Mako Mining Intersects 36.65 g/t Au and 29.5 g/t Ag over 3.1m (Estimated True Width) at the SW Pit

Mako Mining Corp. (TSX-V: MKO) (OTCQX: MAKOF) is pleased to report additional high-grade drill results from an area located approximately 50 meters southwest of the current open pit mining operations at the San Albino West Pit in northern Nicaragua.

In 2022, a total of 13,284 m in 99 drill holes have been completed at the SW Pit. Most of the drilling intersected mineralization within, or immediately outside, the current permitted pit.

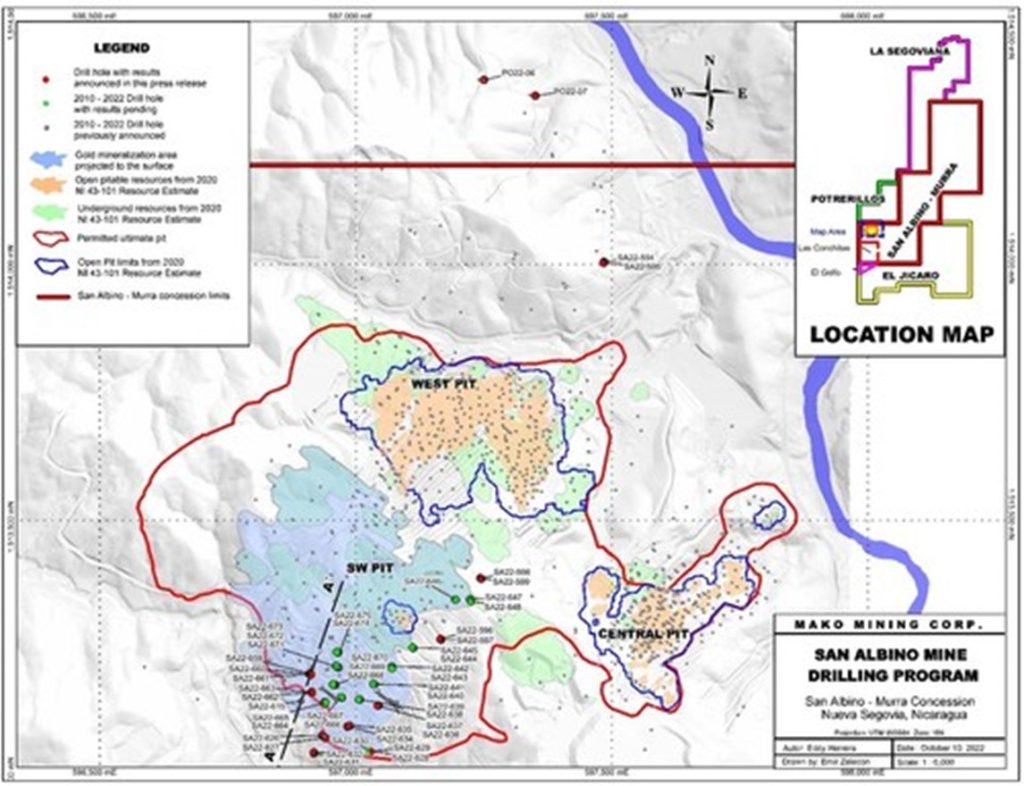

Recent drilling has confirmed gold mineralization over an area of approximately 530 m x 600 m (strike x dip) compared to approximately 50 m x 50 m (see drill plan below) that was previously identified in the 2020 mineral resource estimate as the SW Pit.

A technical report for the current mineral resource estimate at San Albino is available under the Company’s SEDAR profile at www.sedar.com and available on the Company’s website at www.makominingcorp.com (see press release dated October 19, 2020).

Highlights of selected intercepts of the high-grade gold mineralization include:

- 36.65 g/t Au and 29.5 g/t Ag over 3.1 m (Estimated True Width – “ETW”)

including 46.89 g/t Au and 35.8 g/t Ag over 2.2 m - 25.94 g/t Au and 34.6 g/t Ag over 4.1 m (3.6m ETW)

including 37.81 g/t Au and 48.7 g/t Ag over 2.7 m

The objectives of the SW Pit drilling are to identify additional mineral resources and increase the overall size of San Albino Gold deposit within the currently permitted pit limits, and to test extensions of the mineralization beyond the pit limits.

Comprehensive drilling and detailed mapping of the area have identified multi-stage deformation events, with the latest represented by northeast to southwest faulting. The current interpretation indicates the faults may have displaced the vein in a manner that has upthrown blocks across the faults, bringing the mineralized zone closer to surface than the previous down dip projections indicated, increasing the potential for additional open pit mineral resources.

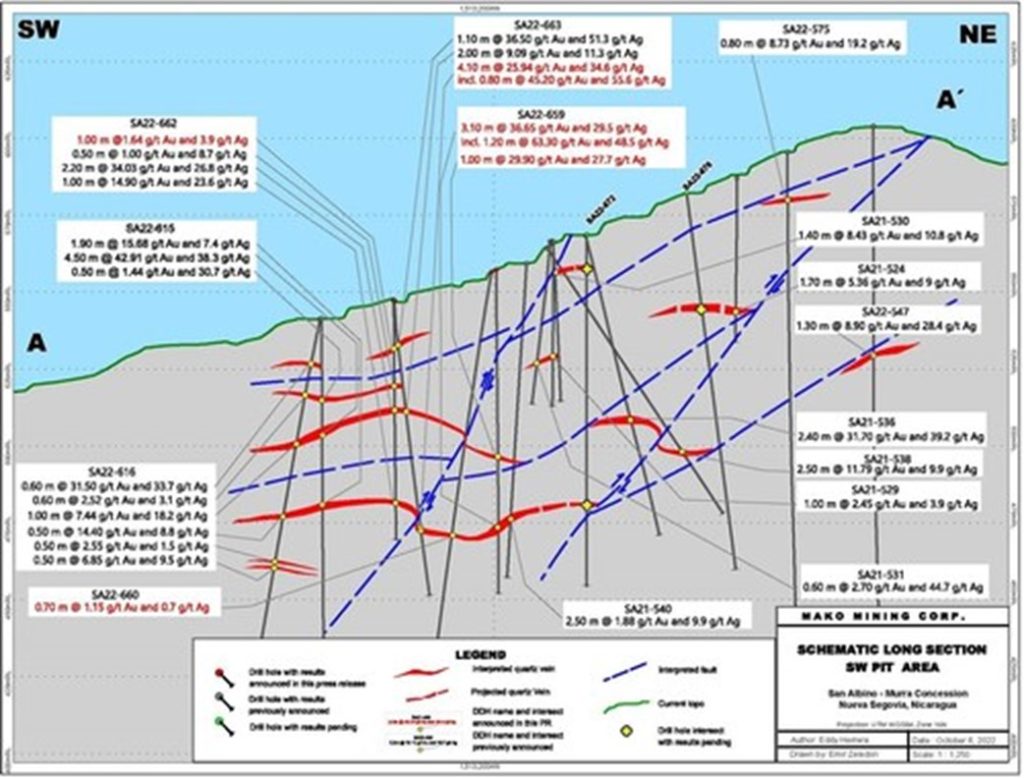

Akiba Leisman, CEO of Mako states: “The drill intercepts highlighted in this press release (including 36.65 g/t Au over 3.1 m ETW) are showing higher than average grade-thicknesses, at open pittable depths, at the edge of our permitted pit and directly underneath our mining contractor’s temporary workshop. As shown in the attached longitudinal section, the strike direction of this zone is open to the southwest, where, due to topography and the plunge of the mineralization, the vein is getting shallower in this direction. All intercepts are close to current infrastructure, and in some cases closer to the plant than where we are mining now. A drill rig is being positioned over 200 m further up-plunge to the southwest, which could significantly increase the scale of the SW Pit if continuity is proven.”

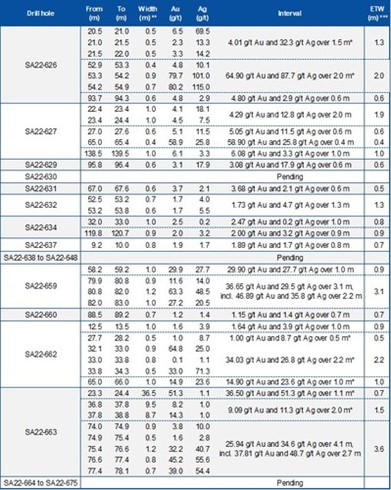

Details of select intersects:

Drill hole SA22-659 intersected multiple intervals of high-grade, near surface gold mineralization, including 36.65 g/t Au and 29.5 g/t Ag over 3.1 m (ETW), 80 m below surface (see attached longitudinal section). This drill hole is collared approximately 58 m along strike from drill hole SA22-615 (see attached drill plan) which intersected 42.91 g/t Au and 38.3 g/t Ag over 4.50 m (4.1m ETW) 35.5 m from surface (see press release dated June 22, 2022). In addition, this hole intersected a mineralized interval grading 29.90 g/t Au and 27.7 g/t Ag over 1.0 m (0.9 m ETW), 58 m from the surface.

SA22-663, collared between the two drill holes mentioned above and approximately 30 m along strike from drill hole SA22-615, intersected multiple mineralized intervals (see table below), including 25.94 g/t Au and 34.6 g/t Ag over 4.1 m (3.6 m ETW), approximately 70 m below surface. The same drill hole intersected two, previously reported intervals grading 36.50 g/t Au and 51.3 g/t Ag over 1.10 m (0.7 m ETW) and 9.09 g/t Au and 11.3 g/t Ag over 2.0 m (1.5 m ETW), at vertical distances from surface of 22 m and 35 m, respectively. Both drill holes confirmed continuity of multiple high-grade gold bearing structures to the northeast along strike and indicate potential to further expand near surface mineral resources.

In addition, the Company received results for four drill holes from scout drilling at the San Albino North target which lies immediately to the north of the San Albino gold deposit straddling two concessions, San Albino-Murra and Potrerillos. Three drill holes intersected anomalous gold intervals, but below an internal cut-off grade (1.0 g/t Au). The other hole did not intersect any significant mineralized intervals.

Note: The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 m of internal dilution. * Previously reported intervals. **Widths are reported as drill core lengths. ***Estimated True Width is estimated from interpreted sections. In addition to the drill holes presented in the table above, the following drill holes returned only anomalous values: SA22-596, SA22-598, SA22-599, SA22-628, SA22-635, SA22-636, SA22-661, SA22-594, SA22-595 and PO22-06. In addition to the drill holes presented in the table above, the following drill holes returned no significant values: SA22-597 and PO22-07.

Sampling, Assaying, QA/QC and Data Verification

Drill core was continuously sampled from inception to termination of the entire drill hole. Sample intervals were typically one meter. Drill core diameter was HQ (6.35 centimeters). Geologic and geotechnical data was captured into a digital database, core was photographed, then one-half split of the core was collected for analysis and one-half was retained in the core library. Drill core samples were kept in a secured logging and storage facility until such time that they were delivered to the Managua facilities of Bureau Veritas and pulps were sent to the Bureau Veritas laboratory in Vancouver for analysis. Gold was analyzed by standard fire assay fusion, 30 gr aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards and blanks were inserted into the sample stream at a ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data.

Qualified Person

John M. Kowalchuk, P.Geo, a geologist and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Kowalchuk is a senior geologist and a consultant to the Company.

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

Table 1: Assay Results Reported in This Press Release (CNW Group/Mako Mining Corp.)

Figure 1. San Albino Mine Drilling Program (CNW Group/Mako Mining Corp.)

Figure 2. Schematic Longitudinal Section (CNW Group/Mako Mining Corp.)

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE