Max Resource Acquiring EBAY Palladium Through PGE Americas Metals

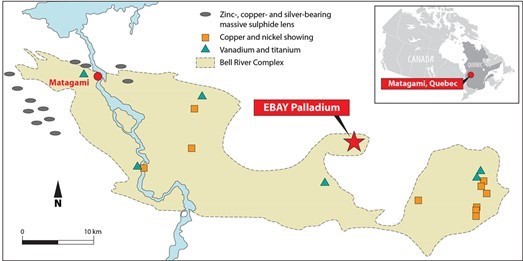

MAX RESOURCE CORP. (TSX-V: MXR) (OTC PINK: MXROF) (FSE: M1D2) is pleased to report it has entered into a Letter of Intent, through its wholly-owned subsidiary, PGE Americas Metals Corp. to acquire 100% of the EBAY Palladium Project located 30-km SE of Matagami in the Abitibi Region of Quebec, Canada. It is underlain by the Archean Bell River Complex, a layered mafic intrusion measuring 65-km by 15-km and 5-km thick. Excellent access to the Project is via a network of logging roads and trials.

Highlight results from historic exploration between 2000 to 2008 include:

- 4.87 g/t palladium-platinum from a 4 to 5-metre wide northerly zone from blast pit grab sampling in 2000;

- 3.04 g/t palladium + 1.39 g/t platinum + 0.12 g/t rhodium (4.55 g/t palladium-platinum-rhodium) and highlight value of 0.18 g/t rhodium from grab sampling in 2005;

- 2.46 g/t palladium-platinum (rhodium was not assayed) from blast pit grab sampling of a newly discovered 500m long zone in 2006;

- 1.90 g/t palladium-platinum over 3.0m from 80.5m to 83.5m (rhodium was not assayed) from the “EBAY Palladium Discovery” drill hole in 2006. Palladium to Platinum ratio varies from 1.25 to 1.0;

- “EBAY Palladium Discovery” was the first reported PGE drill intersection from the Bell River Complex;

- Drilling in 2007 resulted in the discovery of a new zone with 600m on strike, 120m deep, 6.7m to 31.1m wide, open in all directions, highlight values of 2.52 g/t palladium-platinum (rhodium not assayed) width not provided;

- 2007 drilling also includes highlight values of 1.12% copper and 0.36% nickel over 1.8m interval;

- Subsequent aero-magnetic survey extended the target zone to 4.8-km of strike;

- Max is conducting re-analysis of drill core and for rhodium, iridium, osmium and ruthenium values.

The Company cautions investors that grab samples are selected samples and are not necessarily representative of mineralization hosted on the Project. The Company also cautions investors it has not yet verified any of the historical exploration information (Refer to Hinterland Metals AR 2005, October 10 & 17, 2006 News Releases; drill results from Hinterland Metals November 21, 2006, March 13, 2007 & April 10, 2008 News Releases).

“The current palladium price of US$1,550 per/oz is seven-times the 2003 price of US$201 and the current US$5,500 per/oz rhodium price is eleven-times the 2003 price of US$476, making the EBAY project an excellent exploration project for our wholly-owned subsidiary, PGE Americas Metals Corp.,” Max CEO, Brett Matich, commented. “The EBAY team plans to initiate an exploration program, followed by drilling and, at the same time, the CESAR Phase II field program in Colombia continues to expand Max’s exposure to copper and silver markets,” Mr. Matich concluded.

EBAY Palladium Transaction

The Company has entered into a non-binding LOI, paying a $25,000 non-refundable deposit for a 60-day exclusive right to acquire 100% of the EBAY Palladium Project. It can exercise the option by:

(i) Executing the Agreement on or before the expiry of the exclusive option period;

(ii) Issuance of 2,950,000 common shares of Max upon TSX Venture Exchange (“Exchange”) approval of the Agreement;

(iii) Completing the minimum expenditures to maintain the EBAY claims in good standing by October 1, 2020; this amount shall be deducted from second anniversary expenditure amount;

(iv) Payment of $25,000 cash, the issuance of common shares of Max equal to the cash amount of $75,000, calculated as below, on or before the first anniversary date of closing the transaction;

(v) Payment of $25,000 cash, the issuance of common shares of Max equal to the cash amount of $75,000, calculated as below, and total aggregate of $600,000 in expenditures on or before the second anniversary date of closing the transaction; and

(vi) Payment of $75,000 cash (for a total aggregate of $150,000 of cash payments), the issuance of common shares of Max equal to the cash amount of $225,000, calculated as below, and $900,000 in expenditures on or before the third anniversary date of closing the transaction (for total aggregate expenditures of $1,500,000).

Upon acquisition of 100%, interest in the Project, the Company will grant a 2.0% net smelter royalty to the vendor. The Company has the right to purchase one-half of the Royalty for $1,000,000.

The issuance of common shares of Max is to be equal to the cash consideration, calculated by the share price based on the volume weighted average price of the shares over the 30-day period prior to the share issuance.

The Agreement is subject to acceptance and approval by the Exchange. All shares issued pursuant to the Agreement shall be subject to a four-month and one-day hold period.

PGE Americas Metals Corp

“PGE Americas Metals Corp.” was recently formed by Max as a wholly-owned subsidiary, to hold its PGE Choco Project. This was the first step towards building a portfolio of PGE assets with a focus on palladium, platinum and rhodium. The intent is to unlock this value in a timely manner (refer to news release February 25, 2020).

The PGE Choco project is located 120-km SW of Medellin Colombia, within a district with historical production of 1.0Mozs of platinum and 1.5Mozs of gold (1906-1990) by Choco Pacific Mining. Compilation of historical records revealed the potential for related PGE’s particularly palladium and rhodium. In addition, recent field work in 2019 by Max resulted in concentrate values of 114 g/t platinum and 341 g/t gold (refer to news release April 16, 2019).

Colombia was the world’s main source of platinum until 1820 and was world’s largest producer between 1917 and 1923. Source: R.J. Fletcher and Associates (2011) Review of Gold and Platinum Exploration and Production in Choco Province Colombia Part 3. Private Report for Condo to Platinum NL.

CESAR Copper + Silver Project

The wholly-owned CESAR Project is located in north east Colombia lying along an historic 120-km copper-belt, with excellent infrastructure, major oil-gas, coal operations, shipping ports, airports, townships, railways and roadways.

Early success includes, the AM North discovery containing unprecedent values of 24.8% copper + 230 g/t silver over 4m by 1m rock chip panel and 10.4% copper + 88 g/t silver over continuous 1m rock chip interval located 1.8-km along strike, open in all directions.

Further, the AM South discovery is located 40-km SSW along the same mineralized trend, where mineralized structures totaling over 5-km of strike. Rock chip sampling from 0.1 to 25-metre intervals returned highlight values of 5.4% copper and 63 g/t silver.

Follow-up exploration commenced in late February.

North Choco Gold and Copper Project

North Choco consists of wholly-owned mineral applications, located approximately 80-km SW of Medellin, Colombia. The NW Gold-Copper Discovery (refer to October 29, 2019 news release) outcrop reported 1-metre of 49.8 g/t gold and 4.3% copper, continuing under cover in both directions. Future work will focus on mapping and sampling along strike to extend the zone and on locating additional parallel zones.

About Max Resource Corp.

Max, a mineral exploration company with an experienced and successful management team, is focused on advancing its copper, silver and precious metals landholdings in the rich mineral belts of Colombia, and it’s PGE (palladium, platinum, rhodium) landholdings with potential for the discovery of large-scale mineral deposits that can attract major partners.

Tim Henneberry, P Geo (British Columbia), a member of the Max Resource Advisory Board, is the Qualified Person who has reviewed and approved the technical content of this news release on behalf of the Company.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE