ORENINC INDEX down as brokered action shrank

ORENINC INDEX – Monday, May 4th 2020

North America’s leading junior mining finance data provider

Subscribe for weekly updates at oreninc.com/subscribe

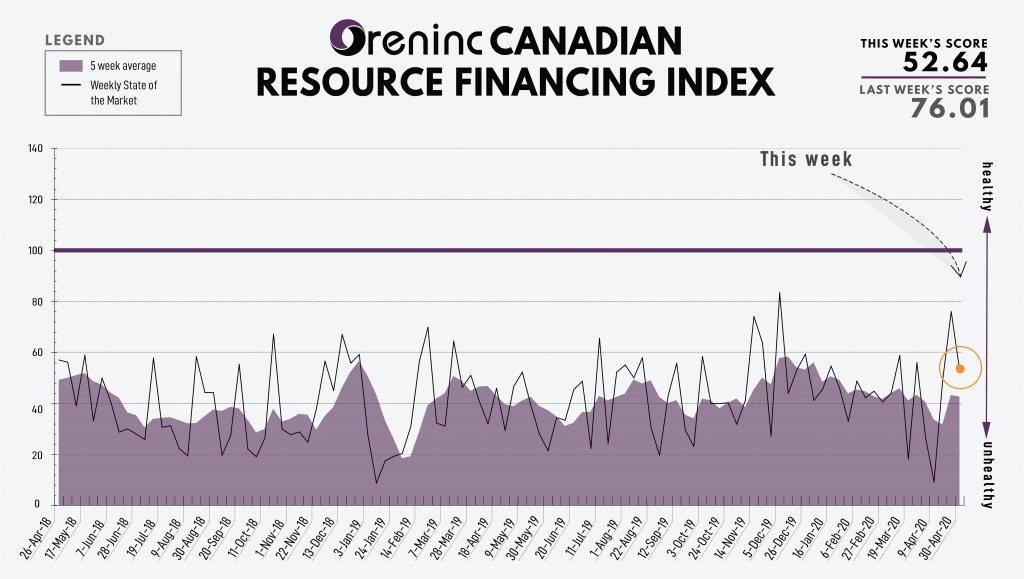

Last Week: 76.01

This week: 52.64

The Oreninc Index fell in the week ending May 1st, 2020 to 52.64 from 76.01 a week ago as brokered action shrank in size.

The COVID-19 virus global death toll increased to over 239,000 and closing in on 3.5 million cases reported, including more than 1 million in the USA.

The USA-China trade war may be heating up as US President Donald Trump blames China for the creation of the COVID-19 virus in one of its laboratories. The US also irked China by sending the USS Barry guided-missile destroyer on a freedom of navigation operation in the South China Sea in waters claimed by China.

Meanwhile, the economic situation facing Americans and their businesses continue to worsen. US GDP fell 4.8% in the first quarter, worse than many observers were expecting and following a similar-sized drop in China. Another 3.84 million people filed first-time jobless claims this past week according to the US Labour Department, the sixth straight week new claims topped 3 million. Some 30.3 million people have filed claims in the past six weeks.

On to the money: financings continued in fine fettle as the total raises announced decreased to $52.29 million, a two-week low, which included two brokered financings for $9.75 million, a two-week low, and two bought-deal financings for $9.75 million, also a two-week low. The average offer size pared back slightly to $5.1 million, a two-week low, while the number of financings fell to 30.

Gold continues to consolidate around the US$1,700/oz level as the spot price closed down at $1,700/oz from $1,729/oz a week ago. The yellow metal is up 12.07% so far this year. The US dollar index pared back to 99.07 from 100.38 last week. The VanEck managed GDXJ also pared back a tad to close down at $41.30 from $41.70 a week ago. The index is down 2.27% so far in 2020. The US Global Go Gold ETF continued to see growth as it closed up at $18.29 from $17.98 a week ago. It is up 4.16% so far in 2020. The HUI Arca Gold BUGS Index closed down slightly at 276.30 from 277.59 last week. The SPDR GLD ETF inventory continued to increase as it closed up at 1,067.9 tonnes from 1,048.31 tonnes last week.

In other commodities, spot silver fell below $15/oz as it closed down at $14.98/oz from $15.25/oz a week ago. Copper shed a couple more cents as it closed down at $2.31/lb frp, $2.33/lb a week ago. A better week for oil as WTI closed up at $19.78 a barrel from $16.94 a barrel a week ago.

The Dow Jones Industrial Average lost ground again as it closed down at 23,723 from 23,775 a week ago. Canada’s S&P/TSX Composite Index closed up again at 14,620 from 14,420 the previous week. The S&P/TSX Venture Composite Index closed up at 473.09 from 462.64 last week.

Summary

- Number of financings decreased to 30.

- Two brokered financings were announced this week for $9.75 million, a two-week low.

- Two bought-deal financings were announced this week for $9.75 million, a two-week low.

- Total dollars decreased to $153.29 million, a two-week low.

- Average offer size fell to $5.1 million, a two-week low.

Financing Highlights

MAG Silver (TSX:MAG) opened and closed a $60 million non-brokered private placement with Eric Sprott.

- 5 million shares @ $13.25.

- Proceeds will fund exploration and development of the Juanicipio silver project in Mexico.

Alphamin Resources (TSX-V:AFM) opened a $42 million non-brokered private placement.

- 1 million shares @ $0.14.

- Prepayment against US$98 million of senior secured debt

- Tremont Master Holdings (48.6% shareholder) subscribed for 251.8 million shares. 60.4 million to be paid in cash and 191.4 million for the assignment and transfer of US$19 million of the amount owning to Tremont under the credit facility.

- Proceeds will be used to prepay at least US$31 million of principal under the credit facility.

Major Financing Openings

- MAG Silver (TSX:MAG) opened a $60 million offering on a strategic deal basis.

- Alphamin Resources (TSX-V:AFM) opened a $42.3 million offering on a best efforts basis. The deal is expected to close on or about November 30th.

- Fosterville South Exploration (TSX-V:FSX) opened a $10 million offering on a best efforts basis. Each unit includes half a warrant that expires in two years.

- Northern Dynasty Minerals (TSX:NDM) opened a $8.75 million offering underwritten by a syndicate led by Cantor Fitzgerald Canada on a bought deal basis. The deal is expected to close on or about May 12th.

Major Financing Closings

- MAG Silver (TSX:MAG) closed a $60 million offering on a strategic deal basis.

- Silvercrest Metals (TSX-V:SIL) closed a $26.98 million offering on a strategic deal basis.

- Thor Explorations (TSX-V:THX) closed a $13 million offering on a best efforts basis.

- Desert Gold Ventures (TSX-V:DAU) closed a $2.57 million offering on a best efforts

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE