Gwen Preston – “The Beginning of the End? The End of the Beginning?”

The Fed did just what everyone expected and raised rates by 25 basis points. That’s the tenth hike in just over a year and brings the Fed funds rate to 5-5.25%.

It’s either the beginning of the end (if you think the Fed has hiked us into a recession) or the end of the beginning (if you think a soft landing or persistent inflation scenario is likely).

Whichever it is, we are now officially waiting to see if anything breaks.

The hike was a unanimous decision, which is a bit surprising to anyone who’s been paying attention to speeches by the various members of the FOMC. I guess they decided to put their differences aside for the sake of a clear message.

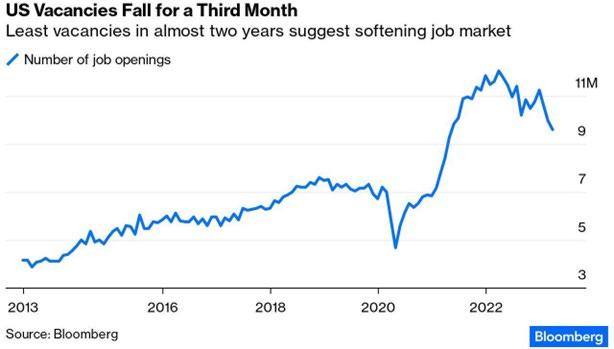

A clear decision to raise rates is one thing. What everyone was more interested in was what message the Fed would send about the path for rates from here. The banking crisis is not over (the failure count is low, at three plus another unfolding, but the banks that have failed are not small), economic growth is moderating (GDP growth was only 1.1% in Q1), and the jobs market is starting to weaken (the latest JOLTS report showed job openings at their lowest in 2 years).

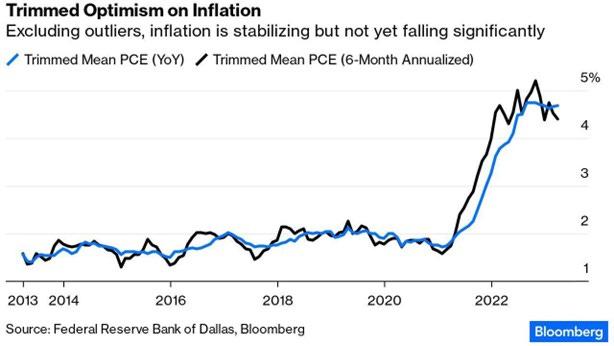

But inflation is not slayed.

So what’s the Fed planning to do next?

The post-meeting statement hinted towards a pause in hiking, not by what it said but by what it didn’t say. The statement omitted a sentence from previous statements that said “The Committee anticipates that some additional policy firming may be appropriate” to get inflation down to 2%.

The statement also described the banking system as “sound and resilient” but noted that upheaval in the financial system could slow borrowing and therefore spending and growth. Here I must point out: only a few hours after the FOMC said that, the fourth bank failure became apparent.

PacWest hasn’t failed yet but it’s very close: its shares are down 90% since February and it is exploring strategic options, including selling itself. So while the system as a whole might be alright, there are clearly still banks with big problems. And further hikes could make those worse – the problems and the number of banks facing them. So that matters.

Forced to bet right now, I would say the Fed will indeed pause its hikes to see how a dramatic increase in borrowing costs that has already derailed three-plus banks (that were dumb about positioning and hedging, to be clear) and slowed growth plays out given a bit more time. But I don’t actually know.

What I do know I that some big-picture patterns are at interesting points.

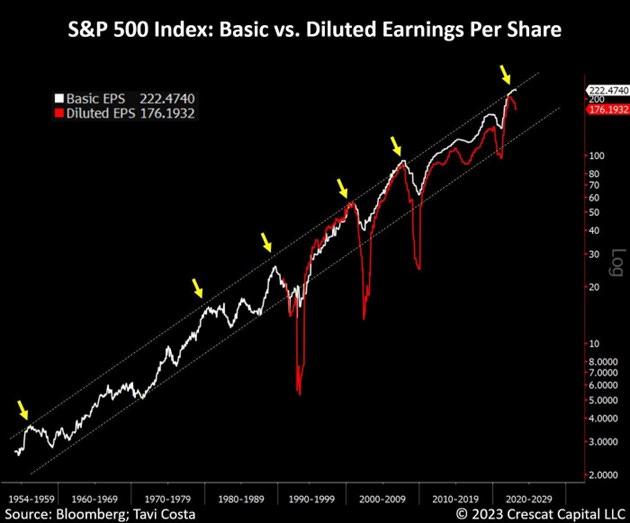

Here’s one: earnings per share remain near all-time highs but diluted earnings have turned down just after reaching the top of a 70-year trend.

Corporate fundamentals go through cycles. We saw earnings surge in the 2000s and 1990s alongside exceptional growth and then contract significantly with the Great Financial Crisis and the Tech Bust. In recent years earnings rocketed up in the post-COVID market; today corporations are facing inflation in labour and material costs, deglobalization challenges, and substantially higher cost of capital.

At the risk of stating the obvious: this isn’t a chart of share prices. Share price patterns in and of themselves are not as useful today as they used to be, since we’ve transitioned to a Fed-obsessed market that loves stimulus.

This is about earnings, which should be the most important share price driver.

Earnings turning down matters because a stock market recession impacts all stocks, whether we like it or not. A recession would hurt base metals stocks more than gold stocks because there’s a logical impact there – slowing or reversing growth means less base metal demand, so metals and miners should decline. Of course, I think that would be the final slide before the mega base metals market gets underway; the fundamentals for that argument only get stronger with each day that passes without new mines being built.

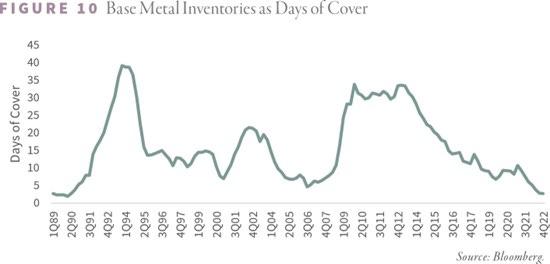

On the chart above: base metal prices were rocketing higher where this chart starts, in the late 1980s, when the global economy boomed and ate up almost all base metal inventories. And I mean rocketed: from 1988 to 1990, zinc surged 230%, copper gained 175%, and nickel shot up 700%.

Supply suddenly became available in 1990 because the Soviet Union started to fall apart, which cut demand dramatically and created a flood of scrap supply, and Japan’s financial bubble popped. It took the next 15 years to work that inventory off but in the 2000s surging Chinese demand pulled inventories way down and once again prices surged: copper, nickel, lead, and zinc all gained 300 to 400%.

This time it was supply response that turned things around: miners built all manner of new mines and inventories piled up again. In the last 10 years those inventories have fallen off as the green transition increased demand while lack of investor interest, conservative management at mining companies, and ever higher permitting hurdles meant few new mines were built.

Today inventories are lower than ever before. And green needs have demand rising. Yes, investors are currently focused on recession risk, which has largely clouded the base metal bull argument. But the cloud will pass and the argument will have only gotten stronger.

With that sidetrack into the base metal rationale over, let me get back to what I think I know right now.

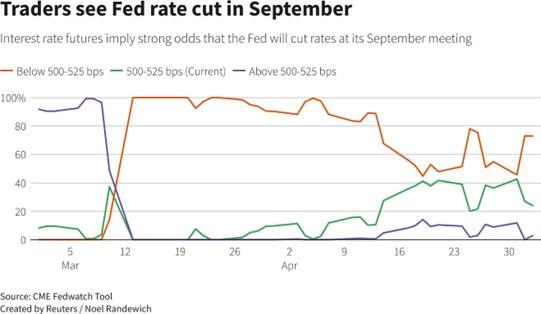

I am pretty sure traders will turn this “potential pause” into a positive – they want a bullish narrative so they will talk up the benefits of a pause. That said, traders are still pricing in a much faster drop in rates than I think likely. Powell certainly made clear yesterday that cuts are not currently being considered at all, yet traders still see 73% odds that the Fed will cut in September.

Traders will want to buy the ‘pause’, but the realization that rates aren’t going to fall without a recession might keep the buying muted until tighter conditions wreak whatever havoc they will, including hits to earnings.

What other big-picture patterns do I think matter right now? How about gold’s action yesterday that took it close to all-time highs? That puts gold in a unique position: about to break out to record levels. Can you think of another asset doing so?

Gold rising this strongly amidst all that’s happening matters because I think it sets gold up for success come what may. There are lots of things that could transpire from here. If hikes are over, we’re officially waiting to see if the Fed broke the economy. When you think of it like that, it’s no wonder a safe haven is seeing buying.

Gold will work as a hedge during and an outperformer after a recession if that’s what happens.

Gold should also work as part of an overall metals bull market if there is no recession because, even though the yellow metal doesn’t get the same demand push that base metals get in a growing economy short on metals, gold gets carried along as part of a metals bull run.

An end to rate hikes also lessens upward pressure on the US dollar. All metals do better when the US dollar is not rising.

And if we end up in a situation of persistent inflation and higher-for-longer rates, then the When Will Things Break? question remains at the fore, encouraging gold as a safe haven.

So while gold stocks usually slide alongside everything else in a stock market recession, I think the slide might be minimal this time if we end up in a recession. I think several recessions in the last decade have reminded investors that gold stays steady or rises as a recession hits and then surges out of the bottom, doling out better returns than any other asset class, and sooner.

Frequent reminders of this in the last decade have investors aligning for that opportunity ahead, which is why gold has been doing so well, and will reduce the hit gold takes if/when a recession does hit.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE