NEVADA KING INTERCEPTS 2.37 G/T AU OVER 75M AT A DEPTH OF JUST 12M BENEATH THE ATLANTA PIT, EXTENDS THE ‘EAST HIGH-GRADE ZONE’ NORTHWARD

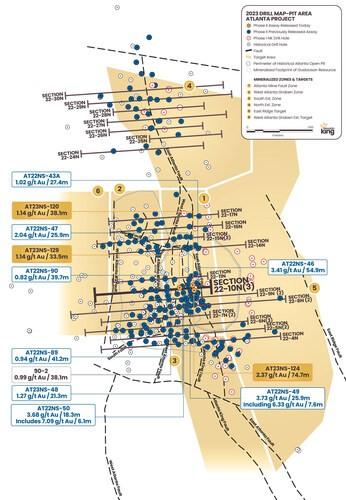

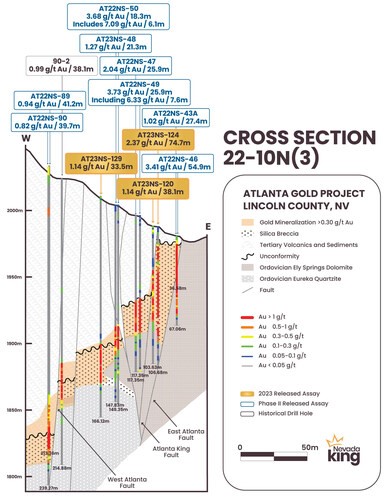

Nevada King Gold Corp. (TSX-V: NKG) (OTCQX: NKGFF) is pleased to announce assay results from three vertical reverse circulation holes recently completed at its Atlanta Gold Mine Project located 264km northeast of Las Vegas, Nevada, in the prolific Battle Mountain Trend. The three holes reported today tested gaps within the existing drill pattern across the 80m-wide northerly trending Atlanta Mine Fault Zone between the East Atlanta Fault and the West Atlanta Fault and are plotted in plan (Figure 1) and along an updated Section 22-10N(3) (Figure 2), initially released on April 20, 2023 and updated on August 10, 2023.

Highlights:

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) |

| AT23NS-124 | 12.2 | 86.9 | 74.7 | 2.37 | 43.9 |

| AT23NS-120 | 33.5 | 71.6 | 38.1 | 1.14 | 43.4 |

| AT23NS-129 | 109.8 | 143.3 | 33.5 | 1.14 | 31.4 |

|

Table 1. All holes reported today along Section 22-10N(3). Mineralization occurs along sub-horizontal horizons generally dipping gently westward; true mineralized thickness in vertical holes is estimated to be between 85% and 95% of reported vertical drill intercept length. |

- 2.37 g/t Au over 74.7m in AT23NS-124 starts at a depth of just 12m beneath the pit floor and was sited to test for a northward extension of higher-grade and thicker mineralization hosted within a 20m-wide fault block, termed the “East High-Grade Zone” that runs along the western side of the EAF and floors the bottom of the Atlanta Pit.

- The East High-Grade Zone had previously been intercepted in holes drilled south of Section 22-10N(3) and today’s intercept successfully extends this zone 30m northward, injecting higher-grade and thicker mineralization into this area of the AMFZ.

- Since historical explorers did not conduct drilling from within the Atlanta pit, the East High-Grade Zone was not discovered until Nevada King’s 2021 drilling campaign that intercepted high-grade oxide mineralization starting at surface from the bottom of the pit, including 5.34 g/t Au over 54.9m and 3.35 g/t Au over 64.1m (released January 12, 2022, and January 20, 2022, respectively).

- As shown in Figure 2, the East High-Grade Zone is atypical in that it hosts grades and thicknesses that are considerably greater when compared to most other mineralized fault blocks comprising the AMFZ.

- AT23NS-120 intercepted 1.14 g/t Au over 38.1m and was positioned 17m north-northwest of AT23NS-124 to define the western boundary of the East High-Grade Zone. The deeper intercept depth relative to AT23NS-124 indicates that AT23NS-120 collared west of the fault bounding the western side of the zone and subsequently drilled down through the boundary fault and into mineralization.

- AT23NS-129 stepped a further 39m west of AT23NS-120 into another drill pattern gap and intercepted 1.14 g/t Au over 33.5m, confirming the presence of mineralization within a westward thickening wedge of silica breccia bounded on top and bottom by shallow-dipping contacts.

Cal Herron, Exploration Manager of Nevada King, comments, “The three holes released today along Section 22-10N(3) provide further support for the current infill drilling program along the AMFZ, the purpose being to better define the grade and geometry of mineralization. With the areal extent of mineralization along the AMFZ now fairly well defined, our current focus is on boosting the average grade by drilling in closer to the high-angle feeder faults responsible for both higher grade and thicker mineralization. Today’s 75m thick intercept averaging 2.37 g/t Au in AT23NS-124 is the thickest intercept recorded to date along the East High-Grade Zone.”

| Hole No. | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Notes |

| AT21-65 | 3.0 | 51.8 | 48.8 | 2.32 | 32.9 | |

| AT22NS-89 | 172.3 | 213.4 | 41.2 | 0.94 | 67.8 | Bottomed in mineralization |

| AT22NS-90 | 182.9 | 222.6 | 39.7 | 0.82 | 52.3 | |

| AT23NS-48 | 91.5 | 112.8 | 21.3 | 1.27 | 35.1 | |

| AT22NS-50 | 89.9 | 108.2 | 18.3 | 3.68 | 27.1 | |

| includes | 93.0 | 99.1 | 6.1 | 7.09 | 33.1 | |

| AT22NS-47 | 64.0 | 89.9 | 25.9 | 2.04 | 27.8 | |

| AT22NS-49 | 62.5 | 88.4 | 25.9 | 3.73 | 46.1 | |

| Including | 67.1 | 74.7 | 7.6 | 6.33 | 28.8 | |

| AT22NS-43A | 3.0 | 30.5 | 27.4 | 1.02 | 21.2 | |

| AT22NS-46 | 4.6 | 59.5 | 54.9 | 3.41 | 26.0 | |

| 90-2 | 135.7 | 173.8 | 38.1 | 0.99 | 90.4 |

|

Table 2. Previously reported and historic holes used in Section 22-10N(3). AT21 series hole was drilled by Nevada King in 2021, while AT22 series holes were drilled by Nevada King in 2022. “90” series hole drilled by Bobcat in 1990. Mineralization occurs along sub-horizontal horizons generally dipping gently westward; true mineralized thickness in vertical holes is estimated to be between 85% and 95% of reported vertical drill intercept length. |

QA/QC Protocols

All RC samples from the Atlanta Project are split at the drill site and placed in cloth and plastic bags utilizing a nominal 2kg sample weight. CRF standards, blanks, and duplicates are inserted into the sample stream on-site on a one-in-twenty sample basis, meaning all three inserts are included in each 20-sample group. Samples are shipped by a local contractor in large sample shipping crates directly to American Assay Lab in Reno, Nevada, with full custody being maintained at all times. At American Assay Lab, samples were weighted then crushed to 75% passing 2mm and pulverized to 85% passing 75 microns in order to produce a 300g pulverized split. Prepared samples are initially run using a four acid + boric acid digestion process and conventional mutli-element ICP-OES analysis. Gold assays are initially run using 30-gram samples by lead fire assay with an OES finish to a 0.003 ppm detection limit, with samples greater than 10 ppm finished gravimetrically. Every sample is also run through a cyanide leach for gold with an ICP-OES finish. The QA/QC procedure involves regular submission of Certified Analytical Standards and property-specific duplicates.

Granting of Options

The Company also announces it has granted 300,000 stock options to a director of the Company with each stock option exercisable at a price of $0.50 into a common share of the Company for a period of five years.

Qualified Person

The scientific and technical information in this news release has been reviewed and approved by Calvin R. Herron, P.Geo., who is a Qualified Person as defined by National Instrument 43-101.

About Nevada King Gold Corp.

Nevada King is the third largest mineral claim holder in the State of Nevada, behind Nevada Gold Mines (Barrick/Newmont) and Kinross Gold. Starting in 2016 the Company has staked large project areas hosting significant historical exploration work along the Battle Mountain trend located close to current or former producing gold mines. These project areas were initially targeted based on their potential for hosting multi-million-ounce gold deposits and were subsequently staked following a detailed geological evaluation. District-scale projects in Nevada King’s portfolio include (1) the 100% owned Atlanta Mine, located 100km southeast of Ely, (2) the Lewis and Horse Mountain-Mill Creek projects, both located between Nevada Gold Mines’ large Phoenix and Pipeline mines, and (3) the Iron Point project, located 35km east of Winnemucca, Nevada.

The Atlanta Mine is a historical gold-silver producer with a NI 43-101 compliant pit-constrained resource of 460,000 oz Au in the measured and indicated category (11.0M tonnes at 1.3 g/t) plus an inferred resource of 142,000 oz Au (5.3M tonnes at 0.83 g/t). See the NI 43-101 Technical Report on Resources titled “Atlanta Property, Lincoln County, NV” with an effective date of October 6, 2020, and a report date of December 22, 2020, as prepared by Gustavson Associates and filed under the Company’s profile on SEDAR+ (www.sedarplus.ca).

| Resource Category | Tonnes

(000s) |

Au Grade

(ppm) |

Contained Au Oz |

Ag Grade

(ppm) |

Contained Ag Oz |

| Measured | 4,130 | 1.51 | 200,000 | 14.0 | 1,860,000 |

| Indicated | 6,910 | 1.17 | 260,000 | 10.6 | 2,360,000 |

| Measured + Indicated | 11,000 | 1.30 | 460,000 | 11.9 | 4,220,000 |

| Inferred | 5,310 | 0.83 | 142,000 | 7.3 | 1,240,000 |

|

Table 3. NI 43-101 Mineral Resources at the Atlanta Mine |

Figure 1. Location map for holes reported in this news release along drill Section 22-10N(3) relative to the perimeter of the historical Atlanta Pit and footprint of the Gustavson 2020 NI 43-101 resource. Shallow drillholes on the mine dumps have been removed from the plot for clarity. (CNW Group/Nevada King Gold Corp.)

Figure 2. Cross section 22-10N(3) looking north across the southern portion of the Atlanta Mine Fault Zone. Higher grade mineralization is concentrated within narrow fault blocks formed between the East Atlanta and Atlanta King Faults and along the western side of the West Atlanta Fault. (CNW Group/Nevada King Gold Corp.)

MORE or "UNCATEGORIZED"

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE

Mishkeegogamang First Nation and First Mining Sign Long Term Relationship Agreement for the Development of the Springpole Gold Project

Agreement setting out the significant participation of Mishkeegog... READ MORE