Orla Mining Reports Positive Drilling Intersections and Metallurgical Results at Camino Rojo Sulphide Extensions

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) is pleased to provide an update on its exploration activities at Camino Rojo Sulphide Extension from the first half of 2024.

Highlight results:

- 4.57 g/t Au, 19.4 g/t Ag, 2.56% Zn, (6.16 g/t AuEq) over 15m, incl. 51.1 g/t Au, 8.08% Zn over 0.8m

- 6.72 g/t Au, 7.7 g/t Ag, 0.79% Zn (7.24 g/t AuEq) over 6.6m, incl. 78.6 g/t Au, 8.24% Zn over 0.5m

- 3.49 g/t Au, 7.60 g/t Ag, 1.06% Zn (4.12 AuEq) over 9.8m, incl. 16.6 g/t Au, 5.63% Zn over 1.5m

- 86% gold recovery rate via bottle roll tests

2024 Camino Rojo Extension Exploration Results (Mexico):

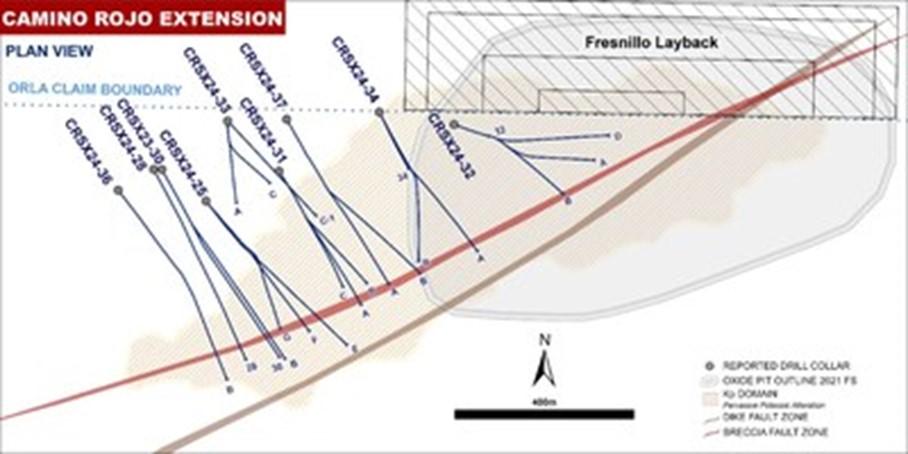

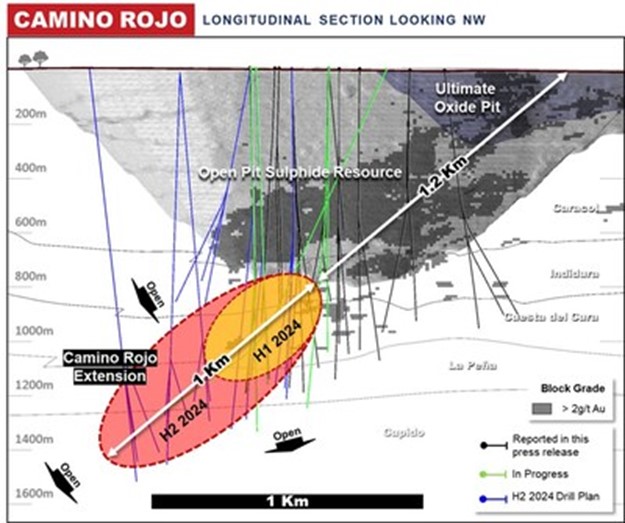

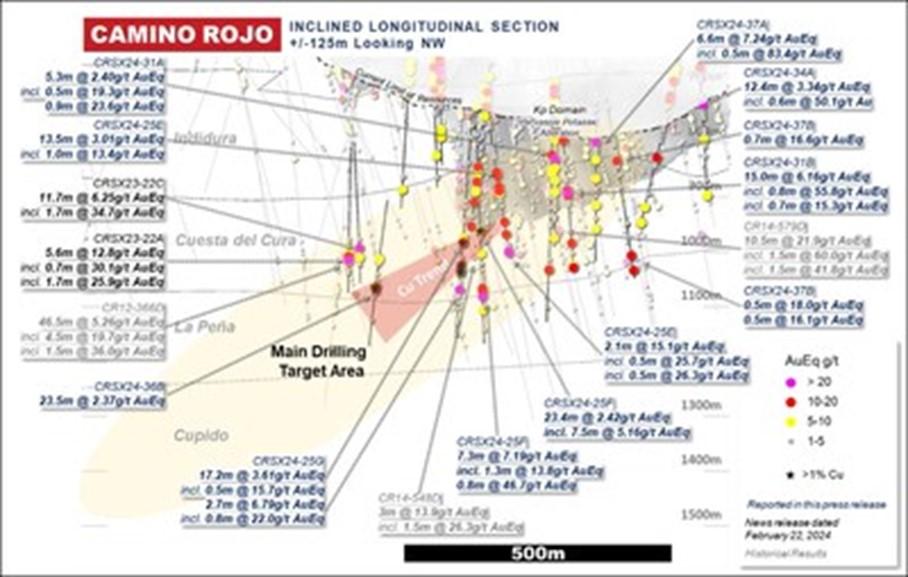

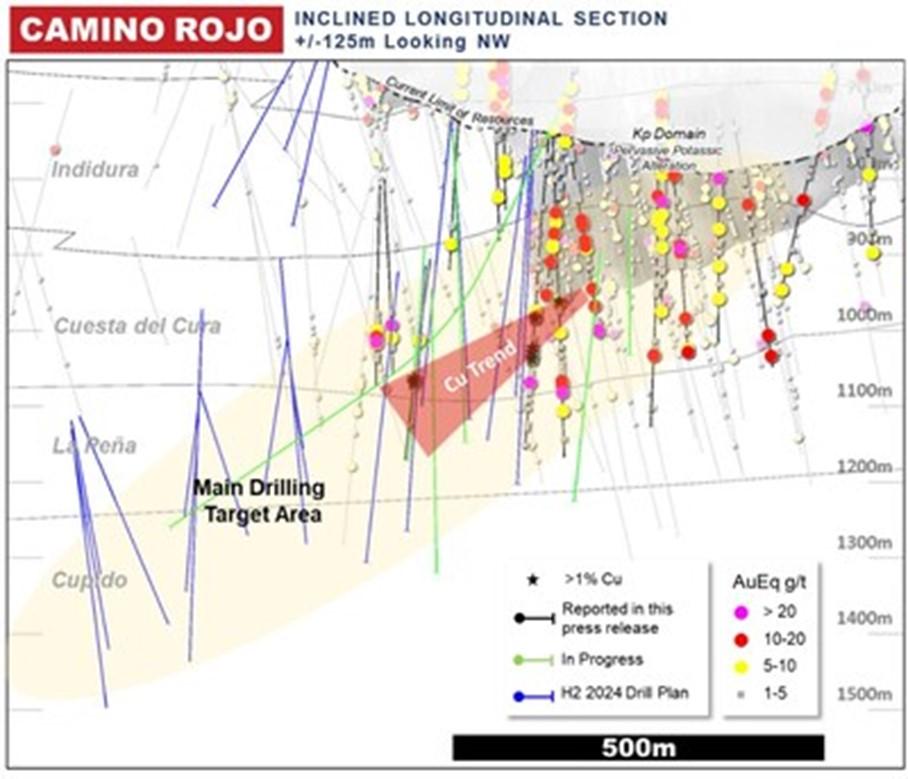

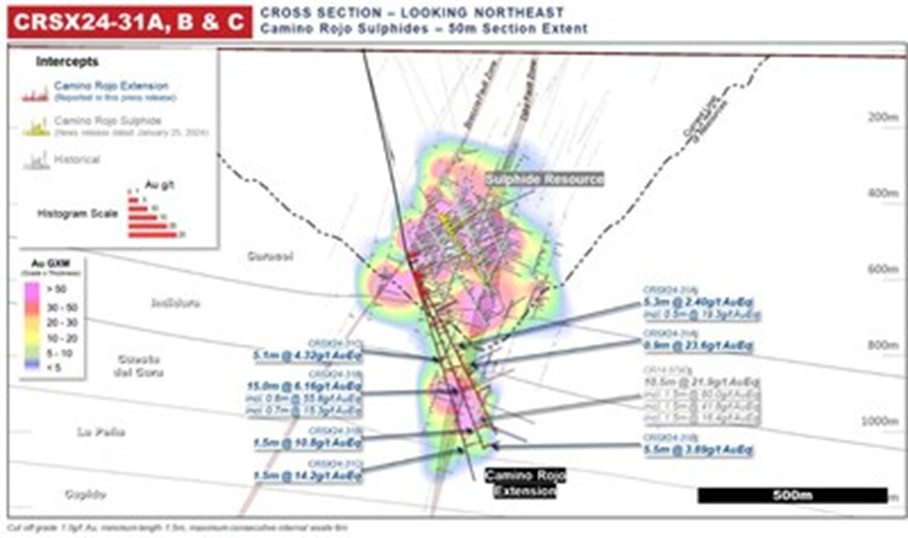

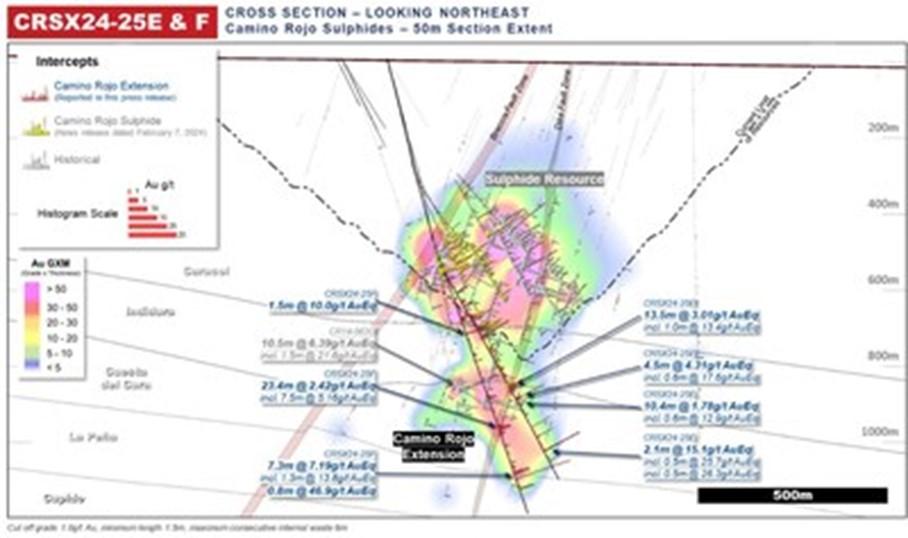

This press release provides results from 19 drill holes and 13,500 metres drilled as part of the 30,000-metre Camino Rojo Extension drill program planned for 2024. To date, 13 significant mineralized drill intersections outside the current resource have been identified, with a grade-by-thickness factor exceeding 30 g/t AuEq per metre (g/t*m). The estimated true width of these intersections ranges from 5.7 to 21.4 metres. Narrower intervals, ranging from 0.4 to 1.6 metres, returned higher gold grades of 10.0 g/t to 78.6 g/t, and zinc values from 1.0% to 18.8%, often as part of wider zones of polymetallic mineralization ranging from a few metres to several tens of metres in core length.

Metallurgical Testing:

Cyanide bottle roll test work on the recent Extension drill holes showed an 86% gold recovery rate, rougher flotation yielded 84% gold recovery, and open-circuit zinc cleaner tests produced a concentrate grading 51.3% zinc and a 94% zinc recovery rate. These positive metallurgical results are consistent with the results of last year’s gold recoveries of 81%-96% for bottle roll and 85%-88% for rougher flotation, highlighting the potential compatibility of this new mineralization style with both standard cyanide processing and flotation methods.

Future Exploration Plans:

The drill results indicate potential expansion of the Camino Rojo Sulphide resource at depth, extending beyond the current mineral resource down plunge by 500 metres and down dip by 300 metres. This high-grade polymetallic (Au-Ag-Zn) semi-massive to massive replacement style mineralization remains open at depth. The remainder of the current exploration program will focus on extending mineralization from 0.5 to 1 kilometre down-plunge of the current limit of mineral resources along the dike structures. This drilling is expected to test open mineralized trends and historical high-grade intersections to assess the broader potential of the growing Camino Rojo deposit.

“The 2024 Camino Rojo Extension drill program has yielded exciting results, including multiple significant mineralized intersections outside the current resource and excellent metallurgical testing outcomes. Our team is thrilled about continuing to expand mineralization along the dike structure and unlocking the Camino Rojo deposit’s full growth potential. Stay tuned for more updates as we continue to push the boundaries of exploration and discovery!”

– Sylvain Guerard, Orla’s Senior Vice President, Exploration

Drill hole detailed highlights:

| HOLE-ID | From (m) |

Core Length (m) |

Au g/t |

Ag g/t |

Zn % |

Pb % |

Cu % |

AuEq g/t |

| CRSX24-25E | 744.0 | 15.0 | 2.40 | 9.23 | 0.44 | 0.04 | 0.02 | 2.77 |

| incl. | 750.0 | 3.00 | 6.19 | 16.7 | 0.11 | 0.07 | 0.03 | 6.50 |

| incl.

And incl. And incl. |

757.5

769.5 769.5 924.0 925.0 |

1.50

9.75 1.50 13.5 1.00 |

5.14

3.49 16.6 2.38 13.1 |

27.7

7.63 31.5 11.9 10.9 |

1.25

1.06 5.63 0.76 0.17 |

0.07

0.02 0.04 0.01 <0.005 |

0.06

0.02 0.07 0.09 0.11 |

6.18

4.12 19.8 3.01 13.4 |

| CRSX24-25F

incl. And incl. And |

1005.2

1008.2 1133.7 1135.0 1151.7 |

23.4

7.50 7.25 1.35 0.85 |

1.86

3.78 3.67 8.24 45.4 |

15.2

37.1 4.23 11.7 54.9 |

0.02

0.04 6.93 10.8 0.89 |

<0.005

<0.005 0.01 0.02 0.90 |

0.28

0.70 0.05 0.10 0.08 |

2.42

5.16 7.19 13.8 46.9 |

| CRSX24-25G

incl. |

1015.2

1027.3 |

17.2

0.50 |

3.25

13.3 |

8.55

57.2 |

0.09

0.20 |

<0.005

<0.005 |

0.16

1.24 |

3.61

15.7 |

| CRSX24-31B | 925.8 | 15.0 | 4.57 | 19.4 | 2.56 | 0.04 | 0.08 | 6.16 |

| incl. | 934.1 | 0.75 | 51.1 | 44.3 | 8.08 | 0.04 | 0.16 | 55.8 |

| incl. | 940.0 | 0.70 | 10.6 | 35.5 | 8.28 | 0.12 | 0.10 | 15.3 |

| CRSX24-34A | 775.6 | 12.4 | 3.15 | 5.04 | 0.19 | 0.01 | 0.02 | 3.34 |

| incl. | 785.9 | 0.60 | 50.0 | 3.10 | 0.06 | 0.01 | 0.01 | 50.1 |

| CRSX24-37A | 845.9 | 6.60 | 6.72 | 7.71 | 0.79 | <0.005 | 0.03 | 7.24 |

| incl. | 850.6 | 0.45 | 78.6 | 51.0 | 8.24 | 0.03 | 0.10 | 83.4 |

| Metal prices used in gold equivalent calculation: Au = $1,750/oz, Ag = $21 / oz, Zn = $1.20/lb, Pb = $0.90/lb, Cu = $3.50/lb. See “Gold Equivalent Calculation” below for additional information. All prices in USD. All composites are in the Camino Rojo Extension. |

Significance of Au, Ag, Zn and now Cu results

These first results from the 2024 exploration program demonstrate significant potential for additional gold, silver, and zinc mineralization associated with polymetallic replacement style mineralization beneath the Caracol-hosted sulphide deposit, the main host rock of the current mineral resources. Recent intersections highlight an increase in copper mineralization, extending from approximately 250 to 500 metres down-plunge from the existing resource limit, and remaining open down plunge, adding a new component to the emerging down-plunge extension potential. Notable copper intersections include 0.7% Cu over 7.5 metres (hole CRSX24-25F), 1.24% Cu over 0.5 metres (hole CRSX24-25G), and 2.74% Cu over 1.1 metres (hole CRSX24-36B). The increased copper grades are associated with skarn-type mineralization and alteration, as well as sulphide replacement mineralization. The occurrence of elevated copper values further supports the interpreted main feeder structures of the mineralized system and provides a down-plunge vector for further drilling during the remainder of the ongoing program.

The geometry of polymetallic replacement style mineralization consists of shallow-dipping, bedding-parallel, and steep-dipping, dike-parallel domains. This mineralization extends at least 500 metres down-plunge from the existing resource and 50 to 250 metres laterally from the dike structures and other secondary interpreted feeder structures.

All mineralized interval lengths reported are down-hole intervals, with true width estimates ranging from 60-98% of the reported interval for all composites >5 grade-by-thickness factor (Au g/t*m). See Table 1 in the Appendix of this news release for estimated true widths of individual composites. A standard sampling length of 1.5 metre is used with a minimum of 0.5 metre when required based on geologic contacts. Drill core is mainly HQ diameter, with reduction to NQ where necessary due to drilling depth. The reported composites were not subject high to “capping”. Orla believes that applying a top cut would have a negligible effect on overall grades. Composites for the sulphide drilling were calculated using 1.0 g/t Au cut-off grade and maximum 6 metres consecutive waste.

| Metal prices used in gold equivalent calculation: Au = $1,750/oz, Ag = $21 / oz, Zn = $1.20/lb, Pb = $0.90/lb, Cu = $3.50/lb. See “Gold Equivalent Calculation” below for additional information. All prices in USD. All composites are in the Camino Rojo Extension. |

Qualified Persons Statement

The scientific and technical information in this news release has been reviewed and approved by Mr. Sylvain Guerard, P Geo., SVP Exploration of the Company, who is the Qualified Person as defined under the definitions of National Instrument 43-101.

To verify the information related to the 2024 drilling programs at the Camino Rojo property, Mr. Guerard has visited the property in the past year; discussed logging, sampling, and sample shipping processes with responsible site staff; discussed and reviewed assay and QA/QC results with responsible personnel; and reviewed supporting documentation, including drill hole location and orientation and significant assay interval calculations.

Quality Assurance / Quality Control –2024 Drill Program

All gold results at Camino Rojo were obtained by ALS Minerals (Au-AA23) using fire assay fusion and an atomic absorption spectroscopy finish. All samples are also analyzed for multi-elements, including silver, copper, lead and zinc using a four-acid digestion with ICP-AES finish (ME-ICP61) method at ALS Laboratories in Canada. If samples were returned with gold values in excess of 10 ppm or base metal values in excess of 1% by ICP analysis, samples are re-run with gold (Au-GRA21) by fire assay and gravimetric finish or base metal by (OG62) four acid overlimit methods. Drill program design, Quality Assurance/Quality Control and interpretation of results were performed by qualified persons employing a Quality Assurance/Quality Control program consistent with NI 43-101 and industry best practices. Standards were inserted at a frequency of one in every 50 samples, and blanks were inserted at a frequency of one in every 50 samples for Quality Assurance/Quality Control purposes by the Company as well as the lab. ALS Minerals and ALS Laboratories are independent of Orla. There are no known drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the drilling data at Camino Rojo.

For additional information on the Company’s previously reported drill results, see the Company’s press releases dated February 4, 2021 (Orla Mining Provides Exploration Update), September 12, 2022 (Orla Mining Advances Exploration & Growth Pipeline), January 31, 2023 (Orla Mining Continues to Intersect Wide, Higher-Grade Sulphide Zones and Expose Deeper Potential at Camino Rojo, Mexico) and February 7, 2024 (Orla Mining Concludes 2023 Camino Rojo Sulphides Infill Program with Strong Results). Historical drill results at Camino Rojo were completed by Goldcorp. Inc. (“Goldcorp”), a prior owner of the project. The Company’s independent qualified person, Independent Mining Consultants, Inc. was of the opinion that the drilling and sampling procedures for Camino Rojo drill samples by Goldcorp (and prior to its acquisition by Goldcorp, Canplats Resources Corporation) were reasonable and adequate for the purposes of the Camino Rojo Report, and that the Goldcorp QA/QC program met or exceeded industry standards. See the Camino Rojo Report for additional information.

Gold Equivalent Calculations

The following metal prices in USD were used for the gold metal equivalent calculations: $1,750/oz gold, $21/oz silver, $0.90/lb lead, $1.20/lb zinc, and $3.50/lb copper. Metal recoveries on the Sulphide Extension, based on the total recovery for the sulphide portion of the existing resource estimate, were 86% for gold, 76% for silver, 60% for lead, and 64% for zinc, and based on a preliminary study of similar carbonate replacement deposits were assumed to be 85% for copper. Metal recoveries on the Camino Rojo Extension, based on a preliminary metallurgical study, were 88% for gold and 92% for zinc, and based on a preliminary study of similar carbonate replacement deposits were assumed to be 85% for silver, 85% for lead and 85% for copper.

The following equations were used to calculate gold equivalence:

- Camino Rojo Sulphide AuEq = Au (g/t) + [ Ag (g/t) * 0.0106] + [ Pb (%) * 0.2460 ] + [ Zn (%) * 0.3499 ] + [ Cu (%) * 1.3555 ]

- Camino Rojo Extension AuEq = Au (g/t) + [ Ag (g/t) * 0.0116] + [ Pb (%) * 0.3406 ] + [ Zn (%) * 0.4916 ] + [ Cu (%) * 1.3247 ]

Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for the recoveries used above.

About Orla Mining Ltd.

Orla’s corporate strategy is to acquire, develop, and operate mineral properties where the Company’s expertise can substantially increase stakeholder value. The Company has two material gold projects: (1) Camino Rojo, located in Zacatecas State, Mexico and (2) South Railroad, located in Nevada, United States. Orla is operating the Camino Rojo Oxide Gold Mine, a gold and silver open-pit and heap leach mine. The property is 100% owned by Orla and covers over 139,000 hectares which contains a large oxide and sulphide mineral resource. Orla is also developing the South Railroad Project, a feasibility-stage, open pit, heap leach gold project located on the Carlin trend in Nevada.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE