Gwen Preston – “Copper: A Price Double Hasn’t Created Supply…So What Will It Take?!?”

Copper is a big, liquid, and essential market. It’s called the PhD of metals for a reason: economic growth requires copper and so demand for the red metal reliably ebbs and flows with the economy.

The copper bull market of the 2000s was driven by massive industrial growth in China. The speed and scale of that growth story was so immense it seemed no subsequent bull market could ever live up.

But I think the one that’s coming will be bigger.

The green revolution is amplifying the amount of copper that’s required in almost everything. Electric vehicles are a common example for good reason: a conventional car uses about 22 kg of copper while an electric vehicle uses 53kg. That kind of increase is simply part of the deal when you rely on electricity, rather than combustion, to power things.

To provide some numbers: the global copper market will trade about 24 million tonnes this year. The majority of that – 22.5 million tonnes – will be conventional, non-green demand: wiring, electronics, conventional vehicles, and so on. Green demand from EVs, charging infrastructure, the green power sector, and so on only stands at about 1.5 million tonnes today.

And so you have global copper demand doing this.

Demand has been rising for two decades already. Really, the China copper story had just started to ease when the green revolution copper story started to grow, creating steadily rising demand.

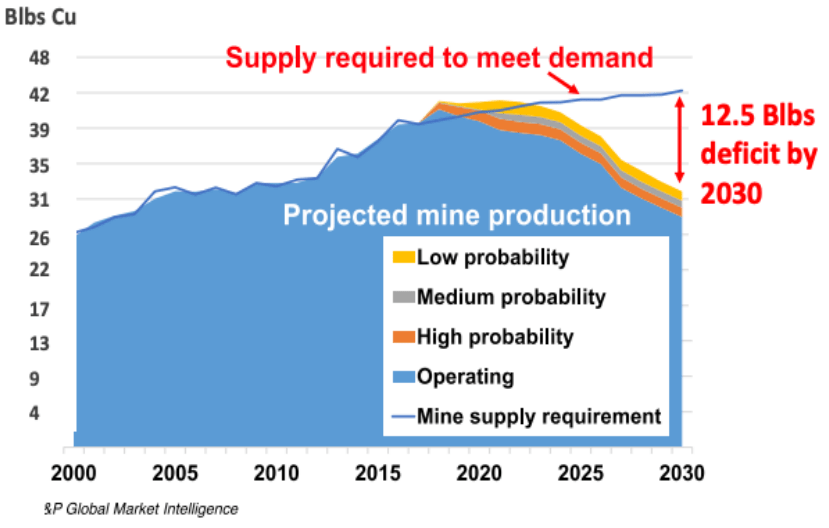

And it’s been a-ok for two decades because supply has kept up. But supply is about to fall off a cliff.

This is where the story gets really interesting, in my opinion – and why it carries such investment potential.

By the middle of this decade – so starting in two years – we will face the largest copper deficit ever. Two years is nothing in the copper world, where projects regularly take over a decade to get permitted, financed, and built (sometimes two decades).

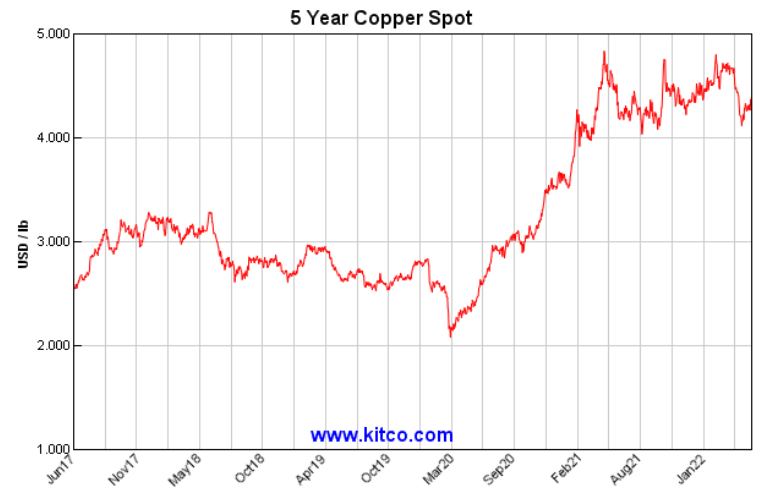

How have we gotten to this point? It’s a good question. For starters, the copper price is up a lot over the last two years. Shouldn’t a doubling of price encourage some new production?

Here is where today’s copper story diverges from the copper story of the 2000s. In 2002, when the scale of pending Chinese copper demand became apparent, there was an almost immediate supply-side response. Companies pushed projects ahead, permits were achieved, capital flowed in, and supply increased in lockstep with the price.

This time, the supply is not responding. Around the world, not a single new copper mine has achieved a building permit in the last two years. Capital is not flowing into the copper sector. And companies are not pushing projects forward aggressively.

There are myriad reasons.

- Corporate Caution.Miners screwed up the last metals bull market spectacularly. They overspent and overbuilt, which meant they didn’t make money at the time and they 4 flooded their markets with supply, creating a bear market that kept them bleeding cash for years. Several major mining companies almost died, including Teck. As a result, there is now a much more conservative mentality among management teams. They are focused on cash flows and dividends, not on aggressive growth that takes advantage of future opportunities. And that conservatism is proving very difficult to erode – the copper price has doubled but capital spending plans have barely budged.

- In the early 2000s, it took six months to a year to permit a new mine. It was longer for really big projects and of course timelines varied from jurisdiction to jurisdiction, but permitting was pretty quick. Today, it takes 2 to 6 years to permit a new mine, and oftentimes much longer. This essential new reality has dramatically slowed miners’ ability to respond to supply shortages in short order.

- ESG Investing.Miners have not fared well in the ESG Investor world. It hasn’t mattered that copper (or nickel or lithium or silver or or or) is essential to decarbonization; miners have been excluded from ESG investment flows. Those flows have been very significant and without them, miners have been left without momentum, which only decreased their investment appeal. The unfortunate truth that we have to dig big holes in the earth to get the metals we need to green our world has left mining out in the investment cold and it’s hard to justify big capital spending to build new mines when one’s share price is, at best, boring (see point 1).

Those points all make sense. But they leave us literally between a rock and a hard place. Copper is not fungible. There is no alternative. It is such a good, safe conductor that it has absolute primacy in its uses.

And so we need to produce more copper. But after a few mine expansions wrap up over the next 12 months, production peaks and then starts to decline about 1% annually from 2024 onward.

What changes that? Price. Since there are no real or significant substitutes for copper and because the green revolution is undeniable, demand is unlikely to falter. And so it will become a game of scarcity. And in those games, price always wins.

It’s also important to note that copper doesn’t represent a large enough portion of the cost for most of the things in which it is used to derail plans. Take electric vehicles, for instance – for copper to double in price again from here would still not impact end car prices much.

How high will copper go? The question is really: how expensive does copper have to be to start destroying demand? To start slowing green buildouts and impeding overall growth? Goldman thinks the number is $15,000 per tonne, which is 55% higher than the price today. Shooting past that on the way is certainly likely.

Yes, the price has already doubled in two years. But today’s price is still not moving the needle at all in terms of investor interest, corporate caution, or end-users stepping upstream to secure supply. To me, that suggests there is still a lot of room to run.

A good analogy someone referenced recently is oil in the 2000s. It started at $15 per barrel…and ended at $140 per barrel. It took a 7X in price to force the market to adjust to the new reality. For oil, that meant demand destruction and finding a new source of supply in fracking. (For copper, new sources of supply are very unlikely.)

It takes incredible price moves to shift an entire market. But the lack of supply response as we come up against the largest shortage the copper market has ever seen to me underlines that copper needs several dramatic shifts – from miners, investors, and users. And given how close the shortage now is, I think the shift will come all at once propelled by a dramatic price gain.

MORE or "UNCATEGORIZED"

First Phosphate Receives Conditional Approval for up to $16.7 Million Non-Repayable Contribution from the Government of Canada

First Phosphate Corp. (CSE: PHOS) (OTCQX: FRSPF) (OTCQX ADR: FPHOY) (FSE: KD0) has been cond... READ MORE

Gold X2 Drills 117m of 1.21 g/t Au, Including 10m of 4.37g/t Au; High-Grade Zone Intersected 280m Beneath the Resource Pit Demonstrating Underground Potential at the Moss Gold Deposit

Gold X2 Mining Inc. (TSX-V: AUXX) (OTCQB: GSHRF) (FWB: DF8), is pleased to announce initial drilling... READ MORE

Tectonic Raises Over C$92 Million; Completes Upsized Private Placement With Full Over-Allotment Exercised

Tectonic Metals Inc. (TSX-V: TECT) is pleased to announce the successful closing of the Company’s ... READ MORE

Cerro de Pasco Resources Enters Project Development Funding Agreement with U.S. International Development Finance Corporation for Quiulacocha

Cerro de Pasco Resources Inc. (TSX-V: CDPR) (OTCQB: GPPRF) (BVL: CDPR) announces that it has ... READ MORE

NorthWest Announces Updated Mineral Resource at Kwanika Reflecting Strategic Shift to Higher-Grade Copper-Gold Focus

NorthWest Copper Corp. (TSX-V: NWST) is pleased to announce an updated mineral resource estimate for... READ MORE