ORENINC INDEX doubles as gold continues above US$1,300/oz

ORENINC INDEX – Monday, February 11th 2019

North America’s leading junior mining finance data provider

Free newsletter sign-up at www.oreninc.com

ORENINC MINING DEAL CLUB

Access to high-quality, pre-vetted financing opportunities

Subscribe at www.miningdealclub.com

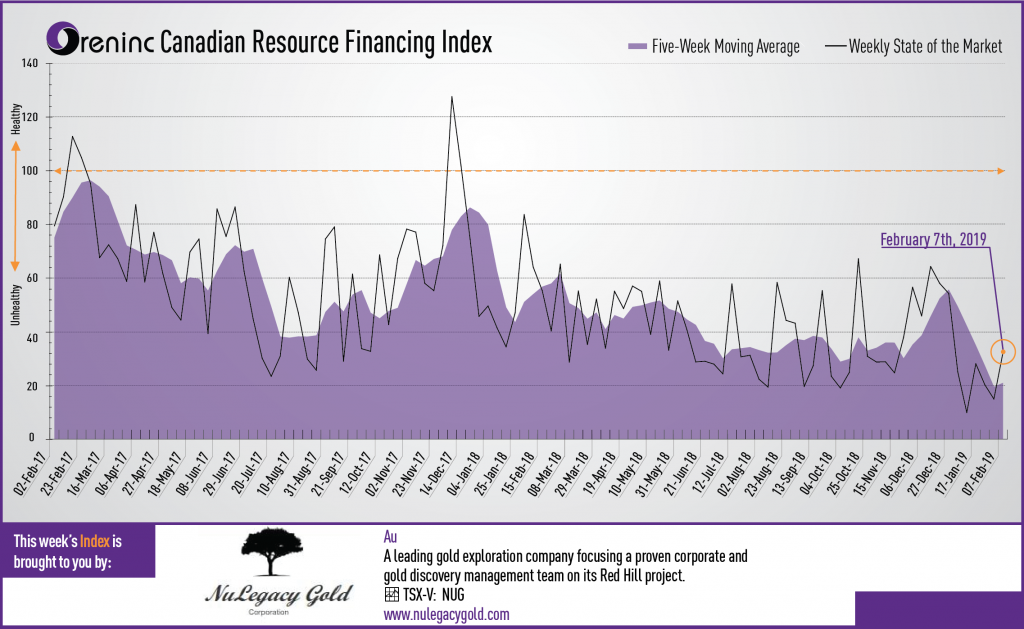

Last week index score: 14.92

This week: 32.13

The Oreninc Index more than doubled in the week ending February 8th, 2019 to 32.13 from 14.92 as the gold price continued to hold about UA$1,300/oz.

With gold continuing to consolidate above the US$1,300/oz level, there were signs of some profit-taking, which many commentators believe is a necessary and welcome prelude to a further future growth push. Mining executives met this past week for the annual Indaba mining conference in South Africa and where Barrick Gold CEO Mark Bristow called for more M&A in the space on the grounds that, “there are too few assets with too many management teams – it’s too inefficient,” and that “the majority of the industry is still struggling to deliver value to long-suffering shareholders.”

A relatively quiet week on the geo-political front with little new noise or disturbance related to China, North Korea, Russia or the Middle East, compared with recent months.

On to the money: total fund raises announced increased to C$31.9 million, a three-week high, that included no brokered financings and no bought-deal financings. The average offer size decreased to C$1.1 million, a two-week low, whilst the number of financings jumped to 30, a seven-week high.

Gold continued to hold firm about the US$1,300/oz mark despite a rising US dollar, to close the week down at US$1,316/oz from US$1,317/oz a week ago, recovering from a low of US$1,306/oz. The yellow metal is up 2.66% this year. The US dollar index showed strength as it closed up at 96.63 from 95.57 last week. The van Eck managed GDXJ put in some strong growth as it closed down at US$32.33 from US$32.84 a week ago. The index is up 6.98% so far in 2019. A similar tale at the US Global Go Gold ETF that closed down at US$12.50 from US$12.64 a week ago. It is up 9.55% so far in 2019. The HUI Arca Gold BUGS Index also closed down at 168.87 from 169.25 last week. The SPDR GLD ETF broke its inventory growth streak of recent weeks as it closed down at 802.12 tonnes from 817.4 tonnes a week ago.

In other commodities, silver gave up some of its recent gains to close down at US$15.82/oz from US$15.91/oz a week ago. Copper continued to strengthen and closed up at US$2.81/lb from US$2.77/lb a week ago. Oil lost a couple of dollars as WTI closed down at US$52.72 a barrel from US$55.26 a barrel a week ago.

The Dow Jones Industrial Average continued to grow as it closed up at 25,106 from 25,063 last week, although it closed the week failing from its mid-week high of 25,411. Canada’s S&P/TSX Composite Index also continued to grow as it closed up at 15,633 from 15,506 the previous week. The S&P/TSX Venture Composite Index closed down at 611.94 from 622.86 last week.

Summary

- Number of financings heightened to 30, a seven-week high.

- No brokered financings were announced this week, a one-week low.

- No bought-deal financings were announced this week, a one-week low.

- Total dollars increased to C$31.9m, a three-week high.

- Average offer size decreased to C$1.1m, a two-week low.

Financing Highlights

International Lithium (TSX-V:ILC) announced a non-brokered private placement of up to 15.4 million flow-through shares @ C$0.065 for gross proceeds of up to $1.0 million.

- The proceeds will be used for exploration on the Raleigh Lake rare metals project in Ontario, Canada.

- The company also announced that the final closing of a non-brokered private placement of up to 50.0 million units @ $0.05 announced in December 2018 was extended until February 28th.

- Each unit consists of one share and half a warrant exercisable @ $0.10 per for two years.

- International Lithium also closed the first tranche of its non-brokered private placement of units for proceeds of $1.2 million and issued 24.0 million shares and 12.0 million warrants.

- The company also announced a non-brokered private placement of convertible debentures of up to £240,000. The debentures will mature in May 2019 and bear interest at 15%. The debenture-holders may convert at any time @ C$0.07 per share.

Major Financing Openings

- International Lithium (TSX-V:ILC) opened a C$5 million offering on a best efforts basis. Each unit includes half a warrant that expires in two years.

- Condor Gold (TSX:COG) opened a C$3.0 million offering on a best efforts Each unit includes half a warrant that expires in two years.

- Miranda Gold (TSX-V:MAD) opened a C$64 million offering on a best efforts basis. Each unit includes a warrant that expires in five years.

- Tudor Gold (TSX-V:TUD) opened a C$5 million offering on a best efforts basis. Each unit includes a warrant that expires in one year.

Major Financing Closings

- NGEx Resources (TSX:NGQ) closed a C$20.0 million offering on a best efforts

- Premier Gold Mines (TSX:PG) closed a C$06 million offering on a strategic deal basis. Each unit included a warrant that expires in three years.

- Platinum Group Metals (TSX:PTM) closed a C$5 million offering on a best efforts basis.

- International Lithium (TSX-V:ILC) closed a C$5 million offering on a best efforts basis.

MORE or "UNCATEGORIZED"

Rupert Resources Reports Results From Project Drilling Including 120m at 6.2g/t Gold

Rupert Resources Ltd. (TSX:RUP) reports assay results from projec... READ MORE

West Red Lake Gold Announces Closing $33 Million Bought Deal Public Offering Including the Full Exercise of the Over-Allotment Option

West Red Lake Gold Mines Ltd. (TSX-V: WRLG) (OTCQB: WRLGF) is ple... READ MORE

Abitibi Metals Drills 13.15 Metres At 4.82% CuEq in Eastern Drilling At The B26 Deposit

Highlights: The Company has received results from drillholes 1274... READ MORE

Patriot Drills 122.5 m at 1.42% Li2O and 71.4 m at 1.57% Li2O at CV5

Highlights Continued strong lithium mineralization over wide inte... READ MORE

Argonaut Gold Announces First Quarter Financial and Operating Results

Argonaut Gold Inc. (TSX: AR) reported financial and operating res... READ MORE