ORENINC INDEX up on deal-flow improves

ORENINC INDEX – Monday, February 10th 2020

North America’s leading junior mining finance data provider

Sign up for our weekly updates at oreninc.com/subscribe/

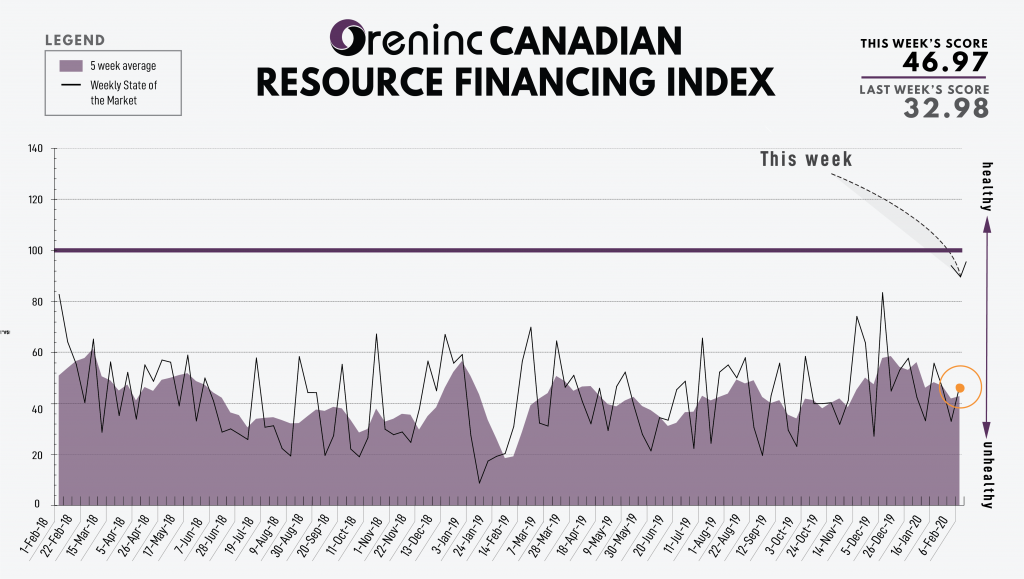

Last Week: 32.98 (Updated)

This week: 46.97

The Oreninc Index rose in the week ending February 7th, 2020 to 46.97 from an updated 32.98 a week ago as more deals were launched, albeit for a lower average amount.

The coronavirus outbreak dominated the news this past week as the number of cases increased and various countries around the world reported cases. In China, where the outbreak started, more than 630 people have died and over 31,000 cases have been confirmed.

With the movement of people in many parts of China restricted and international travel to and from the country having been largely grounded, economic shockwaves are spreading around the world. China’s GDP growth is now expected to come in well under the 6% forecast at the start of the year. With factories shutting as workers stay at home, international supply chains are beginning to feel the strain around the world, while the flow of raw materials to China have slowed with China requesting Chile delay sending shipments of copper, for example.

Oil has been another casualty of the virus outbreak with the price of a barrel of WTI falling to close to fifty bucks, prompting emergency meetings at OPEC headquarters in Vienna to mull production cuts to avert a supply glut further dampening prices.

Positive news is starting to emerge both in terms of containment of the virus, improvement in the rates of those infected who recover and that a vaccine could come sooner than expected.

In the US, President Donald Trump was acquitted of the impeachment charges levelled against him and emerged triumphant and arguably in a stronger position than ever. His State of the Union address was widely viewed as a victory lap as he reeled off a long list of positive economic indicators and other statistics to the chagrin of Democrats. Trump said the booming stock market added more than $12 trillion to the nation’s wealth during his mandate.

Trump also said he has created 7 million jobs over three years. And the jobs news continues to be positive as the ADP Employment Report showed the private sector added 291,000 jobs in January, considerably more than the forecasts of 156,000.

With China’s economy reeling from the impact of the coronavirus, it held out an olive branch to the US by announcing it will halve duties on $75 billion of imports from the US on Valentine’s Day (February 14th) as part of the phase-one trade agreement it agreed with Trump a couple of weeks ago. Washington is set to implement tariff reductions at the same time.

On to the money: total fund raises announced almost halved to $58.9 million, a one-week low, which included one brokered financing for $15 million, a three-week high, and one bought-deal financing for $15.0 million, a nine-week high. The average offer size fell away sharply to $1.8 million, a two-week low, while the number of financings almost doubled to 33.

The gold spot price took a dip to US$1,552/oz as coronavirus fears mounted and spent much of the week clawing back lost ground to close down at $1,570/oz from US$1,589/oz a week ago. The yellow metal is up 3.5% so far this year. The US dollar index saw a strong week as it closed up at 98.68 from 97.39 last week. The VanEck managed GDXJ closed down again at US$40.25 from $41.54 a week ago. The index is down 4.76% so far in 2020. The US Global Go Gold ETF also closed down again at US$16.21 from $16.92 a week ago. It is down 7.69% so far in 2020. The HUI Arca Gold BUGS Index closed down as well at 226.55 from 234.63 last week. The SPDR GLD ETF inventory continued to rise as it closed up at 916.08 tonnes from 903.21 tonnes a week ago.

In other commodities, silver closed down at US$17.70/oz from $18.04/oz a week ago. Copper continues to go through the wringer as a recovery stifled after hitting a low of US$2.50/lb although it closed the week up at $2.55/lb from $2.51/lb a week ago. The oil price continued to soften as WTI closed down again at US$50.32 a barrel from $51.56 a barrel a barrel a week ago.

The Dow Jones Industrial Average rocketed on news of possible containment of the coronavirus, putting on almost 1,000 points to 29,102 from 28,256 a week ago. Canada’s S&P/TSX Composite Index also closed up at 17,655 from 17,318 the previous week. The S&P/TSX Venture Composite Index closed down a smidge at 574.16 from 575.18 last week.

Summary

- Number of financings increased to 33.

- One brokered financing was announced this week for $15 million, a three-week high.

- One bought-deal financing was announced this week for $15 million, a nine-week high.

- Total dollars decreased to $58.9 million, a one-week low.

- Average offer size reduced to $1.8 million, a two-week low.

Financing Highlights

Bear Creek Mining (TSX-V:BCM) opened a $15 million bought deal offering.

- 15 million shares @ $2.10

- Underwritten by a syndicate led by BMO Capital Markets.

- 15% over-allotment option.

- Proceeds will be used to carry out early development works for the Corani silver-lead-zinc deposit in Puno, Peru.

Major Financing Openings

- Bear Creek Mining (TSX-V:BCM) opened a $15 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis. The deal is expected to close on or about February 18th.

- Ascot Resources (TSX-V:AOT) opened a $10 million offering on a best efforts basis. The deal is expected to close on or about February 20th.

- Atex Resources (TSX-V:ATX) opened a $5.1 million offering on a best efforts basis. Each unit includes half a warrant that expires in three years.

- First Mining Gold (TSX:FF) opened a $5 million offering on a best efforts basis. Each unit includes half a warrant that expires in three years. The deal is expected to close on or about February 28th.

Major Financing Closings

- Gran Colombia Gold (TSX:GCM) closed a $40 million offering on a best efforts basis. Each unit included a warrant that expires in three years.

- Africa Energy (TSX-V:AFE) closed a $33.49 million offering on a best efforts basis.

- Eco Oro Minerals (CSE:EOM) closed a $23.46 million offering on a strategic deal basis.

- Talisker Resources (CSE:TSK) closed a $13.06 million offering underwritten by a syndicate led by PI Financial on a bought deal basis.

MORE or "UNCATEGORIZED"

West Red Lake Gold Announces Closing $33 Million Bought Deal Public Offering Including the Full Exercise of the Over-Allotment Option

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is ple... READ MORE

Abitibi Metals Drills 13.15 Metres At 4.82% CuEq in Eastern Drilling At The B26 Deposit

Highlights: The Company has received results from drillholes 1274... READ MORE

Patriot Drills 122.5 m at 1.42% Li2O and 71.4 m at 1.57% Li2O at CV5

Highlights Continued strong lithium mineralization over wide inte... READ MORE

Argonaut Gold Announces First Quarter Financial and Operating Results

Argonaut Gold Inc. (TSX: AR) reported financial and operating res... READ MORE

METALLA REPORTS FINANCIAL RESULTS FOR THE FIRST QUARTER OF 2024 AND PROVIDES ASSET UPDATES

Metalla Royalty & Streaming Ltd. (TSXV: MTA) (NYSE American... READ MORE