O3 Mining Continues To Expand Marban Open Pit Mineralization

O3 Mining Inc. (TSX-V: OIII) (OTCQX: OIIIF) is pleased to provide an update on its fully-funded 250,000 metre drilling program at its Marban and Alpha properties in Val-d’Or, Québec, Canada which seeks to convert, expand, and discover new gold resources. The company is reporting nine holes in this release drilled in and around the Marban open-pittable deposits.

Marban Open Pits

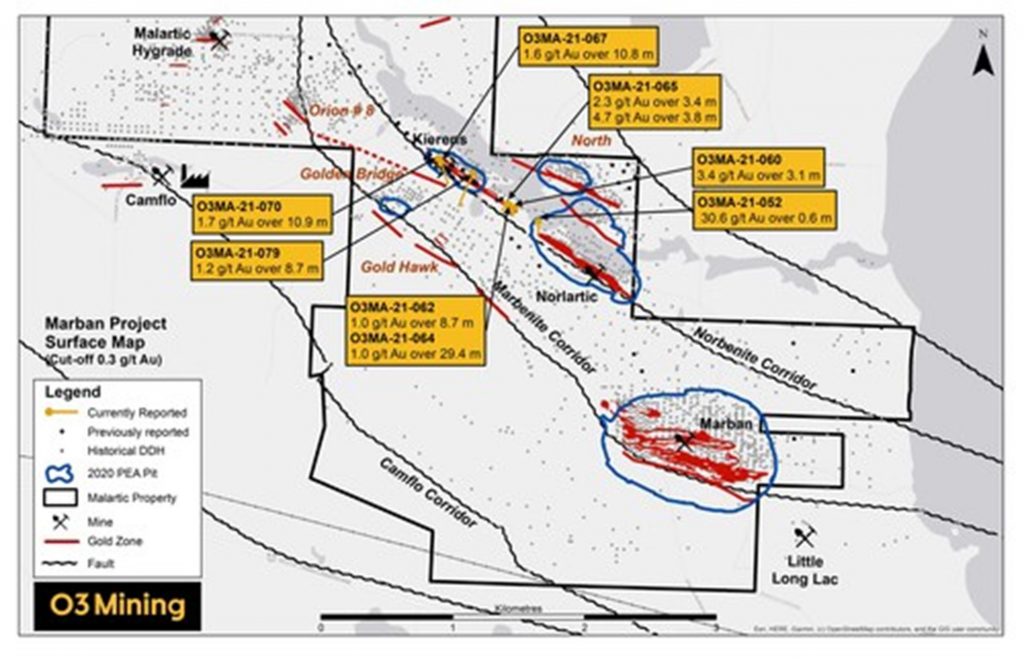

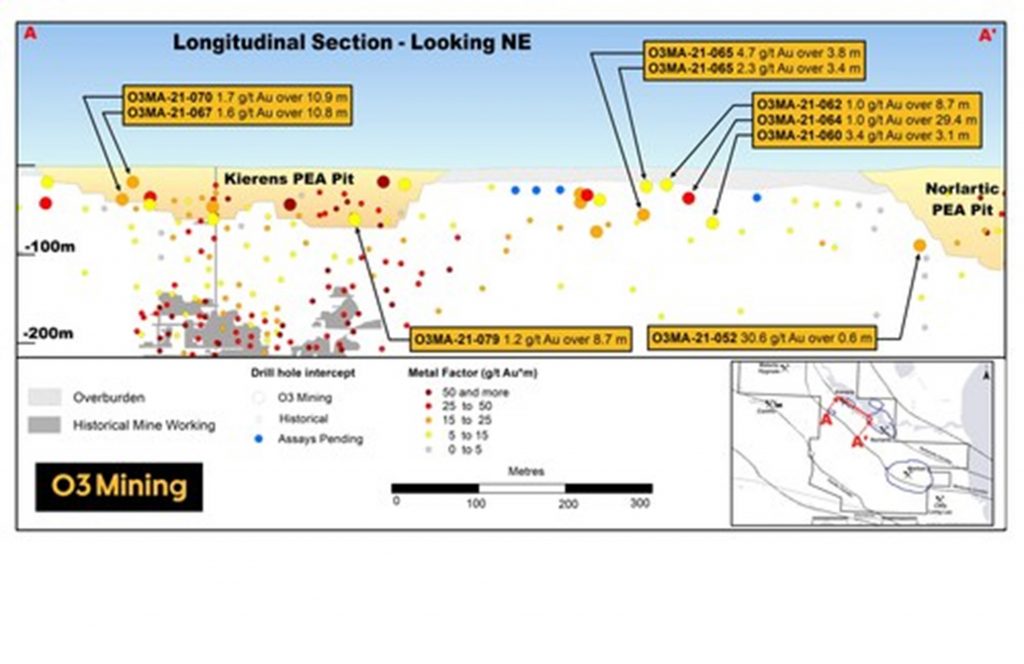

Drilling around the Kierens-Norlartic deposits included holes located between the current proposed pits which confirmed the potential to both expand mineralization outside of the current Kierens-Norlartic proposed pit areas as well as the possibility of combining the pits into one large open-pit with a potential strike length of more than two kilometres.

Drilling Highlights:

- 3.4 g/t Au over 3.1 metres in hole O3MA-21-060

- 1.0 g/t Au over 29.4 metres in hole O3MA-21-064

- 2.3 g/t Au over 3.4 metres and 4.7 g/t Au over 3.8 metres in hole O3MA-21-065

A 3D-model of the Marban project is available on the Company’s website at: https://o3mining.com/presentations/drill-results

The company continues to extend gold mineralization with the potential to increase resources within trucking distance of the planned Marban processing infrastructure as stated in the Preliminary Economic Assessment released on September 08, 2020. The PEA outlined production of 115,000 ounces a year for more than 15 years following an initial capital expenditure of C$256 million.

O3 Mining’s President and Chief Executive Officer, Mr. Jose Vizquerra commented; “We continue to add value to our shareholders through our aggressive drilling program. Today’s results combined with our previously reported results within the open-pittable areas on June 1st, 2021 further show our potential to expand the open pits at Marban and ultimately increase the existing resource. Drilling will continue to seek to expand the size of these areas as well as expanding Marban mineralization at depth”.

Table 1: Drill Hole Intercepts (only intercepts above 5 g/t Au * m are reported, cut-off 0.3 g/t Au and above 200 vertical metres)

| Drill Hole | From (m) |

To (m) |

Interval (m) |

Au (g/t) | Zone |

| O3MA-21-052 | 118.0 | 118.6 | 0.6 | 30.6 | Kierens-Norlartic |

| O3MA-21-060 | 89.3 | 92.4 | 3.1 | 3.4 | |

| O3MA-21-062 | 17.9 | 26.6 | 8.7 | 1.0 | |

| O3MA-21-064 | 29.3 | 58.7 | 29.4 | 1.0 | |

| O3MA-21-065 | 25.8 | 29.2 | 3.4 | 2.3 | |

| O3MA-21-065 | 69.8 | 73.6 | 3.8 | 4.7 | |

| O3MA-21-067 | 14.6 | 25.4 | 10.8 | 1.6 | |

| O3MA-21-070 | 40.9 | 51.8 | 10.9 | 1.7 | |

| O3MA-21-079 | 80.7 | 89.4 | 8.7 | 1.2 |

The drilling highlights consists of a stockwork of quartz veinlets with disseminated pyrite within intermediate and mafic dykes as well as a basaltic unit within the hanging wall of the Norbenite Shear. This geology is consistent with the description of the mineralized zones of the historical mines in and around the Marban property.

Figure 1: Marban Project Drilling Map

Figure 2: Marban Open Pits Longitudinal Section

Drilling Update

The Corporation drilled 86,000 metres during 2019 and 2020 on its Val-d’Or properties testing for Potential Economic Material with 100-metre step-outs aiming to expand current resources of 2.4 million ounces measured and indicated (62.0 Mt @ 1.22 g/t Au)1 and 1.5 million ounces inferred (20.2 Mt @ 2.27 g/t Au)1 and make new discoveries. O3 Mining expects to release more drilling results from its 2021 winter program at Alpha within the next few weeks.

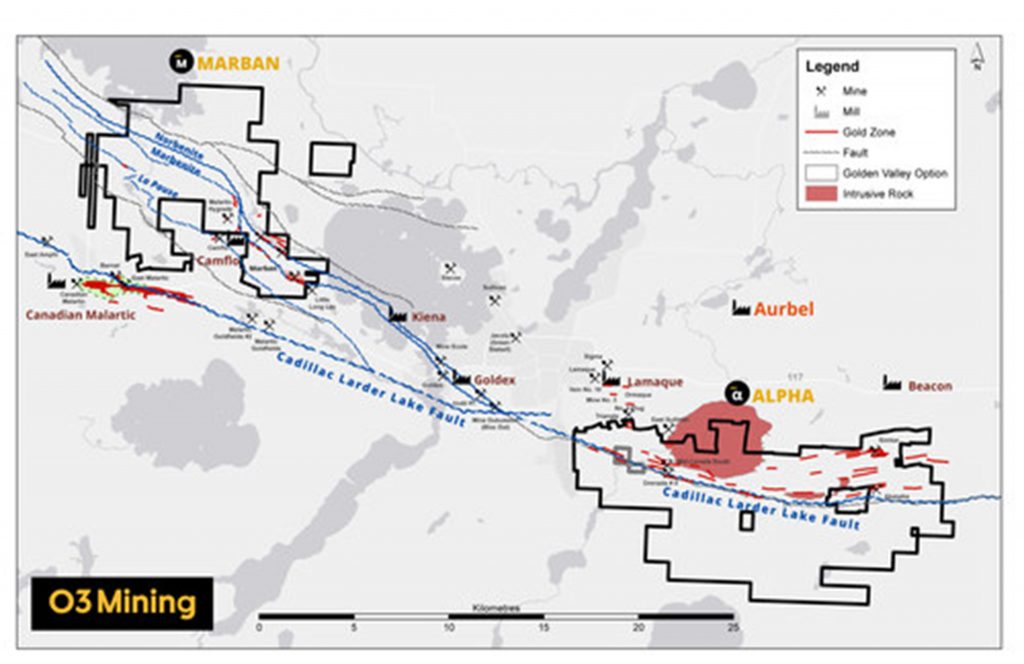

Figure 3: Marban and Alpha Properties Overview

Marban – Project Development

The Marban project is in the heart of the Malartic gold mining camp. It covers 7,525 hectares, and is located 12 kilometres from the Canadian Malartic Mine. The Marban PEA outlined production of an average 115,000 ounces of gold per year over the 15.2 year mine life.

Drilling at Marban has focused on expanding mineralization in and outside of the proposed PEA pit areas, as well as discovering new mineralization for an underground mining scenario. An 80,000 metre drill program is being executed this year, with 27,640 metres drilled so far. There will be up to eight drill rigs testing for PEM, as well as, aiming to convert resources from Inferred to Measured and Indicated, to ultimately become part of Marban’s maiden mineral reserve.

A PEA was completed on the project in 2020, and a Pre-Feasibility Study (“PFS”) is currently underway and due to be completed in 2022 as the next step to advance the project to production. O3 Mining aims to become a leading gold producer and put the Marban project into production by 2026.

Alpha – Advanced Exploration

The Alpha property is located 8 kilometres east of Val-d’Or, Québec, and 3 kilometres south of the El Dorado Lamaque Mine. The property covers more than 7,754 hectares and includes 20 kilometres of the prolific Cadillac Break. O3 Mining has an option agreement that grants the right to acquire 100 per cent interest in the Aurbel Mill located only 10 kilometres from the Alpha property for C$5.0M within the next five years.

Drilling at Alpha is at an earlier stage than at Marban and has focused on grassroots exploration, deposit delineation, and resource expansion. A 56,000 metre program is being executed this year with 38,001 metres completed year to date. O3 Mining will have up to three drill rigs testing for new discoveries using its PEM drilling strategy as well as focusing on deposit delineation and expansion of the current resource. Drilling results from Alpha will be released in the coming weeks as soon as assay results become available.

| 1/ Mineral Inventory: i) Marban Technical Report 2020, ii) Orenada Technical Report 2018, iii) Akasaba Technical Report 2014, iv) Simkar Gold Technical Report 2015, v) East Cadillac Technical Report 2017, vi) Sleepy Technical Report 2014 |

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Mr. Louis Gariepy. (OIQ #107538), VP Exploration, who is a “qualified person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Quality Control and Reporting Protocols

True width determination is currently unknown but is estimated at 65-80% of the reported core length interval for the zones. Assays are uncut except where indicated. Intercepts occur within geological confines of major zones but have not been correlated to individual vein domains at this time. Half-core samples are shipped to Agat laboratory in Val-d’Or, Québec, and Mississauga, Ontario for assaying. The core is crushed to 75% passing -2 mm (10 mesh), a 250 g split of this material is pulverized to 85% passing 75 microns (200 mesh) and 50 g is analyzed by Fire Assay (FA) with an Atomic Absorption Spectrometry (AAS) finish. Samples assaying >10.0 g/t Au are re-analyzed with a gravimetric finish using a 50 g charge. Commercial certified standard material and blanks are systematically inserted by O3 Mining’s geologists into the sample chain after every 18 core samples as part of the QA/QC program. Third-party assays are submitted to other designated laboratories for 5% of all samples. Drill program design, Quality Assurance/Quality Control, and interpretation of results are performed by qualified persons employing a QA/QC program consistent with NI 43-101 and industry best practices.

About O3 Mining Inc.

O3 Mining Inc., an Osisko Group company, is a gold explorer and mine developer on the road to produce from its highly prospective gold camps in Québec, Canada. O3 Mining benefits from the support, previous mine-building success, and expertise of the Osisko team as it grows towards being a gold producer with several multi-million ounce deposits in Québec.

O3 Mining is well-capitalized and owns a 100% interest in all its properties (137,000 hectares) in Québec. O3 Mining trades on the TSX Venture Exchange and OTC Markets. The company is focused on delivering superior returns to its shareholders and long-term benefits to its stakeholders.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE