Gwen Preston – Real Rates, Safe Have Buying, Commodities Set To Soar, Gold’s Technical Setup, Russia Isn’t That Big (but the camel might not be able to carry another straw).

Real Rates

Jerome Powell testified to Congress today and made clear what the Fed will do at its meeting in two weeks: raise rates but only by 25 basis points. Of course the decision is actually a vote among the members of the Federal Open Market Committee, but Powell wouldn’t say the words “25 basis points” if he wasn’t darn sure that’s what the vote will churn out.

This matters because it pulls expectations back down: investors had seen 50 basis points as a shoo-in just a few weeks ago. And 50 basis points made sense based on inflation and unemployment…but it doesn’t make sense in the face of a new war that is impacting global trade and commodity prices.

Gold gains with rate hikes but prefers slow and steady because small hikes keep real rates (interest rates minus inflation) negative. Real rates are already negative and there’s enough inflation that real rates were likely to stay negative, but now they are guaranteed to do so. For instance, in the last 10 trading days the real 5-year yield has plunged from -0.95% to -1.58%.

Safe Haven Buying

Safe haven buying is clearly in action.

I don’t like geopolitical moves but this one has staying power across realms. The actual war is not likely to end soon. The economic risks it has unleashed will restrain interest rate hikes, even as inflation rages. The shadow it has added to a stock market that’s already got some 3 issues has the power to move a lot of money. So this is a geopolitical move but, in a very sad and unusual setup, it’s one with major influence and staying power.

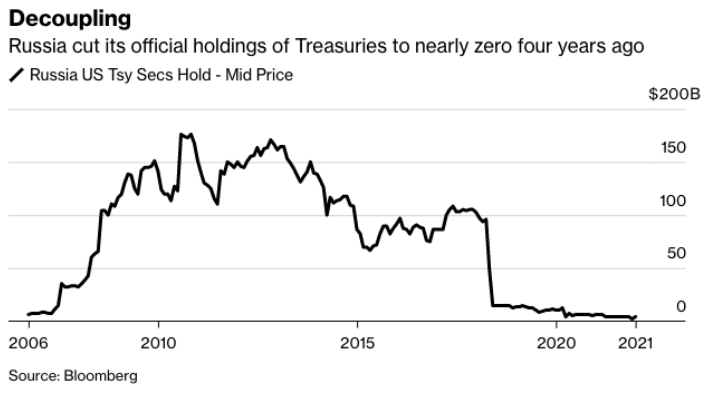

On a related safe buying note that I thought interesting: Russia is actively encouraging its people to buy gold. Last night the Finance Ministry backed ending the 20% Value Added Tax (VAT) on gold purchases. It’s a fair move given that Russia has been cut off from its USD holdings. (Much has been said about this but it’s partly much ado about nothing, as Russia had cut its Treasuries account to almost nothing in 2018. There is a deeper conversation here about what doing this – cutting a nation off from its T-bills account – means for the USD as a global reserve currency, but that’s a discussion for another day.)

Now, the Russian central bank isn’t exactly in a position to spend money on gold right now as other needs are more pressing, like the rouble crashing 35% in one day, but the concept applies broadly. Safe haven buying is a real force and it is in play.

Sudden Supply Risks + Inflation = Commodities Set To Soar

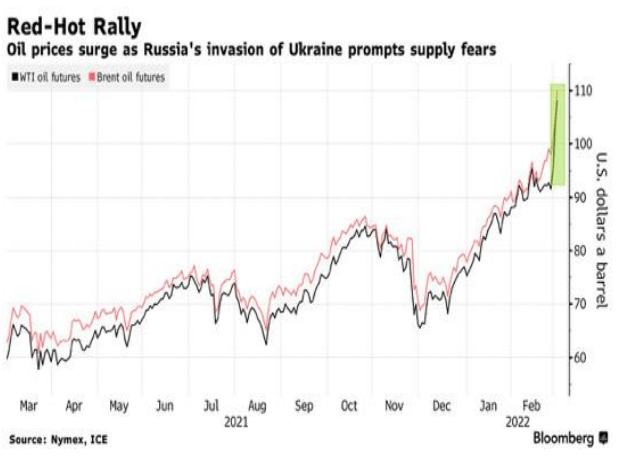

Energy prices really matter to inflation. And energy prices are surging. WTI hit $111.50 per barrel this morning before giving up some ground. Global benchmark Brent crude held above $110 per barrel as companies increasingly refused to buy Russian crude, even though there are no sanctions on it. European gas surged as much as 60% as traders moved away from Russian suppliers.

Many other commodities are running higher alongside energy. Some are 4 specifically at risk because Russia is a major producer (palladium, aluminum, nickel, fertilizer components, wheat). Others are being squeezed because it’s difficult to move them without touching Russia or Russian waters.

Those are the clear and immediate impacts. What else do we see if we step back?

It’s too soon to know, but here’s a thought: top Chinese officials have issued orders to prioritize energy and commodity supply security in the face of Russia-based disruptions. Stateowned entities have been ordered to scour the markets for materials to fill any potential gaps brought on by the conflict. There was no mention of price; in fact, the order noted that cost is not a focus right now.

China is not a small player, so that’s the kind of move that can send prices soaring (for those that haven’t already soared, like European nat gas). When China starts to buy price indiscriminately because it sees supply risk, supply risks that were already coming get much bigger and then prices respond more dramatically.

I think we could see this in several commodities in the next while. And this is part of the rationale for today’s Maven Buys, which is a phosphate company.

Gold’s Technical Setup Now

I am not a technical analyst so I will insert a quote from my friend Jordan Roy Byrne of The Daily Gold, from his note this morning.

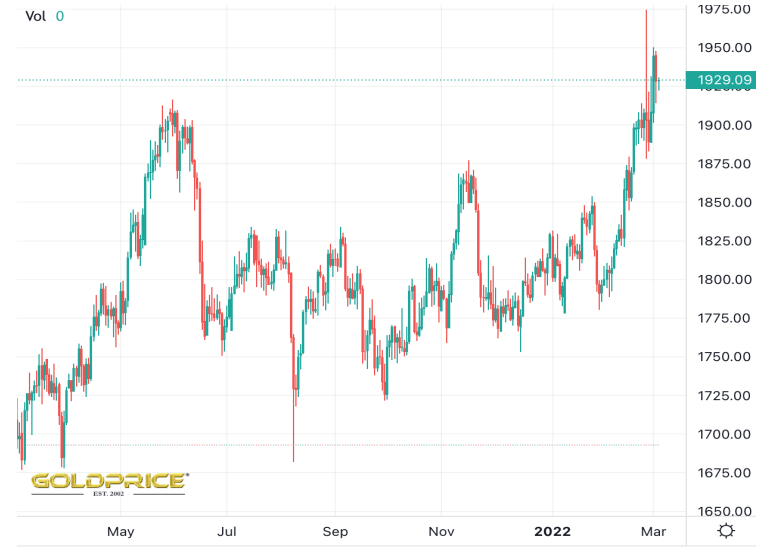

“I hate to over emphasize one day of trading because in the gold market we see false moves all the time but this action was extremely significant. Not only did gold explode above $1900 resistance, but it gapped up and then surged higher after the gap, then closed at the high of the day! This type of gap (breakaway or runaway) is extremely bullish because it does not get filled. In other words, unless gold fills this gap over the next few days, we won’t see $1900 ever again.”

Russia Isn’t That Big

Sanctions and business desertions are extreme and will kick off a severe recession in Russia. Most Russian banks including the central bank itself have been cut off from the international payments system. Trade has been shut down with almost every trading partner except China and even China doesn’t seem keen.

Corporate responses keep piling on top. To offer just a few examples: BP is bailing on its stake in Rosneft and expects to take a $25 billion loss doing so, Exxon is taking steps to exit the country, Boeing will suspend major activity in Moscow and restrict staff and partners in Russia from seeing sensitive data, and Honda and Ford will halt sales and operations there.

This will hurt Russia badly. A crass but important question is then: how much does Russia’s economy matter globally? The answer is: not much. Even a severe recession in Russia is unlikely to have impact elsewhere in and of itself.

However…there’s a camel out there that is getting heavily burdened with all these straws.

I will here quote a Bloomberg article that I thought captured this concept well:

“First, it was inflation. Then came shaky tech earnings. Now, Russia. Slowly, then all of a sudden, forces are gathering that threaten to wring out the excesses that defined the post-pandemic era in markets…

“In isolation, any of the threats facing investors might be navigable. The Fed is tightening, but from very low levels that aren’t likely to impede growth. Russia faces sanctions, but outside of its role as oil supplier it makes up a vanishingly small part of the global economy. And valuations are still high, but no worse than last year when stocks were surging. Put together, however, they are sowing a sense of exhaustion among traders, sapping sentiment as investors struggle to find reasons to be bullish.”

Courtesy of Maven Resources

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE