Critical Investor – “Alianza Minerals Completes Haldane Drilling, Results Expected In January”

Mount Haldane; Haldane project location

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

During a year full of COVID-19 surprises and -distractions, Alianza Minerals (ANZ.V) was able to continue with their drill programs, funded by either partners like Hochschild or themselves. As the results at the Horsethief project disappointed (best result was 76m @ 0.185g/t Au), Hochschild elected to terminate the option agreement, so the project was returned to Alianza again. They didn’t chose to evaluate remaining targets, and this is something management aims to do anyway, in the first quarter of next year.

Historic drill results from the eighties returned intercepts like 39.6m @ 0.79g/t Au and 13.7m @ 1.22g/t Au, and so far Alianza and Hochschild weren’t able to replicate these results. Notwithstanding this, Alianza is still looking to find another Long Canyon as it has similar geological characteristics. Both projects have a contact between Ordovician quartzite and Cambrian limestone/dolomite, the so-called O/C Contact. In line with this, the low grade intercepts were also found at Long Canyon in breccia layers, just like with Horsethief so far, and the size and distribution of altered carbonate rocks along with widespread anomalous gold concentrations remains encouraging. Because of this CEO Jason Weber is motivated to do further evaluation of Horsethief, and aims at finding another JV partner for the project.

Alianza also acquired the lease of the Twin Canyon Gold prospect in southwestern Colorado, and is looking at finding a JV partner for this project as well. Historic sampling has indicated potential for gold mineralization, reinforced by historic rotary drilling which confirmed the presence of a gold grade over 0.5 g/t over a 500 by 500 metres area, indicating disseminated gold mineralization with low and high grade areas. The company completed a first soil sampling program, and based on this it has commenced a second exploration program, consisting of detailed prospecting and geological mapping within areas of gold soil anomalies, expansion of the first soil sampling campaign, and detailed structural mapping to determine the primary controls focusing on gold mineralization. According to Weber, they are awaiting results from the lab but they are encouraged by what they are seeing at Twin Canyon, and are contemplating an application for a drilling permit at the project in advance of securing a partner.

Despite Alianza Minerals not showing solid results at Horsethief, the share price is holding up quite nicely, as can be seen here in the 1 year chart:

Share price Alianza Minerals, 1 year period; source tmxmoney.com

There is no doubt in my mind that the elevated gold and silver prices are multiplying the value for investors of the odds of finding something that could lead towards economic deposits. Horsethief wasn’t their flagship project (which is Haldane) of course, and investors know that Alianza Minerals is a prospect generator, whose primary aim in my view is to fairly quickly find, drill and kill prospects, so exploration failure isn’t a dealbreaker here. And they are aware that Alianza also has another project going on, which is the Tim Silver project in the Yukon, part of a JV with Coeur Mining. According to Weber, Coeur is planning a reconaissance exploration program in early 2021, and after defining targets, possibly setting up a drill program, most likely scheduled for H2, 2021. He has high hopes of the experience and knowledge of Coeur, which accumulated this in spades at exploration work at their nearby and analogue Silvertip mine.

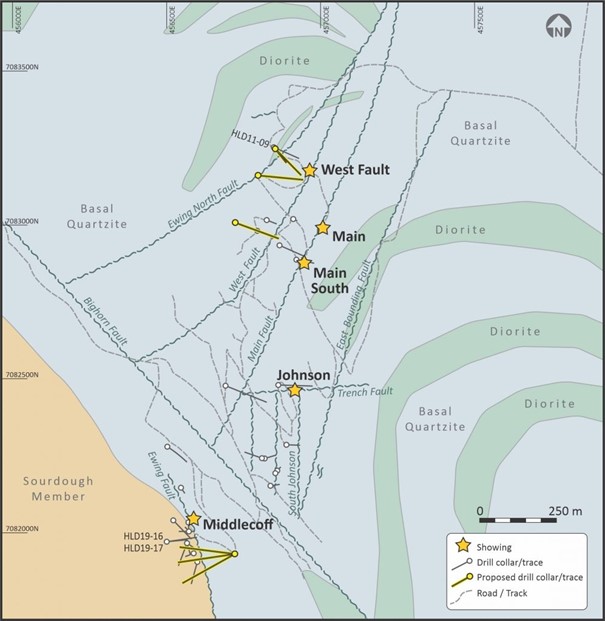

In the mean time, Alianza has been drilling at their 100% owned flagship Haldane project in the Yukon. This is another analogy play, as management is looking to find economic concentrations of vein type mineralization, resembling already mined mineralization in the Keno Hill District, produced by the numerous historic mines that can be found in this area.

The Phase One drilling program was completed recently, a Phase Two program is planned for the spring of 2021, which will also target the recently discovered Bighorn Zone (2.35m@125g/t Ag, 4.39% Pb). The first set of assays of the Phase One program are expected to come in around mid-January.

Sunrise at the coreshack, Mt Haldane Project

As Keno Hill is located in the Yukon which is pretty nordic, the weather conditions were already becoming harsh. Despite this, the Haldane drill program was completed, and according to the news release, the program achieved the following: “Two holes successfully tested the West Fault target on strike and down dip. At the Middlecoff Zone, two holes were collared (for clarity sake: collaring means the formation of the front end of a drill hole, or the collar, which is the preliminary step in drilling to cause the drill bit to engage in the rock) to test the extension of high-grade silver-lead+/-gold mineralization identified in drilling and historic underground development. One hole was terminated before reaching the target due to excessive deviation, while the second successfully intersected the Middlecoff Zone. A total of 798.6 metres of drilling was completed in this program.”

As the originally planned amount of drilling for Haldane was a total of 10 holes (approximately 2,500 metres) with Phase One consisting of 6 holes, I wondered how 6 holes could total 798.6m, with the remaining 4 holes for Phase 2 having to be 1,700m, meaning much deeper holes. According to Weber, Phase 2 would be less meters drilled, coming in at around 1,400 m, number of holes ranging between 4 and 6.

On the financial side of things, after raising C$3.2M in October, the current cash position stands at a healthy C$2.6M, which is enough to carry Alianza through 2021, as costs for upcoming Haldane drilling and G&A are covered this way. According to Weber, they have not planned to go to the markets for another raise in 2021.

Conclusion

It was unfortunate to see drill results at Horsethief disappoint to a degree that Hochschild called it a day and returned the project, but this is the life of a prospect generator. The main focus of management (and investors) targets the fully owned Haldane project, with assays pending for mid-January, and which will see a lot more drilling in 2021. Coeur has all sorts of plans for Tim Silver, and hopefully Weber will be able to land another JV partner for one or two of their other projects, so next year will be shaping up to be a busy one for Alianza Minerals. Hopefully it will be less impacted by worldwide pandemics like this year, and it could return positive results, as the current positive market has been in a rewarding mood in such cases.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Keno Hill, Yukon, with Mt Haldane in the distance

MORE or "UNCATEGORIZED"

First Phosphate Confirms Another High Grade Intersect of 11.85% Igneous Phosphate Across 84 Metres Starting from Surface at Its Begin-Lamarche Project in Saguenay-Lac-St-Jean, Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is plea... READ MORE

MAG Silver Reports First Quarter Financial Results

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) announces the Com... READ MORE

Troilus Announces Feasibility Study Results for the Gold-Copper Troilus Project: Outlines a Large Scale, 22-Year Open Pit Project in Tier-One Jurisdiction With USD$884.5 Million NPV(5%)

Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF) reports results from... READ MORE

Alamos Gold Intersects Higher-Grade Mineralization within a New Zone Near Existing Infrastructure at Young-Davidson

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported new results from i... READ MORE

Titan Reports First Quarter 2024 Results; National Safety Recognition Award

Titan Mining Corporation (TSX: TI) announces the results for the... READ MORE