SILVERCORP REPORTS ADJUSTED NET INCOME OF $6.7 MILLION, $0.04 PER SHARE, AND CASH FLOW FROM OPERATIONS OF $14.1 MILLION FOR Q2 FISCAL 2023

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) reported its financial and operating results for the three months ended September 30, 2022. All amounts are expressed in US dollars, and figures may not add due to rounding.

HIGHLIGHTS FOR Q2 FISCAL 2023

- Mined 290,981 tonnes of ore, milled 291,643 tonnes of ore, and produced approximately 1.8 million ounces of silver, 1,200 ounces of gold, 18.0 million pounds of lead, and 6.0 million pounds of zinc;

- Sold approximately 1.8 million ounces of silver, 1,200 ounces of gold, 17.3 million pounds of lead, and 5.9 million pounds of zinc, for revenue of $51.7 million;

- Realized adjusted earnings attributable to equity shareholders of $6.8 million, or $0.04 per share. The adjustments were made to remove impacts from impairment charges, share-based compensation, foreign exchange, mark-to-market equity investments, and the share of associates’ operating results;

- Reported net loss attributable to equity shareholders of $1.7 million, or $0.01 per share, with the loss mainly due to an impairment charge of $20.2 million against the La Yesca Project;

- Generated cash flow from operating activities of $14.1 million;

- Cash costs per ounce of silver, net of by-product credits, of $0.77;

- All-in sustaining costs per ounce of silver, net of by-product credits, of $8.25;

- Spent and capitalized $2.9 million on exploration drilling, $9.4 million on underground development, and $1.2 million on construction of the new mill and tailings storage facility;

- Spent $1.2 million to buy back 503,247 common shares of the Company under its Normal Course Issuer Bid; and

- Strong balance sheet with $201.0 million in cash and cash equivalents and short-term investments. The Company holds further equity investment portfolio in associates and other companies with a total market value of $111.0 million as at September 30, 2022.

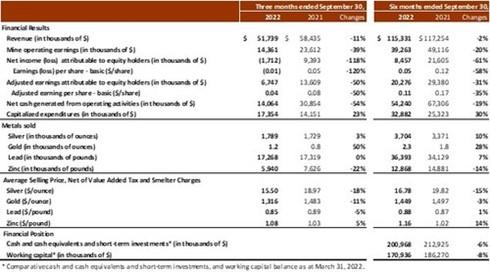

CONSOLIDATED FINANCIAL RESULTS

Net loss attributable to equity shareholders of the Company in Q2 Fiscal 2023 was $1.7 million or $0.01 per share, compared to net income of $9.4 million or $0.05 per share in the three months ended September 30, 2021.

In Q2 Fiscal 2023, the Company’s consolidated financial results were mainly impacted by i) an increase of 3%, and 50%, respectively, in silver and gold sold, and a decrease of 22% in zinc sold; ii) a decrease of 18%, 11%, and 5%, respectively, in the realized selling price for silver, gold, and lead, and an increase of 5%, in the realized selling prices for zinc; iii) a foreign exchange gain of $4.3 million arising from the appreciation of the US dollar against the Company’s functional currencies, mainly the Chinese yuan and Canadian dollar; iv) a loss of $1.6 million on equity investments; and v) an impairment charge of $20.2 million against the La Yesca Project.

Revenue in Q2 Fiscal 2023 was $51.7 million, down 11% compared to $58.4 million in Q2 Fiscal 2022. The decrease is mainly due to the decrease of net realized selling prices for silver, gold and lead.

Income from mine operations in Q2 Fiscal 2023 was $14.4 million, down 39% compared to $23.6 million in Q2 Fiscal 2022. Income from mine operations at the Ying Mining District was $12.9 million, compared to $19.3 million in Q2 Fiscal 2022. Income from mine operations at the GC Mine was $1.5 million, compared to $4.5 million in Q2 Fiscal 2022.

Cash flow provided by operating activities in Q2 Fiscal 2023 was $14.1 million, down $16.8 million compared to $30.9 million in Q2 Fiscal 2022.

The Company ended Q2 Fiscal 2023 with $201.0 million in cash, cash equivalents and short-term investments, down 6% or $11.9 million, compared to $212.9 million as at March 31, 2022. The decrease is mainly due to a negative translation impact of $15.6 million on cash and cash equivalents arising from the appreciation of the US dollar against the Canadian dollar and Chinese yuan.

Working capital as at September 30, 2022 was $170.9 million, down 8% compared to $186.3 million as at March 31, 2022.

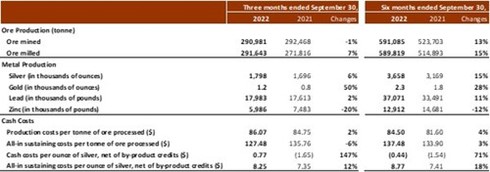

CONSOLIDATED OPERATIONAL RESULTS

In Q2 Fiscal 2023, the Company mined 290,981 tonnes of ore, down 1% compared to 292,468 tonnes in Q2 Fiscal 2022. Ore milled in Q2 Fiscal 2023 was 291,643 tonnes, up 7% compared to 271,816 tonnes in Q2 Fiscal 2022.

In Q2 Fiscal 2023, the Company produced approximately 1.8 million ounces of silver, 1,200 ounces of gold, 18.0 million pounds of lead, and 6.0 million pounds of zinc, representing increases of 6%, 50% and 2%, respectively, in silver, gold and lead production, and a decrease of 20% in zinc production over Q2 Fiscal 2022.

In Q2 Fiscal 2023, the consolidated production costs were $86.07 per tonne, up 2% compared to $84.75 per tonne in Q2 Fiscal 2022. The all-in sustaining production costs per tonne of ore processed in Q2 Fiscal 2023 were $127.48, down 6% compared to $135.76 in Q2 Fiscal 2022.

In Q2 Fiscal 2023, the consolidated cash costs per ounce of silver, net of by-product credits, were $0.77, compared to negative $1.65 in the prior year quarter. The increase was mainly due to a $1.6 million decrease in by-product credits and a $2.6 million increase in expensed production costs.

The consolidated all-in sustaining costs per ounce of silver, net of by-product credits, were $8.25 compared to $7.35 in Q2 Fiscal 2022. The increase was mainly due to the increase in cash costs per ounce of silver offset by a decrease of $2.2 million in administrative expenses, mineral resources tax, and sustaining capital expenditures.

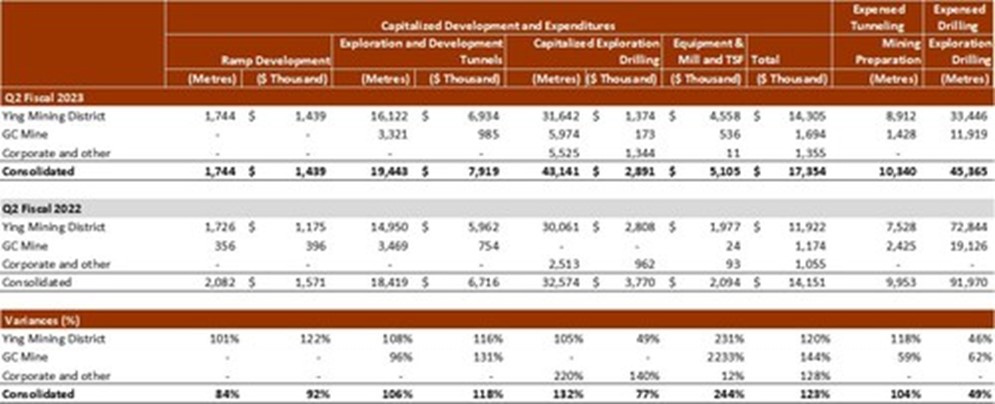

In Q2 Fiscal 2023, on a consolidated basis, a total of 88,506 metres or $4.2 million worth of diamond drilling were completed (Q2 Fiscal 2022 – 124,544 metres or $6.2 million), of which approximately 45,365 metres or $1.3 million worth of underground drilling were expensed as part of mining costs (Q2 Fiscal 2022 – 91,970 metres or $2.4 million) and approximately 43,141 metres or $2.9 million worth of drilling were capitalized (Q2 Fiscal 2022 – 32,574 metres or $3.8 million). In addition, approximately 10,340 metres or $4.0 million worth of preparation tunnelling were completed and expensed as part of mining costs (Q2 Fiscal 2022 – 9,953 metres or $3.4 million), and approximately 21,187 metres or $9.4 million worth of tunnels, raises, ramps and declines were completed and capitalized (Q2 Fiscal 2022 – 20,501 metres or $8.3 million).

In Q2 Fiscal 2023, a total of 5,525 metres or $0.5 million worth of drilling were completed and capitalized at the Kuanping Project. The application for a mining permit is pending review and approval by the relevant provincial government authorities.

As of September 30, 2022, a total of $2.5 million in expenditures have been incurred on the construction of the new 3,000 tonnes per day flotation mill and the new tailings storage facility. A total of 645 metres of drainage tunnels were completed, and the site preparation for the New Mill was also substantially completed. The first batch of $4.1 million (RMB¥29.3 million) of milling equipment was ordered. The environmental and safety assessment study report was revised and is pending government approval.

The Company also spent approximately $1.5 million to upgrade most roads to concrete and upgrade certain environmental protection facilities at the Ying Mining District as part of our continued commitment to build green mines.

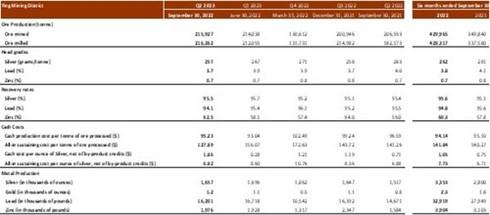

INDIVIDUAL MINE OPERATING PERFORMANCE – Ying Mining District

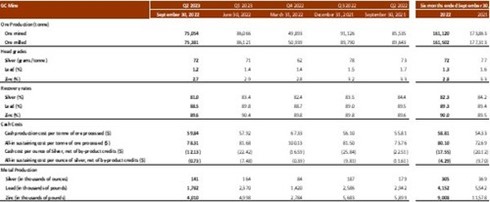

INDIVIDUAL MINE OPERATING PERFORMANCE – GC Mine

As previously disclosed in the Company’s news release dated October 13, 2022, the mining operations at the GC Mine were partially affected in August and September 2022 as the Company worked on improving ventilation and electric power facilities to comply with several new safety production regulations issued by the National Mine Safety Administration of China. The improvements were completed in October 2022 and the Company expects that mining operations at the GC Mine will return to normal operating levels for the remainder of the year.

About Silvercorp

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company’s strategy is to create shareholder value by 1) focusing on generating free cashflow from long life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG.

Tab 1 – CONSOLIDATED FINANCIAL RESULTS (CNW Group/Silvercorp Metals Inc)

Tab 2 – CONSOLIDATED OPERATIONAL RESULTS (CNW Group/Silvercorp Metals Inc)

Tab 3 – EXPLORATION AND DEVELOPMENT (CNW Group/Silvercorp Metals Inc)

Tab 4 – INDIVIDUAL MINE OPERATING PERFORMANCE – Ying Mining District (CNW Group/Silvercorp Metals Inc)

Tab 5 – INDIVIDUAL MINE OPERATING PERFORMANCE – GC Mine (CNW Group/Silvercorp Metals Inc)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE