendees are singing from the same hymn sheet: demand is set to pick up, over-feeding is occurring, security of supply has never been more important, political support is apparent, and mine supply needs to increase.” – Canaccord Research

There are two leading industry consultants: UxC and TradeTech. Leaders from each spoke at the event.

Jonathan Hinze of UxC noted that “a net shift of 33 to 44 million lbs. of U3O8 is needed given the drop in Russian supplies coupled with increasing western tails assays.” That shift is in addition to the market’s existing annual ~30-million-lb. deficit. Secondary supplies usually bridge the supply gap but with financial players soaking up spot market excess and enrichers overfeeding, which has them buying extra uranium instead of selling excess uranium, secondary supplies keep thinning.

Treva Klingbiel, president of TradeTech, gave a long talk late last year that resurfaced recently because (1) she has deep expertise and insight into uranium supplies, demands, and contracts and (2) she was incredibly bullish. Here are some quotes from that talk.

“TradeTech tends to be pretty conservative. We do look with a pretty tough eye. But even with that kind of lens, we really see this as a watershed moment for the nuclear industry. The point I want to make here is that, even without Germany, we have across the globe a real renewed commitment to nuclear, not just because of what’s happening with the war on Ukraine and geopolitics but also because they recognize that climate change is real. And there is a commitment to net zero carbon emissions. So you combine that with the desire for energy independence and energy security and you have what we call The Trifecta. So we do see it as something that will stick. We do see it as a watershed moment.”

“The straight line across the top represents what we see as requirements for uranium going forward. We’ve provided a gradient around that demand line because there’s been a lot of talk about SMR’s and new programs and funding coming out of the EU, the US, Japan, Asia…that are becoming much more solidified. “There’s a huge deficit here in terms of where is that fuel going to come from. You can see thr drop off in production from existing producers right there on the graphic between now and 2040. So we have basically a true supply-demand deficit, on the order of 120 million pounds or more. We could really have a couple of years were things are pretty bumpy for the market. Clearly there’s a need for new uranium mines and we pretty much need everyone looking to be a contender in that space. We’re going to need all hands on deck to bring the supply online to meet demand as we see it coming online in the future.”

Askar Batyrbayev is former COO of the world’s largest uranium producer, Kazatomprom. Since leaving that company he has formed a uranium consultancy. Last week he did an interview with James Conner of Bloor Street Capital. Below are the key bullish points he made, unreservedly.

- He knows of another large physical uranium fund being formed; details will be announced shortly.

- When asked about the current status of the uranium sector: “The fundamentals have never been better” and “There will be a battle for pounds.” He commented that “Spot could go crazy.”

- Asked whether China’s nuclear buildout plans, which are integral to rising global demand forecasts, are realistic: “They should be believed.”

Bank of America released a research note yesterday titled The nuclear necessity – the third bull market for uranium. It was strongly bullish. A few excerpts:

- “We are bullish on uranium and nuclear power. After a decade of underinvestment, a shortage is visible; our strategists forecast 20-40% upside in spot pricing. Global demand is also rising, with 60 new reactors being built and 100 more approved.”

- “Supply is tight and our analysts expect a structural uranium shortage through 2035. Demand is rising amid resource nationalism and a global focus on energy security. There is a chance of further bullish policy shift.”

Those points are familiar to this audience. I’m quoting the note because Bank of America is mainstream. They are not commodity focused or high risk. For Bank of America to get on the uranium train is bullish. The more institutions start seeing the uranium opportunity, the more likely it is that equities attract buying if/when the spot price starts rising regardless of the macro environment.

I’ve waited long enough for this uranium market that I’m not about to start making predictions now about when it will really start. But it does feel like the pressure is really starting to build on the utilities side.

That matters. In late 2022, when uranium ran from $28 per lb to $45 per lb., the main driving force was SPUT. In other words, investors positioning in a commodity because of its tight fundamentals drove the market higher. That’s fine, but a bull market is more sustainable when supplies get so tight that users start scrambling and the price jumps. Investors then pile onto a move that started in a real, current supply crunch, rather than into a forecasted future supply crunch, and investor interest amplifies the tightness.

We’re getting towards the second, more sustainable kind of bull market. Even in 2021 when I talked to uranium experts, there were always some who didn’t believe that run would sustain because supplies just weren’t tight enough yet. Now they are, or they are very close to being so.

Patience is killing me but I am holding on.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE