Lithium Americas Approves Agreement Providing for Separation into Two Leading Lithium Companies

Lithium Americas intends to file circular with details on the Separation by end of June 2023;

Separation will be presented to shareholders for approval at AGM expected for July 31, 2023

Lithium Americas Corp. (TSX: LAC) (NYSE: LAC) is pleased to announce that its Board of Directors has unanimously approved the execution of an arrangement agreement providing for the reorganization of the Company that will result in the separation of its North American and Argentine business units into two independent public companies.

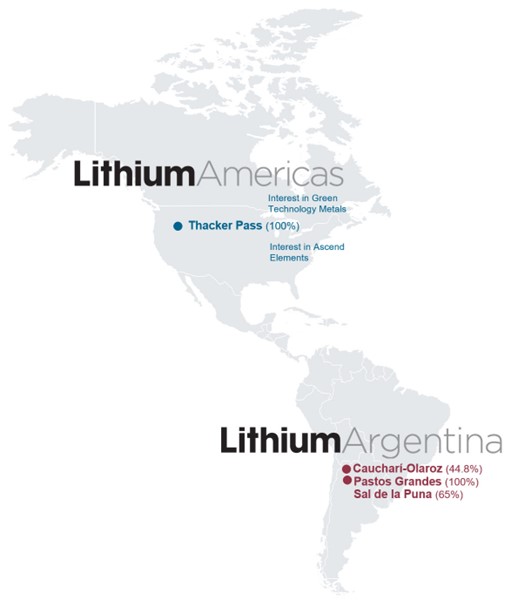

The Separation will establish an Argentina focused lithium company (“Lithium Argentina”) and a North America focused lithium company (“Lithium Americas (NewCo)”). Lithium Argentina will own Lithium Americas’ current interest in its Argentina lithium assets, including the 44.8% interest in Caucharí-Olaroz, the 100%-owned Pastos Grandes project and the 65% interest in the Sal de la Puna project. Lithium Americas (NewCo) will own the 100%-owned Thacker Pass lithium project in Humboldt County, Nevada, as well as the Company’s investments in Green Technology Metals Limited (ASX:GT1) and Ascend Elements, Inc.

KEY BENEFITS OF THE SEPARATION

The Separation is expected to enhance the long-term prospects for each of the business units and provide a number of benefits, including, among others:

- Provide each company with a sharper business and strategic focus, enabling the separate businesses to better attract, retain and motivate key employees.

- Enable each business to pursue its independent and unique growth opportunities.

- Lithium Argentina: Ramp-up of Caucharí-Olaroz, pursuit of Stage 2 expansion and further growth with the significant resource, along with advancement and construction decision regarding Pastos Grandes and potential upside at Sal de la Puna.

- Lithium Americas (NewCo): Construction and production of Phase 1 of Thacker Pass, and planning and execution of Phase 2 and beyond.

- Improve the market’s ability to evaluate each business and value it against its comparables, providing shareholders with enhanced value and flexibility through independent investment opportunities.

- Provide each company with independent access to capital, resulting in more tailored capital allocation practices, thereby allowing each company to expand deeper into its specific domain to maximize the value of its resources.

- Expected to be executed on a tax-deferred basis with tax rulings and to have minimal dis-synergies.

“With this approval by the Board of Directors, we are excited to clear a key milestone in moving forward to separate Lithium Americas into two distinct leading lithium companies,” said Jonathan Evans, President and CEO of Lithium Americas. “We look forward to the value that can be created for shareholders through Lithium Americas (NewCo)’s unique position and the development of one of the largest lithium resources in the U.S., as well as the value generated through Lithium Argentina’s near-term production portfolio with a significant growth pipeline from two high-quality projects.”

LITHIUM AMERICAS (NEWCO) MANAGEMENT

Upon completion of the Separation, Lithium Americas (NewCo)’s management team will include, among others:

- Jonathan Evans (President & CEO) – current Director, President & CEO of Lithium Americas

- Pablo Mercado (EVP & CFO) – current EVP & CFO of Lithium Americas

LITHIUM ARGENTINA MANAGEMENT

Lithium Argentina’s management team will include, among others:

- John Kanellitsas (Interim President & CEO) – current Executive Vice Chair of Lithium Americas

- Alex Shulga (EVP & CFO) – current VP, Finance of Lithium Americas

Additional details with respect to the management team of each entity and the composition of their boards of directors will be set out in the Management Information Circular (the “Circular”).

ANTICIPATED TIMING OF ANNUAL AND SPECIAL MEETING

The annual and special meeting of Lithium Americas shareholders to consider approval of the transaction and annual meeting matters, among other things, is to be held on or about July 31, 2023. The Board of Directors of the Company recommends that shareholders vote in favor of the Separation at the Meeting.

The Separation will be effected by way of a court-approved plan of arrangement under the Business Corporations Act (British Columbia). Under the plan of arrangement, shareholders will retain their proportionate interest in shares of the Company and receive newly issued shares of Lithium Americas (NewCo) in proportion to their then-current ownership of the Company. The Separation will be subject to the approval of: (i) 66 2/3% of votes cast by Lithium Americas shareholders; and (ii) a simple majority of the votes cast by Lithium Americas shareholders, excluding for this purpose the votes held by any person as may be required under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions.

It is currently expected that the Circular, to be prepared in connection with the Meeting, will be finalized and made available on Lithium Americas’ SEDAR profile at www.sedar.com by the end of June 2023. The Circular will also contain further details on the allocation of assets, liabilities and capital structure of the two independent public companies upon separation.

Until the Separation is complete, Lithium Americas will continue to operate as a single company.

CONDITIONS TO THE TRANSACTION

Completion of the Separation is subject to customary conditions and approvals, including the receipt of the Canada Revenue Agency ruling, all required third party approvals, court, tax, stock exchange (including the listing of Lithium Americas (NewCo) common shares on the Toronto Stock Exchange and the New York Stock Exchange) and regulatory approvals and shareholder approval.

FAIRNESS OPINIONS

Lithium Americas’ Board of Directors received fairness opinions from BMO Capital Markets and Stifel GMP that as at the date of such opinions and based upon and subject to the various factors, assumptions, qualifications and limitations set forth therein, the consideration to be received by Lithium Americas’ shareholders under the Separation is fair, from a financial point of view, to Lithium Americas’ shareholders.

ARRANGEMENT AGREEMENT

The Separation is governed by the terms of the arrangement agreement entered into today between Lithium Americas and 1397468 B.C. Ltd., the spinout entity that will become Lithium Americas (NewCo). A copy of the arrangement agreement will be filed under Lithium Americas’ profile on SEDAR at www.sedar.com.

ABOUT LITHIUM AMERICAS

Lithium Americas is focused on advancing lithium projects in Argentina and the United States to production. In Argentina, Caucharí-Olaroz is advancing towards first production and Pastos Grandes represents regional growth. In the U.S., Thacker Pass has received its Record of Decision and has commenced construction.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE