Gwen Preston – “So Many Pipers, So Little Paying…But Look! AI!”

Following two terrible weeks in the junior mining space, last week saw shares generally move sideways while precious metals regained some lost ground. Not a week that inspired confidence but at least it didn’t leave me wondering why I bother.

I have to hope that my rising despair at how long it’s taking for gold to go is a sign that we’re almost there. Isn’t it supposed to be darkest before the dawn?

I realize that isn’t helpful, as it’s neither a fundamental nor technical argument. That isn’t to say sentiment doesn’t matter, because it does, but it’s also hard to find any clarity on that front. Sentiment around gold the metal is fine; like the price, it’s got steady if quiet support that’s enough to keep spot holding near record highs. Sentiment around gold stocks, by contrast, is terrible.

Unfortunately, there’s no reason to think things will get clearer anytime soon. The macro setup could head down a few potential paths from here; some are bearish and some are bullish for precious metals.

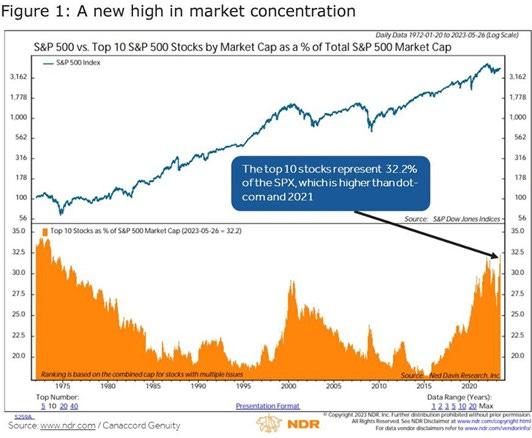

The investing topic de jour is the extreme divergence of the biggest cap (tech) stocks and everything else. The top 10 stocks now represent 32% of overall market capitalization, which means valuation is more concentrated in a few stocks than it was at the dot-com peak and in the speculative tech craze of late 2021. These top 10 stocks account for the entire year-to-date gain in the S&P 500, where eight of eleven sectors are down on the year. In fact, the top 8 stocks account for 107% of the index’s gains.

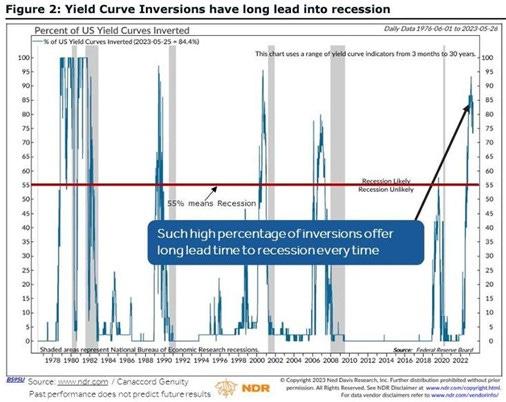

Extreme leadership by a few stocks happens. The question is whether AI big tech stocks are actually leading the stock market (which suggests the rest of the market will follow) or are attracting speculators in a market that, under a shiny surface, is actually weak. Let’s remember that an historic percentage of US Treasury Yield Curves are inverted, manufacturing PMIs are recessionary in most key economies (including the US, China, and EU), consumer and job market confidence keep dipping (the chart below shows in green the differential between those who say jobs are plentiful versus hard to get fell again and is now at its lowest in two years, while overall confidence about now and the future keep slowly declining), and stock liquidity is low and likely to drop further when the US Treasury starts issuing bonds hand over first following a signed debt deal because money will chase bond yields. All told, there’s good reason to lean towards weakness.

I bet you’re tired of hearing about how yield curves are inverted and that reliably leads to recession. After all, US Treasury Yield Curves started to invert a year ago. But hold on – a year isn’t actually that long. Canaccord Chief Investment Officer Tony Dwyer had an interesting comment on this recently, pointing out that today’s 24/7 coverage of financial news has made it feel like it’s taking ages for this recession to begin but in fact it normally takes a year or more for a recession to start following a yield curve inversion.

As for liquidity, it will likely flow to bonds following a final debt deal as investors look for exposure to rising yields. That might be the thing that slows Big Tech stocks; if it does, it would take the shine off the market and investors might see a need to rotate out of speculative tech stocks and into value and cyclical stocks.

There are a lot of if’s and might’s in that paragraph. Would that I could offer more certainty but I can’t. I think money will chase rising bond yields. I think that will slow Big Tech stocks’ crazy ascents. I think that would reveal that the overall market is weaker than it appears right now. I think that will prompt investors to turn defensive.

Certainly indicators suggest manufacturing and growth are slowing. The chart below shows the S&P 500 powering higher on the back of those 8 Big Tech stocks against the price of copper. As you can see, the two usually correlate closely but have diverged in the last month or two. And stocks often follow industrial indicators down.

But bubbles often outlast any supporting rationales, so I don’t know if this will transpire, let alone when or how quickly.

The thing is, those questions matter for gold investors because defensive investors buy gold and larger gold stocks. If the stock market slides, defensive investors usually move into smaller gold stocks once the bottom is in or appears nigh.

If Big Tech stocks don’t falter in the liquidity drain following a debt ceiling deal, there isn’t much reason to think gold or gold stocks will get attention in the near term. In fact, rising bond yields should support the dollar and boost real rates, both of which hurt gold.

Of course, gold has its supports. Top on that list are uncertainty (that endless recession question) and central bank buying.

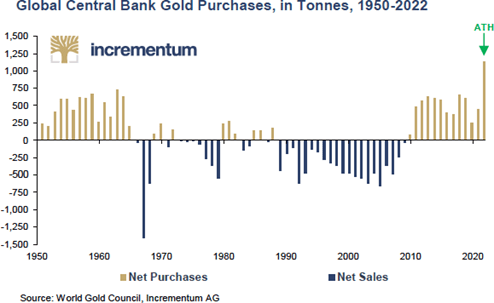

I haven’t talked about central banks lately but they deserve mention. Look at these two charts, borrowed from the always informative 2023 In Gold We Trust report, which just came out last week. Click here to be directed to that report.

The first shows global central bank gold purchases. After eschewing gold in the 1990s and 2000s, central banks started amassing the yellow metal following the Great Financial Crisis and haven’t stopped. And last year they went on a gold-buying spree, buying more than ever before.

The second chart shows gold purchases that central banks reported in blue and did not report in gold. Unreported gold buys have been increasing since early 2022 and shot up in the last two quarters.

Why? I took this from my latest talk:

Deglobalization and de-dollarization are slow processes, but they’re happening. Both require countries to establish new foundations, for trade and financial strength. Gold is part of both – it can be an objective medium of trade for new partners and it backstops currencies and nations that are stepping away from the USD domination.

From that angle, it makes sense that many nations would be quietly acquiring gold and will continue to do so for years to come.

As I note in my presentation, central bank buying doesn’t directly help gold stocks. But if central banks continue buying at this scale, it will in time boost the price of gold to a point that attracts investor attention.

I’ve got to admit: the resurgence of Big Tech speculative investing in 2023 is frustrating for me as a metals investor. Speculation has completely displaced value investing; for a decade it ‘made sense’ because the Fed clearly wasn’t going to let the stock market crash (COVID excepted) and now because it’s become habit. Add in the dominance of passive investing today and things like insane run ups in eight tech stocks to dominate the entire stock market become normal.

Meanwhile, clear shortages in a few years of the metals we need to exist and electrify don’t get any attention. Neither do gold equities, even though the yellow metal is trading near all- time highs and there are good reasons to think it will go higher from here.

I remain convinced that the piper must be paid at some point. I just don’t know which challenge will rise up first and why – high rates, inverted curves, crazy lack of market breadth, significant shortages of many metals, gold stocks lacking life despite a gold price near all-time highs, or something else.

To wrap, I saw this and thought I just had to share.

MORE or "UNCATEGORIZED"

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE

Mishkeegogamang First Nation and First Mining Sign Long Term Relationship Agreement for the Development of the Springpole Gold Project

Agreement setting out the significant participation of Mishkeegog... READ MORE