ORENINC INDEX down as deal flow reduces, average size increases

ORENINC INDEX – Monday, August 26th 2019

North America’s leading junior mining finance data provider

Sign up for our free newsletter at www.oreninc.com

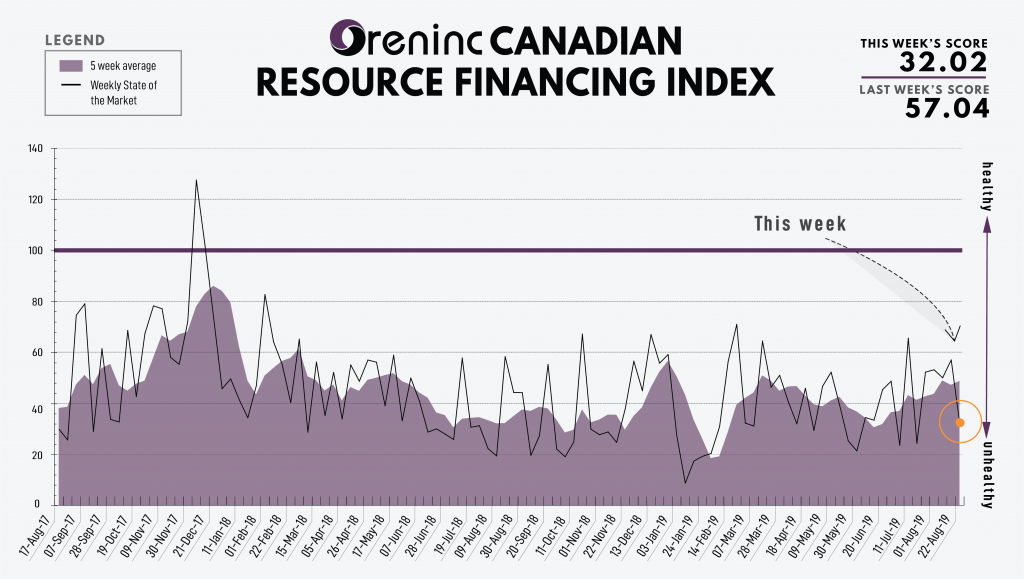

Last Week: 57.04 (updated)

This week: 32.02

The Oreninc Index more fell in the week ending August 23rd, 2019 to 32.02 from an updated 57.04 as the number of deals fell, although the average offer size increased. This followed an updated index score of 50.69 the week ending 2 August when Oreninc was offline for technical reasons during which time gold broke through US$1,500/oz!

Gold investors’ were focused on the Central Bank symposium in Jackson Hole, Wyoming and any indications US Federal Reserve chairman Jerome Powell might give on its future rate setting policy. Gold sold off early in the week presaging dovish comments but the yellow metal rebounded after Powell said the US central bank will act as appropriate to sustain the US economic expansion and that the outlook for the economy continues to be favourable. In effect, Powell gave little indication one way or the other about future interest rate action.

China gave gold a boost as news came out that the Asian nation plans to impose US$75 billion in retaliatory tariffs on US goods including soybeans, cars and oil. Some tariffs will be implemented on September 1st with the remainder on December 15th.

On to the money: total fund raises fell to C$59.3 million, a five-week low, which included three brokered financings for $15.9 million, a two-week low and three bought-deal financings for $15.9 million, also a two-week low. The average offer size increased to $3.7 million, a six-week high, while the number of financings decreased to 16.

Gold saw another strong week as it closed up at US$1,5267oz from $1,513/oz a week ago. The yellow metal is up 19.06% so far this year. The US dollar index closed down at 97.64 from 98.14 last week. The Van Eck managed GDXJ returned to growth as it closed up at US$41.22 from $39.22 a week ago. The index is now up 36.40% so far in 2019. The US Global Go Gold ETF closed up at US$16.95 from $16.16 a week ago. It is up 48.55% so far in 2019. The HUI Arca Gold BUGS Index closed up at 226.21 from 213.65 last week. The SPDR GLD ETF saw its inventory increase to 859.83 tonnes from 843.41 tonnes a week ago, levels last seen in May 2018.

In other commodities, silver closed up at US$17.43/oz from $17.11/oz a week ago. Copper continues to suffer as it closed own at US$2.53/lb from $2.59/lb a week ago. Oil continues to suffer as well as WTI closed down at US$54.17 a barrel from $54.87 a barrel a week ago.

The Dow Jones Industrial Average continued to slide as it closed down at 25,628 from 25,886 a week ago. Canada’s S&P/TSX Composite Index also closed down at 16,037 from 16,149 the previous week. The S&P/TSX Venture Composite Index closed up at 581.95 from 570.43 last week.

Summary

- Number of financings decreased to 16.

- Three brokered financings were announced this week for $15.9 million, a two-week low.

- Three bought-deal financings were announced this week for $15.9 million, a two-week low.

- Total dollars down to $59.3 million, a five-week low.

- Average offer increased to $3.7 million, a six-week high.

Financing Highlights

Thor Exploration (TSX-V:THX) announced a private placement to raise 20.0 million.

- 5 million shares @ $0.20.

- Proceeds to be used for development of its Segilola gold project in Nigeria and exploration in Nigeria and at Douta in Senegal.

- Company decided not to proceed with proposed private placement announced in April, June and July as the 45-day period to close expired.

Liberty Gold (TSX:LGD) announced a bought deal private placement to raise $13.2 million.

- Sprott Capital Partners as lead underwriter

- 0 million shares @ C$0.55.

- 20% overallotment option.

- Proceeds to be used to fund exploration and development of gold and precious metal exploration portfolio in southwest USA, primarily on accelerating exploration and resource growth at the Black Pine project in Idaho, the Goldstrike project in Utah and the Kinsley deposit in Nevada.

- Offering due to close September 10th.

Major Financing Openings

- Thor Explorations (TSX-V:THX) opened a $1 million offering on a best efforts basis.

- Liberty Gold (TSX:LGD) opened a $2 million offering underwritten by a syndicate led by Sprott Capital Partners on a bought deal basis.

- Rupert Resources (TSX-V:RUP) opened a $56 million offering on a best efforts basis.

- African Gold Group (TSX-V:AGG) opened a $5 million offering on a best efforts Each unit includes half a warrant that expires in two years.

Major Financing Closings

- Bonterra Resources (TSX-V:BTR) closed a $96 million offering on a best efforts basis.

- Platinum Group Metals (TSX:PTM) closed a $85 million offering underwritten by a syndicate led by BMO Capital Markets on a bought deal basis.

- Cantex Mine Development (TSX-V:CD) closed a $01 million offering underwritten by a syndicate led by Canaccord Genuity on a bought deal basis.

- Japan Gold (TSX-V:JG) closed a $14 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE