Rick Mills – “2023 was a Record Year for Gold Demand”

Gold demand reached an all-time high in 2023, according to the most recent data from the World Gold Council.

While gold does not play a starring role in the energy and electrification drama, its monetary function gives the precious metal an importance that over-shadows all other mineral commodities.

You don’t purchase gold to take advantage of short-term price fluctuations in the market, you buy it because it will always gain in value compared to paper money.

Over time, gold is a store of value because it is not subject to the inflationary pressures fiat currencies are. Since 1913, when the Federal Reserve was created, the US dollar has lost 96% of its value.

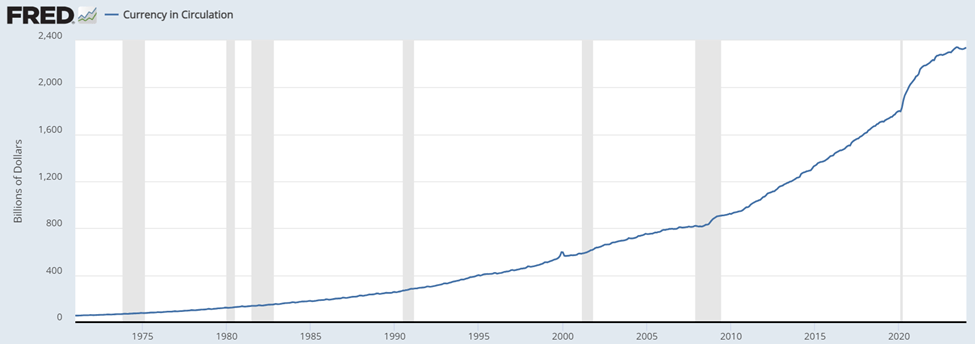

In 2024, gold is worth $2,030 an ounce — 58 times its value in 1971, @ $35 oz when Nixon cut the last gold ties to the US$, meanwhile US$ creation soared, most of it from 1971 as the chart below shows

Currency in Circulation

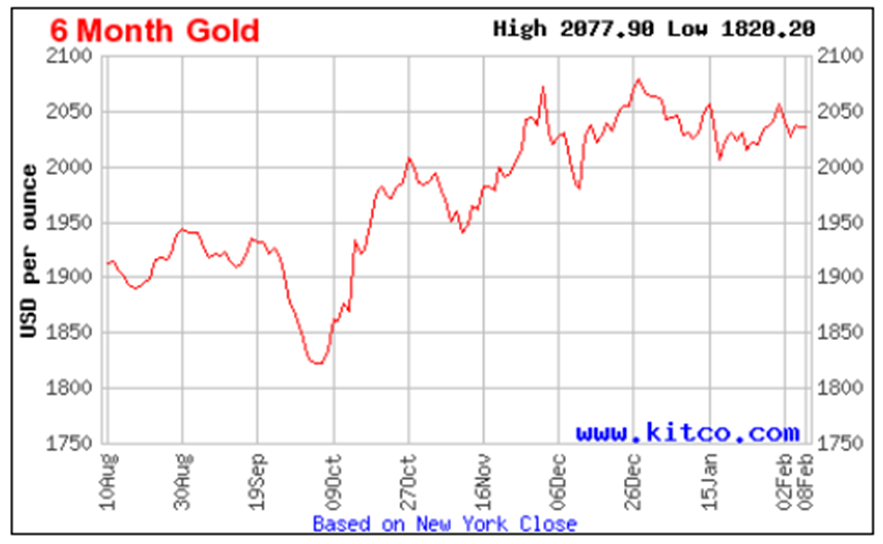

Gold has held up well despite the Fed’s tightening cycle, gaining 13% in 2023, and hitting a record-high $2,135 an ounce in early December.

6-month gold. Source: Kitco

Total gold demand exceeded previous years, and it is expected to keep growing in 2024, as the Federal Reserve moves towards cutting interest rates. Gold is attractive to investors during periods of rate-cutting, as it benefits from lower Treasury yields and a weaker dollar.

Last year, gold prices were mostly underpinned by strong central bank buying. According to the World Gold Council, when over-the-counter (OTC) trades are included, consumption climbed by about 3% to 4,899 tons, the highest figure since data started being collected in 2010. Central bank annual net purchases were 1,037 tons, only 45t off the record set in 2022. The council expects central bank buying to top 500 tons this year.

The average gold price also hit a record in 2023, @ $1,940 an ounce, 8% higher than 2022’s average price.

Last year’s gold’s biggest central bank buyer was Turkey, which increased its share of foreign reserves held in gold by 0.73% in Q4, by far the largest increase of any country. Turkey also purchased the most gold among central bank in 2023. According to a World Gold Council article,

Turkey has long played an important, arguably outsized, role in the global gold market. The country has a long history of domestic gold ownership in both jewellery and investment form, and is the fifth largest gold market globally. As the world’s 11th largest economy, Turkey has seen rapid economic growth, high inflation and regular currency depreciation over the past few decades; a combination that has fuelled healthy growth in retail gold demand in recent years.

On the negative side for gold, outflows from gold-backed exchange-traded funds (ETFs) continued in 2023, losing 244 tonnes in the third consecutive year of decline. European outflows dominated the picture.

Bar and coin demand investment was also subdued, down 3%.

In January, global gold ETFs kicked off 2024 with the eighth monthly outflow, worth USD$2.8 billion, led by North American funds. The council explained that a higher dollar and 10-year US Treasury yield weighed on the gold price last month, leading to sales of gold ETFs. US investors’ appetite for gold was further dented by the surge in US equities.

Louise Street, a senior analyst at WGC, said economic and geopolitical uncertainty is likely to persist this year, boosting demand for gold:

“In addition to monetary policy, geopolitical uncertainty is often a key driver of gold demand, and in 2024 we expect this to have a pronounced impact on the market,” she said. “Ongoing conflicts, trade tensions, and over 60 elections taking place around the world are likely to encourage investors to turn to gold for its proven track record as a safe haven asset.”

Street noted that central banks often turn to gold in times of crisis, and suggested that central bank buying will offset a slowdown in consumer gold demand due to a high gold price and slowing economic growth.

A technical analyst quoted by Sprott Money thinks we are nearing the bottom for gold and silver prices and the peaks for the US dollar and the US 10-year Treasury yield. Author David Brady writes:

Simply put, the corrections in Gold and Silver are coming to a close. The peak in the 10-year and the DXY will signal the beginning of the rally to new record highs in Gold. My target for Silver is 28-30. Then the 10-Year will fall below its low of 3.78% while the DXY breaks 100 and heads down to the 90s. This will support the coming massive rally in Gold. Silver will enjoy even bigger percentage gains.

Conclusion

Gold continues to maintain strength, staying above $2,000 in January and into February despite interest rates and the dollar remaining high. In fact, if we look at real interest rates (the 10-year Treasury yield minus inflation), we are well into positive territory, which should be gold-bearish. Gold investors typically like gold when real rates turn negative. Yet here we are. Gold is rising in tandem with interest rates and the dollar instead of falling, which is counter to the normal trend.

6-month US 10-year Treasury yield. Source: CNBC

-month US dollar index DXY. Source: CNBC

The report from the World Gold Council indicates that gold prices continue to be held up by central bank buying and safe-haven demand. If consumer gold demand in the form of ETF purchases gets added to these two demand drivers, when the Federal Reserve starts cutting interest rates, likely mid-year, it will be even better news for gold prices.

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE