Rick Mills – “Hecla Mining invests $10M in Dolly Varden Silver, upping stake to 15.7%”

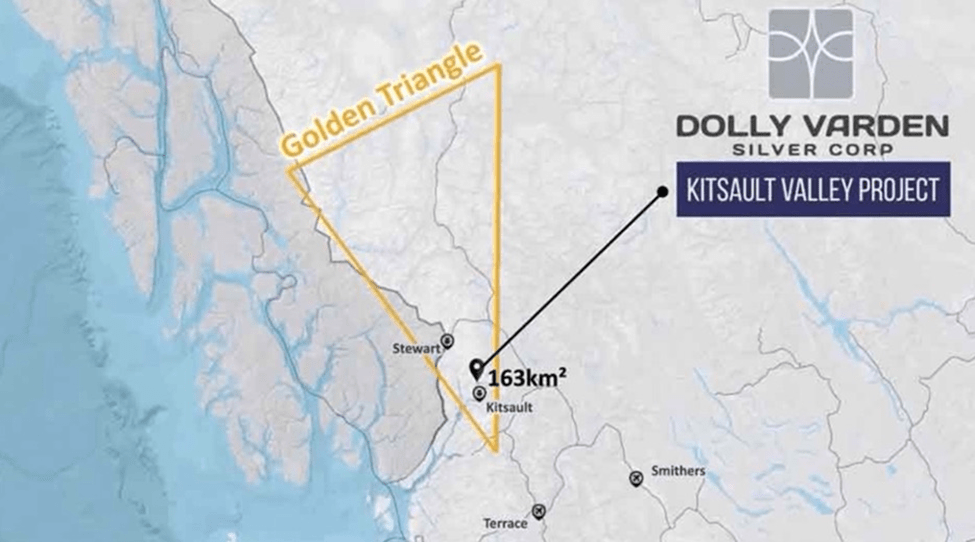

The largest silver producer in the United States now has more skin in the game at Dolly Varden Silver’s (TSX-V:DV) (OTCQX:DOLLF) Kitsault Valley project, located in the minerals-rich Golden Triangle region of northwestern British Columbia.

On Monday, Dolly Varden announced that Hecla will purchase 15,384,616 shares at $0.65 per share for gross proceeds of $10 million. When the offering completes, Hecla’s share percentage will increase from 10.6% to 15.7%, calculated on an undiluted basis.

“Hecla’s support for Dolly Varden Silver’s high-grade Kitsault Valley Project in BC’s prolific Golden Triangle is validated with today’s financing news,” Dolly Varden’s CEO Shawn Khunkhun said in the Oct. 30 news release. “Hecla is the world’s fastest growing established silver producer, the largest in the US and soon to be in Canada. We celebrate Hecla agreeing to increase their stake in Dolly from 10% to 15% and want to extend our gratitude for their financial and technical support of the Company and the project.”

Six million will be used for exploration expenditures, mineral resource expansion and related costs in the Kitsault Valley project, with the balance to be used for working capital and G&A costs, DV said.

The 15,384,616 shares to be acquired by Hecla represent approximately 6.04% of the 254,681,283 shares outstanding.

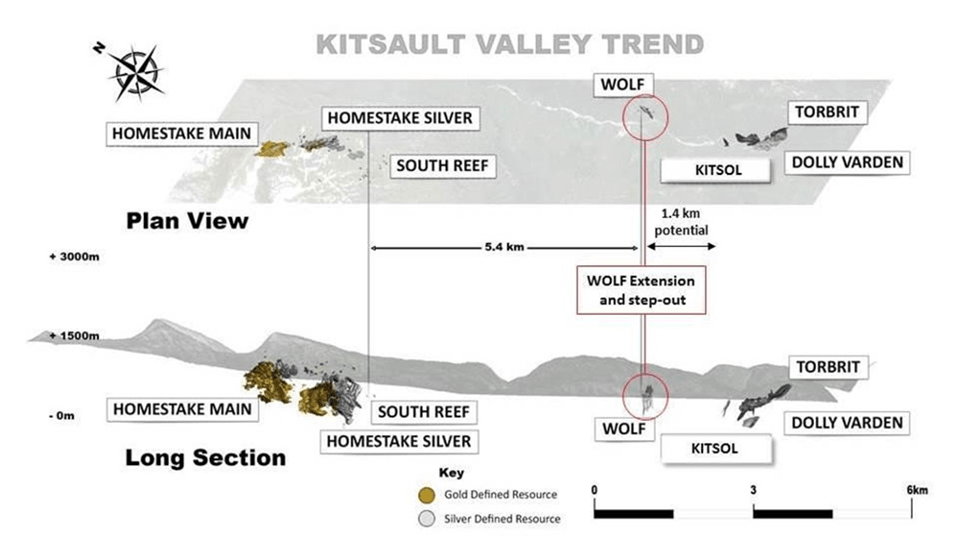

Located at the southern end of the Golden Triangle the Kitsault Valley project represents the amalgamation of Dolly Varden’s original namesake silver property and its recently acquired Homestake Ridge gold-silver property.

This 163-square-kilometer land package hosts one of the largest undeveloped high-grade precious metals projects in Western Canada. Its combined mineral resource is estimated at 34.7 million oz of silver and 166,000 oz of gold in the indicated category and 29.3 million oz of silver and 817,000 oz of gold in the inferred category.

The project has a rich history, which can be traced back to the early 20th century when Scandinavian prospectors first made the silver discovery in what is now the Stewart Complex.

Within the boundaries of the company’s original property are two past-producing silver mines: Dolly Varden and Torbrit, which formed a prolific silver mine camp starting in 1919 that produced more than 20 million ounces in the span of 40 years, with assays as high as 2,200 ounces per tonne.

It should be noted that Dolly Varden was among the most important silver mines in the British Empire during its heyday.

Other historically active mines in the area include North Star and Wolf, which remain underexplored to this day. Together, the four deposits comprise about 90 square kilometers within the Stewart Complex.

While these deposits were already enough to work with, DV always believed that the Kitsault Valley property is prospective for hosting further precious metal deposits, being on the same structural and stratigraphic belts that host numerous other high-grade deposits on the same trend such as Eskay Creek and Brucejack.

Towards the end of 2021, the company further consolidated its position with the acquisition of Homestake Ridge, which occupies the northern half (~75 sq km) of Kitsault Valley. This project features a high-grade gold and silver resource from three known deposits that the company believes can be converted into higher-confidence categories.

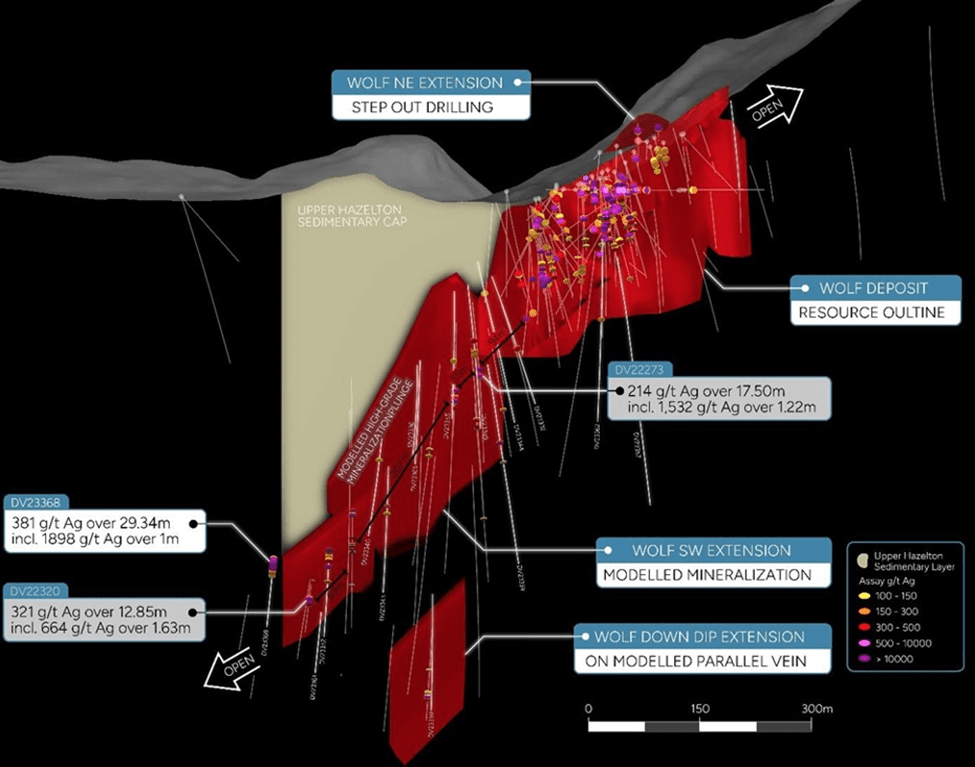

To date, the company has completed over 43,000 meters of the expanded 55,000-meter drill program at Kitsault Valley. Results include 19 drill holes from early-season drilling at the Wolf Vein.

In mid-September, Dolly Varden Silver put out more encouraging results from drilling at Wolf.

The highlight of the bunch was hole DV23-368, a 75m step-out down plunge that intersected 1,898 g/t over 1.00m within 381 g/t Ag over 29.34m core length. The hole was drilled along plunge from the earlier hole DV22-320, which graded 321 g/t Ag over 12.85m.

Wolf Vein longitudinal section with plunge of high-grade silver mineralization and DV23-368 step-out, 19 drill holes from 2023 with assays received shown in bold white.

Drill hole DV22-368 (711.84m to 724.55m) from the Wolf Vein; multi-phase breccia vein-style mineralization with argentiferous galena, argentite and native silver in a silica and bladed crystal.

Drill hole DV22-368 (722.50m) native silver in interval grading 1,898 g/t Ag over 1.00 meter from the Wolf Vein.

“As the drilling progresses at Wolf we are seeing the continuity to depth of the high-grade silver mineralization,” Khunkhun said in the Sept. 11 news release.

“Drill hole DV-368 has extended the length of potentially underground bulk-mineable mineralization plunge to over 950 meters and it remains wide open for expansion, with ongoing drilling continuing to step-out to the south,” he added.

Other notables include DV23-352, another southwest extension step-out that intersected 246 g/t Ag over 18.07m (12.29m estimated true width), including an interval grading 712 g/t Ag over 2.95m (2.01m estimated true width); and DV23-339, which returned 287 g/t Ag, 0.35 g/t Au and 22.83% Pb over 2.65m (1.67m estimated true width).

Dolly Varden said the initial holes tested between the widely spaced holes from the previous season and successfully intersected the vein structure both within and peripheral to the southwest plunge of the high-grade silver mineralization at Wolf.

Area of results released relative to silver and gold deposits of Dolly Varden’s Kitsault Valley trend.

Drilling has been ongoing at Wolf since the start of the 2023 program, and it continues with infill and testing for extensions to the high-grade silver mineralization.

In addition to the aforementioned holes, the company noted several other step-out holes from the program:

Drill hole DV23-359 is a 50m step-out from drill hole DV22-311 that graded 412 g/t Ag over 12.80m, including 1,646 g/t Ag over 2.1m within a vein spay. It intersected the Wolf splay vein as a 30cm wide sulfide-rich vein (2.25% Pb over 0.5m core length). Subsequent drilling intersected the subparallel vein splay vein on either side of DV22-311. Those assays are currently pending.

Drill holes DV23-347, 351, 354 and 356 are step-outs targeting the eastern extension of the veins, collared east of the high-grade intercept of DV22-329. The drill holes did not intercept mineralization, which to DV suggests that the vein breccia may have a more northeasterly strike and parallel the main host structure. It remains open to the northeast, and the company said it will be drilled shortly.

These results build on the strong assay reported in August from two other key areas of the Kitsault Valley property — Kitsol and Torbrit — which also returned high-grade silver mineralization over wide intervals.

Highlighted results from the Kitsol vein in the Torbrit deposit area include the following (Intervals are core length; true widths vary from 64 to 87% of core length interval):

- DV23-334: 297 g/t Ag over 8.32m including 1,090 g/t Ag over 0.90m at Kitsol;

- DV23-336: 342 g/t Ag over 18.00m including 2,270 g/t Ag over 0.50m and 995 g/t Ag with 3.6% Pb over 0.60m at Kitsol;

- DV23-337: 496 g/t Ag over 9.57m including 1,100 g/t Ag over 0.73m at Kitsol;

- DV23-348: 334 g/t Ag over 3.50m including 672 g/t Ag over 1.34m at Torbrit Main, south extension.

Holes DV23-334 and 336 extended the plunge extent of the wide, high-grade silver mineralization at the Kitsol Vein for an additional 40 meters towards surface. The plunge direction has been extended to over 250 meters from the furthest southwest intercept, down plunge in drill hole DV22-323.

Drilling has identified a consistent high-grade interval within the wide vein interval, associated with multiple phases of brecciation (such as holes DV23-334 and DV23-336), the company said in the Aug. 8 news release.

Meanwhile, drill holes DV23-335, 337, 341 and 343 tested the high-grade shoot along strike; hole DV23-337 was a 41m step-out, up plunge from DV18-131, confirming the consistent vertical dimension of the shoot to be of 50-75m, along the length of the plunge. The remaining holes intersected the Kitsol Vein, either above or below the higher-grade mineralized shoot.

Exploration holes to the west, testing for new structures in the hanging wall of the Moose Lamb fault, encountered a block of the Kitsol Vein in drill hole DV23-338 within a fault splay. The Dolly Varden team believes that further modeling with the new oriented core data will guide targeting of the possible offset of the Kitsol Vein across the Moose Lamb fault.

At the southern end of the Torbrit Main deposit, drill holes DV23-348 and 350 were collared as 31m step-outs testing for the mineralized horizon. DV23-348 intersected mineralization consistent with the lower sequence of the basin fill-style silver zone at Torbrit, within potassic and chlorite altered volcanic tuff.

As mentioned in the same release, the 2023 program was expanded by approximately 10,000 meters to 55,000 meters after adding a fifth drill.

According to Dolly Varden, the 15-km-long extent of the prospective Hazelton rocks on the property is host to numerous surface occurrences of alteration and silver mineralization that have been prioritized for drill testing. With the additional meters available under the current budget, drill holes have been planned at discovery-focused exploration targets.

Conclusion

The global silver market is currently witnessing what the Silver Institute calls “possibly the most significant deficit on record” on the back of record demand for the metal. This means silver-focused exploration companies like Dolly Varden will be held in higher regard within the mining industry than before.

“We believe that now is the right time for leverage in precious metals through investment in Dolly Varden Silver on 2023 results, and the upside potential to be germinated in the 2023 program,” Geordie Mark of Haywood Capital Markets recently wrote in a research note. In it, he also set a target price of $2.00 for DV, which is more than three times higher than what the stock is currently trading at.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard does not own shares of Dolly Varden Silver Corp. (TSXV:DV). DV is a paid advertiser on his site aheadoftheherd.com

This article is issued on behalf of DV

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE