Osino Partner Announces New Lithium Discovery and Phase 1 Drilling Results at Omaruru Lithium Project, Namibia

Highlights

- Assay results from Prospect Resources’ Phase 1 RC drill program outline a new, near surface shallow dipping discovery of lithium mineralization in the Southern Brockmans zone and confirmed historical results at Karlsbrunn.

- Highlight intersections from the Phase 1 drilling program include:

- 6m @ 1.30% Li2O from 13m within 14m @ 0.79% Li2O from 13m

- 8m @ 0.99% Li2O from 6m

- 11m @ 0.95% Li2O from 51m

- 7m @ 0.90% Li2O from 17m and 8m @ 0.60% Li2O from 28m

- Drilling undertaken at Brockmans indicates significant prospectivity and scope for identifying larger tonnages of higher-grade lithium mineralization.

- Prospect Resources investing US$1.0M over 12 months to reach a 40% project interest.

- Osino has the option to retain a 49% interest in the project through pro-rata equity contributions and regardless will be carried as a 15% holder in the event of non-funding, until Definitive Feasibility Study (“DFS”).

Osino Resources Corp. (TSX-V:OSI) (FSE:RSR1) (OTCQX:OSIIF) is pleased to provide an update on its majority-owned Omaruru Lithium Project in central Namibia following the completion of a Phase 1 Reverse Circulation drill program by Prospect Resources Limited (ASX:PSC) (FRA:5E8). Osino entered into an Earn-In and Shareholder Agreement with Prospect in Q4 2022 whereby Prospect can earn up to 51% and potentially up to 85% interest in the Project (see Osino press release dated September 30, 2022).

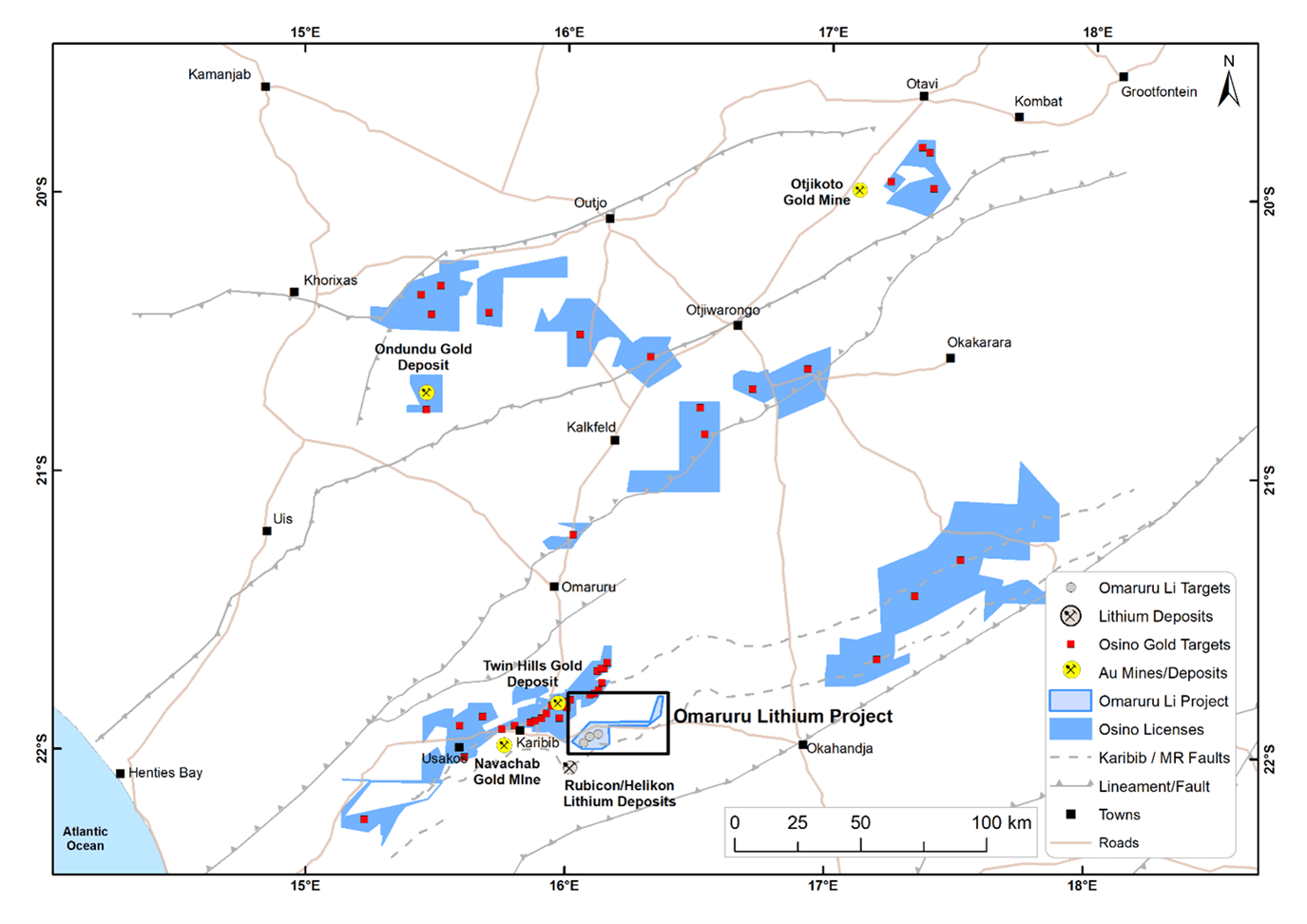

Omaruru is located 20km southeast of Osino’s Twin Hills Gold Project for which a DFS is anticipated to be delivered in Q2 2023. Located east of Karibib and spanning 175km2 (see Figure 1), Omaruru is situated near several historical and current lithium mining operations, including Lepidico’s Karibib Lithium Project located about 10km to the southwest. Omaruru is accessible by road from the sealed B2 National Highway which links the capital Windhoek, 130km the southeast, to the port at Walvis Bay, about 240km further southwest.

Heye Daun, Osino’s President and CEO, commented: “We are excited to receive excellent results generated by Prospect Resources’ team at the Omaruru Lithium Project. The Phase 1 drilling results confirm and expand the success of the early exploration and drilling programs completed by Osino between 2019-2021 and set the stage for a significant, maiden JORC-compliant resource to be delineated at Omaruru later this year. Prospect is a world-class group with a track record for exploring and developing African lithium projects, evidenced by the team’s previous success selling the Arcadia lithium project in Zimbabwe for approximately US$378M cash in 2022. Our Earn-In agreement provides Osino shareholders with continued exposure to the growing scope and excellent upside potential of the Omaruru Lithium Project.”

Project Background

Omaruru contains more than 65 known and mostly zoned pegmatites which belong to the Lithium-Caesium-Tantalum (LCT) family of rare-element pegmatites. These pegmatites occur within an area known as the Karibib Pegmatite Belt, one of five major pegmatite districts in the Damara Belt.

Figure 1: Omaruru Lithium Project location relative to the Twin Hills Gold Project and other mines and deposits in the area

A number of pegmatites within the Karibib Pegmatite Belt have produced lithium in the past, including Lepidico’s Karibib Lithium Project which is focused on the Rubicon and Helikon pegmatites.

Historically, small-scale production from the Karlsbrunn and Brockmans pegmatites located on the Project produced lithium minerals (mainly lepidolite, petalite, amblygonite and spodumene), as well as beryl. Exploration in the vicinity of the Project has generally been for gold, and companies such as Anglo American and Helio Resources Corp. explored the area intermittently prior to 2015.

Osino undertook an initial evaluation of the lithium potential of the Project from 2019-2021. This work included mapping, rock grab sampling and a 16 hole (1,942m) RC drill program in 2020. The drilling highlighted remaining potential at the Karlsbrunn pegmatite in particular, with a number of intersections of 5m or more at grades in the range of 1-1.2% of Li2O. Other drilling and surface sampling indicated lithium mineralization associated with most of the other pegmatites on the Project.

Karlsbrunn Deposit Phase 1 Drilling Program

Significant intersections returned from Prospect’s Phase 1 Drilling Program at the Karlsbrunn deposit include:

- 8m @ 0.99% Li2O from 6m

- 11m @ 0.95% Li2O from 51m

- 10m @ 0.88% Li2O from 35m

- 10m @ 0.82% Li2O from 15m

- 11m @ 0.80% Li2O from 35m

These results show robust lithium grades and pegmatite widths across the deposit and are broadly in line with the initial drilling at Karlsbrunn completed by Osino in 2020.

Prospect also completed detailed sampling of several extensive underground adits at Karlsbrunn which pass laterally through the deposit at several locations. The adits were developed historically to extract petalite and gemstones from the pegmatite, including beryl. Assays from sampling of these adits are pending. These pending results, along with the surface RC drilling results outlined above, are expected to contribute to the estimation of a maiden JORC-compliant Mineral Resource for the Karlsbrunn deposit later this year.

Brockmans Deposit Phase 1 Drilling Program

Prospect completed its maiden drilling at the Brockmans deposit, which is located just over 4km northeast of the Karlsbrunn deposit. Assay results are highly encouraging with two adjacent holes completed in the southern zone evidencing a new discovery of continuous lithium mineralization.

Significant intersections returned from Prospect’s Phase 1 Drilling Program at Brockmans include:

- 6m @ 1.30% Li2O from 13m within 14m @ 0.79% Li2O from 13m

- 7m @ 0.90% Li2O from 17m and 8m @ 0.60% Li2O from 28m

The results from this new drilling at Brockmans indicate a significant thickening of the pegmatite in the south, which is considered a key aspect for the zoning of lithium mineralization in the Karibib District (e.g. Karlsbrunn). Importantly, the limited drilling undertaken at Brockmans indicates significant prospectivity and scope for identifying larger tonnages of higher-grade lithium mineralization within the Omaruru Project

Metallurgical Sampling

Prospect recently collected three, 50kg bulk samples of identified lithium mineralization from the Karlsbrunn, Brockmans and Hillside deposits. These samples are set to undergo early stage metallurgical test work and evaluation in South Africa.

Geochemical Soil Sampling

Prospect completed detailed soil geochemical sampling at Omaruru over eight separate grids in January. Most assays for this work remain outstanding and will be reported separately once all data is received and interpreted.

Prospect’s Upcoming Omaruru Exploration Programs

Prospect expects to complete its Phase 1 earn-in to Omaruru during Q2 2023. Upcoming programs during this period are expected to encompass infill and extensional RC drilling at the Brockmans deposit, limited diamond drilling for metallurgical test work purposes at Karlsbrunn, and potentially first-pass, short-hole, RC drilling of regional exploration targets identified from any cohesive geochemical and soil anomalies associated with LCT mineralization characteristics across the region (i.e. elevated lithium-caesium-rubidium-beryllium values).

Earn-in Agreement Terms

Under the Agreement, Prospect may earn-in to up to 40% interest in the Project with a US$1M investment and a further 11% interest through a US$560,000 investment, totalling a 51% ownership in the Project.

Phase 1 consists of a US$560,000 cash payment to acquire 20%, and a commitment to spend a further US$440,000 on the Project with a 12-month period, to earn an additional 20%. Upon the completion of Phase 1, Prospect may commit to a further US$560,000 within a 12-month period for in-ground exploration to reach 51% ownership.

Upon the completion of Phase 2 and having earned 51%, development funds are to be contributed on a pro-rata basis. If one party fails to contribute their pro rata share, their shareholding will be diluted. The minority shareholder will be diluted down to 15%, at which point their interest shall be free carried until the completion of the DFS.

If Prospect chooses not to proceed after Phase 1 or does not reach more than 50% by the end of a 24-month period (or as extended by mutual consent) Osino will have the right to repurchase Prospect’s interest for an agreed sum.

During the next phase of the Agreement, if Prospect’s spending does not reach a minimum of US$500,000 within the 12-month period following Phase 2, either party will have the option to purchase the other party’s interest for an agreed sum.

Osino will benefit from ongoing exposure to the significant potential of the Omaruru Project while remaining focused on the fast-tracked development of our wholly owned Twin Hills Gold Project and Ondundu Gold Project in Namibia.

Qualified Person’s Statement

David Underwood, BSc. (Hons) is Vice President Exploration of Osino Resources Corp. and has reviewed and approved the scientific and technical information in this news release and is a registered Professional Natural Scientist with the South African Council for Natural Scientific Professions (Pr. Sci. Nat. No.400323/11) and a Qualified Person for the purposes of NI 43-101

About Prospect Resources

Prospect is an ASX listed company focused on the exploration and development of opportunities in battery and electrification metals in the sub-Saharan African region. The team at Prospect has a proven track record of value creation and systematic de-risking of early-stage projects. Prospect successfully advanced its flagship Arcadia Lithium Mine Project in Zimbabwe from exploration through to resource definition, early-stage economic valuation, definitive studies, offtake agreements and strategic project financing process. Arcadia was discovered by Prospect in 2016 and was ultimately sold to Zhejiang Huayou Cobalt in early 2022, for approximately US$378M in cash.

About Osino Resources

Osino is a Canadian gold exploration and development company focused on the fast-tracked development of our wholly owned Twin Hills Gold Project in central Namibia. Since its grassroots discovery by Osino in August 2019 the Company has completed more than 225,000m of drilling and has completed a suite of specialist technical studies culminating in the recently published Twin Hills Pre Feasibility Study. The PFS describes a technically simple and economically robust open-pit gold operation with a 2.15moz gold reserve, 13-year mine life and average annual gold production of over 169koz per annum.

Osino has a commanding ground position of approximately 8,000km2 located within Namibia’s prospective Damara sedimentary mineral belt, mostly in proximity to and along strike of the producing Navachab and Otjikoto Gold Mines. The Company is actively exploring a range of gold prospects and targets along the belt by utilizing a portfolio approach geared towards discovery, targeting gold mineralization that fits the broad orogenic gold model.

Our core projects are favourably located north and north-west of Namibia’s capital city Windhoek. By virtue of their location, the projects benefit significantly from Namibia’s well-established infrastructure with paved highways, railway, power and water in close proximity. Namibia is mining-friendly and lauded as one of the continent’s most politically and socially stable jurisdictions. Osino continues to evaluate new ground with a view to expanding our Namibian portfolio.

MORE or "UNCATEGORIZED"

First Phosphate Confirms Another High Grade Intersect of 11.85% Igneous Phosphate Across 84 Metres Starting from Surface at Its Begin-Lamarche Project in Saguenay-Lac-St-Jean, Quebec, Canada

First Phosphate Corp. (CSE: PHOS) (OTC: FRSPF) (FSE: KD0) is plea... READ MORE

MAG Silver Reports First Quarter Financial Results

MAG Silver Corp. (TSX:MAG) (NYSE American: MAG) announces the Com... READ MORE

Troilus Announces Feasibility Study Results for the Gold-Copper Troilus Project: Outlines a Large Scale, 22-Year Open Pit Project in Tier-One Jurisdiction With USD$884.5 Million NPV(5%)

Troilus Gold Corp. (TSX: TLG) (OTCQX: CHXMF) reports results from... READ MORE

Alamos Gold Intersects Higher-Grade Mineralization within a New Zone Near Existing Infrastructure at Young-Davidson

Alamos Gold Inc. (TSX:AGI) (NYSE:AGI) reported new results from i... READ MORE

Titan Reports First Quarter 2024 Results; National Safety Recognition Award

Titan Mining Corporation (TSX: TI) announces the results for the... READ MORE