VIZSLA SILVER INTERCEPTS ADDITIONAL BONANZA-GRADE SILVER AT COPALA – 2,640 G/T AGEQ OVER 5.30 METRES

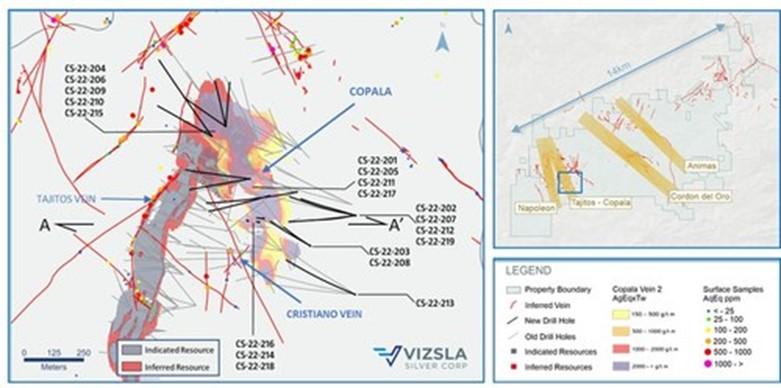

Vizsla Silver Corp. (TSX-V: VZLA) (NYSE: VZLA) (Frankfurt: 0G3) is pleased to report results from 19 new drill holes targeting the Tajitos – Copala resource area at its 100%-owned, flagship Panuco silver-gold project located in Mexico. Today’s intercepts form part of Vizsla’s ongoing 2022 infill/expansionary drill program and are centered on the Copala and Cristiano structures in the western portion of the district. The infill results support grade continuity in the south-central portion of Copala structure, while resource expansion drilling to the north and southeast continue to highlight mineralization remains open.

Highlights

- CS-22-205 returned 2,640 grams per tonne silver equivalent over 5.30 metres true width (2,101 g/t silver and 9.54 g/t gold)

- Including 4,563 g/t AgEq over 0.58 mTW (3,080 g/t silver and 23.60 g/t gold)

- CS-22-210 returned 561 g/t AgEq over 15.50 mTW (425 g/t silver and 2.31 g/t gold)

- And 2,044 g/t AgEq over 1.01 mTW (1,630 g/t silver and 7.34 g/t gold)

- CS-22-216 returned 905 g/t AgEq over 8.09 mTW (626 g/t silver and 4.48 g/t gold)

- CS-22-201 returned 3,340 g/t AgEq over 1.86 mTW (2,536 g/t silver and 13.65 g/t gold)

- CS-22-217 returned 1,862 g/t AgEq over 2.71 mTW (1,495 g/t silver and 6.56 g/t gold)

“The Copala structure continues to impress with high precious metals grades over very broad widths,” commented Michael Konnert, President and CEO. “Infill drilling within the Tajitos-Copala resource area continues to highlight exceptional mineral continuity marked by multiple intervals grading well over 1,000 grams per tonne, while expansionary drilling to the north and southeast demonstrate a growing high-grade footprint. Additionally, at Cristiano, drilling has now traced mineralization over 600 metres long by 300 metres deep. We note that Cristiano was not included in the maiden resource, however, given its near surface, high-grade continuity, we expect it will contribute materially to the pending resource update. We have had a phenomenal year of exploration success at Panuco and have expanded mineralization well beyond the March 2022 resource boundary at virtually every zone. Given the amount of new high grade drill results, inclusion of new mineralized structures, and the fast-approaching holiday season, we have elected to publish the resource update in early 2023. We are extremely pleased with the outcome of our 2022 programs and look forward to another outstanding year as we continue to grow and de-risk the Panuco Project in 2023.”

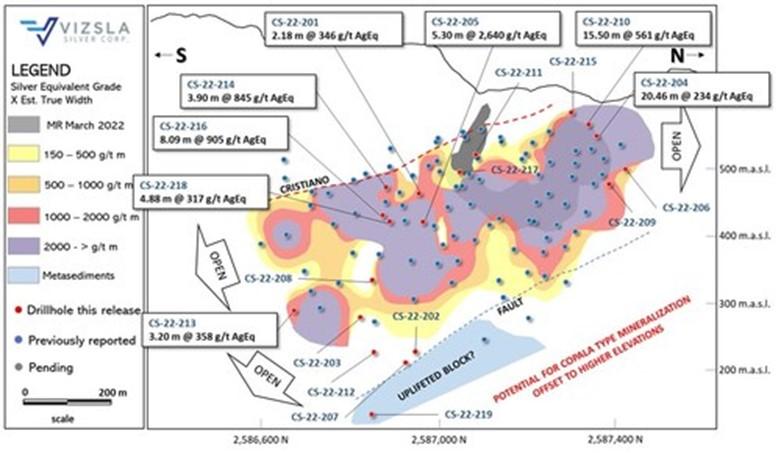

The Copala Structure is located in the western portion of the Panuco district at the northern extent of the Tajitos structure. Copala hosts high precious metals grades (up to 11,053 g/t silver and 33.50 g/t gold over 1.26 mTW) contained within a broader envelope of vein-breccia interlayered with host rock, up to 82 metres thick. Ongoing interpretations by Vizsla’s geologists suggest Copala has an average dip of ~46° to the east (~35° in its northern sector and steepening to ~52° in the southern sector).

Drilling at Copala has now traced mineralization along approximately 1,000 metres of strike length and approximately 400 metres down dip. High-grade silver-gold mineralization remains open to the north and southeast with ongoing detailed structural and geologic interpretations indicating the potential for mineralization to continue into the footwall side of the Tajitos Vein. The ongoing infill-drilling program, which consists of 25 holes drilled at 25 metre centers, was designed to assess grade continuity and to provide sample material for future metallurgical tests. To date, infill-holes CS-22-201, CS-22-205, CS-22-214, CS-22-216 and CS-22-218 have confirmed high-grade at tighter spacing. Additionally, step-out holes drilled to the east, particularly holes CS-22-202, CS-22-207 and CS-22-219, suggest an uplifted block of basement metasediments in fault-contact with andesites and diorite (see figures 2 and 4). Vizsla´s team is working on interpretations to determine the amount of displacement by the fault, to define a target elevation for Copala type mineralization on the footwall side (east) of the fault; i.e. an uplifted block on the east creates potential for Copala type mineralization at shallower elevation. Vizsla plans to test this hypothesis with drill-holes collared on the footwall side of the fault.

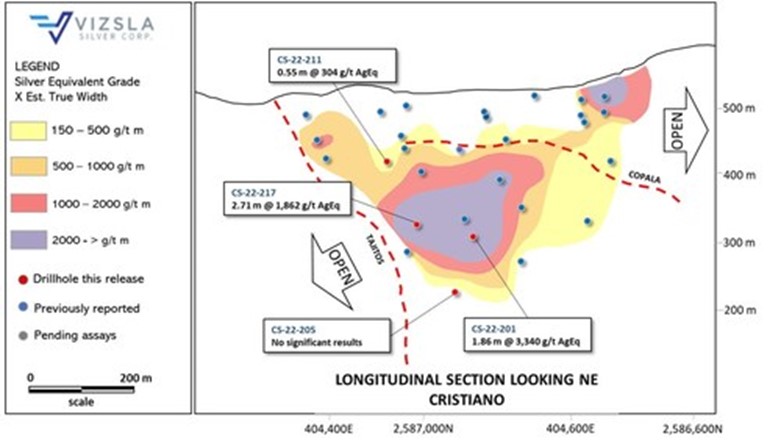

The Cristiano Vein is a precious metals rich structure located at the southwestern margin of the Copala structure. Cristiano is marked by a quartz-carbonate epithermal-vein striking N25°W that dips sub-vertical (85°) to the NE. Drill-holes intersecting Cristiano to date, highlight a high-grade zone plunging to the NW, with vertical extent of 300 metres and approximate strike length of 600 metres. The Cristiano Vein ranges in thickness from 0.7 mTW to 3.5 mTW, with a weighted average grade of 542 g/t silver equivalent.

The Cristiano Vein was initially discovered while targeting the Tajitos-Copala veins, where drilling intercepted the well-mineralized, NW-SE trending fault. Ongoing drilling has now led to new observations and interpretations allowing Vizsla geologists to plan drill holes specifically designed to explore Cristiano along strike and to depth. To the northwest, Cristiano intersects and offsets the Tajitos Vein, suggesting Cristiano post-dates Tajitos mineralization, thus creating a drill target on the footwall of Tajitos (Figure 3). Additionally, open ended intercepts to the southeast suggest mineralization continues in this direction.

| Drillhole | From | To | Downhole Length | Estimated True width | Ag | Au | AgEq | Vein | ||

| (m) | (m) | (m) | (m) | (g/t) | (g/t) | (g/t) | ||||

| CS-22-201 | 212.25 | 214.80 | 2.55 | 2.18 | 237 | 1.74 | 346 | Copala | ||

| Includes | 212.25 | 213.55 | 1.30 | 1.11 | 427 | 3.22 | 629 | |||

| CS-22-201 | 392.15 | 396.00 | 3.85 | 1.86 | 2,536 | 13.65 | 3,340 | Cristiano | ||

| Includes | 392.90 | 393.30 | 0.40 | 0.19 | 7,740 | 57.60 | 11,343 | |||

| Includes | 393.70 | 394.60 | 0.90 | 0.43 | 6,220 | 27.20 | 7,742 | |||

| CS-22-202 | No significant values | Copala | ||||||||

| CS-22-203 | No significant values | Copala | ||||||||

| CS-22-204 | 132.00 | 158.70 | 26.70 | 20.46 | 175 | 0.99 | 234 | Copala | ||

| Includes | 147.25 | 148.50 | 1.25 | 0.96 | 569 | 2.92 | 739 | |||

| Includes | 153.30 | 154.30 | 1.00 | 0.77 | 454 | 2.43 | 597 | |||

| Includes | 156.50 | 157.50 | 1.00 | 0.77 | 673 | 3.42 | 872 | |||

| Includes | 157.50 | 158.70 | 1.20 | 0.92 | 575 | 4.08 | 828 | |||

| CS-22-205 | 283.00 | 288.50 | 5.50 | 5.30 | 2,101 | 9.54 | 2,640 | Copala | ||

| Includes | 284.60 | 285.20 | 0.60 | 0.58 | 3,080 | 23.60 | 4,563 | |||

| CS-22-205 | 553.00 | 553.30 | 0.30 | 0.16 | 85 | 0.24 | 96 | Cristiano | ||

| CS-22-206 | 181.10 | 185.80 | 4.70 | 3.11 | 168 | 0.90 | 221 | Copala | ||

| CS-22-207 | No significant values | Copala | ||||||||

| CS-22-208 | No significant values | Copala | ||||||||

| CS-22-208 | 484.00 | 485.50 | 1.50 | 1.12 | 347 | 0.38 | 350 | FW Splay | ||

| Includes | 485.05 | 485.50 | 0.45 | 0.34 | 873 | 0.99 | 883 | |||

| CS-22-209 | 148.00 | 166.05 | 18.05 | 10.00 | 74 | 0.56 | 109 | Copala | ||

| Includes | 163.45 | 164.20 | 0.75 | 0.42 | 639 | 5.22 | 970 | |||

| CS-22-210 | 117.75 | 140.70 | 22.95 | 15.50 | 425 | 2.31 | 561 | Copala | ||

| Includes | 120.30 | 120.90 | 0.60 | 0.41 | 2,710 | 22.30 | 4,125 | |||

| Includes | 130.60 | 131.40 | 0.80 | 0.54 | 1,285 | 7.24 | 1,716 | |||

| Includes | 131.40 | 132.00 | 0.60 | 0.41 | 1,800 | 9.69 | 2,371 | |||

| Includes | 132.55 | 134.05 | 1.50 | 1.01 | 1,630 | 7.34 | 2,044 | |||

| CS-22-211 | No significant values | Copala | ||||||||

| CS-22-211 | 240.00 | 241.85 | 1.85 | 0.55 | 154 | 2.24 | 304 | Cristiano | ||

| CS-22-211 | 283.25 | 284.50 | 1.25 | 1.25 | 1,103 | 3.76 | 1,296 | Tajitos | ||

| CS-22-212 | No significant values | Copala | ||||||||

| CS-22-213 | 545.10 | 548.60 | 3.50 | 3.20 | 294 | 1.19 | 358 | Copala | ||

| Includes | 546.50 | 547.95 | 1.45 | 1.33 | 308 | 2.08 | 436 | |||

| CS-22-214 | 114.00 | 121.05 | 7.05 | 3.90 | 593 | 4.07 | 845 | Copala | ||

| Includes | 115.50 | 116.80 | 1.30 | 0.72 | 2,020 | 13.50 | 2,850 | |||

| Includes | 116.80 | 117.50 | 0.70 | 0.39 | 681 | 4.22 | 937 | |||

| CS-22-215 | 112.50 | 115.50 | 3.00 | 2.35 | 216 | 0.66 | 248 | Copala | ||

| Includes | 114.00 | 115.50 | 1.50 | 1.18 | 335 | 1.03 | 385 | |||

| CS-22-216 | 181.00 | 194.50 | 13.50 | 8.09 | 626 | 4.48 | 905 | Copala | ||

| Includes | 184.65 | 186.00 | 1.35 | 0.81 | 1,250 | 14.00 | 2,170 | |||

| Includes | 186.00 | 186.95 | 0.95 | 0.57 | 2,230 | 18.10 | 3,376 | |||

| Includes | 186.95 | 188.20 | 1.25 | 0.75 | 1,170 | 7.54 | 1,631 | |||

| CS-22-217 | No significant values | Copala | ||||||||

| CS-22-217 | 325.50 | 330.35 | 4.85 | 2.71 | 1,495 | 6.56 | 1,862 | Cristiano | ||

| Includes | 327.60 | 328.75 | 1.15 | 0.64 | 1,295 | 4.59 | 1,535 | |||

| Includes | 328.75 | 329.10 | 0.35 | 0.20 | 13,118 | 63.70 | 16,783 | |||

| CS-22-218 | 209.60 | 215.30 | 5.70 | 4.88 | 197 | 1.86 | 317 | Copala | ||

| Includes | 211.50 | 213.00 | 1.50 | 1.28 | 283 | 3.19 | 493 | |||

| Includes | 213.00 | 214.15 | 1.15 | 0.98 | 280 | 2.58 | 446 | |||

| CS-22-219 | No intercepted | |||||||||

Table 1: Downhole drill intersections from the holes reported for the new splay vein at the foot wall of Copala. Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $20.70/oz silver and $1,655/oz gold and metallurgical recoveries assumed are 93% for silver and 90% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Napoleon vein (see press release dated February 17, 2022).

| Drillhole | Easting | Northing | Elevation | Azimuth | Dip | Depth |

| CS-22-201 | 404,724 | 2,586,986 | 595 | 257 | -57.7 | 462.0 |

| CS-22-202 | 405,087 | 2,586,905 | 646 | 282 | -63.6 | 634.5 |

| CS-22-203 | 404,896 | 2,586,778 | 666 | 302 | -75.0 | 556.5 |

| CS-22-204 | 404,539 | 2,587,280 | 553 | 304 | -30.8 | 250.2 |

| CS-22-205 | 404,840 | 2,587,003 | 590 | 260 | -50.0 | 596.5 |

| CS-22-206 | 404,541 | 2,587,280 | 552 | 347 | -35.0 | 237.0 |

| CS-22-207 | 405,087 | 2,586,905 | 646 | 286 | -68.2 | 628.0 |

| CS-22-208 | 404,896 | 2,586,778 | 666 | 299 | -67.9 | 505.5 |

| CS-22-209 | 404,541 | 2,587,280 | 553 | 5 | -43.3 | 257.0 |

| CS-22-210 | 404,482 | 2,587,238 | 553 | 323 | -30.0 | 451.0 |

| CS-22-211 | 404,643 | 2,587,058 | 557 | 277 | -39.5 | 349.5 |

| CS-22-212 | 405,087 | 2,586,905 | 646 | 263 | -64.9 | 658.5 |

| CS-22-213 | 405,084 | 2,586,574 | 700 | 295 | -58.8 | 637.5 |

| CS-22-214 | 404,632 | 2,586,883 | 568 | 91 | -89.1 | 208.5 |

| CS-22-215 | 404,482 | 2,587,237 | 553 | 298 | -30.0 | 300.0 |

| CS-22-216 | 404,681 | 2,586,877 | 582 | 271 | -87.0 | 234.0 |

| CS-22-217 | 404,643 | 2,587,058 | 557 | 260 | -54.0 | 452.0 |

| CS-22-218 | 404,701 | 2,586,892 | 595 | 271 | -84.6 | 270.0 |

| CS-22-219 | 405,087 | 2,586,905 | 565 | 262 | -71.4 | 681.0 |

Table 2: Drillhole details for the reported drillholes. Coordinates in WGS84, Zone 13.

About the Panuco project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 6,761-hectare, past producing district benefits from over 86 kilometres of total vein extent, 35 kilometres of underground mines, roads, power, and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

The Panuco Project hosts an estimated in-situ indicated mineral resource of 61.1 Moz AgEq and an in-situ inferred resource of 45.6 Moz AgEq The Technical Report, titled “National Instrument 43-101 Technical Report for the Panuco Project Mineral Resource Estimate Concordia, Sinaloa, Mexico” was filed on SEDAR on April 7, 2022, has an effective date of March 1, 2022 and was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) by Tim Maunula, P.Geo., Principal Geologist, T. Maunula & Associates Consulting Inc and Kevin Murray, P.Eng, Manager Process Engineering, Ausenco.

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in Sinaloa, Mexico. To date, Vizsla has completed over 210,000 metres of drilling at Panuco leading to the discovery of several new high-grade veins. For 2022, Vizsla has budgeted +120,000 metres of resource/discovery-based drilling designed to upgrade and expand the maiden resource, as well as test other high priority targets across the district.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

In accordance with NI 43-101, Martin Dupuis, P.Geo., COO, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Figure 1: Plan map of recent drilling centered on the Copala structure. (CNW Group/Vizsla Silver Corp.)

Figure 2: Inclined longitudinal section for Copala structure with drillhole pierce points. The section is 1x along strike to 1.4x along the dip to compensate for the average 46-degree dip of Copala. (CNW Group/Vizsla Silver Corp.)

Figure 3: Inclined longitudinal section for Cristiano vein with drillhole pierce points. (CNW Group/Vizsla Silver Corp.)

Figure 4: Cross section showing Copala, Cristiano and Tajitos veins. (CNW Group/Vizsla Silver Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE