B2Gold Announces Positive Preliminary Economic Assessment Results for the Gramalote Project; After-Tax NPV (5%) of $778 Million with an After-Tax IRR of 20.6%

B2Gold Corp. (TSX: BTO) (NYSE AMERICAN: BTG) (NSX: B2G) is pleased to announce the results of a positive Preliminary Economic Assessment prepared in accordance with National Instrument 43-101 on its 100% owned Gramalote gold project located in the Department of Antioquia, Colombia. All dollar figures are in United States dollars unless otherwise indicated.

Highlights

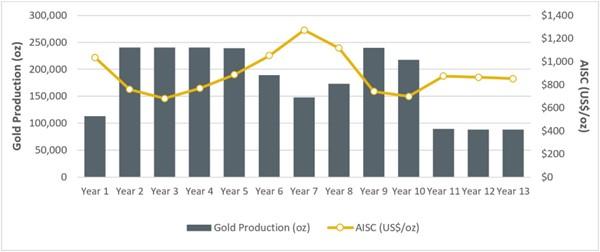

- Significant gold production profile with low-cost structure and favorable metallurgical characteristics

- Open pit gold mine with an initial life of mine of 10 years, with mill processing over 12.5 years

- Average grade processed of 1.26 grams per tonne gold over the first five years, benefitting from the processing of the higher-grade core at the Gramalote Project; Life of Project average grade processed of 1.00 g/t gold

- Life of Project gold production of approximately 2.3 million ounces with an average gold recovery of 95.9% from conventional milling, flotation and cyanide leach of the flotation concentrate

- Average annual gold production of approximately 234,000 ounces per year for the first five years of production

- Average annual gold production of approximately 185,000 ounces per year over the Life of Project

- Projected lowest quartile all-in sustaining costs of $886 per gold ounce over the Life of Project

- Annual processing rate of 6.0 million tonnes per annum

- Strong project economics

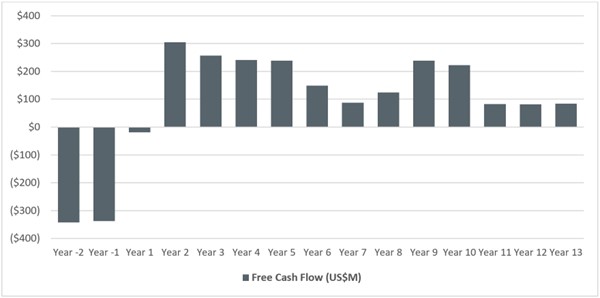

- Life of Project after-tax free cash flow of $1.38 billion

- Assuming a discount rate of 5.0%, net present value after-tax of $778 million, generating an after-tax internal rate of return of 20.6%, with a project payback on pre-production capital of 3.1 years

- Estimated pre-production capital cost of $807 million (includes approximately $93 million for mining equipment and $63 million for contingency)

- Robust amount of historical drilling and engineering studies have been completed on Gramalote, which significantly de-risks future project development

- Over 270,000 meters of historical drilling, providing B2Gold with a robust mineral resource model

- Gramalote has a long history of studies and technical reports which supported the existing mining permit that is currently in place

- As well, specific mining, processing, infrastructure, environmental, and social studies have been historically completed. Extensive metallurgical test work has demonstrated high gold recoveries (approximately 96%) at a coarse grind size for the selected processing flow sheet. This provides a high level of confidence in the engineering, production and operating cost estimates contained in the PEA

- Gramalote benefits from strong local community and government support

- An existing mining permit is currently in place on a larger-scale project; this permit will require modification to reflect the new medium-scale project contemplated in the PEA

- B2Gold anticipates the permit modification time frame will be between 12 and 18 months from submission to the permit authorities

- B2Gold to commence feasibility work with the goal of completing a feasibility study by mid-2025

PEA Overview

The Gramalote Project is located in central Colombia, approximately 230 kilometers northwest of Bogota and 100 km northeast of Medellin, in the Province of Antioquia, which has expressed a positive attitude towards the development of responsible mining projects in the region. Based on the preliminary results completed in 2022 of the contemplated large-scale project with AngloGold Ashanti Limited the project did not meet the combined investment return thresholds for development by both 50% ownership partners, B2Gold and AngloGold. As a result, B2Gold and AngloGold explored alternatives for the project which resulted in B2Gold acquiring AngloGold’s 50% interest in the Gramalote Project, resulting in a sole owner of the Gramalote Project for the first time in recent history. Post consolidation, B2Gold completed a detailed review of the Gramalote Project, including the higher-grade core of the resource, facility size and location, power supply, mining and processing options, tailings design, resettlement, potential construction sequencing and camp design to identify potential cost savings to develop a medium-scale project. The results of the review allowed the Company to determine the optimal parameters and assumptions for the PEA.

The PEA, with an effective date of April 1, 2024, was prepared by B2Gold and evaluates recovery of gold from an open pit mining operation that will move up to approximately 97,000 tonnes per day (35.3 Mtpa), with an approximately 16,500 tpd (6.0 Mtpa) processing plant that includes crushing, grinding, flotation, with fine grinding of the flotation concentrate and agitated leaching of the flotation concentrate followed by a carbon-in-pulp recovery process to process doré bullion. The Mineral Resource estimate for the Gramalote Project that forms the basis for the PEA includes Indicated Mineral Resources of 192.2 million tonnes grading 0.68 g/t gold for a total of 4,210,000 ounces of gold and Inferred Mineral Resources of 85.4 million tonnes grading 0.54 g/t gold for a total of 1,480,000 ounces of gold.

The PEA assumptions include revenues using a gold price of $2,200 per ounce for the first three years of production and $2,000 per ounce over the remaining Life of Project, a fuel price between the current prices and the expected post-subsidy price, and current prices for reagents, labour, power and other consumables. The key parameters of the PEA are presented in the following tables:

Table 1 – Key Parameters of the PEA

| First Five Years | Life of Project | |

| Production Profile | ||

| Years | 5.0 | 12.5 |

| Ore tonnes processed (Mt) | 30.0 | 75.0 |

| Average gold grade processed (g/t) | 1.26 | 1.00 |

| Gold recovery (%) | 96.2 | 95.9 |

| Gold ounces produced (oz) | 1,169,000 | 2,309,000 |

| Average annual gold production (oz) | 234,000 | 185,000 |

| Operating Costs | ||

| Cash operating costs1 ($/oz gold) | 510 | 622 |

| All-In Sustaining Costs2 ($/oz gold) | 822 | 886 |

| Mining cost ($/t mined) | 2.25 | 2.40 |

| Processing cost ($/t processed) | 7.76 | 7.82 |

| General & administration ($/t processed) | 3.03 | 3.49 |

| Capital Costs | ||

| Pre-production capital ($M) | 807 | |

| Sustaining capital ($M) | 364 | |

Notes:

- Cash operating costs consist of mining costs, processing costs and site G&A.

- AISC consist of cash operating costs, royalties, corporate G&A, selling costs and silver credits and excluding pre-production capital costs.

Table 2 – Pre-Production Capital Estimate

| ($M) | |

| Mining pre-strip | 19 |

| Tailings storage facility | 28 |

| Process plant | 263 |

| Mining equipment | 93 |

| Infrastructure (roads, platform, river diversion, camp, etc.) | 177 |

| Owners / management cost | 103 |

| Other (resettlement, general, light vehicles) | 62 |

| Subtotal | 745 |

| Contingency | 63 |

| Total | 807 |

Table 3 – Project Economics Summary

| $2,200/oz (First Three Years), $2,000/oz Long-Term Gold Price | |

| After-Tax | |

| NPV5.0% ($M) | 778 |

| IRR (%) | 20.6% |

| Payback (years) | 3.1 |

| Free cash flow ($M) | 1,376 |

Note:

- NPV5.0% is calculated as of the start of construction expenditure.

Chart 1 – Production and Cost Profile by Year

Chart 2 – Free Cash Flow by Year

Based on the positive results from the PEA, B2Gold believes that the Gramalote Project has the potential to become a medium-scale, low-cost, open pit gold mine. The Gramalote Project has several key infrastructure advantages, including:

- Reliable water supply – high rainfall region and located next to the Nus River

- Adjacent to a national highway, which connects directly to Medellin and to a major river with port facilities, capable of bringing supplies by barge to within 70 km of the site

- Skilled labour workforce within Colombia

In addition, B2Gold expects the Gramalote Project to benefit from several key operational advantages, including:

- Excellent metallurgical characteristics of the ore, which results in high recovery rates at low processing costs

- Relatively low strip ratio (3.3:1 strip ratio over the Life of Project)

- Ability to mine and process higher-grade ore in the initial years of the mine life resulting in improved project economics

The PEA is subject to a number of assumptions and risks, including among others that a Modified Environmental Impact Study will be approved, all required permits, permit amendments and other rights will be obtained in a timely manner, the Gramalote Project will have the support of the local government and community, the regulatory environment will remain consistent, that Gramalote can operate under a single company free trade zone in Colombia, and no material increase will have occurred to the estimated costs.

The PEA is preliminary in nature and includes a small amount of Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA based on these Mineral Resources will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Economic Sensitivities

Gramalote is a medium-scale, low operating cost project and sensitive to the gold price, as demonstrated in the following table:

Table 4 – Economic Sensitivity to Long-Term Gold Price

| Long-Term Gold Price ($/oz) |

After-Tax NPV5.0% ($M) |

After-Tax IRR (%) |

| $1,600 | 310 | 12.0 |

| $1,800 | 544 | 16.5 |

| $2,000 | 778 | 20.6 |

| $2,200 | 1,012 | 24.4 |

| $2,400 | 1,246 | 27.9 |

Note:

- Gold price used in the first three years of production is $200 per ounce higher than long-term gold price in economic sensitivity analysis.

Gramalote Project Mineral Resource Estimate

The Mineral Resource estimate for the Gramalote Project has an effective date of December 31, 2023, and is reported using a gold price of $1,850.

Indicated Mineral Resource Estimate

| Category | Tonnes | Gold Grade (g/t) |

Contained Gold Ounces |

| Total Indicated Resources | 192,220 | 0.68 | 4,210,000 |

Inferred Mineral Resource Estimate

| Category | Tonnes | Gold Grade (g/t) |

Contained Gold Ounces |

| Total Inferred Resources | 85,370 | 0.54 | 1,480,000 |

Notes:

- Mineral Resources have been classified using the CIM standards.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no guarantee that all or any part of the Mineral Resource will be converted into a Mineral Reserve. Inferred Resources are considered too geologically speculative to have mining and economic considerations applied to them that would enable them to be categorized as Mineral Reserves.

- All tonnage, grade and contained metal content estimates have been rounded; rounding may result in apparent summation difference between tonnes, grade and contained metal content.

- The Qualified Person for the Mineral Resource estimate is Andrew Brown, P.Geo., B2Gold’s Vice President, Exploration.

- Mineral Resources assume an open pit mining method and are reported within a conceptual pit based on a gold price of US$1,850/oz, metallurgical recovery of 81.7–84% for oxide and 90.9– 97.6% for sulphide, selling costs of US$62.04/oz including royalties and levies, and operating cost estimates of US$2.36–US$2.61/t mined (average mining cost), US$5.39–US$5.47 for oxide, US$8.39–US$8.49/t for sulphide processed (processing) and US$2.10/t processed (general and administrative).

- Mineral Resources are reported at cut-off grades of 0.16 g/t Au for oxide and 0.19 g/t Au for sulphide.

Gramalote Project Next Steps

B2Gold plans to commence feasibility work with the goal of completing a feasibility study by mid-2025. Due to the work completed for previous studies, the work remaining to finalize a feasibility study for the updated medium-scale project is not extensive. The main work programs for the feasibility study include geotechnical and environmental site investigations for the processing plant and waste dump footprints, as well as capital and operating cost estimates.

The Gramalote Project will continue to advance resettlement programs, establish coexistence programs for small miners, work on health, safety and environmental projects and continue to work with the government and local communities on social programs.

Due to the desired modifications to the processing plant and infrastructure locations, a Modified Environment Impact Study is required. B2Gold has commenced work on the modifications to the Environment Impact Study and expect it to be completed and submitted shortly following the completion of the feasibility study. If the final economics of the feasibility study are positive and B2Gold makes the decision to develop the Gramalote Project as an open pit gold mine, B2Gold would utilize its proven internal mine construction team to build the mine and mill facilities.

About B2Gold

B2Gold is a low-cost international senior gold producer headquartered in Vancouver, Canada. Founded in 2007, today, B2Gold has operating gold mines in Mali, Namibia and the Philippines, the Goose Project under construction in northern Canada and numerous development and exploration projects in various countries including Mali, Colombia and Finland. B2Gold forecasts total consolidated gold production of between 860,000 and 940,000 ounces in 2024.

Qualified Persons

Bill Lytle, Senior Vice President and Chief Operating Officer, a qualified person under NI 43-101, has approved the scientific and technical information related to operations matters contained in this news release.

Andrew Brown, P. Geo., Vice President, Exploration, a qualified person under NI 43-101, has approved the scientific and technical information related to exploration and mineral resource matters contained in this news release.

MORE or "UNCATEGORIZED"

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE

Monument Reports Second Quarter Fiscal 2026 Results

Monument Mining Limited (TSX-V: MMY) (FSE: D7Q1) today announced its financial results for the three... READ MORE

Taseko announces First Cathode Harvest at Florence Copper

Taseko Mines Limited (TSX: TKO) (NYSE American: TGB) (LSE: TKO) is pleased to announce its F... READ MORE

Highland Copper Closes Sale of 34% Interest in White Pine for US$30 Million

Highland Copper Company Inc. (TSX-V: HI) (OTCQB: HDRSF) is pleased to announce, further to its press... READ MORE