Rupert Resources Reports New Drilling From Ikkari Showing Potential for Higher Open Pit Grades and Further Extensions to Depth and West

Rupert Resources (TSX-V:RUP) is pleased to report drilling from its 2022-23 exploration program at its multi-million ounce Ikkari gold discovery at the 100% owned Rupert Lapland Project in Northern Finland.

In November 2022, the company published a mineral resource estimate and preliminary economic assessment for the project demonstrating the potential for a high margin, low impact mine with a life of over 20 years (see November 28, 2022 press release and footnotes 1&2).

Highlights from today’s published results (figure 1) include:

Resource Infill

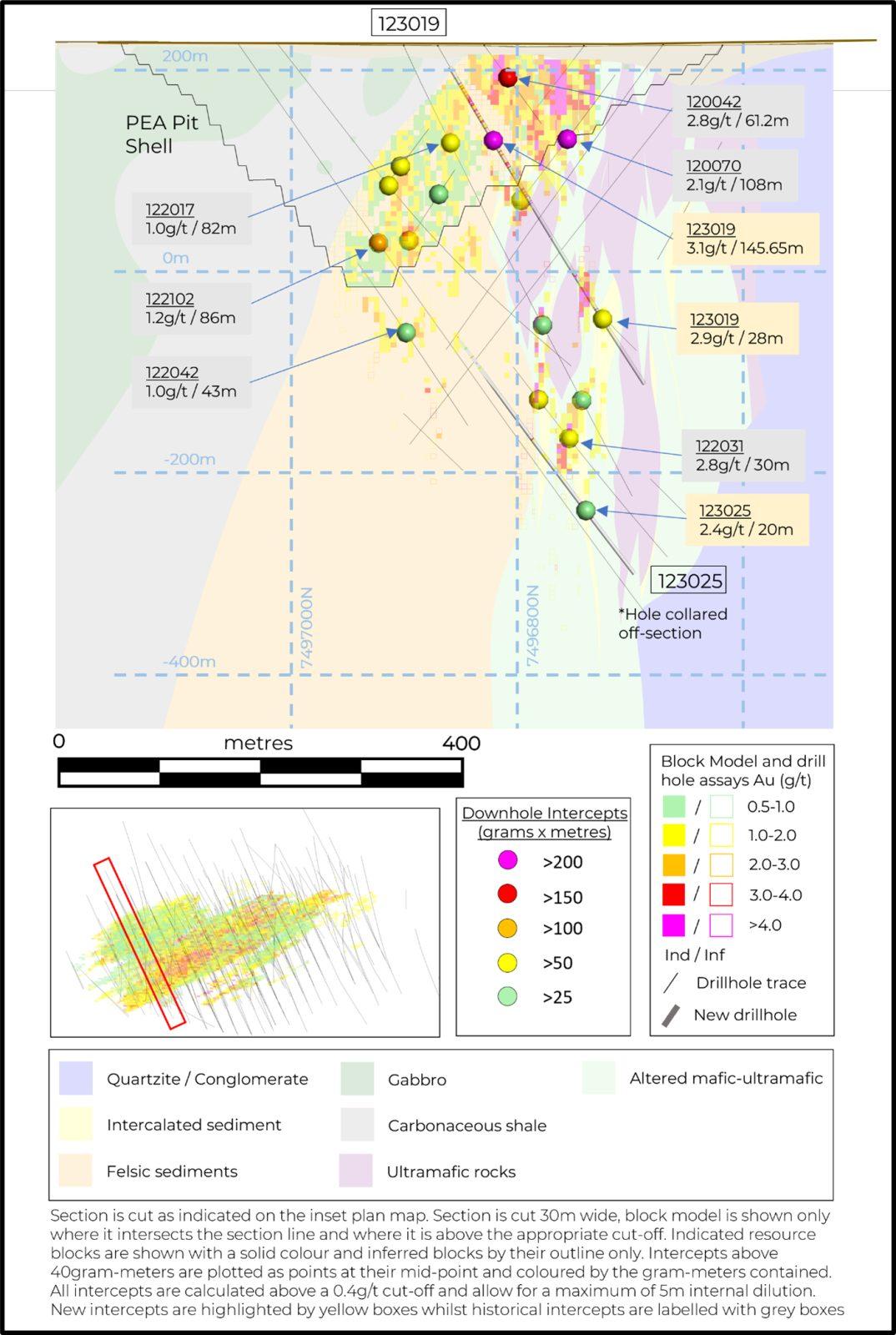

- Hole #123019 – 3.1 grams per tonne gold over 145.7m from 36.0m (31m vertical) and 2.9g/t Au over 28m including 43g/t Au over 1m from 302m (265m vertical) on a western section of the deposit. This further defines high grade mineralisation from surface in a part of the deposit currently classified as Inferred Resources and with lower estimated grade than the new intercept (figures 2 and 3).

- Hole #123040 – 6.5g/t Au over 22m from 225m including 10.2g/t Au over 11m from 227m in the eastern portion of the PEA open pit.

- Hole #123042 – 3.9g/t Au over 96m from 146m including selected sub intervals of 5.8g/t Au over 17m from 168m and 9.1g/t Au over 18m from 194m also in the eastern portion of the PEA open pit.

Extensions

- Hole #123026 – 1.3g/t Au over 88.7m from 487.3m (429m vertical) including 3.1g/t Au over 13.0m from 495m and 2.7g/t Au over 7.0m from 521m (figure 2) at depth in the west of the deposit. The hole confirms the interpreted plunge direction in the west of Ikkari and provides further drill targets to the west of Ikkari at depth.

- Hole #123030 – 3.2g/t Au over 44m from 534m at depth (476m vertical) including 8.9g/t Au over 7m from 552m. This intercept demonstrates potential for the expansion of higher-grade resources at depth in the Ikkari deposit below the current limits of the Indicated Resource.

- Hole #123032 – 2.5g/t Au over 28m from 617m at depth (508m vertical), below the limits of the Indicated Resource, including 19.3g/t Au over 1m from 621m and 23.4g/t Au over 1m from 641m extending the high-grades in the centre of the deposit to depth.

James Withall, CEO of Rupert Resources commented “We have received more positive results from the winter 2022/23 drill programme that demonstrate the exceptional continuity of the Ikkari deposit, potential for grade uplift in the core of Ikkari and extensions at depth in the west in previously untested areas. We have a significant number of results pending from drilling undertaken in recent months that has been focussed on extensions at Ikkari and targets with satellite potential. Our business model in its simplest form, is to continue finding low cost ounces whilst advancing engineering and permitting to de-risk and optimise the critical mass of high-margin resources we have already defined at Ikkari in the November 2022 PEA.”

2022-2023 exploration program

The 2022/2023 work program commenced in August 2022 with over 52,000m completed by the end of April 2023. The 30,000m allocated to Ikkari infill and project drilling has been completed so that an update to the current resource can be commenced once all assays are received. Programs to test extensions at Ikkari as well as potential satellites and new regional targets across Rupert’s 634km2 land position were undertaken in the latter two months of the winter drilling season (March and April) and results are pending.

The infill holes being completed target remaining areas of Inferred Resources within the Indicated Resource outline, they continue to upgrade the geological confidence and the continuity of mineralisation within the deposit. Holes #123019, #123023 and #123024, all delivered very continuous robust mineralised intercepts in the western portions typical of the Ikkari deposit and #123019 delivered grade in excess of those previously estimated for this part of the deposit. Holes #123040 and #123042 defined the northern contact to the mineralisation, increasing resource confidence in this area and confirmed the continuity of discrete high grade zones within the wider mineralised domain. This drilling programme aims to convert all the Inferred Resources above 500m vertical to the Indicated Resource category for inclusion in the PFS study and provide greater confidence and resolution for mining engineering and trade-off studies in the PFS.

The extension drilling programme was designed to increase the Indicated category resources beyond the current limits at depth and demonstrate the open nature of the Ikkari deposit by confirming the interpreted western plunge to the mineralisation at depth. Hole #123026 intercepted several zones near surface but also 1.3g/t Au over 88.7m from 487.3m. The hole also had higher grade subintervals and is located 150m below hole #123003 (74.1g/t Au over 6m – see press release March 21, 2023). Furthermore, hole #123026 represents a 70m down-plunge step-out from hole 122031 (2.8g/t Au over 30m from 471m – see press release dated May 11, 2022) and which was the westernmost intercept, at depth, included in the November 2022 MRE. Hole #123025 intercepted 2.4g/t Au over 20m from 558m successfully targeting the same plunging mineralisation trend which remains open to the west and at depth. The extension programme is also demonstrating more frequent higher grade intercepts at depth in the centre of the deposit as we increase the metres allocated to drilling below 450m vertical. As well as the intercepts highlighted in hole #123032, hole #123031 intersected 4.1g/t Au over 21m from 571m and 41.4g/t Au over 1m from 686m. Further holes have been drilled as part of the extension programme and assays remain pending.

Resource update

On receipt of all the assays for the drilling programmes discussed in the release, work will commence on an updated resource with a target completion in early calendar year Q4 2023.

Figures & tables

Figures and tables featured in the Appendix at end of release include:

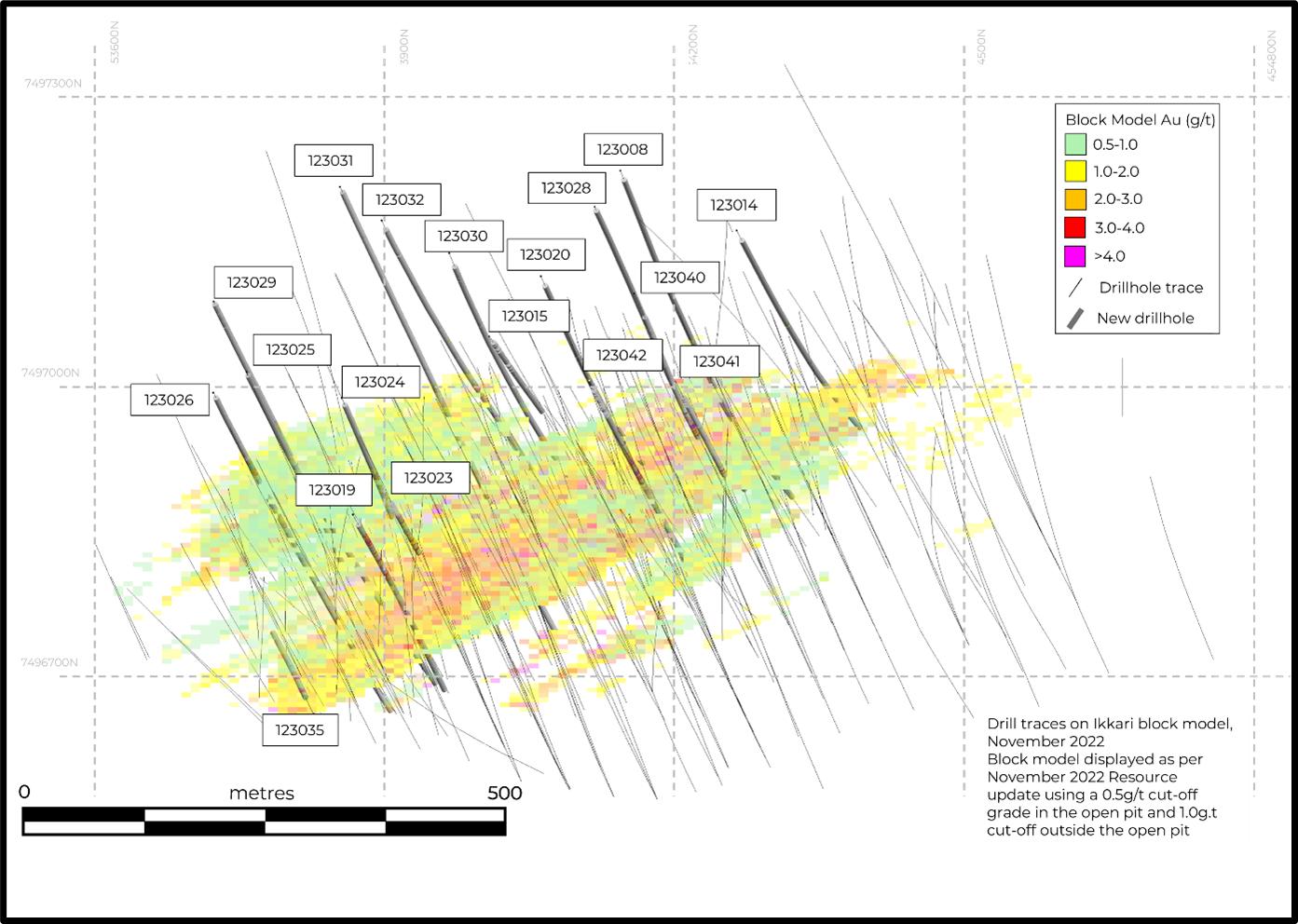

- Figure 1. Location of new drilling at Ikkari on plan map

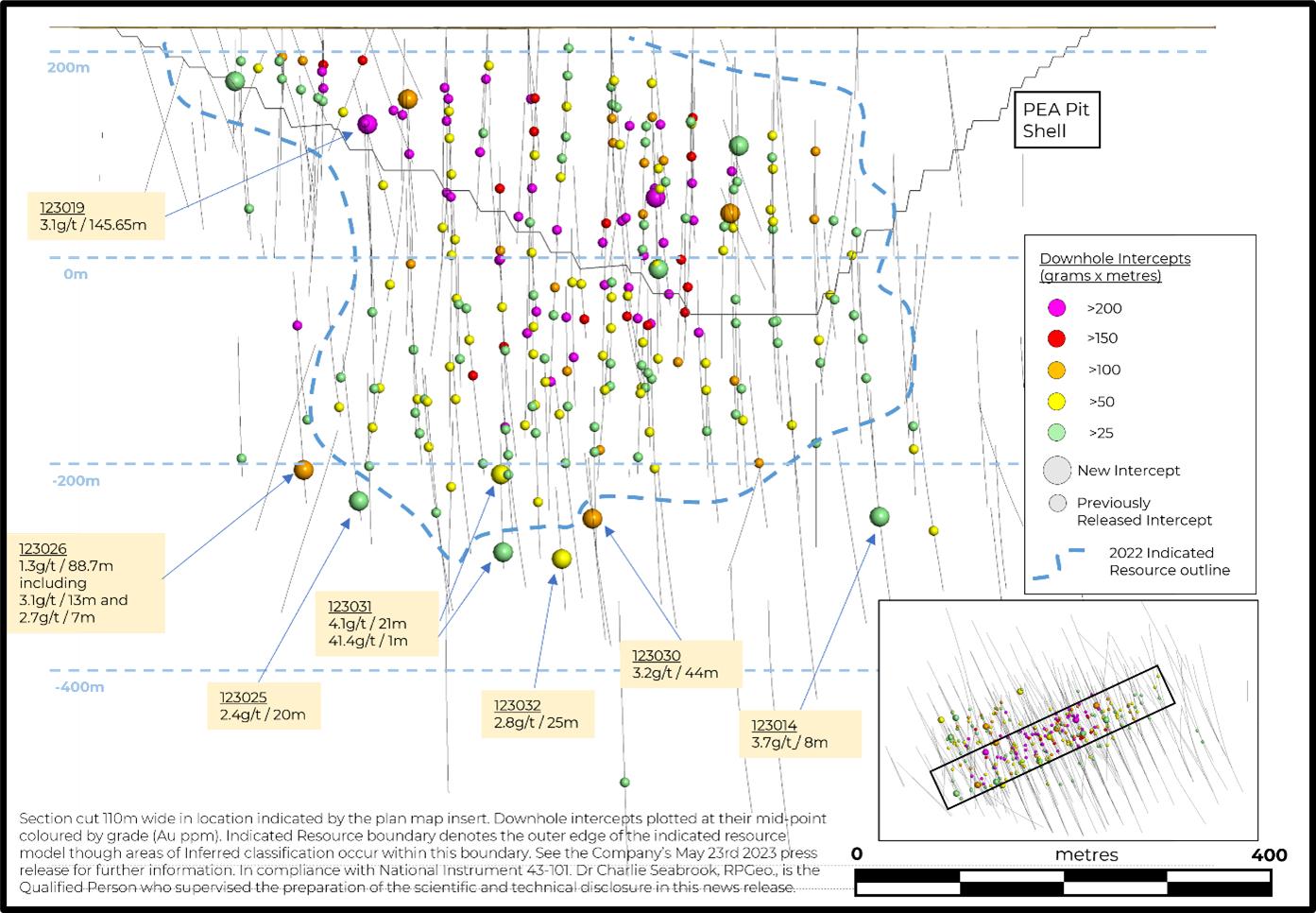

- Figure 2. Long section showing location of the new extension and selected infill drilling at Ikkari

- Figure 3. Cross section showing location and intercept of 123019 at Ikkari

- Table 1. Collar locations of new drill holes at Ikkari

- Table 2. New Intercepts from drilling at Ikkari

Geological interpretation

Ikkari was discovered using systematic regional exploration that initially focused on geochemical sampling of the bedrock/till interface through glacial till deposits of 5m to 40m thickness. No outcrop is present, and topography is dominated by low-lying swamp areas.

The Ikkari deposit occurs within rocks that have been regionally mapped as 2.05-2.15 billion years old Savukoski group greenschist-metamorphosed mafic-ultramafic volcanic rocks, part of the Central Lapland Greenstone Belt. Gold mineralisation is largely confined to the structurally modified unconformity at a significant domain boundary. Younger sedimentary lithologies are complexly interleaved, with intensely altered ultramafic rocks, and the mineralized zone is bounded to the north by a steeply N-dipping cataclastic zone. Within the mineralised zone lithologies, alteration and structure appear to be sub-vertical in contrast to wider Area 1 where lithologies generally dipping at a moderated angle to the north.

The main mineralized zone is strongly altered and characterised by intense veining and foliation that pervasively overprints original textures. An early phase of finely laminated grey ankerite/dolomite veins is overprinted by stockwork-like irregular siderite ± quartz ± chlorite ± sulphide veins. These vein arrays are often deformed with shear-related boudinage and in situ brecciation. Magnetite and/or haematite are common, in association with pyrite. Hydrothermal alteration commonly comprises quartz-dolomite-chlorite-magnetite (±haematite). Gold is hosted by disseminated and vein-related pyrite. Multi-phase breccias are well developed within the mineralised zone, with early silicified cataclastic phases overprinted by late, carbonate- iron-oxide- rich, hydrothermal breccias which display a subvertical control. All breccias frequently host disseminated pyrite, and are often associated with higher gold grades, particularly where magnetite or haematite is prevalent. In the sedimentary lithologies, albite alteration is intense and pervasive, with pyrite-magnetite (± gold) hosted in veinlets in brittle fracture zones.

Review by Qualified Person, Quality Control and Reports

Dr Charlotte Seabrook, MAIG, RPGeo., is the Qualified Person as defined by National Instrument 43-101 responsible for the accuracy of scientific and technical information in this news release.

The majority of samples are prepared by ALS Finland in Sodankylä and assayed in ALS laboratories in Ireland, Romania or Sweden. A minority of samples are prepared by Eurofins Laboratory in Sodankylä and Fire Assay is carried out on site. A pulverised sub-sample is then sent to ALS Ireland for multi-element analysis. All samples are under watch from the drill site to the storage facility. Samples at both laboratories are assayed using 50g fire assay method with aqua regia digest and analysis by AAS for gold. Over limit analysis (>100 ppm Au) is conducted using fire assay and gravimetric finish. For multi-element assays, Ultra Trace Level Method by 4-Acid digest (HF-HNO3-HClO4 acid digestion, HCl leach) and a combination of ICP-MS and ICP-AES are used. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication. Standards, blanks and duplicates are inserted at appropriate intervals. Approximately five percent (5%) of the pulps and rejects are sent for check assaying at a second laboratory.

Base of till samples are prepared in ALS Sodankylä by dry-sieving method prep-41 and assayed for gold by fire assay with ICP-AES finish. Multi-elements are assayed in ALS laboratories in either of Ireland, Romania or Sweden by aqua regia with ICP-MS finish. Rupert maintains a strict chain of custody procedure to manage the handling of all samples. The Company’s QA/QC program includes the regular insertion of blanks and standards into the sample shipments, as well as instructions for duplication.

About Rupert Resources

Rupert Resources is a gold exploration and development company listed on the TSX Exchange. The Company is focused on making and advancing discoveries of scale and quality with high margin and low environmental impact potential. The Company’s principal focus is Ikkari, a new high quality gold discovery in Northern Finland. Ikkari is part of the Company’s “Rupert Lapland Project,” which also includes the Pahtavaara gold mine, mill, and exploration permits (“Pahtavaara”). The Company also holds a 20% carried participating interest in the Gold Centre property located adjacent to the Red Lake mine in Ontario.

Figure 1. Location of new drilling at Ikkari on plan map (Graphic: Business Wire)

Figure 2. Long section showing location of the new extension and selected infill drilling at Ikkari (Graphic: Business Wire)

Figure 3. Cross section showing new drillholes 123019, 123025 and highlighted intercepts from the section (Graphic: Business Wire)

MORE or "UNCATEGORIZED"

Silver Mountain Announces Closing of Prospectus Offering

Silver Mountain Resources Inc. (TSX-V: AGMR) (OTCQB: AGMRF) is ... READ MORE

Mandalay Extends the Storheden Gold Deposit Adjacent to the Operating Björkdal Mine

Mandalay Resources Corporation (TSX: MND) (OTCQB: MNDJF) announce... READ MORE

Collective Mining Intercepts 632.25 Metres at 1.10 g/t Gold Equivalent in a 200 Metre Step-Out Hole to the South at Trap

Collective Mining Ltd. (TSX: CNL) (OTCQX: CNLMF) (FSE: GG1) is pl... READ MORE

Koryx Copper Intersects 207 Meters at 0.49% and 116 Meters at 0.54% Copper Equivalent

Significant copper and molybdenum intersections include: HM19: 11... READ MORE

Red Pine Intercepts Significant Mineralization at the Wawa Gold Project, including 5.34 g/t over 13.39 metres including 16.50 g/t gold over 0.97 metre and 13.62 g/t gold over 2.13 metres

Red Pine Exploration Inc. (TSX-V: RPX) (OTCQB: RDEXF) is pleased ... READ MORE