SSR Mining Announces Positive Results of the Çöpler District Master Plan Studies

SSR Mining Inc. (NASDAQ: SSRM) (TSX: SSRM) (ASX: SSR) is pleased to announce the positive results of its independently prepared Master Plan study of the Çöpler District which will be set forth in an independent National Instrument 43-101 Technical Report on the Çöpler mine. Çöpler has been in continuous operations since 2010 and has cumulatively produced over 2 Moz of gold. The CDMP20 summarizes SSR Mining’s current development strategy for Çöpler and includes analysis for two production scenarios:

- Mineral Reserve case incorporating a supplemental flotation circuit prepared to a Feasibility Study level; and

- An alternative Preliminary Economic Assessment case including the development of Ardich. (1)

Highlights of the Çöpler District Master Plan 2020:

(All results on a 100% basis; currency in U.S. dollars)

- Significant increase in Mineral Reserves and Mineral Resources: Updated figures and growth since December 31, 2019:

- 4.0 Moz Mineral Reserves – increase of 22%;

- 7.4 Moz Measured & Indicated Mineral Resources (2) – increase of 24%; and

- 3.1 Moz Inferred Resources – increase of 58%.

- Reserve Case outlines benefits of operational improvements and the addition of a supplemental flotation circuit:

- NPV5% of $1.7 billion;

- Life of mine production of 3.6 Moz of gold;

- Average annual production of 266,000 ounces of gold over the first five years;

- Average AISC of $865 per ounce (3) over the first five years;

- Average annual free cash flow of $224 million (4) over the first five years;

- Incorporation of supplemental flotation circuit: Increases sulfide plant throughput, lowers operating costs; and

- 21-year asset life at higher processing rates: Mine life extension a result of lower processing costs, additional pit phases, additional tailings capacity, and an increased gold price.

- PEA Case shows potentially robust economic results and increased production scale as a result of including development of the Ardich mineral resources:

- NPV5% of $2.2 billion;

- Life of mine production of 4.6 Moz of gold;

- Average annual production of 306,000 ounces of gold over the first five years;

- Average AISC of $886 per ounce (3) over the first five years;

- Average annual free cash flow of $249 million (4) over the first five years;

- 22-year asset life;

- Ardich deposit incremental development capital of ~$50 million;

- The Ardich deposit is a newly identified deposit that is separate to the other deposits on the property. Drilling is continuing at the Ardich deposit and it is expected that the drilling will further define the Mineral Resource; and

- The PEA Case is preliminary in nature and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would allow them to be categorized as Mineral Reserves, and there is no certainty that the results will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Approval for construction of the supplemental flotation circuit: SSR Mining’s Board of Directors has approved construction of the supplemental flotation circuit at a total cost of $18 million with commissioning expected in Q3 2021.

- Permitting advancing: Permitting and Environmental Impact Assessment updates for both Çöpler and Ardich are underway.

- Tailings capacity constraint removed: A seventh lift of the tailings storage facility along with improved settling, resulting from the flotation circuit removes the Mineral Reserve tailings capacity constraint on total tonnes processed. Engineering and permitting is proceeding on a second smaller tailings facility in anticipation of growth at Ardich and Çöpler.

- Exploration continues at Ardich with positive drill results: Results from drilling completed since February 2020 provide encouragement for extension of the mineralized zones beyond the extents of the updated Mineral Resource. Drilling continues with three drills currently active.

Rod Antal, President and CEO stated, “We are pleased with the results of the updated Çöpler District Master Plan which demonstrates long-term value and the significant organic growth potential of this world-class operation. The CDMP20 clearly outlines a potential path to sustaining ~300,000 ounces of annual production from the district for at least 10 years, the extension of the overall mine life to 20+ years at increased processing rates, and the generation of robust free cash flows over the mine life.

In addition to numerous highly prospective targets identified within the district over the last several years, the subsequent Ardich drilling results, coupled with the C2 exploration results from last week, continue to indicate the significant upside we see at Çöpler for years to come. Ardich represents the most advanced project in the district with exploration, engineering, and permitting continuing to advance the project to potentially bring it into production by 2023.”

Çöpler District Master Plan 2020 Summary

The CDMP20 summarizes the current SSR Mining development strategy for Çöpler and includes analysis for two production scenarios:

- Reserve Case demonstrating the Mineral Reserves and incorporating a supplemental flotation circuit; and

- The alternative PEA Case outlining the development of Ardich.

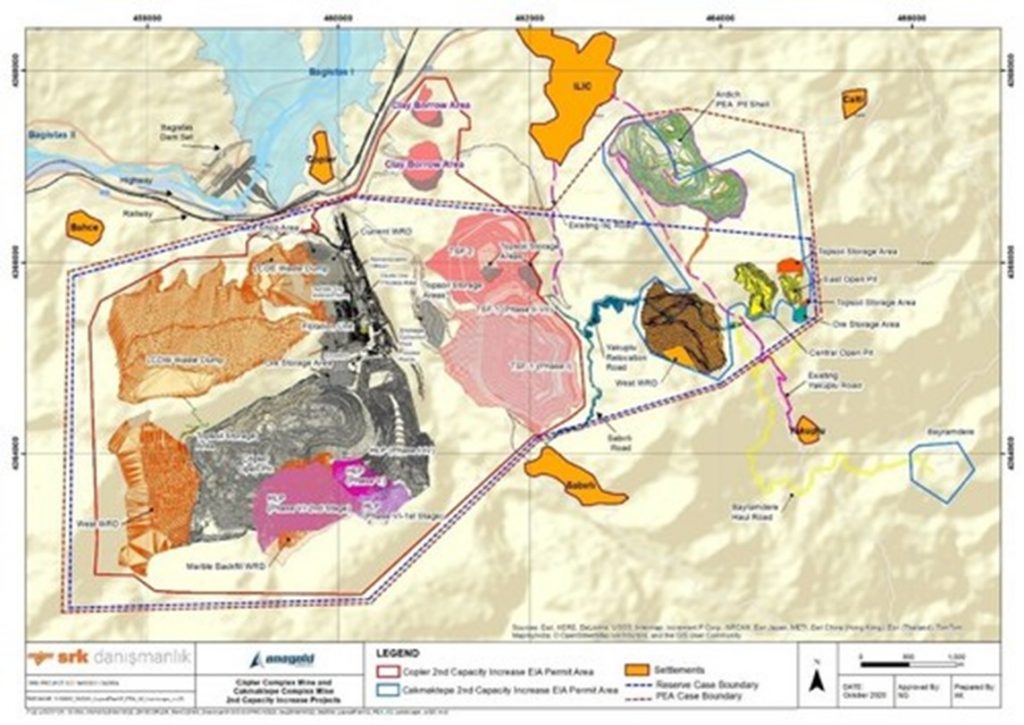

A location plan showing the facility locations and the boundaries of the Reserve Case and the PEA Case is shown in Figure 1.

The CDMP20 scope included:

- Updated Mineral Resource on the Çöpler, Çakmaktepe and Ardich deposits;

- Updated Mineral Reserve on the Çöpler and Çakmaktepe deposits;

- The incorporation of a supplemental flotation circuit in the existing sulfide plant; and

- PEA which includes the preliminary development plan for the Ardich Mineral Resources.

Figure 1. CDMP20 Reserve Case and PEA Case Boundaries. (CNW Group/SSR Mining Inc.)

The Reserve Case is supported by feasibility study level work on the currently operated pits at the Çöpler and Çakmaktepe deposits, the heap leach facility, and the sulfide plant. The processing analysis in the Reserve Case includes incorporation of a flotation circuit into the existing sulfide plant to upgrade sulfide sulfur to fully utilize grinding and pressure oxidation autoclave capacity. The flotation circuit is in detailed design and preliminary construction works are underway pending final permitting which is expected in late 2020.

The PEA Case on an expanded Çöpler project includes the new predominantly oxide Ardich deposit for the enlarged project area, and that reflects the increased capital costs and infrastructure required. The PEA Case analyzes inclusion of production from Ardich in a whole of project analysis and represents a significant change from the Reserve Case economic results and production profile.

The key production and economic analysis from the CDMP20 are shown in Table 1.

Table 1. CDMP20 Results Summary.

| Item | Unit | Reserve Case | PEA Case |

| Oxide Processed | |||

| Heap Leach Quantity | kt | 7,668 | 25,008 |

| Gold Feed Grade | g/t | 1.22 | 1.69 |

| Sulfide Processed | |||

| Quantity Milled | kt | 51,084 | 54,073 |

| Gold Feed Grade | g/t | 2.24 | 2.33 |

| Total Gold Produced | |||

| Oxide – Gold | koz | 256 | 956 |

| Sulfide – Gold | koz | 3,334 | 3,691 |

| Total – Gold | koz | 3,591 | 4,646 |

| Oxide – Gold Recovery | % | 73 | 68 |

| Sulfide – Gold Recovery | % | 91 | 91 |

| 5-Year Annual Average | |||

| Average Gold Produced | koz | 266 | 306 |

| Free Cash Flow | $M | 224 | 249 |

| Production Costs (3) | $/oz Au | 682 | 701 |

| All–in Sustaining Costs (3) | $/oz Au | 865 | 886 |

| Key Financial Results | |||

| Production Costs (3) | $/oz Au | 748 | 726 |

| All–in Sustaining Costs (3) | $/oz Au | 945 | 893 |

| Site Operating Costs | $/t treated | 47.09 | 42.87 |

| After-Tax NPV (5%) | $M | 1,733 | 2,164 |

| Mine Life | years | 21 | 22 |

| Note: 5-Year annual average is for the period January 2021 to December 2025. | |||

Sulfide Plant Flotation Circuit

A 50 to 150 tph flotation circuit will increase overall sulfide plant throughput, utilizing latent capacity in the sulfide plant, in particular the grinding and POX circuits. Total plant throughput will increase up to a maximum of 400 tph, depending on ore type and chemistry. Total plant and flotation circuit throughput will modulate to produce a concentrate that will maintain maximum autoclave sulfide sulfur throughput rates.

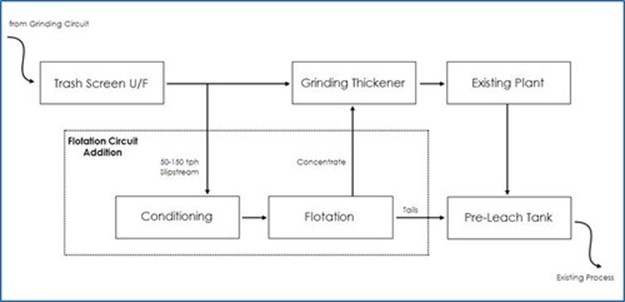

The flotation circuit is being installed between grinding and acidulation, as shown in Figure 2. A bleed / slip stream from the grinding thickener feed will go to flotation, gold bearing sulfide concentrate will return to the grinding thickener to be combined with POX feed. The carbonate rich flotation tailings go directly to leaching.

The projected benefits of the flotation circuit are:

- A significant increase in overall plant throughput rate (1.9 to 2Mtpa design up to a max 3Mtpa);

- Increased tailings settled density provides additional TSF capacity;

- Reduced reagent usage (acid and lime); and

- Making the sulfide plant less dependent on input ore chemical parameters (less process excursions & reduced mine costs).

Figure 2. Flotation circuit block flow diagram and graphics. (CNW Group/SSR Mining Inc.)

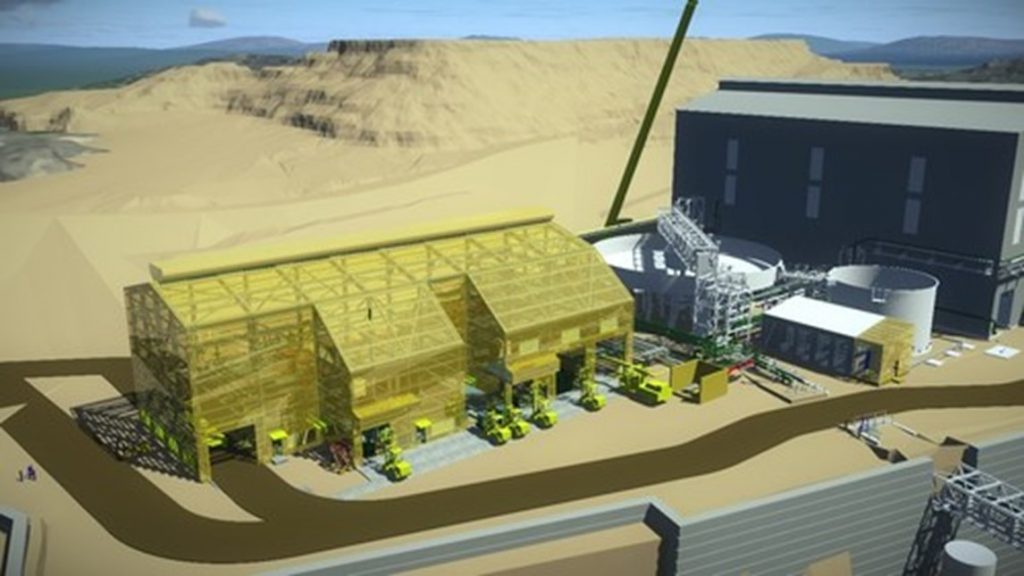

Figure 3. Flotation circuit graphics. (CNW Group/SSR Mining Inc.)

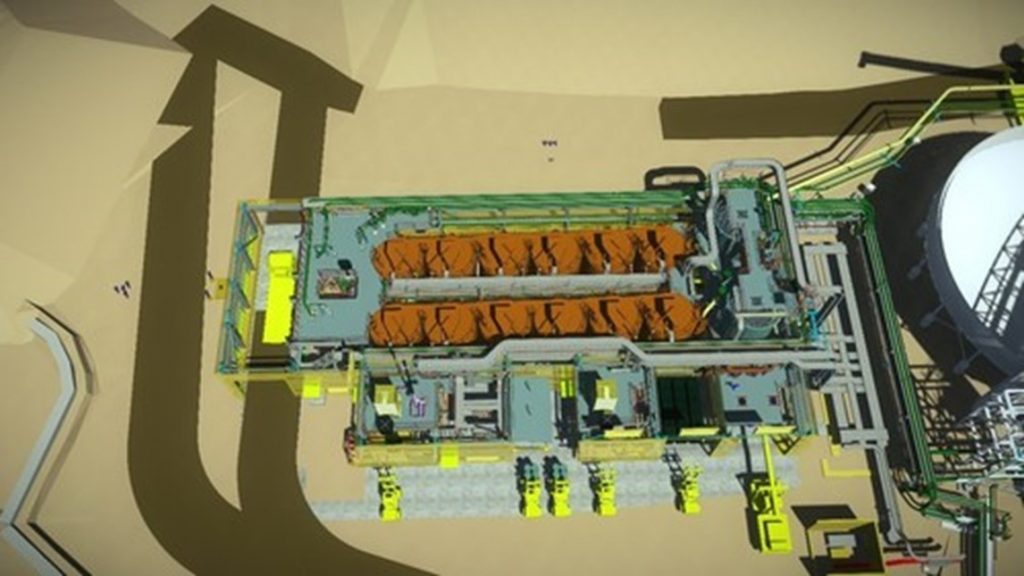

Figure 4. Flotation circuit graphics. (CNW Group/SSR Mining Inc.)

Ardich

The Ardich deposit is a newly discovered deposit that is separate to the other deposits on the property. Drilling is continuing at Ardich and is expected to further define and expand the Mineral Resource. The development of Ardich requires development of a new open pit that is 6 km from the current Çöpler pit and 1 km from the Çakmaktepe pit.

The PEA Case defines the first iteration of the potential development plan for Ardich. Permitting and planning for development is underway. The production profile of the PEA Case is outlined below in Figure 5.

Figure 5. PEA Case production profile. (CNW Group/SSR Mining Inc.)

| Note: 2020E gold production of 330k ounces calculated based on year-to-date actual production of 244k ounces, plus 86k ounces of estimated gold production in Q4 2020. |

Inferred Mineral Resources from Ardich are included in the PEA Case. The Ardich oxide Mineral Resources in the PEA Case for feed to the oxide heap leach represent a more than doubling of the production rate at an average grade that is 50% higher than the Çöpler oxide heap leach processing rate and average grade in the Reserve Case. The PEA Case includes assumptions for separate capital, infrastructure and permitting that will be required to develop the Ardich Mineral Resources. The Ardich Mineral Resource was not included in the previous Technical Report and so the PEA represents a significant change in information.

The PEA Case is preliminary in nature and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would allow them to be categorized as Mineral Reserves, and there is no certainty that the results will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

NPV Sensitivities

Figure 6. Reserve Case NPV Sensitivity. (CNW Group/SSR Mining Inc.)

Figure 7. PEA Case NPV Sensitivity. (CNW Group/SSR Mining Inc.)

Mineral Resources

Overall, there has been a 24% increase in Measured and Indicated contained gold and a 58% increase in Inferred contained gold. The new work has for the first time identified Measured Mineral Resources at Çöpler and Ardich.

The differences have been calculated between the CDMP20 Mineral Resources and the previous Mineral Resources reported as at December 31, 2019. The complete Mineral Resource is shown in Table 2 for each deposit, material type, and classification.

The differences are a function of the following changes:

- Reduction in cut-off grades due to lower unit costs, higher throughputs in the sulfide plant, and increased gold price;

- Larger conceptual pit shell selecting additional model cells above the cut-off;

- Review of metallurgical recoveries;

- Update to Çakmaktepe and Ardich resource models to incorporate recent drillhole data;

- Review of Mineral Resource classification method; and

- Depletion through mining since 31 December 2019.

Table 2. CDMP20 Mineral Resources Summary.

| CDMP20 Mineral Resources Summary (as at the Effective Date) | |||||||

| Classification | Tonnage (kt) |

Grades | Contained Metal | ||||

| Au (g/t) | Ag (g/t) | Cu (%) | Gold (koz) | Silver (koz) | Copper (klb) | ||

| Çöpler Mine Oxide Mineral Resource | |||||||

| Measured | 287 | 1.29 | 7.75 | 0.09 | 12 | 72 | 540 |

| Indicated | 25,139 | 0.98 | 3.44 | 0.15 | 789 | 2,781 | 81,399 |

| Measured + Indicated | 25,427 | 0.98 | 3.49 | 0.15 | 801 | 2,853 | 81,939 |

| Inferred | 33,083 | 0.96 | 7.16 | 0.13 | 1,017 | 7,614 | 94,935 |

| Çöpler Mine Sulfide Mineral Resource | |||||||

| Measured | 2,454 | 2.22 | 7.21 | – | 175 | 569 | – |

| Indicated | 84,558 | 1.84 | 5.04 | – | 5,015 | 12,617 | – |

| Measured + Indicated | 87,012 | 1.86 | 4.71 | – | 5,190 | 13,186 | – |

| Inferred | 34,073 | 1.54 | 12.72 | – | 1,692 | 13,937 | – |

| Çakmaktepe Oxide Mineral Resource | |||||||

| Measured | – | – | – | – | – | – | – |

| Indicated | 3,626 | 1.53 | 8.50 | – | 179 | 993 | – |

| Measured + Indicated | 3,626 | 1.53 | 8.50 | – | 179 | 993 | – |

| Inferred | 1,205 | 0.85 | 4.04 | – | 33 | 157 | – |

| Ardich Oxide Mineral Resource | |||||||

| Measured | 4,707 | 1.63 | – | – | 246 | – | – |

| Indicated | 12,817 | 1.62 | – | – | 666 | – | – |

| Measured + Indicated | 17,524 | 1.62 | – | – | 912 | – | – |

| Inferred | 4,713 | 1.62 | – | – | 246 | – | – |

| Ardich Sulfide Mineral Resource | |||||||

| Measured | 695 | 2.56 | – | – | 57 | – | – |

| Indicated | 2,231 | 3.71 | – | – | 266 | – | – |

| Measured + Indicated | 2,926 | 3.43 | – | – | 323 | – | – |

| Inferred | 782 | 4.24 | – | – | 107 | – | – |

| Bayramdere Oxide Mineral Resource | |||||||

| Measured | – | – | – | – | – | – | – |

| Indicated | 145 | 2.34 | 20.82 | – | 11 | 97 | – |

| Measured + Indicated | 145 | 2.34 | 20.82 | – | 11 | 97 | – |

| Inferred | 8 | 2.17 | 19.95 | – | 1 | 5 | – |

| CPMD20 Mineral Resources Total | |||||||

| Measured | 8,143 | 1.87 | 2.45 | 0.00 | 490 | 641 | 540 |

| Indicated | 128,517 | 1.68 | 3.99 | 0.03 | 6,926 | 16,485 | 81,399 |

| Measured + Indicated | 136,660 | 1.69 | 3.90 | 0.03 | 7,416 | 17,126 | 81,939 |

| Inferred | 73,865 | 1.30 | 9.14 | 0.06 | 3,094 | 21,713 | 94,935 |

- Mineral Resources have an effective date of November 27, 2020.

- Mineral Resources are reported based on end of August 2020 topography surface.

- Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are shown on a 100% basis. Çöpler Mineral Resources are located on ground held 80% by SSR Mining, Çakmaktepe and Bayramdere Mineral Resources are located on ground held 50% by SSR Mining, and approximately 96% of Ardich Mineral Resources are located on ground held 80% by SSR Mining, with the remainder located on ground 50% held by SSR Mining.

- Çöpler Sulfide Indicated total includes stockpiles: 6,674 kt @ 2.63 g/t Au (*).

- Çakmaktepe Oxide Indicated total includes stockpiles: 11 kt @ 2.69 g/t Au (t).

- At Çöpler: oxide is defined as material

- At Ardich and Çakmaktepe, low-sulfur (LS) oxide is defined as material with

- At Bayramdere: oxide is defined as material

- All Mineral Resources in the CDMP20 were assessed for reasonable prospects for eventual economic extraction by reporting only material that fell within conceptual pit shells based on metal prices of $1,750/oz for gold ($1,400/oz for gold and $19.00/oz for silver for Bayramdere). The following parameters were used:

- Metallurgical recoveries in oxide: Çöpler 62.3%–78.4%, Çakmaktepe 38.0%–80.0%, Ardich 40.0%–73.0%, and Bayramdere 75.0%, and in sulfide: Çöpler 85.0%, and Ardich 82.9%;

- Gold cut off grades in oxide: Çöpler 0.32–0.41 g/t Au, Çakmaktepe 0.36–0.76 g/t Au, Ardich 0.30–0.55 g/t Au, and Bayramdere 0.35–0.50 g/t Au, and in sulfide: Çöpler 0.73 g/t Au and Ardich 0.77 g/t Au, (there are no credits for Ag or Cu in the cut-off grade calculations); allowances have been made for royalty payable.

- Reported Mineral Resources contain no allowances for unplanned dilution or mining recovery.

- Totals may vary due to rounding.

Mineral Reserves

Overall, there has been a 39% increase in tonnage above the cut-off across both combined Mineral Reserve categories, with a corresponding 22% increase in contained gold. The major proportion of the increase is from larger pit design at Çöpler.

The differences have been calculated between the CDMP20 Mineral Reserves and the previous Mineral Reserves reported as at December 31, 2019. The complete Mineral Reserve is shown in Table 3 for each deposit, material type, and classification.

The differences are a function of the following changes:

- New designs for two new phases beneath the Çöpler pit;

- Reduction in cut-off grades from the increased throughput provided by the flotation circuit, reduced unit costs and increased gold price;

- Review of metallurgical recoveries;

- Review of Çakmaktepe North; and

- Depletion through mining since December 31, 2019.

Table 3. CDMP20 Mineral Reserves Summary.

| CDMP20 Mineral Reserves Summary (as at the Effective Date) | |||||||

| Classification | Tonnage (kt) |

Grades | Contained Metal | ||||

| Au (g/t) | Ag (g/t) | Cu (%) | Gold (koz) | Silver (koz) | Copper (klb) | ||

| Çöpler Mine – Oxide | |||||||

| Proven Mineral Reserve | 230 | 1.23 | 8.97 | 0.06 | 9 | 66 | 294 |

| Probable Mineral Reserve | 7,364 | 1.23 | 6.16 | 0.13 | 290 | 1,458 | 20,549 |

| Probable – Stockpile | – | – | – | – | – | – | – |

| Total Mineral Reserve | 7,595 | 1.23 | 6.24 | 0.12 | 299 | 1,525 | 20,843 |

| Çöpler Mine – Sulfide | |||||||

| Proven Mineral Reserve | 2,140 | 2.42 | 7.63 | – | 166 | 525 | – |

| Probable Mineral Reserve | 42,461 | 2.18 | 5.73 | – | 2,970 | 7,819 | – |

| Probable – Stockpile | 6,674 | 2.63 | – | – | 564 | – | – |

| Total Mineral Reserve | 51,274 | 2.24 | 5.06 | – | 3,700 | 8,344 | – |

| Çakmaktepe Mine – Oxide | |||||||

| Proven Mineral Reserve | – | – | – | – | – | – | – |

| Probable Mineral Reserve | 274 | 1.26 | 10.91 | – | 11 | 96 | – |

| Probable – Stockpile | 11 | 2.69 | – | – | 1 | – | – |

| Total Mineral Reserve | 285 | 1.32 | 10.49 | – | 12 | 96 | – |

| CDMP20 – Oxide Reserve | |||||||

| Proven Mineral Reserve | 230 | 1.23 | 8.97 | 0.06 | 9 | 66 | 294 |

| Probable Mineral Reserve | 7,638 | 1.23 | 6.33 | 0.13 | 301 | 1,554 | 20,549 |

| Probable – Stockpile | 11 | 2.69 | – | – | 1 | – | – |

| Total Mineral Reserve | 7,879 | 1.23 | 6.40 | 0.12 | 311 | 1,621 | 20,843 |

| CDMP20 – Sulfide Reserve | |||||||

| Proven Mineral Reserve | 2,140 | 2.42 | 7.63 | – | 166 | 525 | – |

| Probable Mineral Reserve | 42,461 | 2.18 | 5.73 | – | 2,970 | 7,819 | – |

| Probable – Stockpile | 6,674 | 2.63 | – | – | 564 | – | – |

| Total Mineral Reserve | 51,274 | 2.24 | 5.06 | – | 3,700 | 8,344 | – |

| CDMP20 Mineral Reserves Total | |||||||

| Proven Mineral Reserve | 2,370 | 2.30 | 7.76 | 0.01 | 175 | 591 | 294 |

| Probable Mineral Reserve | 50,099 | 2.03 | 5.82 | 0.02 | 3,272 | 9,373 | 20,549 |

| Probable – Stockpile | 6,685 | 2.63 | – | – | 564 | – | – |

| Total Mineral Reserve | 59,154 | 2.11 | 5.24 | 0.02 | 4,011 | 9,964 | 20,843 |

- Effective date of the CDMP20 Mineral Reserve is November 27, 2020.

- The Mineral Reserves were developed based on mine planning work completed in October 2020 and estimated based on End of August 2020 topography surface.

- Mineral Reserve cut-offs are based on $1,350/oz Au gold price; average oxide recoveries are 73% and average sulfide recoveries are 91%.

- Çöpler oxide cut-off grades 0.47–0.59 g/t Au, Çöpler sulfide cut-off grade 1.05 g/t Au, Çakmaktepe oxide cut off grades 0.52–0.71 g/t Au; all cut off grades include allowance for royalty payable. There are no credits for silver or copper in the cut-off grade calculations. There is no Çakmaktepe Sulfide Mineral Reserve.

- Economic analysis has been carried out using a long-term gold price of $1,585/oz Au. The economic analysis has used a Q4’20 start date.

- Mineral Reserves tabulated include 403 kt at 2.47 g/t Au from the mine plan scheduled for September 2020.

- Totals may vary due to rounding.

Ownership

The Çöpler mine is owned and operated by Anagold Madencilik Sanayi ve Ticaret Anonim Şirketi SSR Mining controls 80% of the shares of Anagold, Lidya Madencilik Sanayi ve Ticaret A.Ş. controls 18.5%, and a bank wholly owned by Çalık Holdings A.Ş., holds the remaining 1.5%. Exploration tenures surrounding the project area and mining at Çakmaktepe are subject to joint venture agreements between SSR Mining and Lidya that have varying interest proportions. SSR Mining controls 50% of the shares of Kartaltepe Madencilik Sanayi ve Ticaret Anonim Şirketi and 50% of Tunçpinar Madencilik Sanayi ve Ticaret Anonim Şirketi. The other 50% is controlled by Lidya. Greater than 96% of the Mineral Resource is located on SSR Mining owned 80% ground, with the remainder of the mineralization within the 50/50% ownership boundary.

Qualified Persons

The following people served as the Qualified Persons for the CDMP20 Technical Report as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects, and in compliance with Form 43-101F1:

- Bernard Peters, BEng (Mining), FAusIMM (201743), employed by OreWin Pty Ltd as Technical Director – Mining, was responsible for the overall preparation of the CDMP20 and, the Mineral Reserve estimates; and

- Sharron Sylvester, BSc (Geol), RPGeo AIG (10125), employed by OreWin Pty Ltd as Technical Director – Geology, was responsible for the preparation of the Mineral Resources.

Mr. Peters and Ms. Sylvester have each reviewed and approved the information in this news release relevant to the portion of the CDMP20 for which they are responsible.

Data Verification and QA/QC

Data verification procedures are well-established at the project. Routine ongoing checking of all data is undertaken prior to being uploaded to the database. This is followed by campaign-based independent data verification audits at milestone stages throughout data collection programs.

For drillhole data, verification includes the checking of DGPS collar coordinates relative to topographic surveys, checking of down-hole surveys relative to adjacent readings and planned dip and azimuth of the hole, checking logged data entries to ensure they are consistent with log key sheets, cross-checking a subset of assay data with the original laboratory reports, and submission of and review of QA/QC data.

The QA/QC program has historically consisted of a combination of QA/QC sample types that are designed to monitor different aspects of the sample preparation and assaying process: Blanks are routinely inserted in order to identify the presence of contamination through the sample preparation process; a variety of CRM standards are routinely inserted in order to monitor and measure the accuracy of the assay laboratory results over time; Field duplicates are routinely inserted as a means of monitoring and assessing sample homogeneity and inherent grade variability and to enable the determination of bias and precision between sample pairs; laboratory duplicates are inserted as a means of testing the precision of the laboratory measurements; and inter-laboratory pulp duplicates are submitted to alternative independent laboratory to assess for bias or drift. The rate of submission has been modified over time but is currently 3%–5% for blanks, CRMs, and duplicates, and 5%–10% for field duplicates.

Endnotes

- The PEA Case is preliminary in nature and includes an economic analysis that is based, in part, on Inferred Mineral Resources. Inferred Mineral Resources are considered too speculative geologically for the application of economic considerations that would allow them to be categorized as Mineral Reserves, and there is no certainty that the results will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Inclusive of Mineral Reserves.

- Production costs and AISC are determined on a per ounce gold produced basis and do not consider the application of inventory movements or deferred waste stripping. Production costs do not equate to cash costs prepared under SSR Mining non-GAAP measures. AISC do not equate to AISC prepared under SSR Mining non-GAAP measures.

- Free cash flow before interest and debt repayments.

About SSR Mining

SSR Mining Inc. is a leading, free cash flow focused intermediate gold company with four producing assets located in the USA, Turkey, Canada, and Argentina, combined with a global pipeline of high-quality development and exploration assets in the USA, Turkey, Mexico, Peru, and Canada. In 2019, the four operating assets produced over 720,000 ounces of gold and 7.7 million ounces of silver.

SSR Mining’s diversified asset portfolio is comprised of high margin, long-life assets along several of the world’s most prolific precious metal districts including the Çöpler mine along the Tethyan belt in Turkey; the Marigold mine along the Battle Mountain-Eureka trend in Nevada, USA; the Seabee mine along the Trans-Hudson Corridor in Saskatchewan, Canada; and the Puna mine along the Bolivian silver belt in Jujuy, Argentina. SSR Mining has an experienced leadership team with a proven track record of value creation. Across SSR Mining, the team has expertise in project construction, mining (open pit and underground), and processing (pressure oxidation, heap leach, and flotation), with a strong commitment to health, safety and environmental management.

SSR Mining intends to leverage its strong balance sheet and proven track record of free cash flow generation as foundations to organically fund growth across the portfolio and to facilitate superior returns to shareholders.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE