Peter Krauth – “Thoughts From Vancouver Conferences”

These are my first insights after attending two back-to-back resource conferences in Vancouver. First was the Metals Investor Forum (MIF), followed by the Vancouver Resource Investment Conference (VRIC).

Both were very well attended, with the number of attendees nearly tripling in both cases. It was great experiencing the vibe first hand, and I think it’s a sign of the times. It seems the tide may have turned.

Here’s the link to the video of my MIF presentation: A New Silver Bull Market

Just a year ago, these venues had much lighter attendance, with lots of spare seating capacity. This time most seats were filled, with many left standing. What does it mean? To me, at least, it suggests we’ve turned the corner in the commodities sector. Investors are finally switching from general stocks to resources.

Naturally, I’m still cautious, because I realize the first ones to attend, or return to, such events are often those already well informed and interested in commodities. But the numbers mean something, and I saw it with my own eyes. In the last commodities bull, which ran from about 2001 – 2012, the later years saw sold out scenarios with capacity overflowing.

We have a long way to go, which suggests some great times ahead for this sector. If nothing more, interest starting to build.

In this issue, I provide my thesis for buying a new junior silver explorer in an established mining jurisdiction. It’s a project that’s seen a lot of historical drilling. But recent geophysics and geochemical surveys suggest the sweet spot lies just beneath the bottom of those old drill holes. I also share a chapter from my book, The Great Silver Bull, explaining the mining life cycle, then follow on with silver technicals, the portfolio, and company updates.

At these conferences I heard many serially successful mining entrepreneurs, the kind that have built several multi-billion dollar companies, say that there’s been a solid shift in sentiment. Ross Beaty, who wrote the foreword to my book, The Great Silver Bull, spoke at the VRIC and said he’d never seen a more positive setup for the metals markets in his entire 45 year career. In his view, the demand for precious, base, rare earth and specialty metals is going to propel this entire sector to much higher levels over the next few decades. The main drivers are a lack of investment over the past decade, high and ongoing inflation, and the ubiquitous green transition. Frank Giustra, of Goldcorp fame, said he sees interest building in the junior miners. I see that too, but the big momentum has mostly filtered into the large caps so far.

My big picture view is that the smart money sees the broad market as still expensive. Investors may be rotating from growth to value, but value is still not that cheap as demonstrated by the S&P whose P/E is currently at 22.3. Meanwhile, most of large cap miners are south of 19, and many sport a P/E below 9. That’s well under half the S&P.

Since last fall, we’ve seen a substantial move in producers of raw materials. I think that’s the market starting to price in the potential end of Fed rate hikes.

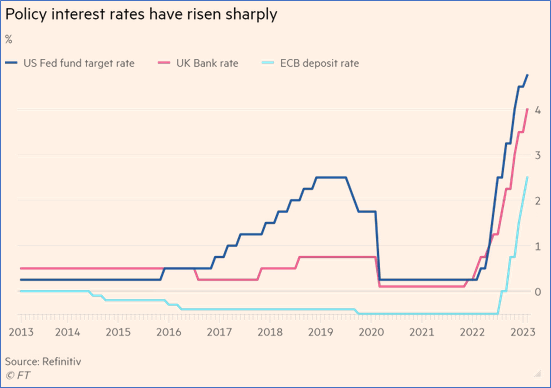

Of course last week the Fed raised rates by the expected 0.25% to the 4.5% – 4.75% range, and said ongoing increases were appropriate as they aim to get inflation back to 2%. And yet the 3-month US Treasury is yielding 4.65% which is nearly in the middle of that range. The 1-year US Treasury is only slightly higher at 4.67%. In other words, the bond market sees one more rate hike, then perhaps cutting by the end of the year.

Gold popped to $1,950 and silver to $24.20 after the rate hike, as the market concluded the Fed was close to pausing rates. Both metals gave that all back the next day. And on Friday, as the jobs numbers reported were a huge blowout, gold dropped to $1,863 and silver to $22.30. The market saw the big jobs number as higher odds the Fed would in fact keep hiking rates longer than previously thought.

The other side of that coin is that high employment levels are also likely to lead to stubbornly high inflation. And that’s the Fed’s dilemma: sacrifice the dollar or the economy. Right now it seems it’s going to be the economy, because higher rates will make debt more costly. Each successive hike brings us closer to something breaking. When the next crisis hits odds are rates will be reversed.

Although I think odds of a recession are still quite strong, overall strength in the labor markets is present as there are no huge waves of layoffs, and job openings remain high. If this holds up, it could lessen the odds of a recession or at least soften its impact.

For me the big risk is that once the Fed stops raising rates, we’ll see a new inflation wave. Maybe it will be stubbornly high employment levels, or wage-inflation take hold. That might be enough to keep the Fed from reaching its 2% inflation target. Once investors see this, it will be a huge boost to precious metals. Remember, many supply chain issues are not resolved, the war in Ukraine rages on and continues to curb access to resources, and China is bent on reopening. China alone could drive huge demand in commodities, manufacturing and services across the board, and could be a new inflation trigger later this year.

At the VRIC conference, I heard three analysts notoriously hesitant to stick their necks out give a price prediction on gold this time around. They all see the metal reaching a new all-time nominal high of USD $2,100 this year.

I’m essentially in agreement. I also think silver could reach $25 in H1, and approach $30 in H2, especially if gold tests $2,100.

The European Central Bank (ECB) is late to the rate hiking cycle, and has just raised rates by 0.5%. That has its deposit rate at just 2.5%, which is still well below the Fed’s 4.5%-4.75%. That was after the Bank of England also raised its rate by 0.25%. The ECB is expected to hike by another 0.5% in March, though many analysts believe that will mark an end to its hiking cycle. The stronger euro is a headwind for the US dollar index, whose largest weighting is the euro at 57.6%.

Naturally a weaker dollar is good for precious metals. Let me be clear…I expect the US dollar to continue weakening, but it’s not likely to happen in a straight line. The US dollar index is down from 112 last fall to below 103 as I write. That’s a significant move in a short time for the world’s reserve currency, and it’s been consistently down since then. A small counter-move higher in the next weeks/months wouldn’t surprise me, but I do expect it to trend towards the 90 level this year or next.

And that would be an ongoing tailwind for silver and gold. Here’s another…

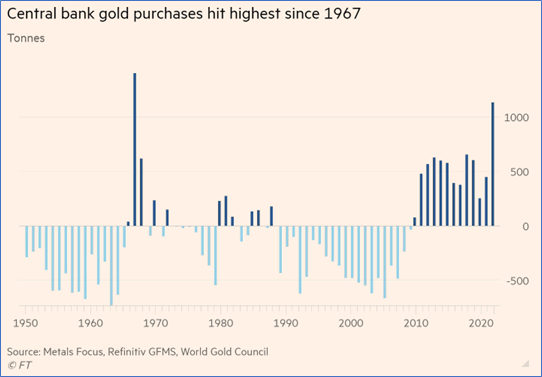

Last year saw Central Bank gold purchases hit their highest level since 1967. 55 years!

That’s monumental.

To those who say gold is useless, I’d ask why then have central banks been accumulating so much of it over the past 10 years? What do they know or expect?

At least one big reason, in my view, is how the US weaponized the dollar last year by freezing Russia’s treasury holdings. You can be sure that hasn’t gone unnoticed by these central banks and other sophisticated sovereign, institutional, and high net worth investors who hold plenty of the world’s current reserve currency. That’s what likely explains the huge buying last year.

They are looking for alternatives. And the best, proven, and longest-standing alternative with no counterparty risk is very simply gold.

Once gold gathers steam and becomes increasingly noticed by mainstream investors, its price will be much higher. That will cause investors to look for other options. The next most attractive and more affordable alternative is silver.

That’s why silver plays catch up to gold in precious metals bull markets, and always outperforms its higher profile cousin.

I’ve been tracking these drivers for years, and I cover all these topics in my recent book, The Great Silver Bull.

If you haven’t picked up a copy yet, it’s easy, and it’s now also available in audiobook format!

CLICK HERE to order The Great Silver Bull

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE