Gwen Preston – “Rates Steady, Inflation Dropping…Unicorn Potential Rising”

It was a big week for data that I will discuss only in brief.

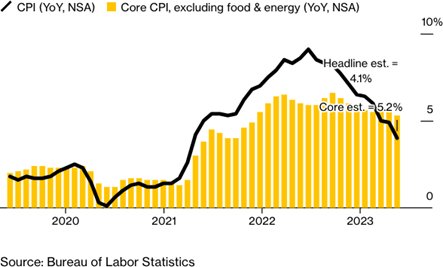

First big release: May inflation numbers. CPI rose 4% in May, the lowest pace since March 2021.

Falling fuel prices helped pull the number down but even Core CPI, which excludes food and energy, fell to 5.2% from 5.5% in April.

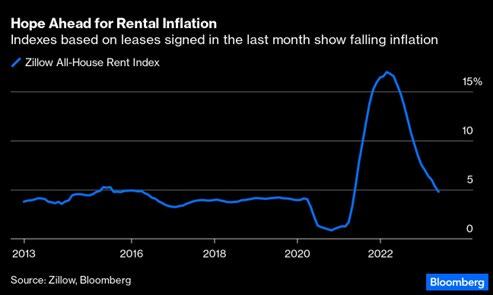

So inflation continues to soften even while the labour market remains hot. That’s the heart of the soft landing setup and this inflation report keeps the soft landing opportunity alive. And there are reasons in the inflation report to believe it will continue to soften in the near term. For one, the CPI uses all leases currently in place to estimate shelter costs, which is accurate but lagging; the Zillow gauge of news leases taken out each month says the spike in rental inflation is over.

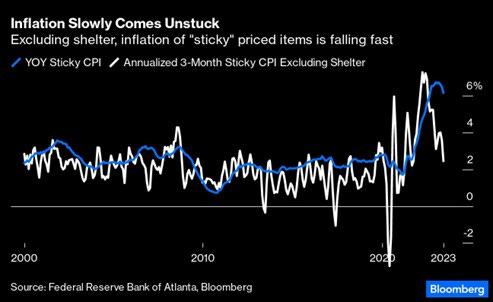

For another, the Atlanta Fed’s sticky versus flexible inflation measures show sticky prices have finally turned down. they remain high but should ease once shelter costs stop rising so quickly, which they already have.

With inflation easing (importantly not surprising to the upside) the Fed left interest rates unchanged at today’s meeting. Makes sense: inflation is no longer accelerating so there’s no need to push too hard against it.

As for cutting rates…inflation remains too high for that and strong employment numbers give no additional reason to cut.

So higher for longer? Yes, as long as the economy doesn’t end up in a recession. That’s still totally unknown. Models based on indicators like inversion curves put odds of a recession in the next 12 months at 100%. Sentiment disagrees, or so says the S&P that’s back in bull market territory.

Fed officials aren’t expecting a recession: in the new Dot Plot showing rate projections by Fed officials, 12 of 18 policymakers penciled in rates at or above 5.5% at the end of the year. Most then expect to cut rates in 2024; the median projection for the end of that year from Fed officials is now 4.6%, and 3.4% by the end of 2025.

I talk macroeconomics, metal prices, and stock expectations all day. These days most people I chat with remain uncertain about what stocks will do while rates remain high but almost all expect a bull run just as soon as rates start coming down.

I hope so, not only for the sake of my portfolio but because a bull stock market would only happen alongside falling rates if inflation falls within a reasonable-to-good economy. In other words, it would only happen if we get perfection, the ideal soft landing that until recently seemed as likely as spotting a unicorn.

Unicorn odds do keep rising, if slowly. It would certainly be the best outcome, in general, and because base metals are desperately undersupplied but will not attract investor attention until there’s some confidence the economy is reliably on track and rising rates aren’t going to knock everything flat again. Meanwhile, gold does well when rates are falling and metals are performing.

We’ll see (that’s annoyingly becoming my mantra). It’s going to be a bit of a boring summer for most metals, I think, as we wait for the other shoe to fall – either the unicorn soft landing shoe I just described or a recession. While we wait, uranium and lithium are more than happy to take center stage.

I had a great call with Amir Adnani of Uranium Energy (NYSE: UEC) on Monday. I will convey the gist of that call next week. For now, it’s time to buy a lithium stock. If you’d like to see which stock I bought recently, you can subscribe to The Maven Letter here or click the button below.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE

Mishkeegogamang First Nation and First Mining Sign Long Term Relationship Agreement for the Development of the Springpole Gold Project

Agreement setting out the significant participation of Mishkeegog... READ MORE