O3 Mining Delivers Positive PEA for Garrison Project

O3 Mining Inc. (TSX-V: OIII) is pleased to announce positive results from the independent Preliminary Economic Assessment on its 100 percent owned Garrison project in the Kirkland Lake region in Ontario, Canada. The PEA has been prepared by Ausenco Engineering Canada Inc. in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

The press release is available on the Corporation’s website at https://o3mining.com/news/

Highlights of the PEA*

(All figures are stated in Canadian dollars unless otherwise stated)

- Long-term gold price: US$1,450/oz

- Exchange rate: C$1.00 = US$0.75

- After-tax net present value at 5% discount rate: $321 million

- After-tax internal rate of return: 33.0%

- After-tax payback period: 2.3 years

- Initial capital: $267 million for a 4.0 million tonne per year processing plant including mine preproduction, infrastructure (roads, power line relocation, tailings facility, ancillary buildings, and water management)

- Life of mine: 12 years

- Average LOM strip ratio: 2.7

- Total mill feed of 47.3 million tonnes resulting in LOM gold production of 1.1 Million oz

- LOM Plan: 82% of total mill feed was sourced from mineral resources classified in the Measured and Indicated category

- Average annual gold production of 121,000 oz in years 1 to 8 (94,000 oz for LOM)

- Average mill head grade of 1.04 g/t gold in years 1 to 8 (0.82 g/t for LOM)

- Average mill recovery: 89.8%

- Measured and Indicated Mineral Resource of 66.3 Mt at 0.86 g/t Au grade

- Cash Cost: US$721/oz

- All-in Sustaining Cost: US$818/oz

| * Cautionary Statement: The reader is advised that the PEA summarized in this news release is intended to provide only an initial, high-level review of the project potential and design options. The PEA mine plan and economic model include numerous assumptions and the use of inferred mineral resources. Inferred mineral resources are considered to be too speculative to be used in an economic analysis except as allowed for by NI 43-101 for PEA studies. There is no guarantee that inferred mineral resources can be converted to indicated or measured mineral resources, and as such, there is no guarantee the project economics described herein will be achieved. |

O3 Mining is pleased to present the results of a PEA on its Garrison Project for an 11,000 tonnes per day open pit mining and Carbon in Leach processing operation with production spanning 12 years clearly demonstrating the potential for the company to become a major North American gold producer. The PEA delivers robust economics with an after-tax IRR of 33.0% and after-tax NPV of $321M at a US$1,450/oz gold price, with very attractive cash costs and AISC, low CAPEX and low capital intensity. The project will target production in excess of 121,000 ounces gold per year during years 1 to 8, while peaking at more than 155,000 ounces in Year 2.

“Garrison has been in the shadow of our Marban and Alpha properties in Québec but as this PEA shows, it is an integral part of the value proposition of O3 Mining. Garrison came from Osisko Mining Inc., which completed first-class exploration work that defined the initial resource. We have worked with Ausenco to produce a high-quality PEA that focuses on capital efficiency and demonstrates the value of Garrison to O3 Mining. Today, Garrison is a 2.9-million-ounce deposit in the heart of one of the most recognised mining districts in Canada. We are thrilled that the PEA has shown a production profile of 121,000 ounces per year during the first eight years at very attractive economics. The Corporation is ready to maximize Garrison’s value by advancing the studies to further de-risk the project,” said Jose Vizquerra, President, CEO and Director of O3 Mining.

“The Garrison PEA demonstrates an NPV of $321 million which follows hot on the heels of our Marban PEA (See Press Release September 8, 2020) in Québec which also demonstrated compelling project economics with an after-tax NPV of $423 million, an IRR of 25.2% with a 15 year mine life and an average annual gold production of 115,000 oz. Together these PEAs mark the transition of O3 Mining from an explorer to an up-and-coming gold developer with a total NPV of $744 million of fundamental value,” added Mr. Vizquerra.

The Corporation looks forward to working with its partners in the Timmins-Kirkland Lake area including the Matheson municipalities and the Wahgoshig First Nation community (Wahgoshig) as well with the support of the Ontario and federal governments, to advance the Garrison Project.

Overview

Ausenco was appointed as lead consultant on September 16, 2020 to prepare the PEA in accordance with NI 43-101, and was assisted by Moose Mountain Technical Services.

The Garrison Project is located in Timmins-Kirkland Lake area of northeastern Ontario along the Highway 101 corridor, approximately 40 km east of Matheson, 40 km north of town of Kirkland Lake, and 100 km east of the city of Timmins). Geologically, the project is situated along the Porcupine-Destor break in the Abitibi Greenstone Belt (AGB) and contains the Garrcon, JonPol, and 903 Deposits.

Financial Analysis

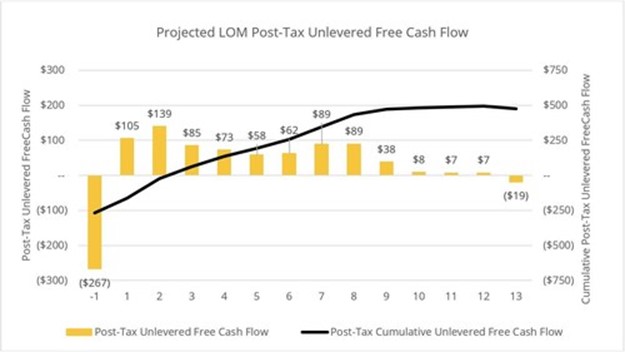

The economic analysis was performed assuming a 5% discount rate. On a pre-tax basis, the NPV5% is $470 million, the IRR is 41.1% and the payback period is 2.0 years. On an after-tax basis, the NPV5% is $321 million, the IRR is 33.0% and the payback period is 2.3 years. A summary of project economics is listed in (Table 1) and shown graphically in the figures below.

Table 1: Summary of project economics

| GENERAL | LOM TOTAL / AVG. |

| Gold Price (US$/oz) | $1,450 |

| Exchange Rate ($US:$CAD) | 0.75 |

| Mine Life (years) | 12.0 |

| Total Waste Tonnes Mined (kt) | 128,260 |

| Total Mill Feed Tonnes (kt) | 47,343 |

| Strip Ratio | 2.7 |

| PRODUCTION | LOM TOTAL / AVG. |

| Mill Head Grade (g/t) (Average gold mill head grade of 1.04 g/t in years 1 to 8) | 0.82 |

| Mill Recovery Rate (%) | 89.8% |

| Total Mill Ounces Recovered (koz) | 1,126 |

| Total Average Annual Production (koz) | 94 |

| OPERATING COSTS | LOM TOTAL / AVG. |

| Mining Cost ($/t Mined) | $2.7 |

| Mining Cost ($/t Milled) | $9.9 |

| Processing Cost ($/t Milled) | $11.2 |

| G&A Cost ($/t Milled) | $1.0 |

| Total Operating Costs ($/t Milled) | $22.1 |

| Refining & Transport Cost ($/oz) | $2.5 |

| Royalty NSR | 1.5% |

| Cash Costs (US$/oz Au) | $721 |

| AISC (US$/oz Au) | $818 |

| CAPITAL COSTS | LOM TOTAL / AVG. |

| Initial Capital ($M) | $267 |

| Sustaining Capital ($M) | $126 |

| Closure Costs ($M) | $30 |

| Salvage Value ($M) | $11 |

| FINANCIALS – PRE TAX | LOM TOTAL / AVG. |

| NPV (5%) ($M) | $470 |

| IRR (%) | 41.1% |

| Payback (years) | 2.0 |

| FINANCIALS – POST TAX | LOM TOTAL / AVG. |

| NPV (5%) ($M) | $321 |

| IRR (%) | 33.0% |

| Payback (years) | 2.3 |

| NPV/ Initial CAPEX | 1.2 |

Notes

* Cash costs consist of mining costs, processing costs, mine-level general & administrative expenses and refining charges and royalties.

** AISC includes cash costs plus sustaining capital, closure cost and salvage value.

Figure 1: Projected Annual and Cumulative LOM Post-Tax Unlevered Free Cash Flow

Sensitivity

A sensitivity analysis was conducted on the base case pre-tax and after-tax NPV and IRR of the project, using the following variables: metal price, total CAPEX (initial + sustaining), total operating cost and exchange rate. The tables below provide a summary of the sensitivity analysis.

Table 2a: Post-Tax NPV (5%) Sensitivity

| GOLD PRICE US$/Oz |

BASE CASE | INITIAL CAPEX (-25%) |

INITIAL CAPEX (+25%) |

OPEX

(-25%) |

OPEX (+25%) |

FX

(-25%) |

FX

(+25%) |

| $1,100 | $47 | $111 | ($16) | $186 | ($112) | $333 | ($162) |

| $1,250 | $167 | $230 | $103 | $301 | $25 | $484 | ($38) |

| $1,450 | $321 | $384 | $257 | $452 | $185 | $686 | $96 |

| $1,750 | $547 | $611 | $484 | $679 | $415 | $989 | $283 |

| $2,000 | $737 | $801 | $673 | $868 | $605 | $1,242 | $434 |

Table 2b: Post-Tax IRR Sensitivity

| GOLD PRICE US$/Oz |

BASE CASE | INITIAL CAPEX (-25%) |

INITIAL CAPEX (+25%) |

OPEX

(-25%) |

OPEX (+25%) |

FX

(-25%) |

FX

(+25%) |

| $1,100 | 10.2% | 20.4% | 3.5% | 22.0% | 0.0% | 34.0% | 0.0% |

| $1,250 | 21.2% | 33.5% | 13.3% | 30.8% | 8.2% | 44.6% | 0.1% |

| $1,450 | 33.0% | 48.3% | 23.6% | 41.5% | 23.5% | 58.2% | 15.0% |

| $1,750 | 49.0% | 68.7% | 36.9% | 56.7% | 40.8% | 77.2% | 30.2% |

| $2,000 | 61.5% | 84.8% | 47.3% | 68.7% | 53.9% | 92.5% | 41.1% |

Mineral Resource

The Mineral Resource is estimated from a drill hole database containing 1,378 drill holes within the model boundaries, including 257,889 assay intervals for a total assayed length of 258,223 metres. Interpolations are done using multiple indicator kriging (MIK) within four domains defined by lithology and faulting. Classification to Indicated is based on the average distance to two drill holes of less than 25-50 metre spacing depending on the domain.

Classification is then adjusted to ensure continuity of blocks with Inferred adjusted to minimize extrapolation of grades. The base case cut-off grade is 0.30 g/t Au based on metallurgical recoveries, Processing + G&A costs of $14.50/tonnes and a US$1,400/oz Au price, with smelter terms as detailed in the notes below. The Measured and Indicated mineral resource is estimated at 66.3 Mt at 0.86 g/t Au for a total of 1.8Moz, and the Inferred Mineral resource is 45.3Mt at 0.73 g/t Au for a total of 1.1Moz. Table 3 summarizes the Resource Estimate at a 0.3g/t cut-off.

Table 3: Mineral Resource Estimate (effective date November 25, 2020)

| CLASS | SOURCE | TONNAGE (Kt) | AU (G/T) |

AU METAL (kOz) |

| Indicated | 903 | 27,558 | 0.843 | 747 |

| Jonpol | 17,786 | 0.914 | 523 | |

| Garrcon | 20,923 | 0.821 | 552 | |

| All Indicated | 66,268 | 0.855 | 1,822 | |

| Inferred | 903 | 30,760 | 0.690 | 682 |

| Jonpol | 7,521 | 0.756 | 183 | |

| Garrcon | 7,056 | 0.866 | 197 | |

| All Inferred | 45,337 | 0.729 | 1,062 | |

Notes:

- The Mineral Resource estimate has been prepared by Sue Bird, P.Eng., an independent Qualified Person, from Moose Mountain Technical Services.

- Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The open-pit Mineral Resource has been confined by a “reasonable prospects of eventual economic extraction” pit shell generated using the following assumptions: US$1,800/oz. Au at a currency exchange rate of 0.75 US$ per C$; 99.95% payable Au; $4.30/oz Au offsite costs (refining, transport and insurance); a 2% NSR royalty; $14.50/t process and G&A costs; $2.40/t mining costs and pit slopes of 25 degrees in the overburden and 40 degrees below the overburden. Metallurgical recovery is 90.5% at 903, 95.5% at Garrcon, 92.45% at JonPol-non-refractory and 56.2% in JonPol-refractory.

- The specific gravity of the deposit has been determined by lithology as being between 2.74 and 3.32.

- Numbers may not add due to rounding.

There are no other known factors or issues that materially affect the Mineral Resource estimate other than normal risks faced by mining projects in the province in terms of environmental, permitting, taxation, socio-economic, marketing, and political factors and additional risk factors as listed in the “Cautionary Note Regarding Forward-Looking Information” section below.

Mining

The mine plan includes 47 Mt of mill feed and 128 Mt of waste over the 12-year mine life coming from three deposits: 903, Jonpol, and Garrcon. Mine planning is based on conventional open-pit methods suited for the project location and local site requirements. Owner-operated and managed open pit operations are anticipated to begin one year prior to mill start-up, run for nine years to pit exhaustion, followed by three years of low-grade stockpile reclamation to the mill. The subset of Mineral Resources contained within the targeted open pit shells, summarized in Table 4 with a 0.30 g/t Au cut-off grade, forms the basis of the PEA mine plan and production schedule.

Table 4: PEA Mine Plan Production Summary

| CATEGORY | VALUE |

| PEA Mill Feed | 47,343 kt |

| Average Mill Feed Gold Head Grade | 0.82 g/t Au |

| Waste Overburden and Rock | 128,260 kt |

| Strip Ratio | 2.7 |

| Mill Feed Gold Grade (Years 1-5) | 1.11 g/t Au |

| PEA Mill Feed | 47,343 kt |

Notes:

- The PEA Mine Plan and Mill Feed estimates are a subset of the December 10, 2020 Mineral Resource estimate and are based on open-pit mine engineering and technical information developed at a Scoping level for the 903, JonPol, and Garrcon deposits.

- PEA Mine Plan and Mill Feed estimates are mined tonnes and grade, the reference point is the primary crusher.

- Cut-off grade 0.30 g/t Au assumes US$1,400/oz. Au at a currency exchange rate of 0.75 US$ per C$; 99.95% payable gold; $4.30/oz offsite costs (refining, transport, and insurance); a 2.0% NSR royalty; and a 90% metallurgical recovery.

- The cut-off grade covers processing costs of $12.00/t, administrative (G&A) costs of $1.00/t, and low-grade stockpile Rehandle costs of $1.50/t.

- Mining dilution of 20% at 0.10 g/t is applied to the in-situ Mineral Resources. Mining Recovery of 96% of diluted tonnages is assumed.

- Estimates have been rounded and may result in summation differences.

The economic pit limits are determined using the Pseudoflow algorithm. The 903 deposit is planned as one pit split into three phases or pushbacks. The Jonpol deposit is planned as one pit split into two phases. The Garrcon deposit is planned as five pits with the largest (western) pit split into 2 phases. Pit shells are generated with 40-degree overall slope angles in bedrock and 25-degree slope angles in the overburden.

Detailed pit configurations with benching and ramps have not been carried out. Chosen phase shell targets have room for these details to be added in future planning and modifications to pit contents are not expected to be materially altered. General pit sequencing is shown in Table 5 below.

Table 5: PEA Mine Plan Pit Sequencing

| PHASES MINED | Y-1 | Y01 | Y02 | Y03 | Y04 | Y05 | Y06 | Y07 | Y08 | Y09 |

| 903 Phase 1 | X | X | X | X | ||||||

| 903 Phase 2 | X | X | X | X | X | |||||

| 903 Phase 3 | X | X | X | X | X | X | X | X | ||

| Jonpol Phase 1 | X | X | X | X | ||||||

| Jonpol Phase 2 | X | X | X | X | X | |||||

| Garrcon Phase 1 | X | X | X | |||||||

| Garrcon Phase 2 | X | X | X | X | X | X | X | |||

| Garrcon Phase 3 | X | X | X | X |

The mill will be fed with material from the pit at an average rate of 4.0 Mtpa (11ktpd). Cut-off grade optimization is employed, which feeds a low-grade stockpile north of the primary crusher, which is planned for reclamation to the mill in the later years of the mine life. Overburden will be placed in various stockpiles throughout the project. Waste rock will be placed in two main stockpiles adjacent to all pits. The mine plan includes backfill of waste rock into the smaller mined out Garrcon pits.

Mining operations will be based on 365 operating days per year with two 12-hour shifts per day. An allowance of 10 days of no mine production has been built into the mine schedule to allow for adverse weather conditions. The mining fleet will include diesel-powered down the hole (DTH) drills with 165mm bit size for production drilling, diesel-powered RC (reverse circulation) drills for bench-scale grade control drilling, 12 m3 bucket size diesel hydraulic excavators, and 13 m3 bucket-sized wheel loaders for production loading, and 91 t payload rigid-frame haul trucks and 36 t articulated trucks for production hauling, plus ancillary and service equipment to support the mining operations. In-pit dewatering systems will be established for each pit. All surface water and precipitation in the pits will be handled by submersible pumps.

The mine equipment fleet is planned to be purchased via a lease financing arrangement. Owner-managed maintenance on mine equipment will be performed in the field with major repairs in the shops located near the primary crusher.

Milling

The Garrison Process Plant employs standard Carbon-In-Leach (CIL) technology along with gravity concentration for gold recovery. The plant includes crushing, grinding, gravity concentration, classification, leach and CIL, and detoxification before deposition into a Tailings Storage Facility. The plant will treat 4.0 Mt of ore per year at an average throughput of 11,000 tonnes per day.

The mill design availability is 8,059 hours per year or 92%. The plant has been designed to realize an average recovery of 89.8% (92.3% Au during initial high-grade production) of the gold over the life of the project based on metallurgical test work completed at various laboratories in Canada and the USA between 2011 and 2018. Of this, 24.5% of the gold will be extracted by the gravity circuit and a further 65.3% by the leach/CIL process.

Tailings storage capacity has been identified to safely accommodate the life of mine production as described in this PEA. Tailings produced over the first eight years of mine operation will be accommodated in a new tailings storage facility to be constructed south of the open pits The tailings storage facility perimeter containment dams will be constructed with waste rock and overburden from open pit mine development and will utilize the downstream construction method to ensure safe tailings storage over the long-term.

Runoff from the tailings storage facility will be collected in an adjacent water management pond. In order to allow mining of the Garrcon Pit – Phase #3 in Year 4, the adjacent highway will be diverted to the North.

Capital and Operating Costs

The total pre-production capital cost for the Garrison Project is estimated to be $267M including allowances for indirect costs and contingency of $29M and $38M respectively. Sustaining capital costs are estimated at $126M, including closure costs (Table 6). Operating costs are estimated at $22.1 per tonne milled (Table 7).

Table 6: Total Capital and Operating Costs

| COST AREA DESCRIPTION | INITIAL CAPITAL COST

($M) |

SUSTAINING CAPITAL COST ($M) |

TOTAL CAPITAL COST ($M) |

| Mining | $40 | $113 | $153 |

| Processing | $115 | — | $115 |

| Infrastructure (and Tailings) | $35 | $13 | $48 |

| Indirect Costs | $29 | — | $29 |

| Owner’s Project Costs | $9 | — | $9 |

| Contingency | $38 | — | $38 |

| Total | $267 | $126 | $393 |

Table 7: Total Life of Mine Operating Costs

| COST AREA | LOM ($M) |

ANNUAL AVG. COST ($M) |

AVG. LOM

($/T MINED) |

AVG.LOM

($/T |

AVG. LOM (US$/OZ) |

OPEX (%) |

| Total Mine Operating Costs Including Reclaiming Costs |

$469 | $39 | $2.7 | $9.9 | $313 | 45% |

| Total Mill Processing Including Water Treatment Costs |

$532 | $44 | $3.0 | $11.2 | $355 | 51% |

| Total G&A Costs | $45 | $4 | $0.3 | $1.0 | $30 | 4% |

| Total | $1,047 | $87 | $6.0 | $22.1 | $698 | 100% |

Gold Production

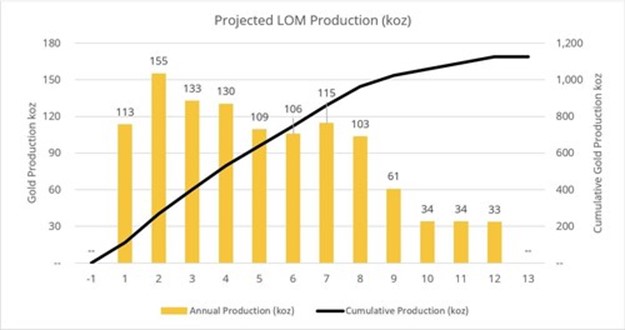

Projected gold production averages 121,000 ounces per year over years 1 to 8, peaking at 155,000 ounces in year two. The LOM production averages 94,000 ounces per year.

Figure 3: Projected LOM Production (koz)

Opportunities to further increase NPV

Database refinement and additional QAQC work along with infill drilling could upgrade the classification from Inferred to Indicated or Measured. Additional structural and geologic studies as well as step-out drilling along strike of the mineralization could extend the resource both laterally and at depth.

The PEA mine plan does not exploit the entire Mineral Resource. There is project expansion opportunity to be further investigated during the next study phase, which could include more, or all, of the additional Mineral Resource.

Additional metallurgical test work will be targeted at increasing the leach feed grind size, and assessing a wider variability of resource hardness, to in turn reduce mill equipment sizing. Additional testing of JonPol samples to improve recoveries should also be completed.

Next Steps

The results of the PEA indicate that the proposed Project has technical and financial merit using the base case assumptions. It has also identified additional field work, metallurgical test work, trade-off studies and analysis required to support more advanced mining studies.

The Qualified Persons consider the PEA results sufficiently reliable and recommend that the Garrison Project be advanced to the next stage of development through the initiation of a pre-feasibility study and working towards completion of an Environmental Impact Study for the Project while exploring the geological potential of the Garrison project.

PEA Details

The independent PEA was prepared through the collaboration of the following firms: Ausenco, and Moose Mountain Technical Services. These firms provided mineral resource estimates, design parameter and cost estimates for mine operations, process facilities, major equipment selection, waste and tailings storage, reclamation, permitting, and operating and capital expenditures. Table 8 summarizes the contributors and their area of responsibility.

Table 8: Consulting Firm and Area of Responsibility

| CONSULTING FIRM |

AREA OF RESPONSIBILITY |

| Ausenco Engineering Canada |

· Metallurgical test work development and analysis; · Mass balance; · Process plant design; · Process plant capital costs and operating costs; · Electrical and IT infrastructure design and costs; · Design and costs of utilities and infrastructure including on-site roads; · Material transport and General and administration operating costs; · Financial Analysis and overall NI 43-101 integration; · Water treatment plant design, capital and operating costs; · Tailings, ore and waste rock management facility designs and costs; · Surface water management infrastructure design and costs; · Site wide water balance; · Rock mass characterization and rock mechanics input to pit design; · Hydrogeology; · Geotechnical input for surface infrastructure design; · Waste rock, tailings, and ore geochemical characterization; · Groundwater quality input to environmental studies; · Environmental studies, permitting and closure costs; · Regulatory context, social considerations, and anticipated environmental issues.

|

| Moose Mountain Technical Services |

· Historical data review; · Current and historical geology, exploration, drilling; · Sample preparation and QAQC, and data verification; · Mineral resource estimate (O3 completed geological modelling of ore bodies); · Geotechnical input for pit design; · Mine and mine infrastructure design; · Mine production scheduling; and · Mine capital costs and operating costs.

|

Qualified Person

All technical information, not pertaining to the PEA, in this news release has been reviewed and approved by Mr. Louis Gariepy, Eng. (OIQ #107538), VP Exploration, who is a “qualified person” as defined by NI 43-101).

The PEA has been prepared by Ausenco. The contributors to the report are QPs under NI 43-101 and are independent of O3 Mining for the purposes of the NI 43-101. The technical content of the PEA and this press release has been reviewed and approved by:

Tommaso Roberto Raponi, P.Eng, Process and Infrastructure

Scott Elfen, P.E., Tailings and Water Management

Mike Petrina, P.Eng, Mining

Sue Bird, P.Eng, Resource Estimate

Scott Weston, P.Eng, Environment

Quality Control and Reporting Protocols

The primary lab for O3 Mining is SGS in Cochrane, Ontario is an independent accredited laboratory. The core samples shipped to SGS are crushed to 75% passing -2 mm (10 mesh), a 250 g split of this material is pulverized to 85% passing 75 microns (200 mesh) and 30 g is analyzed by Fire Assay (FA) with an inductively coupled plasma atomic emission spectroscopy (ICP-AES) finish. For samples with visible gold or metallic minerals, or initial fire assay values greater than 3g/t, the metallic screen lead fire assay is used. A sample of certified standard material, a duplicate and a blank are inserted by O3 Mining’s geologists into each set of 20 submitted samples as part of the Quality Assurance, Quality Control (“QAQC”) program. Duplicate pulps are submitted to the secondary laboratory, Bureau Veritas, as part of the check assay program.

For drilling in the 2000s, prior to ownership by O3 Mining, the assaying and QAQC program was similar to that employed by the Corporation and has been reviewed. Some samples of historic core have been re-assayed during the modern era assay program. To the extent historic core logs exist for the historic drilling, they have been reviewed. The drill program design, QAQC and interpretation of results are performed by qualified persons employing a QAQC program consistent with NI 43-101 and industry best practices.

O3 Mining’s CEO Jose Vizquerra shared results of its Preliminary Economic Assessment on its Garrison Project located in the heart of Kirkland Lake, Ontario, one of the most recognized mining districts in Canada.

Figure 1: Projected Annual and Cumulative LOM Post-Tax Unlevered Free Cash Flow (CNW Group/O3 Mining Inc.)

Figure 2: Site Plan (CNW Group/O3 Mining Inc.)

Figure 3: Projected LOM Production (koz) (CNW Group/O3 Mining Inc.)

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE