Rick Mills – “Guyana Goldstrike Aims to Add Ounces at Gold-Bearing Iron Formation

Wedged between two resource giants on the north coast of South America, Guyana has a low profile among its more well-known neighbors: Venezuela to the west and the dense rainforests of Brazil’s Amazon region to the south.

The Caribbean nation bordering the Atlantic Ocean was settled by the Dutch before coming under the control of Great Britain in the late 18th century. Formerly known as British Guyana, the country didn’t gain independence until 1970. The British influence extends to present day, being the only country in South America where English is the first language. Guyana is sparsely populated, just 782,000 people dispersed throughout its 215,000 square kilometers.

Geologically, Guyana has a rich endowment of minerals and offshore oil. Its Guyana Basin and inland Takatu Basin have attracted big oil companies like Shell, Total and Mobil, since the 1940s. Four more companies joined the search for black gold in 2008, and in 2015 ExxonMobil discovered 3.7 billion barrels of light crude in sandstone reservoirs about 200 kilometers offshore.

A recent report by Wood Mackenzie calls ExxonMobil’s 10th find in the region “one of the most impressive exploration campaigns in recent times,” the Houston Chronicle reported. The oil giant plans to start production in early 2020 through the Liza Phase 1 development.

Records of gold mining go back to the 16th century, when early prospectors panned its four major rivers and their tributaries.

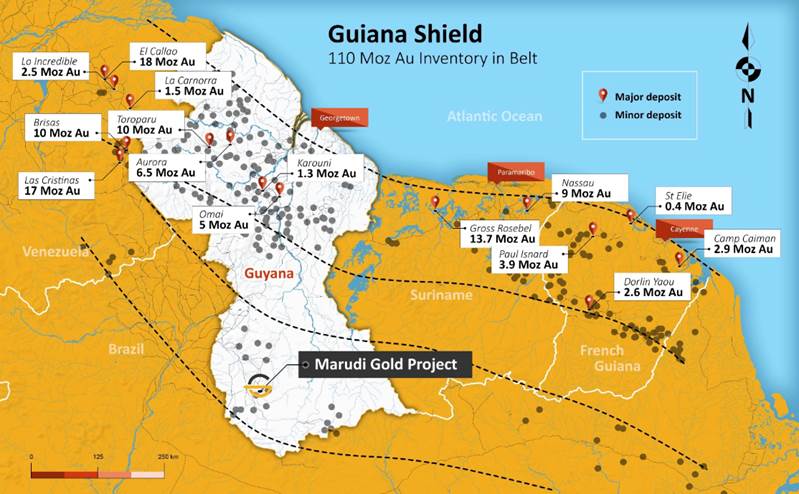

Today Guyana produces around 600,000 gold ounces a year. The major deposits are, in order of size, Toropaur (10Moz), Aurora (6.5Moz), Omai (5Moz) and Karouni (1.3Moz).

Guyana Goldfields put the Aurora gold deposit into production in 2016, with Troy Resources’ Karouni gold mine starting the same year. The former is currently constructing a decline to take the Aurora mine from open pit to underground – a first for Guyana.

The country lies over the Guiana Shield, a 110-million-ounce gold depository that stretches over 415,000 square kilometers, taking in Guyana, Suriname, French Guiana, much of southern Venezuela, plus parts of Colombia and Brazil. All of the gold mined in Guyana has come via the Guiana Shield formation.

One of three “cratons” of the South American Plate, the Guiana Shield is recognized as a major gold-producing region that has continuity with West Africa. However, unlike West Africa (eg. Ghana, Burkina Faso), the Guiana Shield is under-explored particularly in the south – all the major and most of the minor deposits are in the north.

The rocks of the 1.7 billion-year-old formation consist of greenstones overlain by sub-horizontal layers of sandstones, quartzites, shales and conglomerates intruded by sills of younger mafic intrusives such as gabbros.

Guyana is the only country in South America that is governed by British Common Law, not the Napoleonic Code, meaning that Guyana’s legal system is similar to former British colonies like Canada (except Quebec) and Australia. Canadians were even brought in to assist in crafting mining regulations.

Mining in Guyana is managed by the Geology and Mines Commission (GGMC) under the mining act of 1989. Under the act the state is the owner of all subsurface mineral rights and authorizes the GGMC to manage these resources.

A “Mining Information Toolkit for Guyana” was put together by the Canadian government in 1989 with the goal of helping American Indian communities to better understand and participate in mining. Modeled on a “Mining Information Kit for Aboriginal Communities” the Canadian kit has since been adapted in Peru and Mexico.

The relatively unexplored southwestern part of the country is the focus of Guyana Goldstrike (TSX-V:GYA), which is developing Guyana’s first gold-hosted banded iron formation.

Gold-hosted banded iron formations

While most banded iron formations (BIF) are composed of at least 15% iron (Fe), some BIFs are associated with non-Fe resources, including gold deposits in greenstone terranes – fragments of crust broken off from tectonic plates.

Research suggests that black shales found in banded iron formations played a role in the creation of gold deposits. However it’s still a matter of debate as to whether the gold was part of the original BIF, or if it came from an external source. Black shales are associated with two BIF-hosted gold districts, Randalls in Australia and Homestake in the US state of South Dakota.

The gold in banded iron is associated with greenstone belts believed to be ancient volcanic arcs, or in adjacent underwater troughs. Greenstone belts often contain gold, silver, copper, zinc and lead ores.

The gold is usually found in cross-cutting quartz veins/ veinlets, or as fine disseminations associated with pyrite, pyrrhotite and arsenopyrite. The host strata has generally been folded and deformed. In terms of mineralogy, gold-bearing BIFs may include native gold, pyrite, arsenopyrite, magnetite, pyrrhotite, chalcopyrite, sphalerite, galena, stibnite, and rarely, gold tellurides.

Gold in banded iron formations make excellent exploration targets because of their scalability. Like VMS deposits, they are often found in clusters, something that is attractive to major gold companies looking for new deposits that can be developed into mines with longevity.

Perhaps the best example of a gold-bearing banded iron deposit is the shuttered Homestake mine in South Dakota. The elephant deposit was the largest and deepest gold mine in North America before it closed in 2002. Between 1878 and 2001 Homestake produced an incredible 43.9 million ounces.

The gold ore was contained almost exclusively within the Homestake Formation, a 20 to 30-meter layer of iron carbonate and iron silicate that had been deformed, resulting in upper greenschist facies of siderite-phyllite, and lower amphibolite facies of grunerite schists.

Two other good examples are the Lupin mine in Nunavut, also depleted, which produced about 3 million ounces, and the Musselwhite mine in Ontario, one of the largest gold mines in Canada with 1.85 million ounces in reserves. Goldcorp mines about 265,000 ounces a year from the banded iron formation that hosts the ore, which is composed of coarse almandine garnets in fine-grained grunerite.

We’ll get to a description of Guyana Goldstrike’s gold-hosted banded iron formation in the property section below, but first, a brief company history.

Guyana Goldstrike (TSX.V:GYA)

The company’s origins go back to a 2016 LOI (letter of intent) between Swift Resources and Romanex Guyana Exploration, which had the Marudi Gold Project that is now GYA’s flagship. Through a series of payments (last payment 2020), Swift has acquired privately-held Romanex in 2017, and changed its name to Guyana Goldstrike.

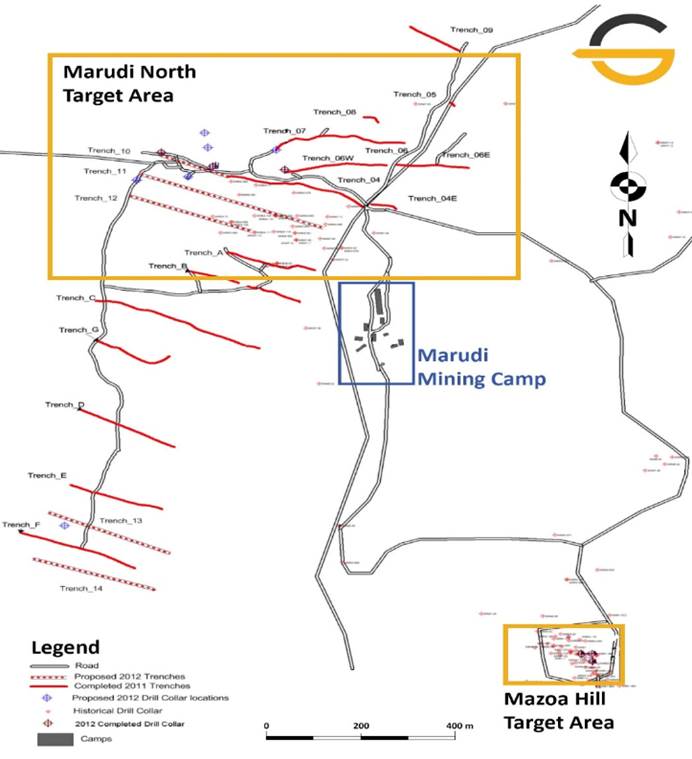

The Marudi property was of interest to chief geologist and exploration manager Locke Goldsmith, who first started exploring there in 1991. A decade later, the Haileybury School of Mines, Ontario graduate was back in Guyana doing soil sampling, trenching and limited drilling at Marudi North – focusing on the known deposits.

A total of 42,000 meters of historical drilling has been completed at the Marudi Gold Project by previous operators since 1985, or 141 drill holes.

A year ago, Guyana Goldstrike commissioned a new resource estimate to verify previous work done at the Mazoa Hill zone. The NI 43-101-compliant report delineated 259,100 ounces of gold at 1.8 grams per tonne (g/t) in the indicated category and 86,200 ounces inferred grading 1.6 g/t.

The 50-square-kilometer property is 85% unexplored – leaving plenty of upside for the company and investors. And it comes with an 18-year mineral license.

Before we get to the highly prospective Marudi Gold Project and Guyana Goldstrike’s recent exploration activities, of interest is GYA’s relationship to Zijin Mining – the largest gold company in China.

Zijin funding

Locke Goldsmith, GYA’s head geo, had a good history with Zijin Mining’s Canadian representative. The pair worked together at Ivanhoe Mines in China, where they discovered a mine that is still in production.

When Guyana Goldstrike reached out to Zijin looking to fund an exploration program, the gold major came through with a substantial $3.2 million – in exchange for a 24% stake.

The funding is through Gold Mountain Assets, which manages Zijin’s Global Fund and its Midas Exploration Fund. The two funds are separate, with one strictly for exploration and the other set up to invest in pre-production opportunities. Guyana Goldstrike received an investment from both funds.

“What they liked was that Marudi presented itself as a home-run opportunity, hit for the fences. It has great exploration upside, and they wanted the dollars earmarked for further identification and exploration discovery of ounces,” said Peter Berdusco, GYA’s President and CEO, in an exclusive Ahead of the Herd interview this week. He added:

“To me, getting funding from both the Midas Exploration Fund and the Global Fund was a clear message that not only did they see the exploration side of this, but they saw the progression of this project, potentially to the production side.”

Marudi Gold Project

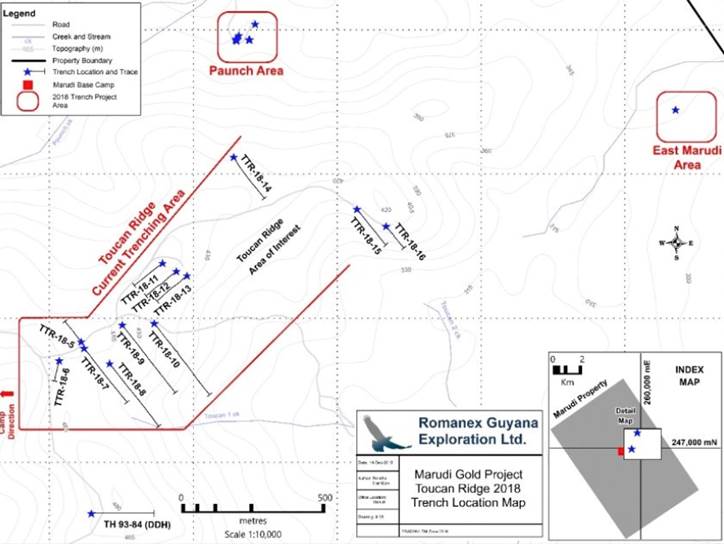

Guyana Goldstrike put the Zijin funding towards a trenching program at a new bedrock target at the Marudi Gold Project – Toucan Ridge – hoping to add to the other two mineralized zones, Mazoa Hill (where the 2018 resource estimate was completed) and Marudi North, where 2012 drilling will add additional ounces.

Mineralization at Marudi is related to gold-hosted banded iron deposits that occur in other greenstone belts around the world. As already noted, these deposits can be remarkably long-lived with sizeable gold production.

According to Goldsmith, the property has similar stratigraphy (rock layers) and mineralization to the Homestake, Lupin and Musselwhite mines.

With trenching started at Toucan Ridge last year, Guyana Goldstrike made a discovery in July, returning assays up to 1.25 grams per tonne from 90.4 meters of trenching, out of the 1.75-kilometer target.

Assay results continue to roll in from the quartzite-metachert host rock at Toucan Ridge, about a kilometer north of Mazoa Hill. The latest returned 1.46 g/t gold over 6m within 9.6m of 1 g/t gold. One of the trenches assayed a high-grade 23.50 g/t gold over 0.6m, within 3.6m of 4.82 g/t gold.

“On Toucan, we have trenched deep to bedrock and have exposed the quartzite-metachert host rock in all of the trenches, to one extent or another,” said Goldsmith.

“We’ve got good grades on-surface, on Toucan Ridge,” he added. “We’re ready to look for another pit outline there to add to the first pit outline at Mazoa Hill, perhaps a gram-and a half to maybe two and a half.”

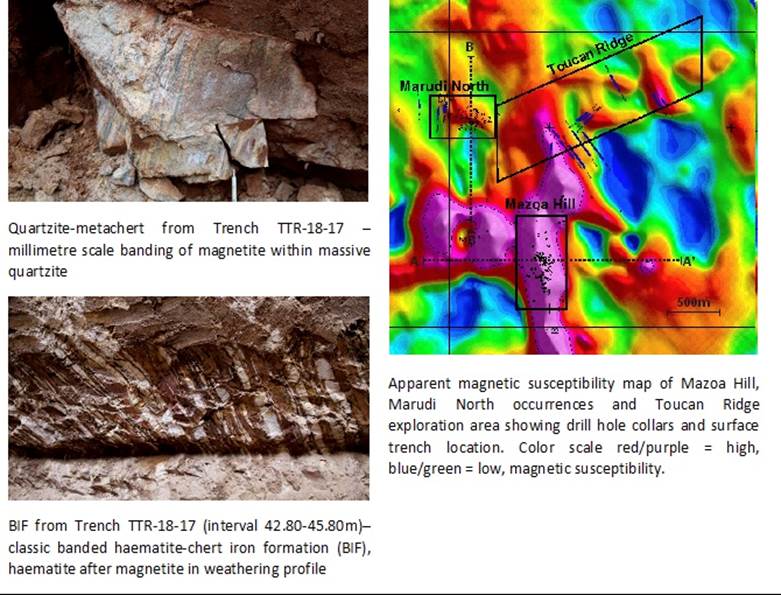

However, with much of the ground weathered and covered with vegetation, and no visible outcrops, it was decided last summer that conducting an airborne geophysical survey would provide valuable information about the project that trenching is unable to. The results were released this week.

The survey – the first of its kind ever conducted on Marudi – covered the entire 5,463 hectares, including the previously drilled Mazoa Hill and Marudi North zones, plus all the areas that have been trenched, sampled and mapped.

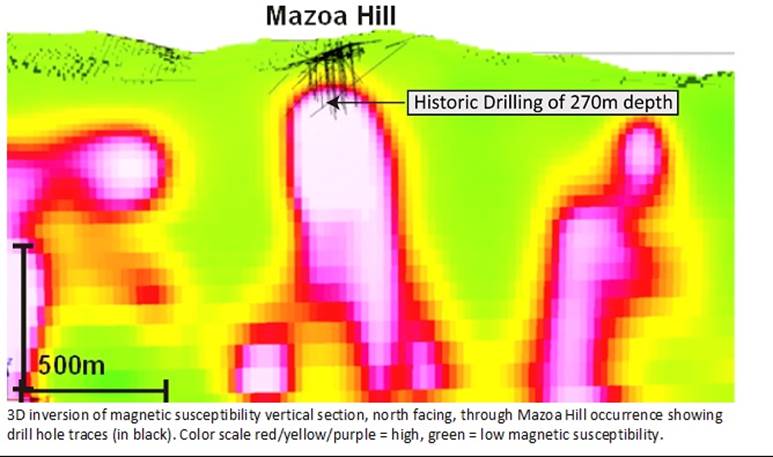

The results showed a strong correlation between rock that is highly magnetized underground (a marker for gold mineralization), and previous drilling at MazoaHill and Marudi North. Magnetic anomalies along Toucan Ridge correlated with gold anomalies identified by trenching at surface.

The airborne geophysical survey also found new targets along strike and deeper than the known mineralization at Mazoa Hill and Marudi North, under the trenched areas along Toucan Ridge, and at several magnetic anomalies found throughout the property.

“The geophysics interpretation has greatly advanced our understanding of the controls on gold mineralization on the Marudi Gold Project and identifies priority targets to both expand the known mineral resource and discover new occurrences,” Berdusco states in the Feb. 28 news release.

Exploration upside

Gold-hosted banded iron deposits are remarkable not only for their longevity, but the number of “pods” that they often contain. As one pod is mined out, others are usually found. That’s because, like VMS deposits, gold-hosted banded iron deposits often occur in clusters. Guyana Goldstrike wants to find out what other deposits might be hidden among Marudi and what potential other properties in that area may yield to the east and west.

Also, worth noting is what has been revealed through the airborne geophysical survey. Drilling at Mazoa hill for example has only gone as deep as 250 meters. The survey shows magnetic signatures three to four times that depth, indicating the possibility of an underground mine. But Guyana Goldstrike won’t explore at depth just yet; it’s focused on trying to build one, two, even up to eight pits – like the Rosabel gold mine in Suriname – jointly owned by the Iamgold and the Suriname government.

For now, though, GYA is taking it one step at a time. A 2,000-meter drill program is planned for later this year. The 10 to 12-hole program, which still has tobe fine-tuned, will focus on Toucan Ridge, building on the mineralization found in trenches. The drill holes will target the anomalies identified in the magnetic survey.

The end game is to find a million ounces or more – enough to interest a gold major in a buyout.

Guyana Goldstrike has 52 million shares issued and outstanding, with management, friends and family holding about half, and Zijin Mining owning 24%. The public float is under 8 million shares.

Conclusion

Guyana Goldstrike has everything I like to see in a gold junior: Historical drilling showing mineralization, ample upside, a safe jurisdiction to invest in, an experienced management team and high institutional/ insider ownership.

But Guyana Goldstrike is a cut above the rest for a few reasons. One, Marudi is a gold-hosted banded iron formation. We know this kind of gold deposit has legs. We already have a resource at Mazoa Hill, prospectivity at Marudi North, and a very promising new zone in Toucan Ridge. If all goes well this year GYA could have a million ounces and two pit outlines. There are additional targets to the east and the west. And the company doesn’t have any competition; it has 100% of Marudi and has a lock on the rest of the trend.

Second, I like that Guyana Goldstrike is “drilling to kill”. Management isn’t wasting time and money on surveys, they’re identifying targets and drilling them. If one target doesn’t work, it’s dead, and they’re on to the next one. The magnetic survey is a useful tool to focus the targets, but now GYA needs to drill them. Nothing like the truth machine to accelerate an exploration program, and build shareholder value.

Third, I love that a major gold company has the confidence to drop three and a half million into its treasury. Zijin of course is looking for an eventual payout; it may not get it right away, but obviously sees the blue sky potential.

For all of these reasons I have GYA on my radar screen.

Richard (Rick) Mills

Ahead of the Herd Twitter

Ahead of the Herd FaceBook

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Guyana Goldstrike (TSX-V:GYA), is an advertiser on Richard’s site aheadoftheherd.com. Richard owns shares of GYA

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE