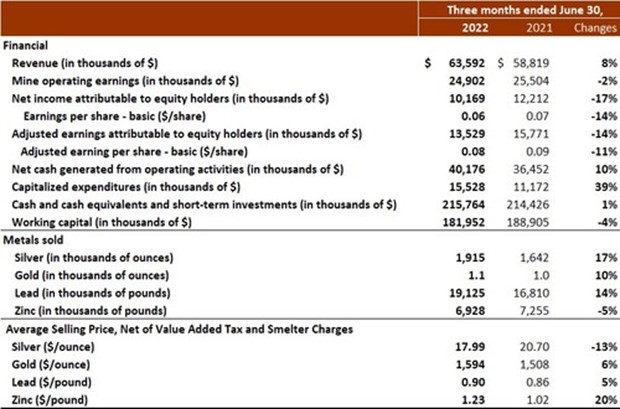

SILVERCORP REPORTS ADJUSTED EARNINGS OF $13.5 MILLION, $0.08 PER SHARE, AND CASH FLOW FROM OPERATIONS OF $40.2 MILLION FOR Q1 FISCAL 2023

Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) reported its financial and operating results for the three months ended June 30, 2022. All amounts are expressed in US Dollars, and figures may not add due to rounding.

HIGHLIGHTS FOR Q1 FISCAL 2023

- Mined 300,104 tonnes of ore and milled 298,176 tonnes of ore, up 30% and 23% compared to the prior year quarter;

- Sold approximately 1.9 million ounces of silver, 1,100 ounces of gold, 19.1 million pounds of lead, and 6.9 million pounds of zinc, representing increases of 17%, 10%, and 14% in silver, gold and lead sold, and a decrease of 5% in zinc sold, compared to the prior year quarter;

- Revenue of $63.6 million, up 8% compared to $58.8 million in the prior year quarter;

- Net income attributable to equity shareholders of $10.2 million, or $0.06 per share, compared to $12.2 million, or $0.07 per share in the prior year quarter;

- Adjusted earnings attributable to equity shareholders of $13.5 million, or $0.08 per share, compared to $15.8 million, or $0.09 per share in the prior year quarter. The adjustments were made to remove impacts from impairment charges, share-based compensation, foreign exchange, mark-to-market equity investments, and the share of associates’ operating results.

- Cash flow from operations of $40.2 million, up 10% or $3.7 million compared to $36.5 million in the prior year quarter;

- Cash cost per ounce of silver, net of by-product credits, of negative $1.57 compared to negative $1.43 in the prior year quarter;

- All-in sustaining cost per ounce of silver, net of by-product credits, of $9.25 compared to $7.46 in the prior year quarter;

- Spent and capitalized $3.1 million on exploration drilling, $9.7 million on underground development and $1.2 million on the construction of the new mill and tailings storage facility;

- Paid $2.2 million of dividends to the Company’s shareholders;

- Spent $0.9 million to buy back 334,990 common shares of the Company under its Normal Course Issuer Bid, and subsequent to the quarter, bought back further 404,970 common shares of the Company for $1.0 million; and

- Strong balance sheet with $215.8 million in cash and cash equivalents and short-term investments, up $2.9 million or 1% compared to $212.9 million as at March 31, 2022. The Company holds further equity investment portfolio in associates and other companies with a total market value of $147.4 million as of June 30, 2022.

CONSOLIDATED FINANCIAL RESULTS

Net income attributable to equity holders of the Company in Q1 Fiscal 2023 was $10.2 million or $0.06 per share, compared to $12.2 million or $0.07 per share in the three months ended June 30, 2021.

In Q1 Fiscal 2023, the Company’s consolidated financial results were mainly impacted by i) an increase of 17%, 10%, and 14%, respectively, in silver, gold and lead sold; ii) an increase of 6%, 5%, and 20%, respectively, in the realized selling prices for gold, lead and zinc; iii) a foreign exchange gain of $1.7 million arising from the appreciation of the US dollar against the Company’s functional currencies, mainly the Chinese yuan and the Canadian dollar; offset by iv) a decrease of 13% in the realized selling price for silver; v) a decrease of 5% in zinc sold; vi) a loss of $2.7 million on equity investments; and vii) an increase of 7% in per tonne production costs.

Revenue in Q1 Fiscal 2023 was $63.6 million, up 8% compared to $58.8 million in Q1 Fiscal 2022.

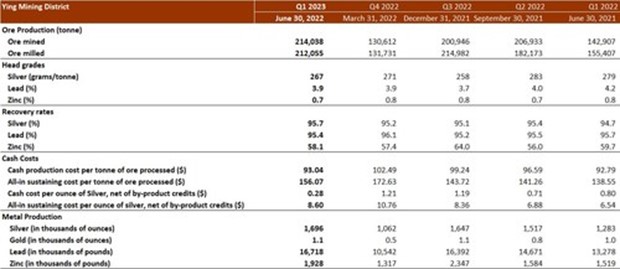

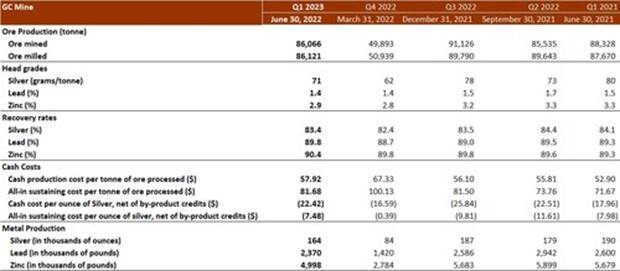

Income from mine operations in Q1 Fiscal 2023 was $24.9 million, down 2% compared to $25.5 million in the prior year quarter. Income from mine operations at the Ying Mining District was $21.4 million, up 1% compared to $21.2 million in Q1 Fiscal 2022. Income from mine operations at the GC Mine was $3.6 million, down 19% compared to $4.4 million in Q1 Fiscal 2022.

Cash flow provided by operating activities in Q1 Fiscal 2023 was $40.2 million, up 10% or $3.7 million, compared to $36.5 million in Q1 Fiscal 2022.

The Company ended Q1 Fiscal 2023 with $215.8 million in cash, cash equivalents and short-term investments, up 1% or $2.9 million, compared to $212.9 million as at March 31, 2022.

Working capital as at June 30, 2022 was $182.0 million, down 2% compared to $186.3 million as at March 31, 2022.

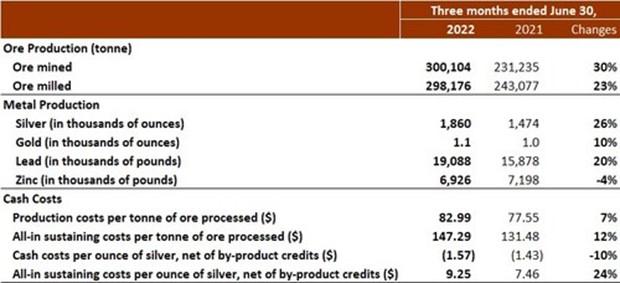

CONSOLIDATED OPERATIONAL RESULTS

In Q1 Fiscal 2023, the Company mined 300,104 tonnes of ore, up 30% compared to 231,235 tonnes in Q1 Fiscal 2022. Ore milled in Q1 Fiscal 2023 was 298,176 tonnes, up 23% compared to 243,077 tonnes in Q1 Fiscal 2022.

In Q1 Fiscal 2023, the Company produced approximately 1.9 million ounces of silver, 1,100 ounces of gold, 19.1 million pounds of lead, and 6.9 million pounds of zinc, representing increases of 26%, 10% and 20%, respectively, in silver, gold and lead production, and a decrease of 4% in zinc production over Q1 Fiscal 2022. The Company is on track to produce 7.0 million to 7.3 million ounces of silver, 6,300 to 7,900 ounces of gold, 68.4 million to 71.3 million pounds of lead, and 32.0 million to 34.5 million pounds of zinc in Fiscal 2023.

Compared to Q1 Fiscal 2022, the Company’s consolidated per tonne costs in the current quarter were mainly impacted by i) inflationary cost pressure resulting in higher material and utility costs; ii) an average 9% increase in employees’ pay rates; iii) increased drilling and tunneling resulting in higher costs included in mining costs and sustaining capital expenditures; offset by iv) an average 2% depreciation of the Chinese yuan against the US dollar.

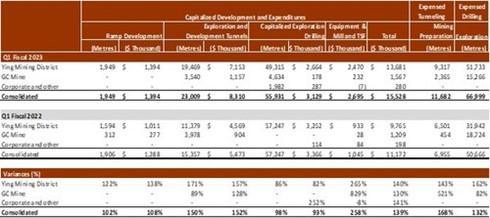

In Q1 Fiscal 2023, on a consolidated basis, a total of 122,930 metres or $4.9 million worth of diamond drilling were completed (Q1 Fiscal 2022 – 107,913 metres or $4.6 million), of which approximately 66,999 metres or $1.8 million worth of underground drilling were expensed as part of mining costs (Q1 Fiscal 2022 – 50,666 metres or $1.3 million) and approximately 55,931 metres or $3.1 million worth of drilling were capitalized (Q1 Fiscal 2022 – 57,247 metres or $3.3 million). In addition, approximately 11,682 metres or $4.1 million worth of preparation tunnelling were completed and expensed as part of mining costs (Q1 Fiscal 2022 – 6,955 metres or $2.8 million), and approximately 24,958 metres or $9.7 million worth of tunnels, raises, ramps and declines were completed and capitalized (Q1 Fiscal 2022 – 17,263 metres or $6.8 million).

An application for a mining permit for the Kuanping Project has been submitted and is pending review and approval by the relevant provincial government authorities.

As of June 30, 2022, a total of $1.2 million expenditures have been incurred on the construction of the new 3,000 tonne per day floatation mill (the “New Mill”) and the new tailings storage facility (the “TSF”). The preliminary design and engineering survey, the water and soil conservation studies for the New Mill and the TSF, and the feasibility study for the TSF have been completed. The Company also received the construction permit for the New Mill and is in the process of negotiating purchases of major equipment for the New Mill. The Company expects that the final approval of the environmental and safety assessment studies, and the detailed engineering design of the New Mill and the TSF will be granted in the second quarter of Fiscal 2023.

INDIVIDAL MINE OPERATING PERFORMANCE

About Silvercorp

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company’s strategy is to create shareholder value by 1) focusing on generating free cashflow from long life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG. For more information, please visit our website at www.silvercorp.ca.

CONSOLIDATED FINANCIAL RESULTS (CNW Group/Silvercorp Metals Inc)

CONSOLIDATED OPERATIONAL RESULTS (CNW Group/Silvercorp Metals Inc)

EXPLORATION AND DEVELOPMENT (CNW Group/Silvercorp Metals Inc)

INDIVIDAL MINE OPERATING PERFORMANCE – YING MINING DISTRICT (CNWGroup/Silvercorp Metals Inc)

INDIVIDAL MINE OPERATING PERFORMANCE – GC MINE (CNW Group/Silvercorp Metals Inc)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE