GR Silver Mining Reports Wide Gold and Silver Zones from the Final Drill Holes to be Incorporated into the Plomosas Mine Area Resource Estimation

GR Silver Mining Ltd. (TSX-V: GRSL) (OTCQB: GRSLF) (FRANKFURT: GPE) is pleased to report assay results from the final drill holes to be incorporated into the resource estimation at the Plomosas Mine Area at the Plomosas Silver Project in Sinaloa, Mexico. These results represent wide intersections of predominantly gold and silver-rich epithermal veining.

Drill highlights:

PLI21-10

- 41.7 m @ 1.13 g/t Au

PLI21-14

- 11.1 m @ 0.81 g/t Au

279-IM

- 13.0 m @ 328 g/t Ag, 0.5 % Pb, 1.2% Zn, 0.1% Cu and 0.2 g/t Au – 397 g/t AgEq1

A listing of significant drill results from the Plomosas Mine Area are presented in Table 1.

| _________ |

| 1 AgEq is based on long term gold, silver, zinc, lead and copper prices of US$1,600 per ounce gold, US$16.50 per ounce silver, US$0.85 per pound zinc, US$0.95 per pound lead and US$2.00 per pound copper. The metallurgical recoveries are assumed as 90% Ag, 95% Au, 78% Pb, 70% Zn and 70% Cu. |

GR Silver Mining President and CEO, Marcio Fonseca commented “This final batch of drilling results from drill holes PLI21-10 and 14, represent a step out of approximately 150 m to the north from the closest underground information in the Plomosas Mine Area. As a result, they confirm the presence of attractive gold and silver epithermal mineralization in unmined zones of the historic Plomosas Mine Area. These results represent the delineation of new prospective host rocks defining additional targets for future drilling beyond the area of the maiden resource estimation, which is currently in progress.”

The gold mineralization, as evidenced in drill holes PLI21-10 and 14, is hosted by hydrothermal breccias which commonly include irregular colloform banded quartz veins related to a NW-oriented structural trend. This mineralization style is illustrated by the core samples displayed in the following link: (see Link to Core Photos).

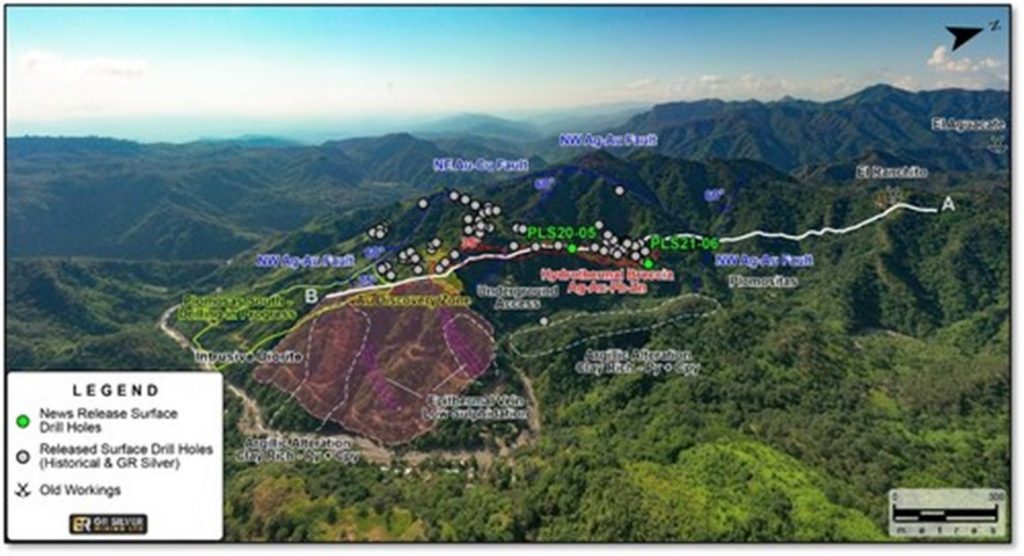

The following figure (Figure 1) illustrates the location of all surface holes released to date on the Plomosas Mine Area and a select group of results representing the Ag-Au rich mineralized intervals that are currently being incorporated into the maiden resource estimation for this area.

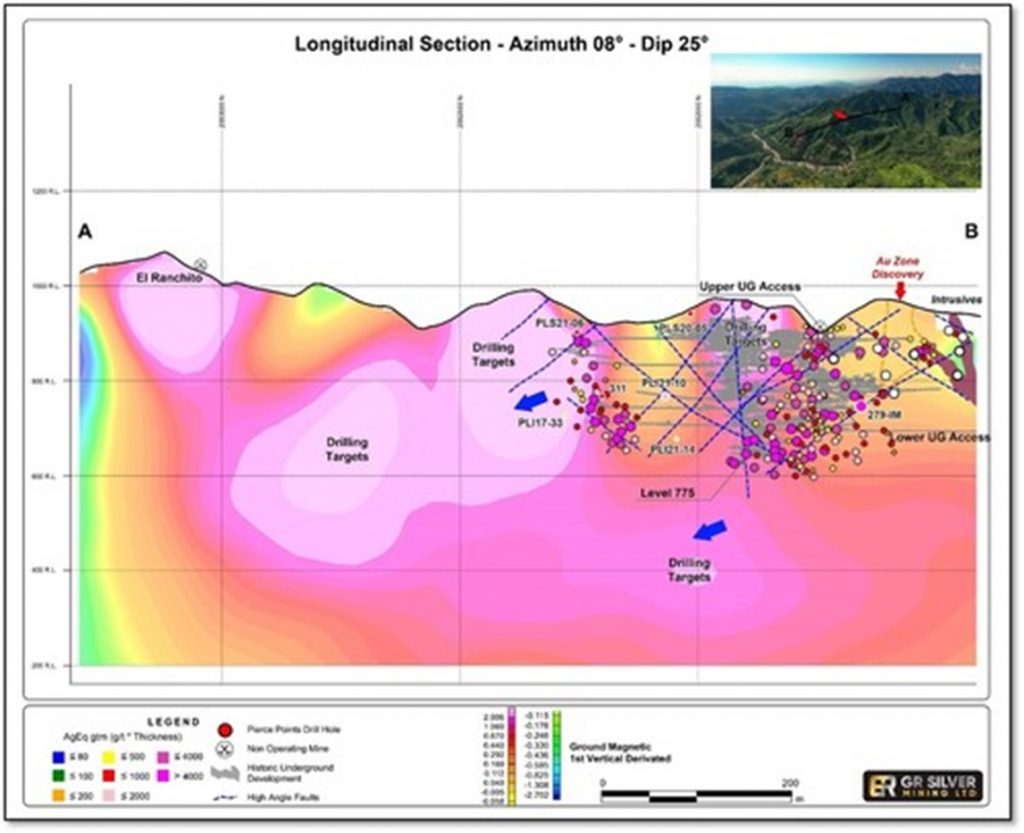

The longitudinal section (Figure 2) demonstrates the 2 km long N-S trend of the Plomosas Mine Area, extending northwards towards the historical old workings at El Ranchito and El Aguacate. The longitudinal section also includes geophysical anomalies outlining the preferential location of potential mineralized zones along strike, as well as grade times thickness pierce points of surface and underground drill holes in AgEq grams per tonne times metres (gtm).

The discovery of precious metal only mineralized epithermal veins has encouraged the Company to pursue an extensive surface core drilling program, outside of areas under resource estimation, such as at Plomosas South (see News Release dated June 21, 2021), with the objective of identifying new discoveries in H2|2021.

Table 1: Drill Hole Assay Results

|

Hole No. |

From (m) |

To (m) |

Drilled width (m) |

True width (m) |

Ag g/t |

Au g/t |

Pb % | Zn % | Cu % | AgEq g/t |

| PLI21-10 | 46.7 | 88.4 | 41.7 | 29.5 | 1 | 1.13 | n/a | 0.1 | n/a | |

| includes | 48.6 | 61.4 | 12.8 | 9.1 | 1 | 2.12 | 0.1 | 0.1 | n/a | |

| PLI21-14 | 64.0 | 75.1 | 11.1 | 6.4 | 1 | 0.81 | n/a | 0.1 | n/a | |

| includes | 64.0 | 70.0 | 6.0 | 3.4 | 1 | 1.38 | n/a | 0.2 | n/a | |

| PLS20-05 | 9.0 | 13.0 | 4.0 | 3.6 | 163 | 0.05 | 6.4 | 3.7 | 0.2 | 499 |

| PLS21-06 | 8.1 | 14.3 | 6.2 | 6.1 | 120 | 0.48 | 2.8 | 0.7 | 0.1 | 285 |

| PLI17-33 | 113.8 | 114.8 | 1.0 | 0.9 | 9 | 5.24 | 0.2 | 0.2 | n/a | |

| 279-IM | 25.3 | 38.3 | 13.0 | 11.8 | 328 | 0.19 | 0.5 | 1.2 | n/a | 397 |

| 311 | 1.0 | 2.0 | 1.0 | 1.0 | 680 | 0.04 | 0.6 | 2.4 | 0.08 | 774 |

| 5.0 | 10.0 | 5.0 | 4.9 | 143 | 0.02 | 1.2 | 4.3 | 0.09 | 397 |

| AgEq is based on long term gold, silver, zinc, lead and copper prices of US$1,600 per ounce gold, US$16.50 per ounce silver, US$0.85 per pound zinc, US$0.95 per pound lead and US$2.00 per pound copper. The metallurgical recoveries are assumed as 90% Ag, 95% Au, 78% Pb, 70% Zn and 70% Cu. All numbers are rounded. Results are uncut and undiluted. “n/a” = no relevant assays. |

Table 2: Drill Hole Locations

| Hole No. | East (m) | North (m) | RL (m) | Azinuth (*) | Dip (*) | Depth (m) | Type |

| PLI21-10 | 451,209 | 2,552,085 | 771 | 118 | 0 | 180.0 | UG |

| PLI21-14 | 451,039 | 2,552,058 | 740 | 230 | -65 | 272.3 | UG |

| PLS20-05 | 451,544 | 2,552,011 | 951 | 0 | -90 | 150.5 | Surface |

| PLS21-06 | 451,592 | 2,552,248 | 910 | 90 | -50 | 109.5 | Surface |

| PLI17-33 | 451,172 | 2,552,219 | 772 | 60 | -22 | 162.2 | UG |

| 279-IM | 451,158 | 2,551,655 | 735 | 90 | 24 | 76.8 | UG |

| 311 | 451,281 | 2,552,198 | 774 | 128 | -45 | 77.5 | UG |

| All numbers are rounded. BOLD drill holes are drilled by GRSL; East (m) and North (m) are UTM coordinates in WGS84, zone 13. |

Qualified Person

The scientific and technical data contained in this News Release related to the Plomosas Project was reviewed and/or prepared under the supervision of Marcio Fonseca, P. Geo. He has approved the disclosure herein.

Quality Assurance Program and Quality Control Procedures

The Company has implemented QA/QC procedures which include insertion of blank, duplicate and standard samples in all sample lots sent to SGS de México, S.A. de C.V laboratory facilities in Durango, Mexico, for sample preparation and assaying. For every sample with results above Ag >100 ppm (over limits), these samples are submitted directly by SGS de Mexico to SGS Canada Inc at Burnaby, BC. The analytical methods are 4-acid Digest and Inductively Coupled Plasma Optical Emission Spectrometry with Lead Fusion Fire Assay with gravimetric finish for silver above over limits. For gold assays the analytical methods are Lead Fusion and Atomic Absorption Spectrometry Lead Fusion Fire Assay and gravimetric finish for gold above over limits.

The recent drill holes, completed by First Majestic from 2016 to 2018, followed QA/QC protocols reviewed and validated by GR Silver Mining, including insertion of blank and standard samples in all sample lots sent to First Majestic’s Laboratorio Central facilities in La Parilla, Durango, for sample preparation and assaying. Additional validation and check assays were performed by an independent laboratory at SGS de México, S.A. de C.V. facilities in Durango, Mexico. The analytical methods applied for these recent holes for Ag and Au assays comprised of Fire Assay with Atomic Absorption finish for samples above Au >10ppm and Ag >300ppm and Gravimetric Finish. Lead and Zn were analyzed using Inductively Coupled Plasma Optical Emission Spectrometry. GR Silver Mining has not received information related to the Grupo Mexico QA/QC and assay protocols and at this stage is considering the information historic for news release purposes.

About GR Silver Mining Ltd.

GR Silver Mining Ltd. is a Mexico-focused Company engaged in cost-effective silver-gold resource expansion on its 100%-owned assets which lie on the eastern edge of the Rosario Mining District, in the southeast of Sinaloa State, Mexico.

Plomosas Silver Project

GR Silver Mining’s 6,574 ha Plomosas Silver Project is located near the historic mining village of La Rastra and within 5 km of the Company’s San Marcial Silver Project, in the Rosario Mining District. The Project is a past-producing asset where only one mine, the Plomosas lead-zinc(-silver-gold) underground mine, operated a 600 tpd crush-mill-flotation circuit from 1986 to 2001, producing approximately 8 M ounces of silver, 73 M pounds of lead and 28 M pounds of zinc2.

The March 2020 acquisition of the Plomosas Silver Project included 563 historical and recent drill holes from both surface and underground locations. These drill holes represent an extensive database allowing the Company to advance towards resource estimation and potential project development in the near future.

The Company recently completed a drilling program with surface holes focused on expanding known mineralization along strike in two areas, the Plomosas Mine Area and the San Juan Area. Underground drilling included in the program targeted the extension of recent Au-rich discoveries at the lowest level (775 m RL, or ~250 m below surface) of the Plomosas Mine Area and six low sulphidation epithermal veins at the San Juan Area. Both areas are currently the subject of NI 43-101 resource estimations.

The assets include all facilities and infrastructure including access roads, surface rights agreement, water use permit, 8,000 m of underground workings, water access, 60 km – 33 KV power line, offices, shops, 120-person camp, infirmary, warehouses and assay lab representing approximately US$30 M of previous capital investments. The previous owners invested approximately US$18 M in exploration, including extensive geophysics and geochemistry programs.

The silver-gold mineralization on this Project displays the alteration, textures, mineralogy and deposit geometry characteristics of a low sulphidation epithermal silver-gold-base metal mineralized vein/breccia system. Previous exploration was focused on polymetallic (Pb-Zn+/-Ag-Au) shallow mineralization, hosted in NW-SE structures in the vicinity of the Plomosas Mine. The E-W portion of the mineralization and extensions of the main N-S Plomosas Fault remain under-explored.

| __________ |

| 2 Historical production figures according to internal company production reports by IMMSA (Grupo Mexico) |

San Marcial Project

San Marcial is a near-surface, high-grade silver-lead-zinc open pit-amenable project. The Company filed a National Instrument 43-101 (“NI 43-101”) report entitled “San Marcial Project Resource Estimation and Technical Report, Sinaloa, Mexico” having an effective date of March 18, 2019 and an amended date of June 10, 2020 (the “Report”), which contains a 36 Moz AgEq (Indicated) and 11 Moz AgEq (Inferred) resource estimate. The Report was prepared by Todd McCracken and Marcelo Filipov of WSP Canada Inc. and is available on SEDAR. The company recently completed over 320 m of underground development in the San Marcial Resource Area, from which underground drilling is planned to expand the high-grade portions of the resource down-dip. The Company recently discovered additional mineralization in the footwall, outside of the existing resource, and will also be drilling this area. GR Silver Mining is the first company to conduct exploration at San Marcial in over 10 years.

Recent exploration has identified silver and gold mineralization in areas previously defined as non-mineralized, discovering evidence of pervasively altered rocks with intense silicification, veining and associated wide, silver and gold mineralized zones on the footwall of the NI 43-101 resource area.

La Trinidad Project

The La Trinidad Project was acquired in March 2021. While La Trinidad has been the focus of artisanal mining activity over many decades, commercial operations began late in the 20th century. Anaconda Minerals Corp. was first to drill the project in the mid-late 1980s. After initially taking up an option on the Project in 1993, Eldorado Gold Corp. then commenced an open pit gold mine at La Trinidad in 1995, known as the Taunus Pit, with ore being processed via a heap leach operation. The mine operated until 1998, producing approximately 52,000 oz of gold3.

Exploration undertaken by Oro Gold from 2006 identified additional resources below the Taunus Pit and operations recommenced late in 2014. Gold output from the heap leach pads continued until late 2019 for a total cumulative production by Oro Gold of 112,000 oz gold4,5. In addition to La Trinidad, the portfolio acquired by GR Silver Mining includes an extensive regional database of geological, geochemical and geophysical information resulting from historical exploration expenditure by Oro Gold of more than CDN$18.6 M since 2006.

| _________ |

| 3 Refer to Marlin Gold Mining Ltd. 2nd Amended NI 43-101 Technical Report dated February 1, 2013 |

| 4 Refer to Marlin Gold Mining Ltd. MD&A dated April 30, 2015, April 29, 2016, May 1, 2017, April 30, 2018, August 29, 2018 |

| 5 Refer to Mako Mining Corp. MD&A dated August 28, 2019, April 29, 2020 |

Cimarron Project

Cimarron is another advanced stage project that was acquired along with the La Trinidad Project in March 2021 and is located 40 km to the NW of La Trinidad. A number of targets have been identified at Cimarron including Calerita, El Prado, Huanacaxtle, Betty and Veteranos, however Calerita is the only target to have been drilled to date. The near surface historical Inferred Resource at the Calerita prospect contains 3.7 Mt at 0.65 g/t Au for approximately 77,000 oz of gold6, which is considered to be open along strike and down dip.

While the 2011 resource is considered by GR Silver Mining to be a historical resource, the Company considers the resource estimate as being relevant and reliable, considering a lack of significant additional exploration work since its release. A key parameter in the historical resource is the usage of a US$1,200/oz gold price compared to a much higher current spot gold price. A Qualified Person (QP) would be required to review the historical resource report and make recommendations in order to verify and upgrade it to a current resource. A QP has not done sufficient work to classify the historical estimate as current mineral resources. The Company is treating the 2011 resource estimate as a historical estimate. The company plans to re-assess the work completed by previous owners and define the feasibility of additional drilling, aiming at identifying additional near-surface mineralization.

The Plomosas, San Marcial and La Trinidad Projects collectively represent a geological setting resembling the multi-million-ounce San Dimas Mining District which has historically produced more than 600 Moz Ag and 11 Moz Au over a period of more than 100 years.

| _______ |

| 6 Refer to Oro Mining Ltd. NI 43-101 Technical Report dated March 18, 2011 |

Other Projects

GR Silver Mining’s other projects are situated in areas attractive for future discoveries and development in the same vicinity of Plomosas, La Trinidad and San Marcial in the Rosario Mining District. Following the acquisition of Marlin Gold Mining Ltd. (“Marlin”) in March 2021, GR Silver Mining controls a concession portfolio of over 1,000 km2, two previously producing mines fully permitted for future developments and a total combined 75 km of structures with field evidence of 24 Ag-Au veins in historic old workings.

Figure 1: Drone Image – Plomosas Mine Area, Surface Drill Collars and the New Drilling Area known as Plomosas South (CNW Group/GR Silver Mining Ltd.)

Figure 2: Longitudinal Section: Plomosas Mine Area – Planned Resource Area – Exploration Targets (CNW Group/GR Silver Mining Ltd.)

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE