Marimaca Signs Binding Option to Acquire the Pampa Medina Project

Marimaca Copper Corp. (TSX: MARI) is pleased to announce the signing of a binding option agreement to acquire the Pampa Medina project from Sociedad Contractual Minera Elenita. Details of the transaction are found below in the “Transaction Summary” section of this press release.

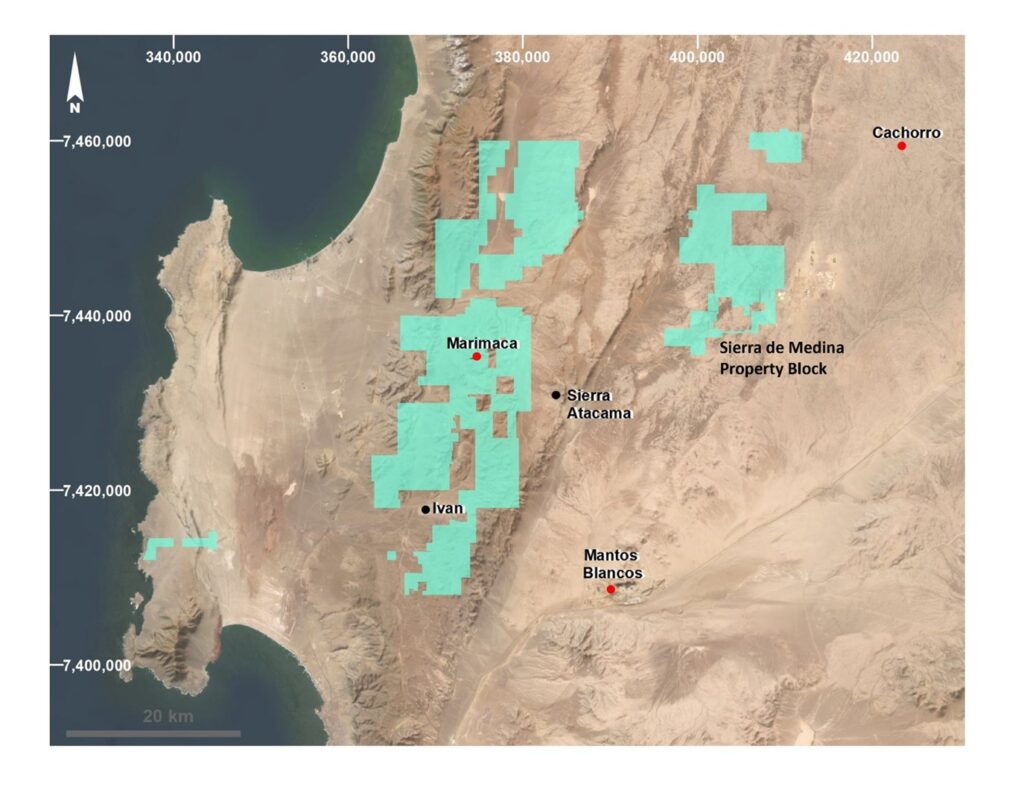

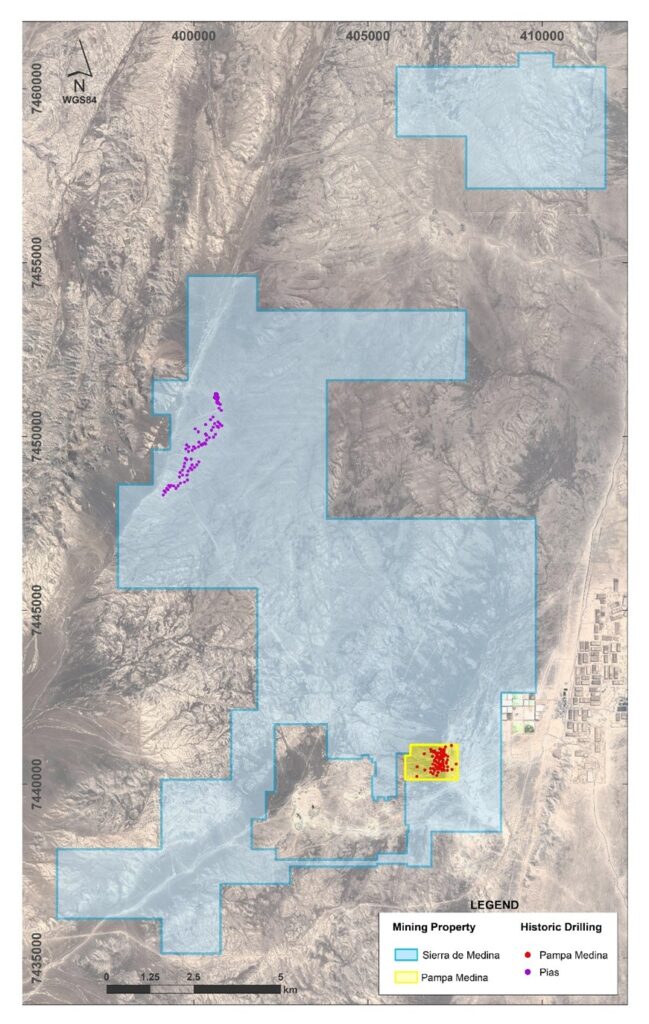

The Pampa Medina project consists of 4 mining concessions totaling 144 hectares. Pampa Medina is located within the southern portion of the Company’s broader 14,500ha Sierra de Medina property package (see Figures 1, 2 and 3), and is situated approximately 28km in distance and ~200m higher elevation relative to the Company’s planned processing infrastructure as defined in the ongoing Marimaca Oxide Deposit Definitive Feasibility Study (see press release dated January 16th, 2024).

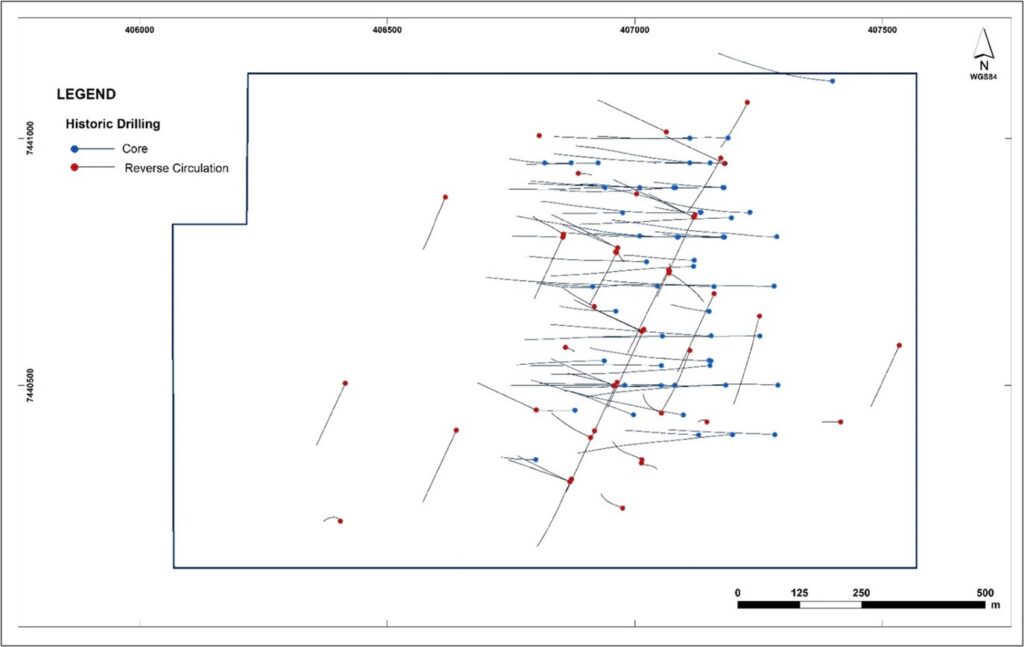

Pampa Medina hosts a historical, National Instrument 43-101 – Standards of Disclosure for Mineral Projects non-compliant resource estimate of copper hosted in dominantly oxide mineralization, which is detailed below in Table 1 alongside relevant technical and regulatory disclosure. Approximately 41,000m of historical drilling data at Pampa Medina was inherited per the Agreement. The Company has commenced a detailed quality assurance, quality control and validation program which is summarized below. Marimaca Copper will review results of the program and define next steps with the intention to release a maiden resource estimate at Pampa Medina in early Q1 2025.

Hayden Locke, President & CEO, commented:

“This acquisition aligns with our strategy to grow our base of leachable copper resources to complement the MOD, to underpin mine life growth and, perhaps more importantly, support our goal of increasing our scale of production target to more than 50,000 tonnes of copper cathode per annum.

A cornerstone of this strategy is proximity of resources to the planned infrastructure of the MOD development. Pampa Medina is located within 25km of the preferred plant site for the MOD development, and there are several clear routes for a synergistic development using the MOD infrastructure. We have run an initial, internal, technical and economic evaluation to understand how it may fit with the broader development strategy and, as expected, the results were positive. As a result, we will take some additional time to consider whether this may change our base case development strategy for the MOD, which is currently being designed in our Definitive Feasibility Study.

Pampa Medina lies in the middle of one of our most prospective exploration targets, at SdM. We have completed surface geology in and around the historical resource, including several geophysical surveys, and are excited about the potential to extend both along strike to the north and south, and down plunge to the east-north-east.

Finally, the team is currently drilling the satellite Mercedes Target, which remains a key part of our complementary resource growth strategy. We hope to receive first results of this campaign in in the coming months before the rigs move to SdM to test our various targets there up to the end of the year.”

Table 1. Historical Estimate – Pampa Medina (taken from Informe Técnico Recursos Actualizados 2020, GeoInvest (“GeoInvest, 2020”)

The historical estimate uses CIM categories. The Qualified Person (QP) has not done sufficient work to classify the historical estimate as a current resource at this stage. The Company is not treating the historical estimate as a current resource and intends to verify and upgrade the historical estimate via a planned work program outlined in the “Validation Program” section of this news release.

| Category (GeoInvest, 2020) | Tonnes | CuT (%) | CuS (%) |

| Indicated | 12,267,505 | 0.857 | 0.730 |

| Inferred | 28,053,957 | 0.659 | 0.558 |

The historical estimate was reported pit-constrained via a Lerchs-Grossman pit optimization utilizing the following assumptions CuT is total copper. CuS is acid soluble copper. Historic estimate reported at a cutoff of 0.30% CuT. Copper price assumption of US$3.00/lb, mining cost of US$1.50/t, processing costs of US$10.50/t Cu, Solvent-Extraction and Electrowinning Costs of $0.25/lb Cu, recovery assumption of (CuS*0.92+(CuT-CuS)*0.75)*CuT. The historical estimate incorporates 23,984m of diamond drilling across 61 drill holes and 17,485m of reverse circulation drilling across 39 drill holes

Property Overview

- 144ha land package within Marimaca’s broader Sierra de Medina exploration property package

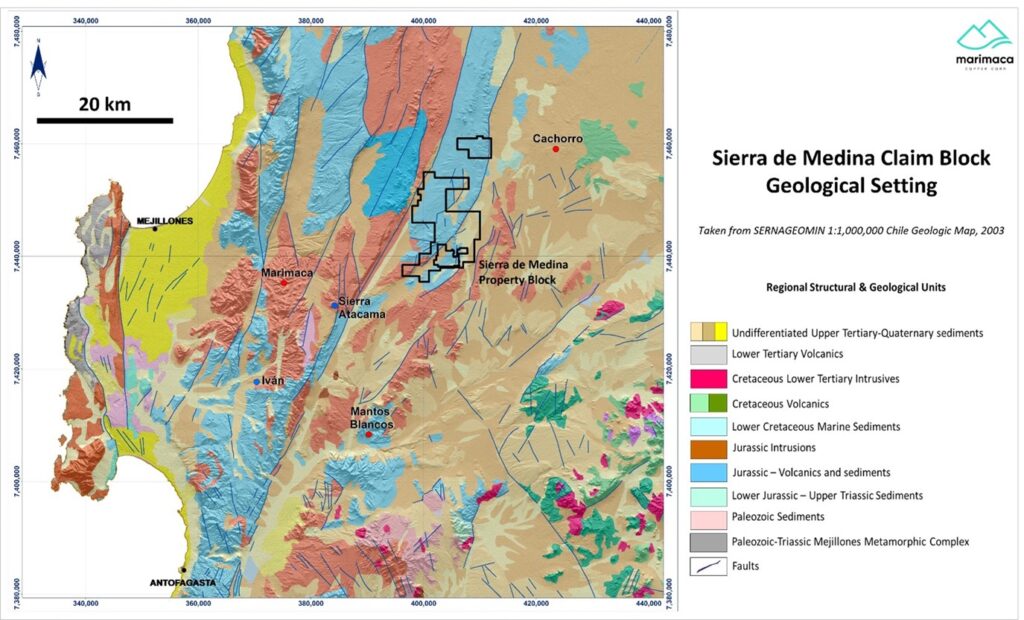

- Located in the eastern domain of the Antofagasta Region’s coastal copper belt, which hosts large, ‘Manto’-style copper deposits including Capstone Copper’s Mantos Blancos mine and Antofagasta Minerals’ Cachorro project (Figure 4)

- Mineralization, observed to date through re-logging of historical drill core, confirms strong oxide copper presence (atacamite, chrysocolla) as well as primary and secondary chalcocite

- Known mineralization remains open to the northeast, down-dip which extends onto Marimaca Copper’s 100% owned land position (Figure 2)

- Complements the previously announced Pias target within the broader Sierra de Medina land position – where exploration drilling is currently underway (see Figure 3)

- Significant geological database to leverage for further exploration vectoring in the broader Sierra de Medina land package

Validation Program (Underway)

- Geological relogging of complete historical diamond drilling database

- Drill collar GPS validation, topography validation, survey validation

- Resampling and re-assaying program against the historical assay database of diamond drilling

- Reinterpretation and rebuild of the geological model

- Release of maiden MRE planned for early Q1 2025

Transaction Summary

- Under the terms of the Agreement, Marimaca Copper will pay the following over an option term of 5-years to acquire 100% of Pampa Medina. Marimaca Copper may withdraw and relinquish property rights back to SCM Elenita at any time.

- US$150,000 on signing

- US$350,000 on the first anniversary of signing

- US$500,000 24 months from of signing

- US$1,500,000 36 months from signing

- US$2,500,000 48 months from signing

- US$7,000,000 60 months from signing

- SCM Elenita will retain a 1.5% net smelter royalty on the Pampa Medina property. Marimaca Copper will have the ability to buy back 1.0%of the NSR

Figure 1: Marimaca Land Position – Marimaca and Sierra de Medina

Figure 2: Sierra de Medina – Pampa Medina Property and Pias Target (see press release dated February 27, 2024)

Figure 3: Pampa Medina – Historical Drilling

Figure 4: Regional Geological Setting

Qualified Person

The technical information in this news release has been reviewed and approved by Sergio Rivera, VP of Exploration, Marimaca Copper Corp, a geologist with more than 35 years of experience and a registered member of the Comision Minera (Chilean Mining Commission), as well a member of the Colegio de Geólogos de Chile, Instituto de Ingenieros de Minas de Chile and of the Society of Economic Geologist USA, and who is a Qualified Person for the purposes of NI 43-101. As noted previously, the Qualified Person (QP) has not done sufficient work to classify the historical estimate presented in this news release as a current resource.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE