West Red Lake Gold Intersects 66.66 g/t Au Over 2.0m, 21.84 g/t Au over 3.11m and 6.27 g/t Au over 10.1m at Rowan Mine

West Red Lake Gold Mines Ltd. (TSX-V:WRLG) (OTCQB: WRLGF) is pleased to report additional drill results from its Phase 1 exploration program on its 100% owned Rowan Property located in the prolific Red Lake Gold District of Northwestern Ontario, Canada. Hole RLG-23-153 intersected 66.66 grams per tonne gold over 2.0 metres, when compared to much of the historical drilling, mineralized zones encountered in this years campaign demonstrate increased widths and continuity. The company has now completed 37 drill holes and 11,467 m of drilling to date of a 17,000 m drilling campaign that has been expanded to 25,000 m on the back of a very successful exploration season thus far.

HIGHLIGHTS:

- Hole RLG-23-153 Intersected 2.0m @ 66.66 g/t Au, from 235m to 237m, Including 0.5m @ 266.27 g/t Au, from 235.5m to 236m.

- Hole RLG-23-156B Intersected 3.11m @ 21.84 g/t Au, from 275m to 278.11m, Including 0.83m @ 77.64 g/t Au, from 277.28m to 278.11m.

- Hole RLG-23-154 Intersected 10.1m @ 6.27 g/t Au, from 214.9m to 225m, Including 0.6m @ 84.13 g/t Au, from 223.45m to 224.05m.

Shane Williams, President & CEO, stated, “Our team is very impressed with the drill results coming out of the Rowan Mine target. What was previously believed to be a very narrow high-grade gold system continues to deliver results that demonstrate real potential for broader zones of high-grade gold mineralization which could prove advantageous for any future mining scenario. With every hole drilled at Rowan, not only does our confidence in this asset grow, but its viability as a potential future source of high-grade mill-feed for Madsen increases as well. In the mining industry it is very rare to have size and grade working in your favor, but at Rowan we are seeing both.”

The high-grade mineralized vein zones encountered at the Rowan Mine target area continue to exceed expectations, confirm the geologic model, and further improve the existing high-grade (9.2 g/t Au) 827,462 ounce Inferred Mineral Resource at the Rowan Mine. Sections for the Rowan Mine drilling outlined in this release are provided in Figures 1 through 6.

TABLE 1. Significant intercepts (>4 g/t Au) from drilling at Rowan Mine Target.

| Hole ID | Target | Zone | From (m) | To (m) | Thick (m)* | Au (g/t) |

| RLG-23-153 | Rowan Mine | V101 (hw) | 235.00 | 237.00 | 2.00 | 66.66 |

| Incl. | Rowan Mine | 235.50 | 236.00 | 0.50 | 266.27 | |

| AND | Rowan Mine | V101 | 253.95 | 255.10 | 1.15 | 27.61 |

| Incl. | Rowan Mine | 253.95 | 254.60 | 0.65 | 48.58 | |

| AND | Rowan Mine | V101 | 276.65 | 277.15 | 0.50 | 81.44 |

| RLG-23-154 | Rowan Mine | V102 | 214.90 | 225.00 | 10.10 | 6.27 |

| Incl. | Rowan Mine | 223.45 | 224.05 | 0.60 | 84.13 | |

| RLG-23-155B | Rowan Mine | V103 | 146.50 | 147.00 | 0.50 | 4.24 |

| AND | Rowan Mine | V102 (fw) | 226.75 | 227.25 | 0.50 | 5.72 |

| AND | Rowan Mine | V101 | 276.50 | 277.00 | 0.50 | 7.30 |

| RLG-23-156B | Rowan Mine | V103 | 158.48 | 159.18 | 0.70 | 46.20 |

| AND | Rowan Mine | V102 | 242.00 | 243.00 | 1.00 | 4.11 |

| AND | Rowan Mine | V102 (fw) | 275.00 | 278.11 | 3.11 | 21.84 |

| Incl. | Rowan Mine | 277.28 | 278.11 | 0.83 | 77.64 | |

| AND | Rowan Mine | V101 | 311.60 | 312.10 | 0.50 | 25.42 |

| RLG-23-157 | Rowan Mine | V103 | 212.50 | 214.00 | 1.50 | 7.29 |

| Incl. | Rowan Mine | 213.40 | 214.00 | 0.60 | 10.49 | |

| AND | Rowan Mine | V102 | 255.16 | 256.00 | 0.84 | 6.16 |

| AND | Rowan Mine | V102 | 259.00 | 262.00 | 3.00 | 4.24 |

| Incl. | Rowan Mine | 260.27 | 260.77 | 0.50 | 11.31 | |

| AND | Rowan Mine | V102 | 284.88 | 290.00 | 5.12 | 4.07 |

| Incl. | Rowan Mine | 284.88 | 286.00 | 1.12 | 10.37 | |

| RLG-23-158 | Rowan Mine | V103 (hw) | 115.00 | 116.00 | 1.00 | 20.90 |

| Incl. | Rowan Mine | 115.00 | 115.50 | 0.50 | 40.23 | |

| AND | Rowan Mine | V102 (fw) | 255.50 | 256.65 | 1.15 | 8.54 |

| Incl. | Rowan Mine | 255.50 | 256.00 | 0.50 | 17.80 | |

| AND | Rowan Mine | V102 (fw) | 260.50 | 261.60 | 1.10 | 5.28 |

| Incl. | Rowan Mine | 261.00 | 261.50 | 0.50 | 9.22 |

*The “From-To” intervals in Table 1 are denoting overall downhole length of the intercept. True thickness has not been calculated for these intercepts but is expected to be ≥ 70% of downhole thickness based on intercept angles observed in the drill core. Composite intervals do not cross sample boundaries < 0.1 g/t Au. Under ‘Zone’ column, (hw) is indicating ‘hanging wall to’ and (fw) is indicating ‘footwall to’ main vein zones.

A total of 17,000m of infill and expansion drilling was originally proposed for the Rowan Mine target in 2023. Based on the positive results received to date, the program has been expanded to 25,000m and is expected to be completed by year end 2023. The additional drill meters will be used to continue de-risking the Rowan Mine resource, and test the growth potential down-plunge on the highest-grade portions of the resource. Current drilling at Rowan has only tested mineralization down to a depth of approximately 550m. All of the high-grade zones still remain open below this vertical depth. The Red Lake Mining District is known to host orebodies that extend down to +4 kilometre depth, which bodes well for the down-plunge growth potential at Rowan.

It is the Company’s belief that potential synergies could exist between high-grade resources at the Rowan Mine target area and Madsen. The Company has initiated a metallurgical study at Rowan to begin evaluating this potential opportunity, as well as a geotechnical study to better characterize the rock mass properties within the mineralized vein zones at Rowan.

In conjunction with infill and expansion drilling, the Company is also initiating the necessary baseline environmental and archaeological assessments to begin moving the project towards an Advanced Exploration Permit status.

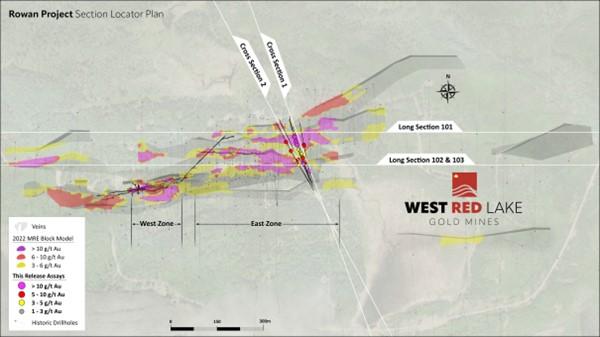

FIGURE 1. Deposit-scale plan map of Rowan Mine Target area showing traces and intercepts for holes highlighted in this News Release.

TABLE 2: Drill collar summary for holes reported in this News Release.

| Hole ID | Target | Easting | Northing | Elev (m) | Length (m) | Azimuth | Dip |

| RLG-23-153 | Rowan Mine | 422171 | 5657799 | 365 | 363 | 339 | -51 |

| RLG-23-154 | Rowan Mine | 422171 | 5657799 | 365 | 450 | 330 | -64.5 |

| RLG-23-155B | Rowan Mine | 422171 | 5657799 | 365 | 381 | 330 | -50 |

| RLG-23-156B | Rowan Mine | 422171 | 5657799 | 365 | 408 | 338 | -55 |

| RLG-23-157 | Rowan Mine | 422171 | 5657799 | 365 | 471 | 340 | -67 |

| RLG-23-158 | Rowan Mine | 422171 | 5657799 | 365 | 375 | 346 | -58 |

DISCUSSION

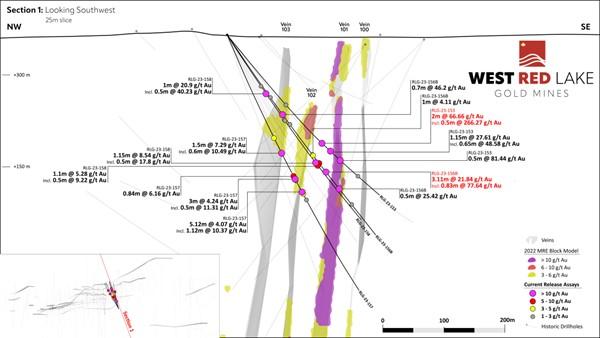

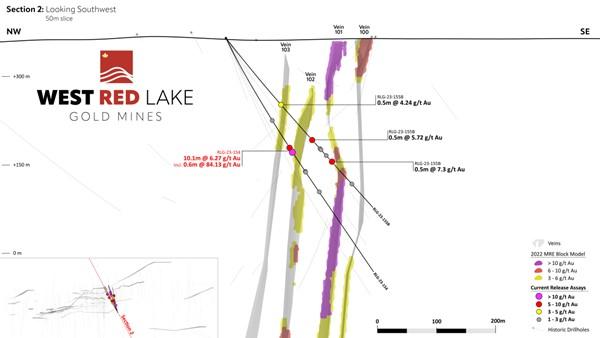

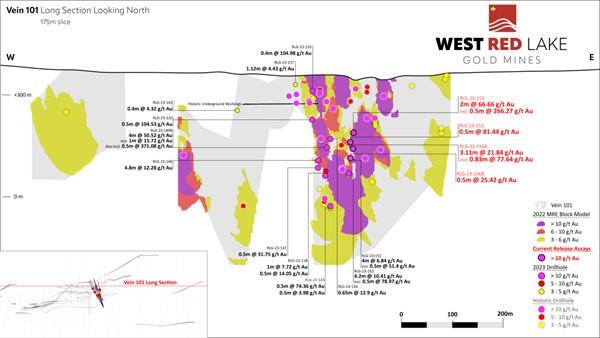

The Rowan Mine Target consists of more than seven sub-parallel, near-vertical, east-west trending veins that are currently defined over a strike length of approximately 1.1 km – mineralization remains open along strike and at depth. The orientation of the veins at the Rowan Mine tend to follow the direction of D2 deformation, which is oriented in an east-west direction over this part of the property. Individual mineralized vein zones usually average 1.0 to 1.5m in thickness, with an overall thickness of the Rowan vein corridor at around 115m. Gold mineralization is typically localized within quartz-carbonate veins hosted within and along the ‘footwall’ margin of a porphyritic felsic intrusive, with increased grades often associated with the presence of visible gold and base metal sulphides (e.g. galena, sphalerite). High-grade dilation zones or ‘ore chutes’ along the Rowan vein trend have been recognized as important controls for localizing thicker and higher-grade zones of gold mineralization. The position and geometry of these dilation zones is well understood at Rowan.

The drilling completed at the Rowan Mine Target in 2023 has been focused on validating historical data across the Inferred Resource, and also infilling apparent gaps in the analytical data set which was a product of very selective sampling techniques implemented during previous drilling campaigns. Assay results received from the 2023 drilling program continue to confirm our thesis that quartz veining and gold mineralization continue at depth and along strike, with grades consistent with, or higher than those outlined in the current Inferred Mineral Resource which remains open in all directions. For example, the 100 Vein Zone – which is the furthest north vein currently modeled within the overall Rowan vein corridor – was previously interpreted to be a lower grade portion of the block model. Recent drilling has confirmed that higher grades are present within the 100 Vein Zone below 150m elevation, suggesting that gold grades are increasing at depth within this zone which is a trend that has been observed elsewhere in the Red Lake district. Drilling at the Rowan Mine Target area will continue with an emphasis on infill and expansion of the existing high-grade mineral resource.

FIGURE 2. Rowan Mine drill section showing assay highlights for Holes RLG-23-153, -156B, -157 and -158[1].

____________________________

1 Mineral Resources are estimated at a cut-off grade of 9.2 g/t Au and using a gold price of US$1,600/oz. Please refer to the technical report entitled “Technical Report and Resource Estimate on the West Red Lake Project” dated December 13, 2022 prepared for WRLG by John Kita, P.Eng., and filed December 30, 2022 on www.sedar.com.

FIGURE 3. Rowan Mine drill section showing assay highlights for Holes RLG-23-154 and -155B[1].

____________________________

1 Mineral Resources are estimated at a cut-off grade of 9.2 g/t Au and using a gold price of US$1,600/oz. Please refer to the technical report entitled “Technical Report and Resource Estimate on the West Red Lake Project” dated December 13, 2022 prepared for WRLG by John Kita, P.Eng., and filed December 30, 2022 on www.sedar.com.

FIGURE 4. Rowan Mine longitudinal section for Vein 101 showing 2023 intercepts > 4 g/t Au. Assay highlights from current press release shown in red[1].

____________________________

1 Mineral Resources are estimated at a cut-off grade of 9.2 g/t Au and using a gold price of US$1,600/oz. Please refer to the technical report entitled “Technical Report and Resource Estimate on the West Red Lake Project” dated December 13, 2022 prepared for WRLG by John Kita, P.Eng., and filed December 30, 2022 on www.sedar.com.

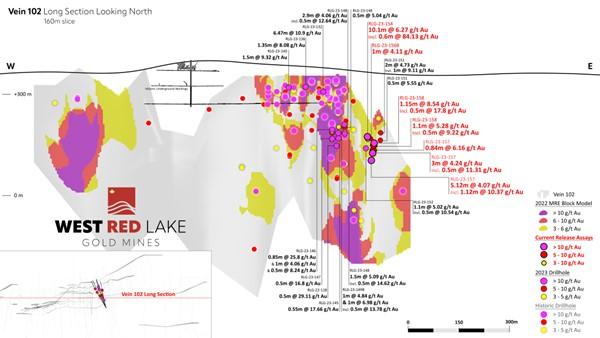

FIGURE 5. Rowan Mine longitudinal section for Vein 102 showing 2023 intercepts > 4 g/t Au. Assay highlights from current press release shown in red[1].

____________________________

1 Mineral Resources are estimated at a cut-off grade of 9.2 g/t Au and using a gold price of US$1,600/oz. Please refer to the technical report entitled “Technical Report and Resource Estimate on the West Red Lake Project” dated December 13, 2022 prepared for WRLG by John Kita, P.Eng., and filed December 30, 2022 on www.sedar.com.

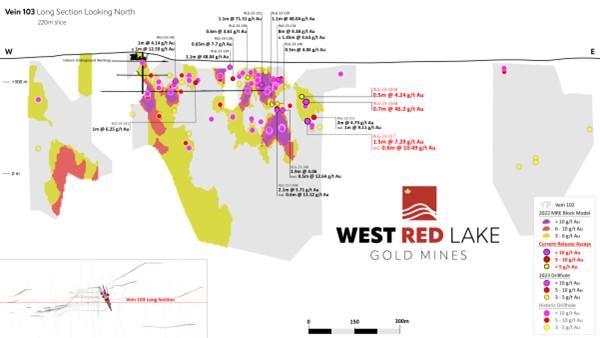

FIGURE 6. Rowan Mine longitudinal section for Vein 103 showing 2023 intercepts > 4 g/t Au. Assay highlights from current press release shown in red[1].

____________________________

1 Mineral Resources are estimated at a cut-off grade of 9.2 g/t Au and using a gold price of US$1,600/oz. Please refer to the technical report entitled “Technical Report and Resource Estimate on the West Red Lake Project” dated December 13, 2022 prepared for WRLG by John Kita, P.Eng., and filed December 30, 2022 on www.sedar.com.

High resolution versions of all the figures contained in this press release can be found at the following web address: https://westredlakegold.com/august-28th-news-release-maps/.

Longitudinal sections showing all intercepts > 3 g/t Au on Veins 101, 102 and 103 can be viewed here: https://westredlakegold.com/august-1st-news-release-maps/.

QUALITY ASSURANCE/QUALITY CONTROL

Drilling completed at the Rowan Property consists of oriented NQ-sized diamond drill core. All drill holes are systematically logged, photographed, and sampled by a trained geologist at WRLG’s Mt. Jamie core processing facility. Minimum allowable sample length is 0.5m. Maximum allowable sample length is 1.5m. Standard reference materials and blanks are inserted at a targeted 5% insertion rate. The drill core is then cut lengthwise utilizing a diamond blade core saw along a line pre-selected by the geologist. To reduce sampling bias, the same side of drill core is sampled consistently utilizing the orientation line as reference. For those samples containing visible gold a trained geologist supervises the cutting/bagging of those samples, and ensures the core saw blade is ‘cleaned’ with a dressing stone following the VG sample interval. Bagged samples are then sealed with zip ties and transported by WRLG personnel directly to SGS Natural Resource’s Facility in Red Lake, Ontario for assay.

Samples are then prepped by SGS, which consists of drying at 105°C and crushing to 75% passing 2mm. A riffle splitter is then utilized to produce a 500g course reject for archive. The remainder of the sample is then pulverized to 85% passing 75 microns from which 50g is analyzed by fire assay and an atomic absorption spectroscopy (AAS) finish. Samples returning gold values > 5 g/t Au are reanalyzed by fire assay with a gravimetric finish on a 50g sample. Samples with visible gold are also analyzed via metallic screen analysis (SGS code: GO_FAS50M). For multi-element analysis, samples are sent to SGS’s facility in Burnaby, British Columbia and analyzed via four-acid digest with an atomic emission spectroscopy (ICP-AES) finish for 33-element analysis on 0.25g sample pulps (SGS code: GE_ICP40Q12). SGS Natural Resources analytical laboratories operates under a Quality Management System that complies with ISO/IEC 17025.

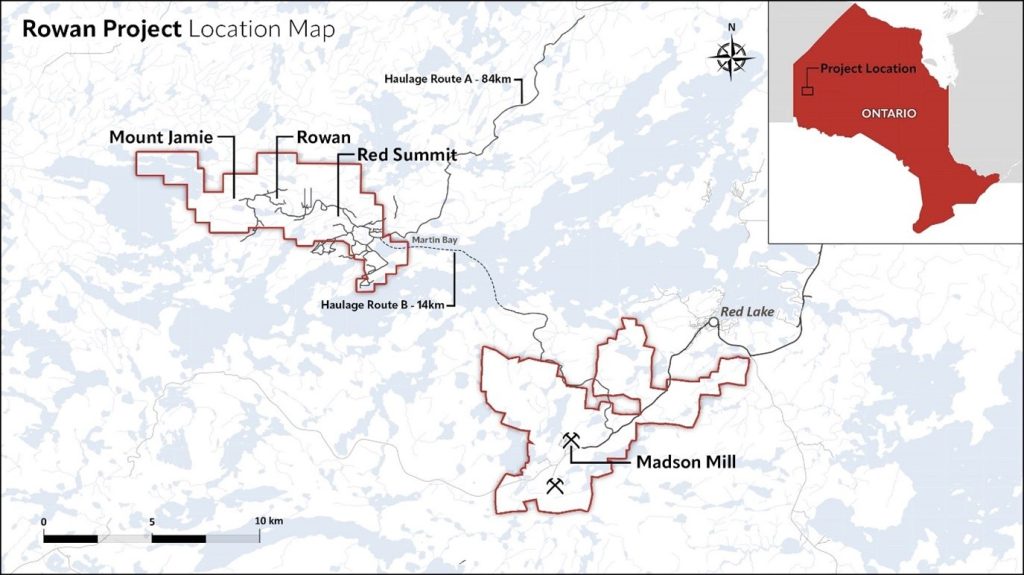

West Red Lake Gold’s Rowan Property presently hosts a National Instrument 43-101 Inferred Mineral Resource of 2,790,700 t at an average grade of 9.2 g/t Au containing 827,462 ounces of gold with a cut-off grade of 3.8 g/t Au (NI 43-101 Technical Report authored by John Kita, P.Eng., dated December 13, 2022 and filed December 30, 2022 on www.sedar.com). The Inferred Mineral Resource is located in the area of the historic underground Rowan Mine site and situated within a 1.8 km strike length portion of the regional scale Pipestone Bay St Paul Deformation Zone.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

DEFERRED CONSIDERATION PAYMENT TO SPROTT

On August 24, 2023 the Company issued 2,400,000 common shares in the capital of the Company at deemed price of C$0.70 per common share as payment of US$1,250,838 to a fund managed by Sprott Resource Lending Corp (“Sprott”) for deferred consideration related to the Company’s acquisition of Pure Gold Mining Inc. (the “Obligation”), and issued a replacement promissory note dated August 24, 2023 in the amount of US$5,533,094 to Sprott for the remaining Obligation.

MARKETING CONTRACT

Further to its news release of August 14, 2023, the Company clarifies terms of the marketing service agreement it has entered into with Gold Standard Media LLC.. The Marketing Agreement has a twelve-month term, which commences on the later of August 9, 2023, and the approval of the TSXV, and has an upfront payment of US$500,000 payable to GSM upon the approval of the TSXV.

Marketing services to be provided by GSM will include email marketing campaigns, landing pages, advertisements, and other related services to assist the Company in raising its public awareness and online presence. GSM may engage its affiliates including Future Money Trends, Wealth Research Group LLC and Portfolio Wealth Global LLC to provide these marketing services.

GSM is a limited liability company existing under the laws of the State of Texas with an office at 723 W, University Ave. #110-283 Georgetown Texas and is owned and operated by Kenneth Ameduri, Juliet Ameduri, and Lior Gantz, each of who are arm’s length to the Company. GSM nor its affiliates directly or indirectly hold any securities of the Company.

None of the Company or its officers are involved directly with the creation of the materials distributed by GSM. The Company will provide GSM with publicly available source information for their disclosure and the Company will be involved in reviewing the materials for accuracy prior to dissemination.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE