Vizsla Expands Napoleon Resource Area to 1,000 Metres With an Average 3.5 Metre Width at 482 g/t AgEq

Vizsla Silver Corp. (TSX-V: VZLA) (OTCQB: VIZSF) (Frankfurt: 0G3) is pleased to provide results from nineteen new holes targeting the Napoleon Vein resource area at its flagship Panuco silver-gold project located in Mexico.

Highlights

- To date, 105 holes drilled within the Napoleon Corridor highlight an average true width of 3.5 metres with a weighted average grade of 482 g/t silver equivelant (161 g/t Ag, 3.11 g/t Au, 0.45% Pb and 1.3% Zn)

- Step-out drilling extends high-grade mineralization 50 metres to the south, while infill drilling further demonstrates a continuous panel of mineralization

Notable intercepts include:

-

- NP-21-149: 1,296 g/t AgEq (185 g/t Ag, 11.35 g/t Au, 0.49 % Pb and 2.25 % Zn) over 5.93 mTW including,3,647 g/t AgEq (344 g/t Ag, 33.78 g/t Au, 1.17 % Pb and 6.30 % Zn) over 1.89 mTW

- NP-21-133: 1,288 g/t AgEq (188.0 g/t Ag 10.74 g/t Au 1.27 % Pb and 3.47 % Zn) over 1.46 mTW

- NP-21-148: 916 g/t AgEq (113.9 g/t Ag, 6.49 g/t Au, 0.78 % Pb and 8.02 % Zn) over 1.40 mTW

- Mineralization targeted for resource delineation now extends over 1,000 metres in length, 370 metres deep and remains open to the south and at depth

| Note: All numbers are rounded. Silver equivalent is calculated using the following formula: AgEq = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types. |

Vizsla President and CEO Michael Konnert commented: “In only thirteen months since the discovery of the Napoleon Vein, the zone has grown considerably, now representing a large panel of continuous mineralization over 1,000m long with excellent grades over potentially minable widths. With increased grades and thickness developing down-plunge to the south, Napoleon continues to be the primary focus for resource delineation at Panuco and will no doubt form the backbone of the Company’s maiden resource estimate planned for Q1, 2022.”

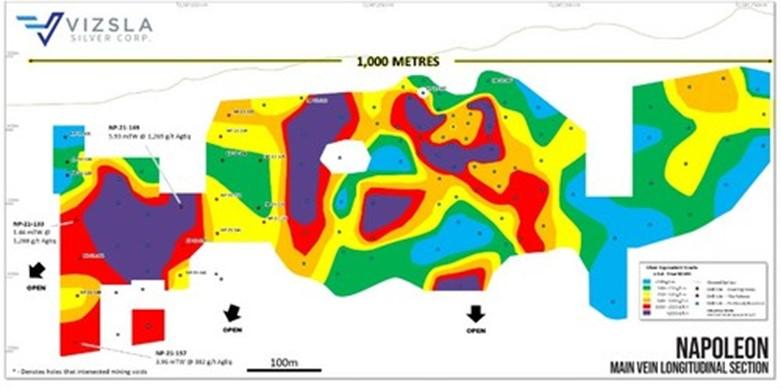

Figure 1: Longitudinal section from the main Napoleon prospect with all holes labelled and selected intersections shown.

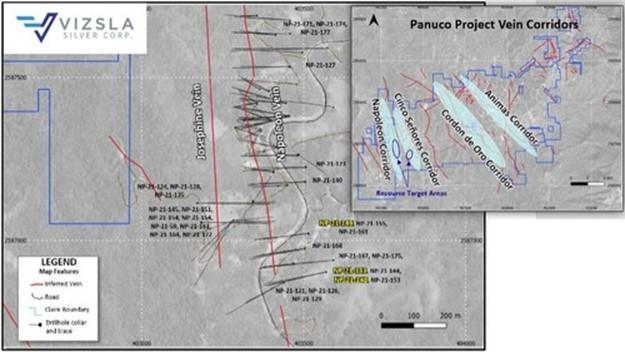

Figure 2: Plan map of the main Napoleon Corridor resource area with all holes labelled and selected intersections shown.

Napoleon Drilling Detail

Recent drilling at Napoleon has locally extended the body of mineralization within an interpreted shallowly plunging panel to the south. Most of the newly reported holes are from the southern end of the mineralized zone and continue to show a wide vein with very high grades.

Step-out drill holes NP-21-133,142 and 157 were successful in extending the Napoleon Vein by 50 metres to the south along strike and down plunge from the previously reported fence of holes. Mineralization remains open to the south and at depth and continues to be the Company’s primary focus for resource drilling.

Additionally, systematic grid drilling on 50 metre centers has now largely infilled the remaining untested areas to the north, highlighting a continuous zone of mineralization. In total, mineralization is defined over a strike length of 1,000 metres and to a depth of 370 metres.

To date, 105 holes completed within the Napoleon resource area highlight an average vein width of 3.5 metres with a weighted average grade of 482g/t AgEq (161 g/t silver, 3.11 g/t gold, 0.45% lead and 1.3% zinc). This represents a 9% increase in weighted average grade and a 0.5 metre reduction in average width since the last update (see press release dated April 6, 2021). Average weighting does not include grade capping, total length and depths are estimations and all holes are included resulting in inclusion of potentially non-economic material.

An average specific gravity of 2.72 has been calculated from 49 samples after rejecting outliers.

Relative to the last update, both silver (155 to 161 g/t) and gold (2.74 to 3.11 g/t) grades have increased, with the later largely attributable to a significantly higher gold/silver ratio observed at the southern end of the resource drilling area.

Moving forward, Vizsla will complete wider, 100 metre step-out holes in this area to better define the potential edge of mineralization. This will allow for more spatial data to be incorporated into the Project’s resource database ahead of the drilling cut-off date for inclusion in the maiden resource estimate (planned for Q1, 2022).

Complete table of Napoleon Resource Area Intersections

| Drillhole | From | To | Estimated true width |

Gold | Silver | Lead | Zinc | Silver Equivalent | Comment |

| (m) | (m) | (m) | (g/t) | (g/t) | (%) | (%) | (g/t) | ||

| NP-21-121 | No Significant Results | ||||||||

| NP-21-124 | 261.1 | 263.0 | 1.48 | 0.77 | 30.0 | 0.16 | 0.45 | 113.9 | |

| NP-21-126 | 82.0 | 84.95 | 1.16 | 0.66 | 100.1 | 0.03 | 0.08 | 158.1 | |

| NP-21-128 | No Significant Results | ||||||||

| NP-21-129 | 63.0 | 64.65 | 0.84 | 1,209.9 | 0.25 | 0.70 | 1,237.3 | Hangingwall | |

| Incl. | 64.35 | 64.65 | 4.58 | 5,750.0 | 1.34 | 3.67 | 5,947.5 | ||

| And | 96.05 | 97.05 | 0.57 | 0.35 | 65.6 | 0.05 | 0.11 | 98.1 | Napoleon |

| NP-21-133 | 248.25 | 250.6 | 1.46 | 10.74 | 188.0 | 1.27 | 3.47 | 1,288.0 | |

| NP-21-135 | 322.0 | 324.1 | 1.26 | 0.61 | 126.1 | 0.06 | 1.66 | 215.5 | |

| NP-21-140 | 69.5 | 73.8 | 2.58 | 0.42 | 66.7 | 0.19 | 0.74 | 123.7 | Napoleon |

| And | 77.35 | 81.0 | 2.19 | 1.73 | 60.3 | 0.40 | 0.75 | 244.3 | |

| NP-21-142 | 289.5 | 295.7 | 3.01 | 3.62 | 40.4 | 0.80 | 3.98 | 485.7 | |

| NP-21-145 | 328.4 | 333.25 | 3.40 | 3.10 | 109.9 | 1.20 | 1.11 | 445.8 | |

| NP-21-148 | 339.2 | 340.6 | 1.40 | 6.49 | 113.9 | 0.78 | 8.02 | 915.5 | |

| Incl. | 340.0 | 340.3 | 0.11 | 25.2 | 365 | 2.71 | 22.90 | 3,285.0 | |

| NP-21-149 | 210.45 | 218.6 | 5.93 | 11.35 | 184.6 | 0.49 | 2.25 | 1,295.6 | |

| Incl. | 211.85 | 214.45 | 1.89 | 33.78 | 343.6 | 1.17 | 6.30 | 3,646.5 | |

| NP-21-151 | 217.55 | 220.5 | 1.53 | 1.88 | 56.3 | 0.10 | 0.47 | 241.1 | |

| NP-21-154 | 165.45 | 169.55 | 2.37 | 0.31 | 27.2 | 0.20 | 0.70 | 75.6 | |

| NP-21-155 | 248.0 | 257.0 | 6.33 | 1.79 | 51.7 | 0.17 | 1.14 | 246.2 | |

| Incl. | 253.0 | 256.55 | 2.50 | 3.03 | 63.9 | 0.24 | 2.42 | 403.6 | |

| Incl. | 256.0 | 256.55 | 0.39 | 6.21 | 58.3 | 0.50 | 3.05 | 715.9 | |

| NP-21-157 | 391.5 | 401.6 | 3.96 | 1.79 | 81.5 | 0.76 | 5.22 | 382.0 | |

| NP-21-159 | 147.85 | 153.0 | 4.28 | 0.23 | 28.6 | 0.27 | 0.76 | 71.7 | |

| NP-21-161 | 280.75 | 286.5 | 3.43 | 0.98 | 19.8 | 0.14 | 0.62 | 127.7 | |

| NP-21-162 | 129.25 | 136.5 | 5.61 | 0.43 | 92.2 | 0.15 | 0.34 | 137.8 | |

| Table 1: Drillhole intersections from the Napoleon Vein Resource area not previously reported. | |||||||||

| Note: All numbers are rounded. Silver equivalent is calculated using the following formula: AgEq = ((Au_g/t x 52.48) + (Ag_g/t x 0.5289) + (Pb_ppm x 0.0013) + (Zn_ppm x 0.0013)) / 0.5627. Metal price assumptions are $17.50 oz silver, $1,700 oz gold, $0.75 pound lead and $0.85 pound zinc, recoveries assumptions are 96% gold, 94% silver, 78% lead and 70% zinc based on similar deposit types. | |||||||||

Drill Collar Information

| Prospect | Drillhole | Easting | Northing | Elevation | Dip | Azimuth | Hole Depth |

| Napoleon | NP-21-121 | 403439 | 2586871 | 421 | -40.0 | 241.0 | 267.8 |

| NP-21-124 | 403174 | 2587114 | 526 | -43.7 | 91.9 | 292.5 | |

| NP-21-126 | 403439 | 2586871 | 421 | -60.0 | 241.0 | 250.5 | |

| NP-21-127 | 403458 | 2587634 | 488 | -63.0 | 272.0 | 381.0 | |

| NP-21-128 | 403174 | 2587114 | 526 | -48.0 | 90.6 | 329.3 | |

| NP-21-129 | 403439 | 2586871 | 421 | -68.0 | 241.0 | 367.5 | |

| NP-21-133 | 403570 | 2586903 | 466 | -50.0 | 255.0 | 301.5 | |

| NP-21-135 | 403170 | 2587114 | 527 | -52.0 | 89.5 | 391.5 | |

| NP-21-140 | 403344 | 2587120 | 477 | -40.0 | 44.0 | 120.0 | |

| NP-21-142 | 403570 | 2586903 | 466 | -56.0 | 255.0 | 340.5 | |

| NP-21-145 | 403188 | 2587055 | 530 | -57.0 | 89.0 | 382.0 | |

| NP-21-148 | 403570 | 2586903 | 466 | -60.0 | 255.0 | 384.0 | |

| NP-21-149 | 403515 | 2587021 | 449 | -50.0 | 263.0 | 251.0 | |

| NP-21-151 | 403279 | 2587057 | 497 | -66.4 | 92.5 | 255.0 | |

| NP-21-154 | 403283 | 2587061 | 498 | -60.5 | 92.5 | 261.0 | |

| NP-21-155 | 403515 | 2587021 | 449 | -58.0 | 270.0 | 301.7 | |

| NP-21-157 | 403570 | 2586903 | 466 | -65.0 | 255.0 | 435.0 | |

| NP-21-159 | 403283 | 2587061 | 498 | -49.5 | 92.5 | 190.5 | |

| NP-21-161 | 403515 | 2587021 | 449 | -63.5 | 263.0 | 310.8 | |

| NP-21-162 | 403283 | 2587061 | 498 | -40.0 | 84.7 | 162.0 | |

| Table 2: Drill hole details. Coordinates in WGS84, Zone 13 | |||||||

About the Panuco project

The newly consolidated Panuco silver-gold project is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 9,386.5-hectare, past producing district benefits from over 75 kilometres of total vein extent, a 500 ton per day mill, 35 kilometres of underground mines, tailings facilities, roads, power and permits.

The district contains intermediate to low sulfidation epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are mainly continental volcanic rocks correlated to the Tarahumara Formation.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption (“AA”) spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company’s quality assurance / quality control protocol.

Qualified Person

The Company’s disclosure of technical or scientific information in this press release has been reviewed and approved by Martin Dupuis, P.Geo., Vice President of Technical Services for Vizsla Silver. Mr. Dupuis is a Qualified Person as defined under the terms of National Instrument 43-101.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE