Ascendant Resources Intersects 78.5 Meters @ 22.72% Zinc Equivalent of Massive Sulphide in Venda Nova North Deposit at Lagoa Salgada Property Portugal

Exceptional Results From 6 hole metallurgical Drill Campaign

- High-Grade Cu-Ag Transition Zone Defined At Venda Nova North Including 6m @ 9.06% CuEq1

Ascendant Resources Inc. (TSX: ASND) (OTCQB: ASDRF) (FRA: 2D9) reports assay results from 6 metallurgical holes drilled between November 2021 and March 2022 at the Venda Nova deposit at its Lagoa Salgada Project, Portugal. The scope of the program was designed to generate fresh representative samples to optimize the metal recoveries from the various ore types seen within the Venda Nova as part of the ongoing metallurgical testwork. Samples are being tested at Grinding Solutions Ltd. in the United Kingdom.

Drill results currently being reported have outlined continuous intervals of high grade mineralized in the north zone throughout the different domains and several corridors of Fissural ore in the southern zone. The high-grade tenor of these results are expected to significantly increase the contained metal in both deposits.

In addition, the new holes (and incorporating previous results) have now identified a new subdomain within the massive sulphides in the north zone. This new subdomain is characterized by a secondary enrichment blanket, rich in both copper and silver. The increased understanding of the various domains is expected to improve the accuracy of metallurgical testing and subsequent results.

Drill Hole Highlights Include (Apparent Width):

Met_MS_01

- 109.0m @ 20.15 % ZnEq.1 from 167m (6.03% Zn, 0.33% Cu, 5.14% Pb, 1.67g/t Au, 118.35g/t Ag and 0.20% Sn) including:

- 6.0m @ 9.06% CuEq.1 from 176m (0.12% Zn, 1.25% Cu, 4.68% Pb, 2.57g/t Au, 401g/t Ag and 0.23% Sn) (newly defined Secondary Massive Sulphide zone); and

- 78.5m @ 22.72% ZnEq.1 from 182m (8.17% Zn, 0.26% Cu, 6.57% Pb, 1.60g/t Au, 105g/t Ag and 0.20% Sn) (Primary Massive Sulphide zone).

Met_MS_02

- 84.6m @ 8.95% ZnEq.1 from 161.9m (1.61% Zn, 0.35% Cu, 2.28% Pb, 0.40g/t Au, 53.36g/t Ag and 0.21% Sn)

- 48.9m @ 11.68 % ZnEq.1 from 143.1m (0.34% Zn, 0.41% Cu, 1.65% Pb, 1.55g/t Au, 103.83g/t Ag, and 0.26% Sn)

Met_MS_04

- 46.2m @ 15.43% ZnEq.1 from 151.1m (4.55% Zn, 0.28% Cu, 4.09%Pb, 0.83g/t Au, 129.04g/t Ag and 0.14% Sn)

Met_ST_01

- 18m @ 2.59% CuEq.1 from 227.0m (2.55% Zn, 0.79% Cu, 1.84% Pb, 0.11g/t Au and 35.00g/t Ag)

- 12m @ 1.94% CuEq.1 from 365m (2.25% Zn, 0.79% Cu, 0.59% Pb, 0.04g/t Au and 19.67g/t Ag)

Current results and ongoing infill drilling to date have:

- assisted in the definition of more accurate metal zoning within the massive sulphide including the addition of a Copper-Silver enriched blanket (named the Secondary Massive Sulphide Zone) directly below the Gossan and above the primary massive sulphides;

- provided discreet and fresh representative samples to assist with ongoing metallurgical testing; and

- returned grades significantly higher than the predictive block model in the north zone which should enhance the overall metal content

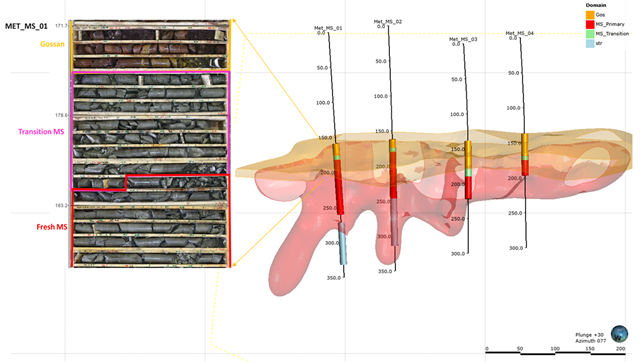

The detailed zoning and understanding of the north zone has been developed using geochemical indexes and metal ratios as demonstrated in Figure 1 & Figure 2.

Mark Brennan, Chairman of Ascendant stated, “Our metallurgical and infill drilling program continues to enhance the potential resource and economic opportunity we see at Lagoa Salgada and these exceptional high grade results and new enrichment blanket demonstrate we are still in the early stages of understanding the mineral endowment at the Venda Nova area. With these strong results we continue to focus on rapidly progressing our feasibility study however we continue to believe there is still significant upside at Venda Nova and the greater Lagoa Salgada land package.”

Figure 1. Long Section along the North Zone. Drill traces show new domains, core picture depicts ore domains in upper portion of Hole Met_MS-01.

Program Details

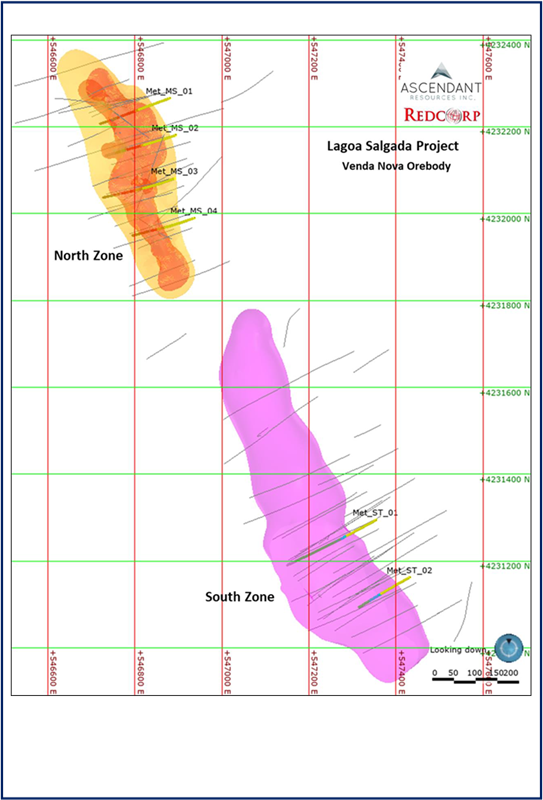

The metallurgical drilling program consisted of six drill holes that were completed in Q1 2022. Four holes were collared in the North Zone and 2 in the South Zone (Tables 1 and 2 and Figure 2).

Core was split and one half was shipped to GSL, and the other half was sent to ALS for Geochem analysis. Besides metal, samples were assayed for full ICP by mass spectrometry to aid geochemical classification of lithologies and relevant alteration; and to provide a new ore domain framework.

Metal clustering and ratios were used in the Northern Zone to model the massive internal zoning. Two subdomains within the massive sulphide ore were defined (Figure 2), Secondary and Primary. The former represents a shallow dipping blanket parallel to the overlying gossan ore. This secondary massive sulphide domain is characterized by higher Cu values due to secondary enrichment. Zn is generally low and Pb shows some variability but with general high values.

Separating the enriched blanket from the primary ore has relevant implication both in processing and mining economics. The enriched blanket relevant composites reported here average CuEq. grade above 6% in an average apparent thickness of 7 meters. Copper, Tin and precious metals are the main economic drivers of this domain that could become a separate mining/processing ore type. The primary massive sulphide domain shows higher Zn grades than the bulk of the massive sulphide with less metal ratio variability which Ascendant believes could have positive impact in metallurgical recoveries.

Assays were received in April 2022, and validated results show numerous mineralized intervals. Significant intercepts in both sectors have confirmed the shape and extent of the domains used in the current resource model. A simple prognose exercise reveals that the holes completed in the Northern Zone, particularly Met_MS-01, have considerable higher metal tenors along its traces than the one predicted with the estimator of the current block model.

Ongoing Drilling Program

Drilling in the property has continued after the completion of the Met holes. As of April 22, a total of 5,036m have been completed (inclusive of the 2,000m reported today). Five infill holes have been finalized (2 in the North and 3 in the souths) and three are in progress (South Zone).

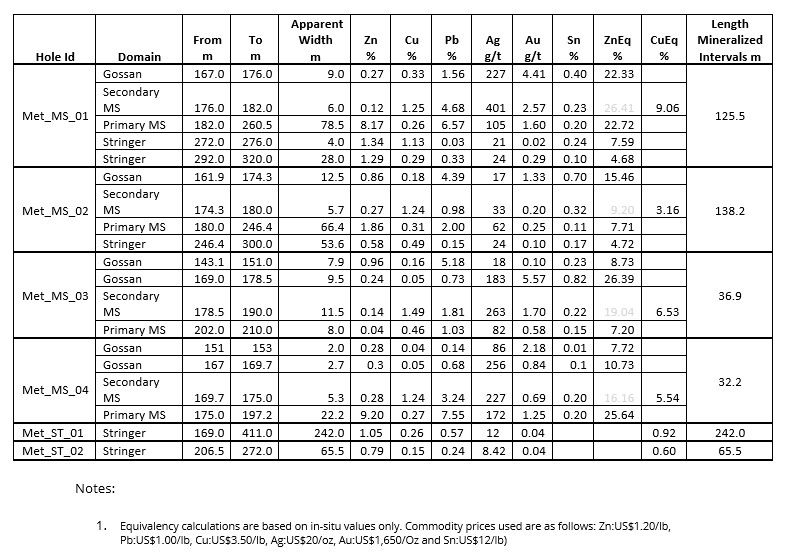

Table 1: Drill Results by Domains

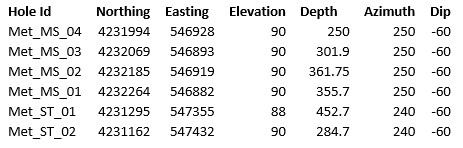

Table 2: Drill Hole Information

Figure 2. Plan view with Venda Nova sectors, domain projections and location of new reported drilling

Quality Assurance and Quality Control

Core samples are retrieved from the core barrel by the drilling crew. Each core box is labeled with the drill hole number, the depth intervals, and an arrow indicating the downhole direction. Core samples retrieved from the barrel are immediately transferred to the core boxes and transported after to the logging facilities in batches. After the logging, core is cut in half and placed in labeled sample bags with the sample tags and transported to the sample preparation lab of ALS Lab, in Seville, Spain. Samples are dried, crushed to 70 % passing 2 mm, split and finally pulverized to 85 % passing 75 μm. Pulp samples are then sent to their analytical Laboratory in Galway, Ireland, for analysis. The core samples are analyzed for gold (ppm) by fire assay (Au‐AA25), and for the other elements by two different ICP Multi element analysis: 1) (ME-ICPORE) – base metal ores and mill products by optical emission spectrometry using the Varian Vista inductively coupled plasma spectrometer 2) ME-MS61r: Four-acid digestion paired with ICP-MS and ICP-AES with REE analytes included.

ALS Laboratories has routine quality control procedures which ensure that every batch of samples includes three sample repeats, two commercial standards and blanks. ALS Laboratories is independent from Ascendant. Ascendant used standard QA/QC procedures, when inserting reference standards and blanks, for the drilling program. No significant QAQC failure issues were identified in the reported batches.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Sergio Gelcich, P.Geo., Vice President, Exploration for Ascendant Resources Ltd, who is a Qualified Person as defined in National Instrument 43-101.

About Ascendant Resources Inc.

Ascendant is a Toronto-based mining company focused on the exploration and development of the highly prospective Lagoa Salgada VMS project located on the prolific Iberian Pyrite Belt in Portugal. Through focused exploration and aggressive development plans, the Company aims to unlock the inherent potential of the project, maximizing value creation for shareholders.

The Venda Nova deposit at Lagoa Salgada contains over 10.33 million tonnes of Measured and Indicated Resources @ 9.06 % ZnEq and 2.50 million tonnes of Inferred Resources @ 5.93 % ZnEq in the North Zone; and 4.42 million tones of Indicated Resources @ 1.50 % CuEq and 10.83 million tonnes of Inferred resources @ 1.35 % CuEq in the South Zone. The deposit demonstrates typical mineralization characteristics of Iberian Pyrite Belt VMS deposits containing zinc, copper, lead, tin, silver and gold. Extensive exploration upside potential lies both near deposit and at prospective step-out targets across the large 10,700ha property concession. The project also demonstrates compelling economics with scalability for future resource growth in the results of the Preliminary Economic Assessment. Located just 80km from Lisbon, Lagoa Salgada is easily accessible by road and surrounded by exceptional Infrastructure. Ascendant holds a 21.25% interest in the Lagoa Salgada project through its 25% position in Redcorp – Empreendimentos Mineiros, Lda, (“Redcorp”) and has an earn-in opportunity to increase its interest in the project to 80%. Mineral & Financial Investments Limited owns the additional 75% of Redcorp. The remaining 15% of the project is held by Empresa de Desenvolvimento Mineiro, S.A., a Portuguese Government owned company supporting the strategic development of the country’s mining sector. The Company’s interest in the Lagoa Salgada project offers a low-cost entry to a potentially significant exploration and development opportunity, already demonstrating its mineable scale.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE