Gwen Preston – “No Simple Headline For This Mess…”

A few good data points sent markets higher this week. Key among those good data points were weak inflation numbers, showing CPI and all its permutation extended steady declines in October. That seems to have cemented the idea that rates have topped, which sent yields down so markedly that it seemed the bond rout of the last year might have ended.

At least, it seemed that way for a day.

I start with this because man oh man it remains strange out there. Stocks ripping higher while growth slows; bond yields rising while inflation falls; seven stocks responsible for pulling entire stock market higher.

In today’s comment, I want to highlight some of the strangeness. I’ll do it point form, rather than my usual extended blather.

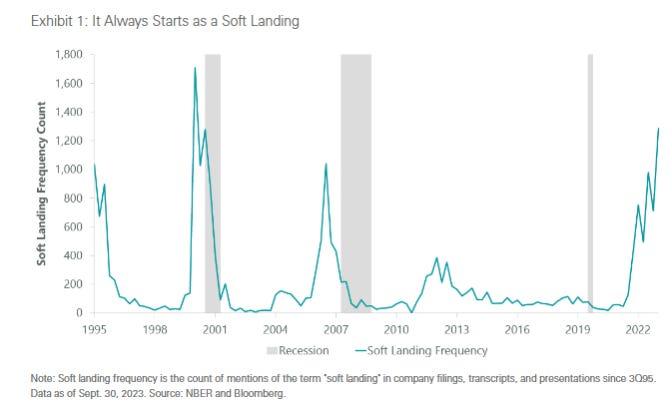

- Searching documents filings going back to 1995, it appears mentions of a ‘soft landing’ have spiked twice before…and both times were followed by a recession. It’s a reminder that recessions usually come on gradually, disguised as soft landings until they really hit. Also, if you define soft landing as a period when rates rise but economic growth doesn’t contract for even one quarter, it has happened only once before. That was in the mid-1990s, when Alan Greenspan’s sudden hard hikes created a short, brutal bond bear market and sparked credit crises in emerging market but growth remained positive in the US. That, however, happened as America enjoyed the peace dividend from the end of the Cold War, which put the federal budget into surplus. A very different setting from today.

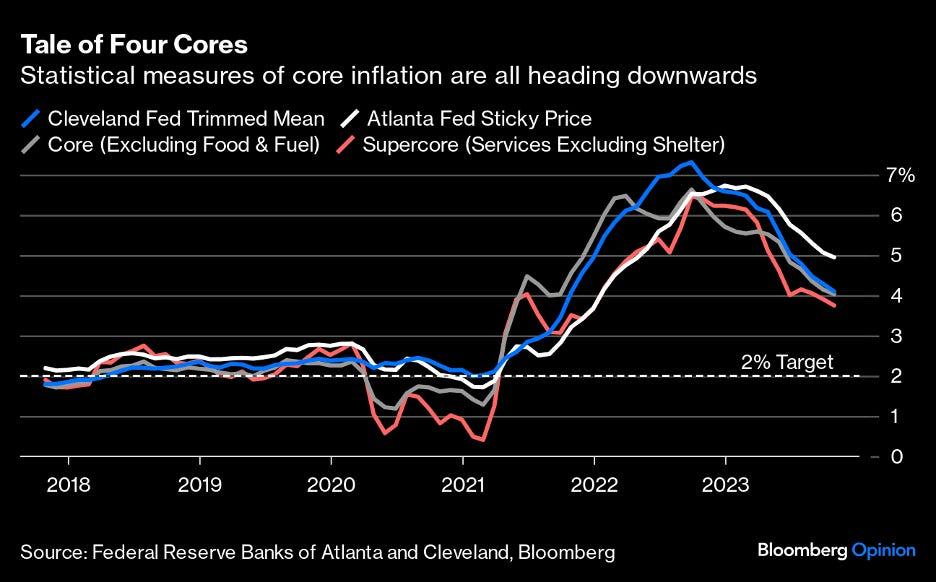

- October inflation data was about as good as could have been expected. All four of the average measures that we have all watched closely for the last few years dropped again, extending what are now clear downward trends. Those measures are the Trimmed Mean (excludes the biggest outliers in either direction and averages the rest), the Sticky Price Index (goods and services who prices are difficult to reduce), the Core measure (excludes volatile food and energy prices), and the Supercore measure (services only, excluding shelter). Rate of decline is still slow and all four remain above the Fed’s 3% target, but they’re moving the right direction.

- Markets went a bit wild over this inflation print. The S&P 500 jumped 2.2%, bonds rallied, and gold added 1%, all within minutes of the inflation report. The same rationale drove all three moves: the Fed will stop raising rates if inflation is truly under control.

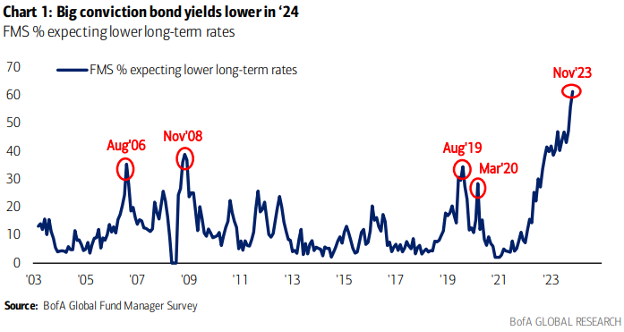

- Bonds in the moment: over the last year, investors have watched the bond market break free from its 30-year trend of rising prices and declining yields. Then came COVID and the Fed’s war on inflation, which changed that long trajectory, driving bond yields up and prices down. Meanwhile, the pool of buyers for T Bills keeps shrinking while America’s need to issue debt keep rising, which created more price pressure.

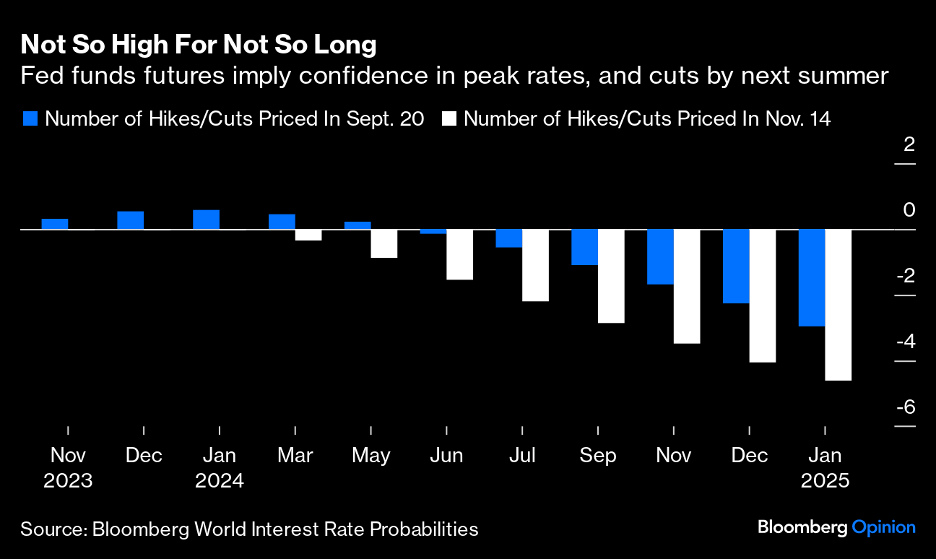

Now, with inflation seemingly under control and unemployment rising, there’s little reason to expect any more rate hikes. Instead the conversation is now all about cuts. That explains the chart below. All kinds of investors have been watching bonds for the last year, waiting for the chance to buy. And this Bank of America survey says fund managers think that time is now: a record number think long-term yields are heading down from here.

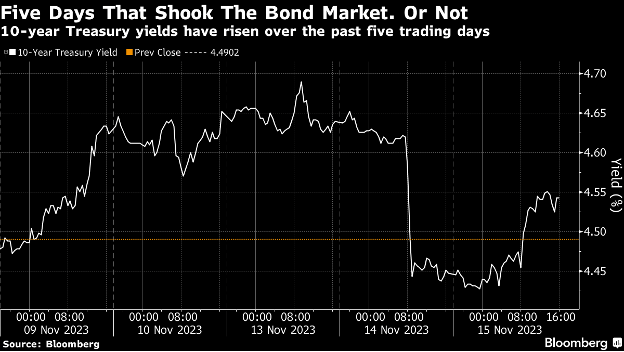

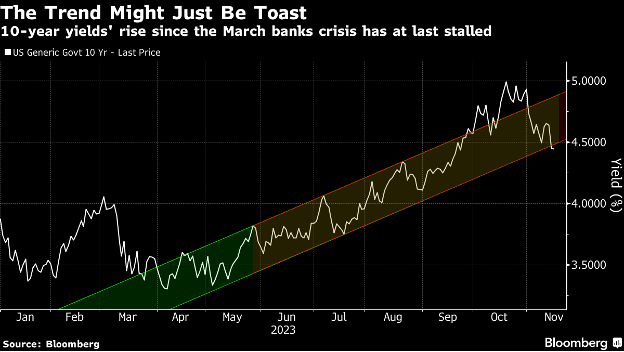

The way bonds yields plummeted on that October inflation print had people proclaiming the bond rout was over, bolstered by charts like this.

Yields bumped higher again only a day later, a reminder that change takes time. For now markets are expecting rates to still be above 4% entering 2025 (five cuts would bring the rate to 4-4.25%). If we get a recession, cuts will be bigger and faster than that.

- But…there’s also that bond oversupply question. Last week a $24-billion auction of 30y Treasuries did not go well. It had a bid-to-cover ratio of 2.24, versus a usual BTC of 2.3 to 2.5 (it was 2.6 to 2.8 a few years ago, when there were more buyers!).

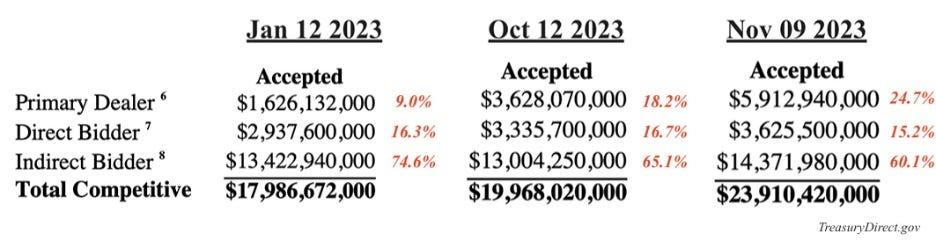

When we look at who bid…

Foreign buyers (indirect bidders) dropped to 60.1% from 74.6% at the start of the year.

Institutions (direct bidders) failed to make up the difference, taking only 15.2% (down slightly over the year). That left primary dealers holding the bag for almost 25%, versus 9% in January.

When the BTC is bad, the tail grows. The tail is the difference between where bond yields trade when issued versus at auction (expected versus actual yield). Tails are usually 2 to 3 basis points. Anything above 4 is bad.

This auction had a 5.3 basis point tail. That’s the worst tail for a 30y auction since 2011, when the S&P downgraded US credit rating from AAA to AA+.

There is one important note to add to this story: ICBC, the Chinese bank, is a big player in the Treasury market. And it was hit with some kind of cyber attack on Thursday that killed its bids, which made the bid side weaker than it really was. It’s impossible to know how much difference ICBC would have made. We’ll just have to see what happens at the next long-dated Treasury auction.

That disastrous auction happened shortly after the US Treasury released an issuance calendar showing less borrowing in Q4 than expected, and a plan to borrow more on the short end of the curve than the long end.

This was obviously an effort to manage fears of a near-term T-bill tsunami. The Treasury even said as much:

“Primary dealers explicitly noted a high degree of uncertainty overall around deficit and growth forecasts, reinforcing Treasury’s need to maintain flexibility.”

My Take: this is the Treasury admitting that primary dealers (the banks that buy T Bills and then resell them to investors) are worried that weak demand is going to leave them stuck having to buy more of the auctions than they want.

Remember the context: the US government is running a $2-trillion annual deficit and therefore must issue more debt every year, even while buyers drift away. The T Bill marketplace is still immense; it isn’t going to dry up quickly. But the Treasury itself just acknowledged there’s an issue.

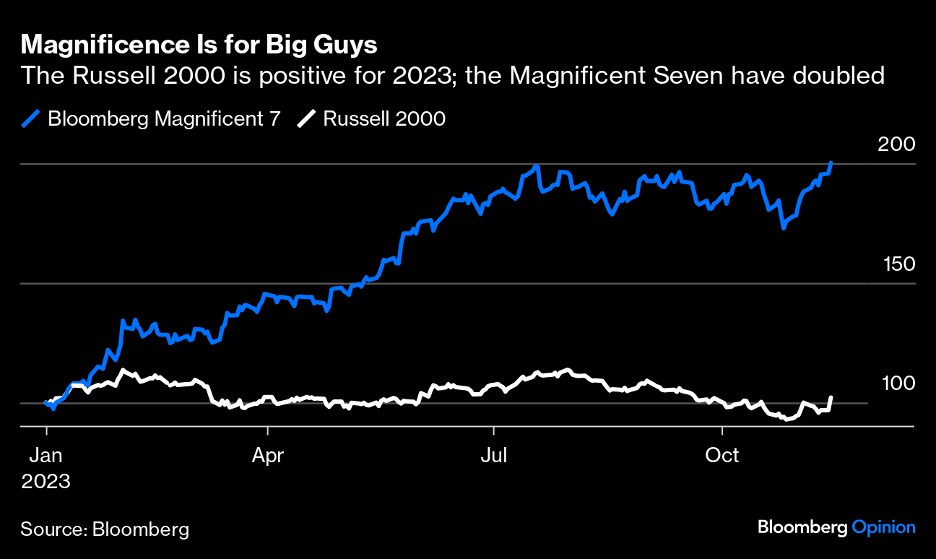

- To finish on a different note, I have thought many times in the last two years how similar today’s stock market feels to the late 1990s. Then, tech companies were the only sector holding up the market – and holding it up dramatically via the Cot Dom Bubble. Today, the Magnificent 7 are responsible for ALL of the market’s gains this year.

Uncertainty in the bond market – will yields turn up again because there really is too much supply or is the bond rout done because rates are topped? – makes for a shaky foundation to a market that doesn’t really know which way to go. Inflation seems to be coming down (which is good) but unemployment is rising, growth is slowing, and valuation multiples for Big Tech look rich in that context.

And soft landings are usually not real; they’re the optimist’s view on the lead-up to a recession.

Recession risk is real. Rates are likely topped. Gold could do well in such an environment. Base metals will have to keep waiting.

Courtesy of the Resource Maven

MORE or "UNCATEGORIZED"

Spanish Mountain Gold Announces Larger Scale Preliminary Economic Assessment With a Base Case NPV5% After-Tax of C$1.0 Billion, 18.2 % IRR and 3.4 Year Payback at US$ 2,450/Oz Gold Price; at US$3,300/Oz Spot Gold Price NPV5% C$2.3 Billion, 32.0% IRR and 2.0 Year Payback; Including an Updated Mineral Resource Estimate for Its Spanish Mountain Gold Project

Spanish Mountain Gold Ltd. (TSX-V: SPA) (FSE: S3Y) (OTCQB: SPAUF)... READ MORE

Aura Announces Preliminary Q2 2025 Production Results

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) is plea... READ MORE

Cascadia Announces Closing of Financing

Cascadia Minerals Ltd. (TSX-V:CAM) (OTCQB:CAMNF) is pleased to an... READ MORE

Abcourt Closes US$ 8M Loan Facility to Start Sleeping Giant Mine

Abcourt Mines Inc. (TSX-V: ABI) (OTCQB: ABMBF) is pleased to anno... READ MORE

Mishkeegogamang First Nation and First Mining Sign Long Term Relationship Agreement for the Development of the Springpole Gold Project

Agreement setting out the significant participation of Mishkeegog... READ MORE