The Critical Investor – “Omai Gold Mines Intercepts 31.1m @ 4.07g/t Au Within Open Pit Depth At Wenot”

In an increasingly uncertain market environment as a result of the Fed communicating their intentions for more rate hikes, and ever stronger signals of a looming recession, Omai Gold Mines (TSX-V:OMG) continues to explore for more gold in addition to their 3.7Moz resources for Wenot and Gilt Creek. After several uneconomic drill results for various exploration targets, Omai hit very decent mineralization at the west end of Wenot with hole 23ODD-063: 31.1m @ 4.07 g/t Au, 9.6m @ 3.38 g/t Au, 6.8m @ 3.09g/t Au and 1.8m @ 14.21 g/t Au. The beauty of these results is that all intercepts are within open pit limits, and prove great continuity of the vertical lenses of Wenot to depth.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates, forecasts or predictions regarding Omai Gold Mines’ resource potential are those of the author alone and do not represent views, opinions, estimates, forecasts or predictions of Omai or Omai’s management. Omai Gold Mines has not in any way endorsed the views, opinions, estimates, forecasts or predictions provided by the author.

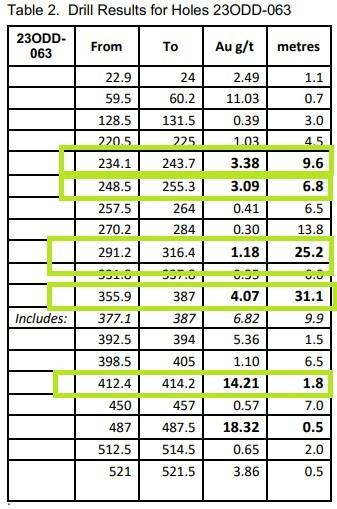

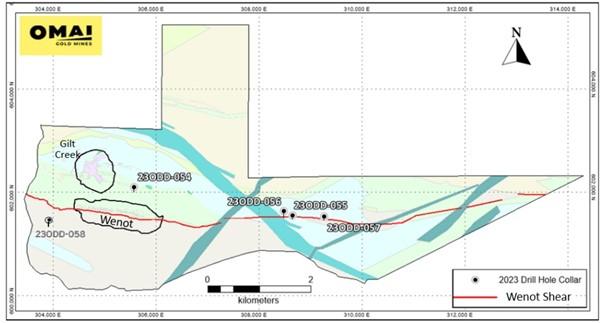

It was good to see Omai Gold Mines announcing some good drill results for Wenot on June 22, 2023, as the Pyramid and Broccoli Hill drilling didn’t provide anything economic yet unfortunately, as was reported on April 28, 2023 (holes 23ODD-054 to 058 for 1,364m). Eleven holes have been completed this year, for a total of 3,569m. Just one hole was reported in this news release, being 23ODD-063, with the following results:

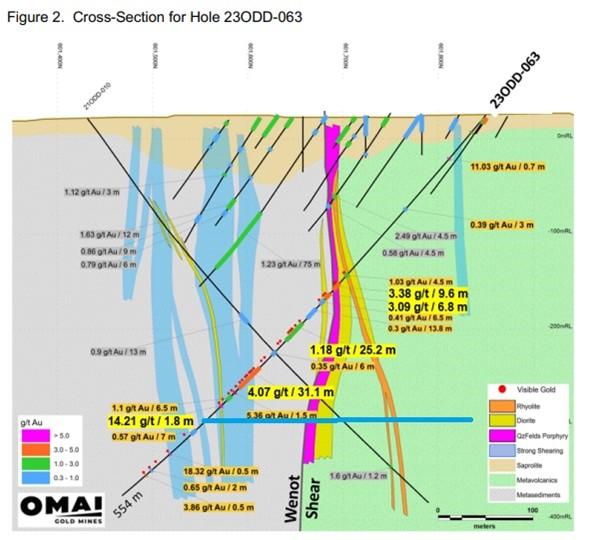

It will be clear that Wenot consists of many mineralized lenses, and as can be seen at the following section, these lenses all start close to the surface, and possess great continuity at depth:

What I like most about this drill result, is the impressive 31.1m @ 4.07g/t Au intercept, besides the multiple other signficant intersections which are all well above -300m depth (see blue line above), deemed open pittable by management. Such an intercept is very substantial and high grade for open pit, as those deposits usually are economic at 1g/t Au with a decent strip ratio and tonnage. Of course the drill results aren’t true width as drilling happened under an angle, but say 25m true width @ 4.07g/t is equivalent to 100m @ 1g/t Au for example. As can be seen, the blue shear zones were intercepted as management thought they would extend at depth. CEO Ellingham was obviously pleased with this confirmation:

“These impressive new drill results continue to confirm the magnitude of the Wenot deposit, by demonstrating strike and depth continuity of significant gold mineralization. We have not seen any limitations to the Wenot deposit, and as such are confident that additional drilling can further expand the gold resources. At Wenot, 88% of the NI 43-101 mineral resource estimate lies above a 300 m depth and the few holes that tested below confirm continuity and suggest that grades may increase with depth, particularly at the west end of the deposit.”

This increasing grade at depth is interesting, but will need a lot of deep drilling (500-600m holes) in order to get a resource delineated on it, which is costly. I wondered if the current campaign might already result into an updated resource for Wenot in the foreseeable future, and if management is aiming at a certain number and more deep drilling (4Moz Au seems like a nice target). CEO Ellingham answered:

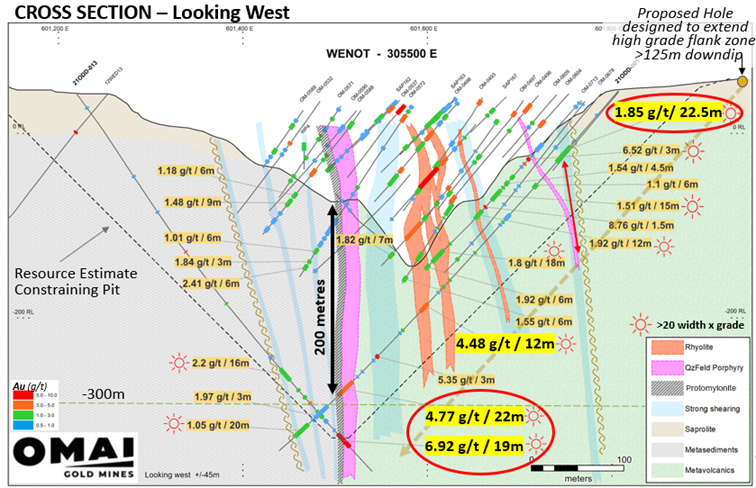

“On the resource: maybe a potential 10-15% increase for a total resource target, but also focused on adding ounces and boosting grade in the most important areas that would see early mining. We will probably look to update the resource near year end. To elaborate a bit more on this: we already have defined a very sizeable resource so our drilling is to achieve specific objectives; 1) to complete very strategic holes in the west Wenot area that is the likely first area for mining. As we all know, it is the first couple years of a mining operation that most impacts the NPV “net present value” of a mining asset. Also, it drives the early cash flow. We know that the west Wenot is very favourable and is to surface, and in this area we have 750 metre strike (size of many other mines) but there was limited drilling so with just a few holes, such as -063, we can very positively impact the West Wenot, both with these grades and widths.

On the increasing grade at depth: remember 88% of our resource is above 300m depth. (compare that with Reunion that put out their very first resource and suggest a pit to 610m vertical depth ! ) Also note that for our resource, between 200-300 metres resulted in 830,000 oz of resource. There is limited drilling below 300m, so we just want to demonstrate that the mineralization continues to 500m depth. Few things: if between 300-400 adds another 800,0000 oz that is amazing and also we only need a couple holes to demonstrate the potential. Also, if the grade improves that is even more impressive. Remember that even in hole 001 we showed grades and 4.77g/t over 22 m and 6.92 gpt / 19m as well as 4.48 g/t over 12 m …..these could also support a decline from the bottom of a pit. (excellent grades and widths !).”

More drilling costs more money of course, and after raising C$4.22M in December of last year, Omai Gold Mines has an estimated C$3.1M left in the treasury nowadays, which will last until Q4, 2023, likely causing the company to tap the markets around that period. As this last raise already caused quite a bit of dilution, and the share count is standing at 377.85M O/S these days, once in a while I receive remarks from investors about the share structure. I don’t have many problems with it as Omai is a developer with substantial resources and around for a long time, but I can imagine it would make life easier while raising money for example. CEO Ellingham insisted on elaborating why Omai does’t need a consolidation of shares anytime soon. She stated: “There is a lot of upside in our stock and we believe the unrealized value of our asset is being noticed. We are in the same position as a lot of juniors with respect to an absence of retail trading, but much better positioned with a very tangible asset. The current drill hole met and exceeded our objectives in again demonstrating that the Wenot deposit is large but clearly can be larger and potentially higher grade in certain strategic near surface areas.”

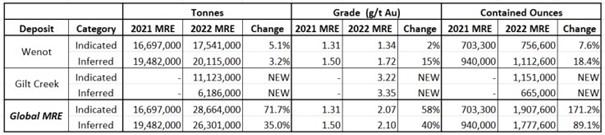

As a reminder, the October 2022 NI43-101 resource estimate delineated a combined 3.7Moz Au Indicated and Inferred deposit for Wenot and Gilt Creek:

And keep in mind, when using a much more robust cut-off grade for Wenot of 0.6g/t Au the ounces only go down from 1.85Moz Au Ind & Inf to 1.7Moz Au Ind & Inf, but the average grade increases from 1.62g/t Au Ind & Inf to 1.86g/t Au Ind & Inf. For Gilt Creek, a cut-off grade of 2.0g/t Au decreases total ounces from 1.8Moz Au to 1.5Moz Au, but even more importantly with the average grade increasing from 3.27g/t to 4.02g/t Au, and this is much more robust for an underground project. So with a slight increase in cut-off grades for both deposits, a likely pretty economic resource of 3.2Moz Au is achieved.

As of now, the company has established an exploration target at Wenot with a size of at least 2.7 km long, by 450 m deep, by 200-300 m wide, with only 50% of this larger area having been drill tested. The Wenot shear corridor is a regional structure and it is highly likely that the gold-bearing zones extend beyond the drill-tested area. The geologists have identified an eastern extension of the Wenot shear corridor that continues four to five kilometres along strike. The plan for now is to complete the current 5,000m drill program at Omai, which encompasses 4-5 holes for 1,500m, involving testing more of Wenot, Broccoli Hill, Pyramid, and some of the high grade near surface zones identified in the 2020 drilling. I also wondered if management was intending to drill test the large magnetic lows at Broccoli Hill in particular. CEO Ellingham answered: “With the NI 43-101 resource completed in late 2022, it is clear that this is a gold project that will move forward. We are on the radar now for potential acquirers and as such it is important that we drill very strategically to prove that this project (and its shareholders) deserve a far higher valuation. This impact is best optimized through drilling to demonstrate the size potential, and in addition we are contemplating to initiate a PEA to show superior economics of Wenot compared with other projects in Guyana.”

Conclusion

Although Omai Gold Mines remains cheap with a valuation of EV/oz around C$5/oz, management is looking for ways to re-rate the stock. It has always been exploration, but the markets didn’t react particularly strongly to the increased resource updates. Therefore management is looking into initiating a PEA potentially in Q4 of this year, together with increasing the resource another 10-15%. The latest drill result proved solid continuity and potentially increased grades at depth of the mineralized lenses at Wenot, results reported earlier at the early stage targets Broccoli Hill and Pyramid didn’t find economic mineralization yet, but management isn’t done exploring there. The focus will remain at Wenot and Gilt Creek, with plans for drilling will finish the 5000m and continue a further 3000m. Stay tuned!

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Omai Gold Mines is a sponsoring company. All facts are to be checked by the reader. For more information go to www.omaigoldmines.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE