Meridian Completes Cabaçal DFS Drill Program with Strong Results and Advances Regional Exploration

Highlights:

- Meridian reports multiple Au-Cu-Ag intersections from final phase of Cabaçal DFS drilling, with highlights including:

- CD-760: 27.5m @ 1.9g/t AuEq (1.4% CuEq); and

- 12.8m @ 4.9g/t AuEq (3.6% CuEq);

- Including 6.4m @ 8.2g/t AuEq (6.1% CuEq);

- CD-752: 17.6m @ 1.8g/t AuEq (1.3% CuEq);

- Including 3.1m @ 6.5g/t AuEq (4.8% CuEq);

- CD-743: 24.5m @ 1.9g/t AuEq (1.4% CuEq);

- Including 9.4m @ 4.4g/t AuEq (3.3% CuEq);

- CD-748 hits gold dominant layer grading 16.4m @ 0.9g/t Au, 0.1% Cu & 0.2g/t Ag;

- Strengthens regional exploration prospectivity for bulk tonnage gold deposits;

- Grassroots exploration at Cigarra maps new 2.0km precious and base-metal VMS prospect;

- Peak precious metal grades of 1.5g/t Au and 12.1g/t Ag in drilling;

- Base metal dominant domain seen along strike, with assays pending; and

- Exploration drill program continues.

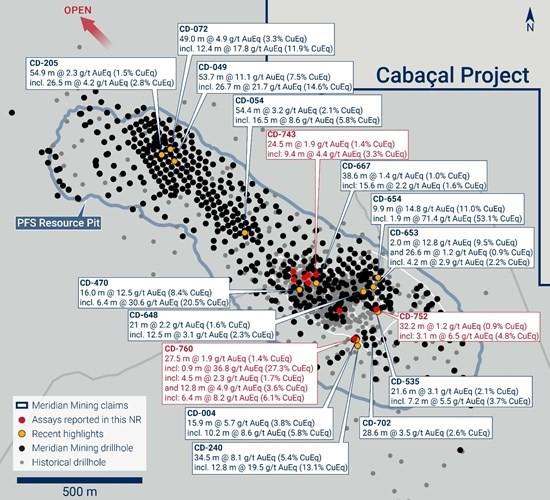

Meridian Mining UK S (TSX: MNO) (FSE: N2E) (Tradegate: N2E) (OTCQX: MRRDF) is pleased to announce results from the final phase of Cabaçal’s Definitive Feasibility Study’s drill program. Starting at shallow depths, multiple stacked layers1 hosting robust grades of Au-Cu-Ag ore are reported (“Figure 1”). Locally, high-grade gold overprinting (including visible gold) of the VMS layers returned 0.9m @ 35.8g/t Au. This now-completed DFS drill program has returned robust grades of gold, copper and silver mineralization that will be strong contributors to the DFS’s resource and reserve upgrades in 2026.

Meridian is also reporting greenfield exploration success at Cigarra. Initial results demonstrate that peripheral precious and base-metal VMS mineralization, similar to that drilled on the edge of the Cabaçal deposit, has been intercepted. Two rigs are currently drilling into this VMS trend, which is untouched by historical exploration activity. This initial drilling campaign is being used to further vector the drill plan towards a potential hydrothermal centre.

Mr. Gilbert Clark, CEO, comments: “The final phase of drilling at Cabaçal has been completed, as a major milestone of the DFS program, well in advance of the FID decision in 2026. We have now completed a tremendous effort of counter-cycle investment, positioning Meridian perfectly to benefit from strengthening commodity prices and generalist investor interest.

“We are very excited by the initial exploration results at Cigarra. Although we have only a few holes completed to date into this previously untested 2km prospect, hitting good grades of gold and silver with the first drill hole, is a tremendous result. The gold mineralization in particular, looks very similar to the “in-pit” gold-only zones at Cabaçal, and we may have the potential for a future bulk-tonnage gold discovery.

“Having over CAD 60 million in the bank, Meridian is one of the only well funded true gold and copper developers, with an exceptionally economic VMS deposit and an exciting exploration portfolio to test.”

Cabaçal Drilling

Assay results (“Table 1”) have been returned from the final phase of Cabaçal’s DFS drilling, with multiple intersections with stacked layers of Au-Cu-Ag mineralization reported from the Central Copper Zone and Southern Copper Zones.

Figure 1: Cabaçal drill highlights reported today.

Some of strongest intersections highlights included:

CD-760: 27.5m @ 1.9g/t AuEq (1.4% CuEq) from 98.4m, including 0.9m @ 36.8g/t AuEq (27.3% CuEq) from 105.1m, and including 4.5m @ 2.3g/t AuEq (1.7% CuEq) from 112.6m; and 12.8m @ 4.9g/t AuEq (3.6% CuEq) from 131.3m – a hole testing along strike from CD-240 intersection2.

CD-752: 37.6m @ 0.5g/t AuEq (0.3% CuEq) from 19.4m; 32.2m @ 1.2g/t AuEq (0.9% CuEq) from 87.9m, including 3.1m @ 6.5g/t AuEq (4.8% CuEq) from 105.9m.

CD-743: 24.5m @ 1.9g/t AuEq (1.4% CuEq) from 40.3m, including 9.4m @ 4.4g/t AuEq (3.3% CuEq) from 50.0m (mining void 34.3 – 37.7m, 46.7 – 48.3m).

In addition to the intervals above, there are a large number of strongly supporting intersections easily accessible to open pit development from the western zone, with subsidiary highlights being:

| Hole-id | Zone | Int | AuEq | CuEq | Au | Cu | Ag | From |

| (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (m) | ||

| CD748* | SCZ | |||||||

| 22.5 | 0.7 | 0.5 | 0.2 | 0.4 | 0.8 | 65.0 | ||

| Including | 2.9 | 2.9 | 2.1 | 1.1 | 1.5 | 3.2 | 84.6 | |

| 16.4 | 1.0 | 0.7 | 0.9 | 0.1 | 0.2 | 103.6 | ||

| Including | 3.2 | 4.1 | 3.1 | 4.2 | 0.1 | 0.3 | 116.8 | |

| CD745 | SCZ | |||||||

| 17.9 | 1.1 | 0.8 | 0.5 | 0.5 | 0.9 | 43.5 | ||

| Including | 8.1 | 1.9 | 1.4 | 0.8 | 1.0 | 1.8 | 53.3 | |

| CD740 | SCZ | |||||||

| 11.7 | 1.2 | 0.9 | 0.4 | 0.6 | 1.2 | 17.0 | ||

| Including | 2.8 | 3.5 | 2.6 | 1.5 | 1.6 | 2.4 | 25.8 | |

| 7.4 | 1.5 | 1.1 | 0.9 | 0.5 | 1.5 | 50.3 | ||

| Including | 4.1 | 2.4 | 1.8 | 1.6 | 0.7 | 2.3 | 53.6 | |

| CD733 | CCZ | |||||||

| 5.6 | 3.5 | 2.6 | 2.2 | 1.1 | 2.4 | 28.4 | ||

| Including | 2.8 | 6.7 | 4.9 | 4.1 | 2.0 | 4.3 | 28.9 | |

| 20.7 | 0.8 | 0.6 | 0.4 | 0.3 | 1.1 | 37.4 | ||

| Including | 1.1 | 3.9 | 2.9 | 2.7 | 1.0 | 3.6 | 43.0 | |

| CD731 | SCZ | |||||||

| 68.1 | 0.5 | 0.4 | 0.2 | 0.3 | 0.8 | 22.3 | ||

| Including | 2.1 | 4.4 | 3.3 | 1.8 | 2.1 | 3.2 | 31.2 | |

| Including | 4.4 | 1.1 | 0.9 | 0.4 | 0.6 | 3.4 | 64.2 | |

| CD726 | SCZ | |||||||

| 19.1 | 0.7 | 0.5 | 0.5 | 0.2 | 0.4 | 45.1 | ||

| Including | 1.9 | 3.7 | 2.8 | 2.7 | 0.9 | 1.6 | 58.7 | |

| 4.8 | 1.8 | 1.4 | 1.1 | 0.6 | 4.2 | 73.3 |

*CD-748 was stopped short of target depth ending in mineralization, due to broken drill rods.

Drilling has been conducted to refine aspects of the geometry of the mineralization and grade characteristics, and to supplement the density database. CD-760, ~60m along strike along strike to the north-east of the CD-240’s intersection of 34.5 metres @ 7.9 g/t AuEq (5.3% CuEq) included variably gold-rich and copper-rich intervals of 12.8m @ 19.0g/t AuEq (12.7% CuEq). The basal subzone of CD-760 graded 12.8m @ 4.9g/t AuEq (3.6% CuEq) from 131.3m included a sub-intervals of 6.4m @ 5.1% Cu, 1.4g/t Au & 23.3g/t Ag from 136.3m, including 2.9m @ 7.4% Cu, 2.4g/t Au & 32.1g/t Ag from 138.9m, including 1.1m @ 10.1% Cu, 3.7g/t Au & 43.3g/t Ag from 139.9m.

CD-752 was an infill hole, designed to better trace the up-dip projection of mineralization in CD-535 and CD-0123, confirming a rich dense basal layer beneath stacked upper layers of Cu and Cu-Au mineralization.

Hole CD-743, although intersecting two mining voids, showed the past mining did not fully extract material at the historical cut-off grades, with an intersection of 9.4m @ 4.2g/t Au, 0.3% Cu & 0.5g/t Ag from 50.0m.

Results have been provided to the Company’s resource and mining consultancy, GE21, who are advancing with updates to the geological and mineralization models in collaboration with the Company’s technical team.

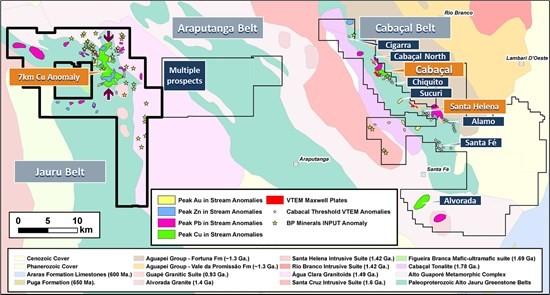

Exploration Update — Cigarra Drilling

Greenfields exploration drilling at Cigarra is targeting an IP chargeability trend defined over a 2km strike length with multiple bands across strike spanning a distance of ~270 to 760m. This area is untested by drilling. Results from the first drill hole, CD-776 confirm the region is fertile for hosting VMS type base and precious metals, returning 3.1m @ 0.5g/t Au, 6.2g/t Ag, 0.1% Zn from 69.9m. There is a sample with 2.5% Zn over 0.6m from 75.1m slightly offset from the gold zone. Peak precious metal grades were 1.5 g/t Au, 12.1g/t Ag in CBDS112667 over 0.8m from 70.5m.

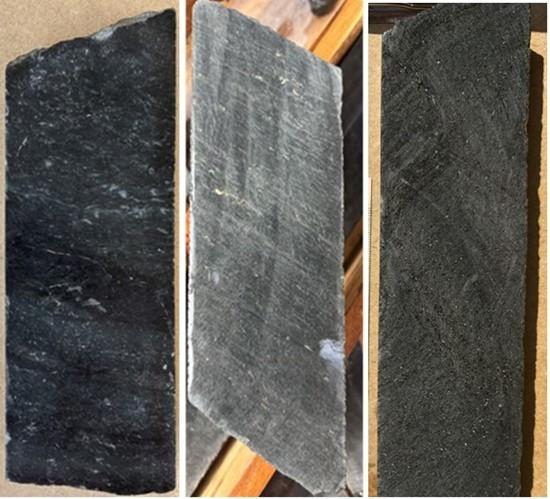

Cigarra’s gold mineralization presents a strong resemblance to Cabaçal’s in-pit gold dominant layers of the mine sequence rocks (“Photo 1”). Having an abundant chloritization / silicification parallel to the main S₁ foliation, along with disseminated garnets within chlorite. Minor sulfides present are variably chalcopyrite, pyrite and sphalerite. Some early boudinaged veins are seen along the foliation, along with a more upright cross-cutting foliation. These features are typical of the Cabaçal deposit and may indicate a potential for Cigarra to host a comparative resource upside.

Photo 1: Left to right: Cabaçal: CD-110 8.6g/t Au, CD-748 1.7g/t Au, and Cigarra: CD-776 1.5g/t Au

Some parts of Cigarra are concealed by colluvial cover, although peak Cu in soil response can reach up to 722 ppm Cu, 180 ppb Au, 1211 ppm Zn (in different samples), with patterns suggestive of some VMS style metal zonation. The mineralization is positioned within a broader lithogeochemical anomaly and pyrite halo, with pyrite extending from 13.8 – 130.3m and a broad ppb-level gold anomalous background. Gold shows positive correlations with silver, with Se, Te, Pb, As. Cigarra shows sodium depletion and magnesium enrichment, similar to what is seen at Cabaçal associated with hydrothermal leaching and chloritic alteration.

Holes are being drilled at broad spacings to assist with establishing vectors to hydrothermal and appear to visually show some variation in copper – zinc disseminated sulphide associations, with further assays pending.

Some select drilling is also being undertaken along the margin of the Cabaçal tonalite, testing associated geochemical anomalies for which assays are pending.

Cigarra is located ~10 km along strike from Cabaçal to the northwest (“Figure 2”), a good spacing for the periodicity of hydrothermal centres in VMS settings.

Figure 2: Cigarra regional location.

Technical Notes

Samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with 70% passing 85% passing 200µm. Routine gold analyses have been conducted by Au‐AA24 (fire assay of a 50g charge with AAS finish). High‐grade samples (>10g/t Au) are repeated with a gravimetric finish (Au‐GRA22), and base metal analysis by methods ME-ICP61 and OG62 (four acid digest with ICP-AES finish). Visible gold intervals are sampled by metallic screen fire assay method Au‐SCR21. Samples are held in the Company’s secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps and coarse rejects are retained and returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. Approximately 5% of archived samples are sent for umpire laboratory analysis, including any lots exhibiting QAQC outliers after discussion with the laboratory. In BP Minerals sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 80-90% of intersection width. Assay figures and intervals are rounded to 1 decimal place. Gold equivalents for new results reported from Cabaçal are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.346*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), and Copper equivalents are calculated as: CuEq(%) = (Cu(%) * %Recovery) + ((0.743* (Aug/t * %Recovery)) + ((0.0094*(Ag(g/t) * %Recovery)) where:

- Au_recovery_ppm = 5.402ln(Au_Grade_ppm)+88.66

- Cu_recovery_pct = 3.906ln(Cu_Grade_pct)+ 95.27

- Ag_recovery_ppm = 30.354ln(Ag_Grade_ppm)+43.691

Recoveries based on 2022 and 2023 metallurgical testwork on core submitted to SGS Lakefield

Qualified Person Statement

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, verified and approved the technical information in this news release.

About Meridian

Meridian Mining is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- The initial resource definition at the second higher-grade VMS asset at Santa Helena as the first stage of the Cabaçal Hub development strategy;

- Regional scale exploration of the Cabaçal VMS belt to expand the Cabaçal Hub strategy; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report dated March 31, 2025, entitled: “Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study” outlines a base case after-tax NPV5 of USD 984 million and 61.2% IRR from a pre-production capital cost of USD 248 million, leading to capital repayment in 17 months (assuming metals price scenario of USD 2,119 per ounces of gold, USD 4.16 per pound of copper, and USD 26.89 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 742 per ounce gold equivalent & production profile of 141,000-ounce gold equivalent life of mine, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.3:1, and the low operating cost environment of Brazil.

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold, 0.44% copper and 1.64g/t silver (at a 0.25 g/t gold equivalent cut-off grade).

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company’s profile on SEDAR+ at www.sedarplus.ca and on the Company’s website at www.meridianmining.co.

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (PGeo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

Table 1: Assay Results from Cabaçal Drilling

| Hole-id | Dip | Azi | EOH | Zone | Int | AuEq | CuEq | Au | Cu | Ag | Zn | From |

| (m) | (m) | (g/t) | (%) | (g/t) | (%) | (g/t) | (%) | (m) | ||||

| CD760 | -66 | 324 | 160.3 | SCZ | ||||||||

| 4.0 | 0.2 | 0.2 | 0.0 | 0.2 | 0.6 | 0.0 | 55.7 | |||||

| 6.8 | 0.6 | 0.5 | 0.6 | 0.1 | 0.2 | 0.0 | 88.8 | |||||

| 27.5 | 1.9 | 1.4 | 1.4 | 0.4 | 1.5 | 0.1 | 98.4 | |||||

| Including | 0.9 | 36.8 | 27.3 | 35.8 | 1.5 | 3.3 | 0.1 | 105.1 | ||||

| Including | 4.5 | 2.3 | 1.7 | 0.9 | 1.1 | 4.1 | 0.4 | 112.6 | ||||

| 12.8 | 4.9 | 3.6 | 0.9 | 3.0 | 14.1 | 0.4 | 131.3 | |||||

| Including | 6.4 | 8.2 | 6.1 | 1.4 | 5.1 | 23.3 | 0.6 | 136.3 | ||||

| Including | 2.9 | 12.3 | 9.1 | 2.4 | 7.4 | 32.1 | 0.6 | 138.9 | ||||

| Including | 1.1 | 17.2 | 12.8 | 3.7 | 10.1 | 43.3 | 0.8 | 139.9 | ||||

| CD752 | -63 | 055 | 130.5 | CCZ | ||||||||

| 37.6 | 0.5 | 0.3 | 0.1 | 0.3 | 0.7 | 0.0 | 19.4 | |||||

| 3.0 | 0.3 | 0.2 | 0.1 | 0.2 | 0.1 | 0.0 | 60.0 | |||||

| 2.8 | 0.8 | 0.6 | 0.5 | 0.2 | 0.2 | 0.0 | 65.7 | |||||

| 12.5 | 0.2 | 0.2 | 0.0 | 0.2 | 0.1 | 0.0 | 72.5 | |||||

| 32.2 | 1.2 | 0.9 | 0.3 | 0.7 | 2.9 | 0.1 | 87.9 | |||||

| Including | 17.6 | 1.8 | 1.3 | 0.5 | 1.0 | 4.9 | 0.2 | 98.5 | ||||

| Including | 3.1 | 6.5 | 4.8 | 1.7 | 3.6 | 18.4 | 0.3 | 105.9 | ||||

| Including | 0.8 | 12.0 | 8.9 | 3.2 | 6.6 | 30.2 | 0.4 | 108.1 | ||||

| CD748 | -52 | 098 | 120.7 | SCZ | ||||||||

| 22.5 | 0.7 | 0.5 | 0.2 | 0.4 | 0.8 | 0.1 | 65.0 | |||||

| Including | 2.9 | 2.9 | 2.1 | 1.1 | 1.5 | 3.2 | 0.3 | 84.6 | ||||

| Including | 1.2 | 4.6 | 3.4 | 1.4 | 2.5 | 5.6 | 0.6 | 85.8 | ||||

| 16.4 | 1.0 | 0.7 | 0.9 | 0.1 | 0.2 | 0.0 | 103.6 | |||||

| Including | 3.2 | 4.1 | 3.1 | 4.2 | 0.1 | 0.3 | 0.0 | 116.8 | ||||

| CD745 | -60 | 044 | 100.6 | SCZ | ||||||||

| 2.3 | 0.4 | 0.3 | 0.0 | 0.3 | 1.7 | 0.0 | 13.9 | |||||

| 2.9 | 0.7 | 0.5 | 0.1 | 0.5 | 1.1 | 0.0 | 31.3 | |||||

| 4.4 | 0.6 | 0.4 | 0.2 | 0.3 | 0.5 | 0.0 | 37.3 | |||||

| 17.9 | 1.1 | 0.8 | 0.5 | 0.5 | 0.9 | 0.0 | 43.5 | |||||

| Including | 8.1 | 1.9 | 1.4 | 0.8 | 1.0 | 1.8 | 0.0 | 53.3 | ||||

| Including | 0.8 | 10.9 | 8.1 | 3.1 | 6.0 | 11.4 | 0.1 | 59.8 | ||||

| 13.8 | 0.3 | 0.3 | 0.2 | 0.2 | 0.7 | 0.0 | 68.1 | |||||

| CD743 | -60 | 045 | 90.6 | CCZ | ||||||||

| 2.9 | 0.6 | 0.4 | 0.0 | 0.4 | 0.3 | 0.0 | 13.8 | |||||

| 8.7 | 0.5 | 0.4 | 0.4 | 0.1 | 0.3 | 0.1 | 19.3 | |||||

| Including | 2.6 | 1.2 | 0.9 | 0.9 | 0.3 | 0.6 | 0.0 | 19.3 | ||||

| 24.5 | 1.9 | 1.4 | 1.8 | 0.2 | 0.4 | 0.0 | 40.3 | |||||

| Including | 9.4 | 4.4 | 3.3 | 4.2 | 0.3 | 0.5 | 0.0 | 50.0 | ||||

| 1.5 | 0.6 | 0.5 | 0.2 | 0.4 | 2.0 | 0.2 | 67.6 | |||||

| 4.2 | 0.5 | 0.4 | 0.2 | 0.3 | 0.9 | 0.0 | 71.2 | |||||

| CD740 | 72-.41 | 045 | 90.1 | SCZ | ||||||||

| 1.6 | 0.2 | 0.1 | 0.0 | 0.1 | 0.4 | 0.0 | 11.1 | |||||

| 11.7 | 1.2 | 0.9 | 0.4 | 0.6 | 1.2 | 0.0 | 17.0 | |||||

| Including | 2.8 | 3.5 | 2.6 | 1.5 | 1.6 | 2.4 | 0.1 | 25.8 | ||||

| 4.0 | 0.4 | 0.3 | 0.2 | 0.2 | 0.3 | 0.0 | 32.0 | |||||

| 1.8 | 1.3 | 0.9 | 0.7 | 0.5 | 1.5 | 0.0 | 46.0 | |||||

| 7.4 | 1.5 | 1.1 | 0.9 | 0.5 | 1.5 | 0.0 | 50.3 | |||||

| Including | 4.1 | 2.4 | 1.8 | 1.6 | 0.7 | 2.3 | 0.0 | 53.6 | ||||

| 2.3 | 0.5 | 0.3 | 0.1 | 0.3 | 0.8 | 0.0 | 64.5 | |||||

| 6.7 | 0.6 | 0.4 | 0.2 | 0.3 | 1.9 | 0.0 | 75.0 | |||||

| CD733 | -63 | 044 | 90.1 | CCZ | ||||||||

| 2.2 | 1.9 | 1.4 | 0.4 | 1.2 | 3.8 | 0.2 | 17.4 | |||||

| 5.6 | 3.5 | 2.6 | 2.2 | 1.1 | 2.4 | 0.2 | 28.4 | |||||

| Including | 2.8 | 6.7 | 4.9 | 4.1 | 2.0 | 4.3 | 0.2 | 28.9 | ||||

| 20.7 | 0.8 | 0.6 | 0.4 | 0.3 | 1.1 | 0.0 | 37.4 | |||||

| Including | 1.1 | 3.9 | 2.9 | 2.7 | 1.0 | 3.6 | 0.0 | 43.0 | ||||

| 2.1 | 0.8 | 0.6 | 0.2 | 0.5 | 1.7 | 0.0 | 72.8 | |||||

| 0.5 | 2.0 | 1.5 | 0.4 | 1.3 | 5.7 | 0.4 | 78.0 | |||||

| CD731 | -44 | 046 | 101.7 | SCZ | ||||||||

| 68.1 | 0.5 | 0.4 | 0.2 | 0.3 | 0.8 | 0.0 | 22.3 | |||||

| Including | 2.1 | 4.4 | 3.3 | 1.8 | 2.1 | 3.2 | 0.1 | 31.2 | ||||

| Including | 4.4 | 1.1 | 0.9 | 0.4 | 0.6 | 3.4 | 0.0 | 64.2 | ||||

| CD726 | -59 | 044 | 94.8 | SCZ | ||||||||

| 5.8 | 0.2 | 0.2 | 0.0 | 0.2 | 0.3 | 0.0 | 14.2 | |||||

| 2.9 | 0.4 | 0.3 | 0.1 | 0.2 | 0.3 | 0.0 | 24.7 | |||||

| 19.1 | 0.7 | 0.5 | 0.5 | 0.2 | 0.4 | 0.0 | 45.1 | |||||

| Including | 1.9 | 3.7 | 2.8 | 2.7 | 0.9 | 1.6 | 0.0 | 58.7 | ||||

| 0.3 | 1.0 | 0.7 | 0.3 | 0.6 | 1.8 | 0.0 | 69.9 | |||||

| 4.8 | 1.8 | 1.4 | 1.1 | 0.6 | 4.2 | 0.0 | 73.3 |

1 See Technical Note for true thickness estimate and separate AuEq and CuEq equations

2 Meridian Mining News release of Mar 27, 2023.

3 Meridian Mining News releases of September 4, 2024 and June 15, 2021.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE