Jeff Clark – “CHEAPER THAN DIRT! These Mining Stocks Are Cheaper Than the Topsoil in Your Backyard”

You don’t need me to tell you that mining stocks are at depressed levels.

But how cheap they are right now just might shock you…

CHEAPER THAN DIRT—FOR REAL!

I joked to someone at a conference back in 2018 that mining stocks were probably as cheap as dirt. It got me thinking, so when I got back to the office I had a researcher run the calculations—and was stunned at what we found.

Even better, I liked how mining stocks performed shortly after we reported how cheap they were. Over the next 18 months GDX gained 101%. You basically doubled your money in a short period of time by investing in a static index fund.

Why? They were dramatically oversold and poised to jump at the smallest catalyst—much like the setup we have today, as you’ll see.

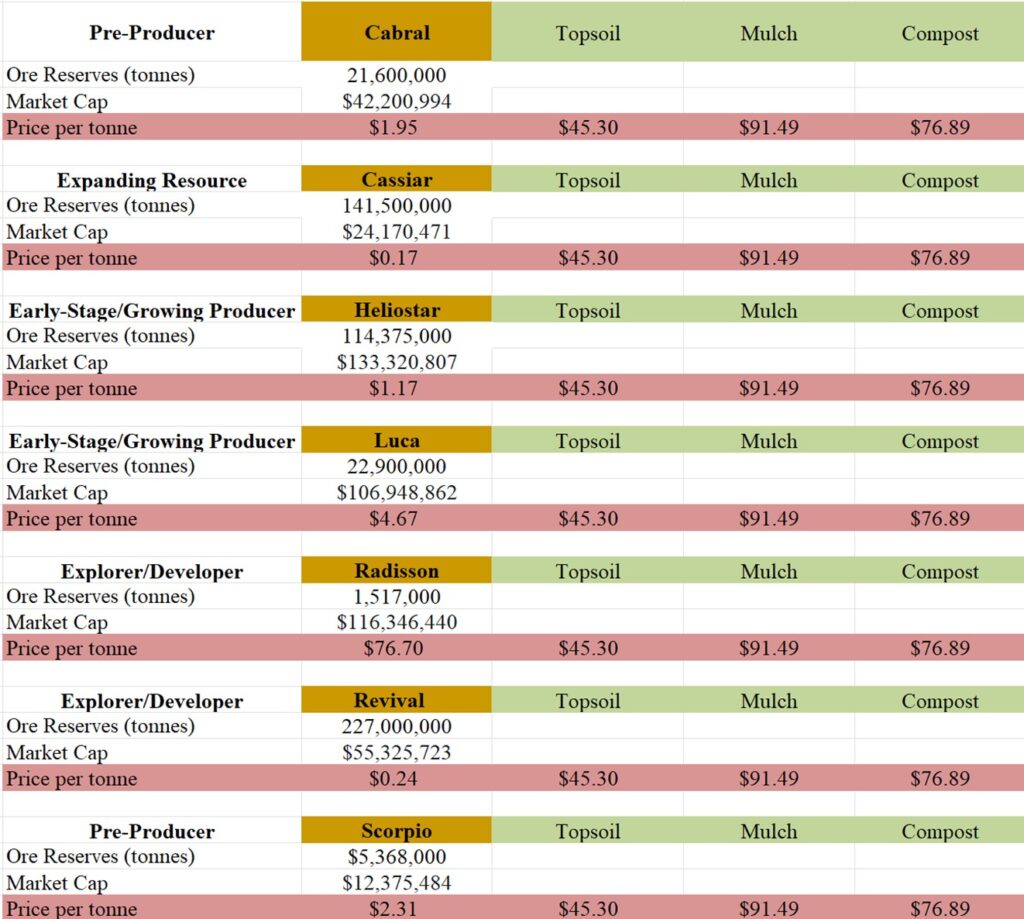

Since we’re still near the bottom of the typical mining cycle, I updated our tables and calculated the price of price per tonne of each explorer and developer in our portfolio with a Resource and compared it to the price per tonne of topsoil, mulch and compost. (These forms of dirt are typically sold by the cubic yard, which we then converted to a metric ton to compare apples to apples). Prices as of 12-31-24.

You too, may be amazed at what we found…

Gold Explorers/Developers

First up, the gold explorers and developers in the Gold Advisor portfolio (view free with signup).

The rows you want to look at are the colored ones labeled Price per tonne, which shows the current value of each stock compared to the price of topsoil, mulch and compost.

Every single company in the Gold Advisor portfolio with a resource is currently selling at a price cheaper than the landscaping dirt you can buy at Home Depot. Only Radisson is more “expensive” than topsoil, though is cheaper than mulch or compost.

And get this: mulch is basically decaying leaves and bark, so all our stocks are currently cheaper to buy than decaying leaves and bark!

Remember, a “resource” is basically a project that has an economic value of gold. It takes money to dig it all up, but the “gold in the ground” is currently selling for less than dirt. Amazing.

Silver Explorers/Developers

Here’s a comparison of the two silver explorers and developers in our portfolio.

Vizsla Silver is cheaper than all forms of commercial dirt, and Dolly Varden is cheaper than mulch and compost. The value of their stocks at current prices is literally dirt cheap.

There’s one stock in our portfolio that almost defies belief…

Mirror, Mirror on the Wall, Who’s the Cheapest of Them All?

We added a copper explorer on August 1 last year, and the stock has gone nowhere but down. This despite having a solid copper Resource with multiple projects that carry strong exploration potential.

Check out just how cheap it is currently selling for.

Vizsla Copper is selling for nearly a tenth of the price of topsoil. And half again that of mulch.

It’s one of the cheapest copper exploration stocks you’ll find, one that already has a resource and a drill program currently in the planning stages.

WALK THROUGH THE DOOR WHILE IT’S WIDE OPEN

The obvious conclusion from this data is that we can buy these stocks at a price that is literally cheaper than the dirt in your backyard.

And every one of these companies carries strong exploration potential. They are, or will be, drilling soon, so there are catalysts on tap.

It’s a circumstance we won’t see very often in our investing lifetime. And with tax loss selling now officially over, we may not have to wait long for the rebound to begin.

- Mining stocks currently offer a profile of unusually low risk vs. outsized potential.

I say grab it while it’s available.

Jeff’s Disclosure: These are some of the sponsoring companies of our website, but they get invited only if I personally own them. If I wouldn’t own it, we turn them down—and we’ve turned down many companies. You can see here I’m overweight many of these stocks.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE