Getchell Gold Corp. Announces Positive Preliminary Economic Assessment Fondaway Canyon Gold Project, NV

Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) (FWB: GGA1) is pleased to announce positive results from the independent Preliminary Economic Assessment completed on the Company’s 100%-owned Fondaway Canyon gold project in Nevada. Based on mineral resources drilled to date and limiting the scope of the PEA to the mineral resources in the Central Area of the Project, the PEA outlines an open pit mining and conventional 8,000 tonne per day milling operation with an initial planned mine life of approximately 10.5 years. The PEA contemplates the production and sale of a high-grade concentrate to a local 3rd party refinery for pressure oxidation or roasting followed by cyanidation to produce doré.

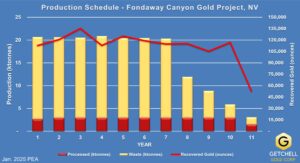

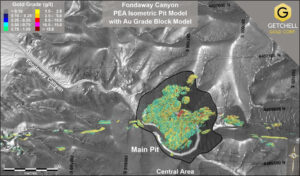

Figure 1: Central Area Main Pit – Final Pit Limit showing gold grade block model (CNW Group/Getchell Gold Corp.)

PEA Highlights

- Strong project economics

- $546 million pre-tax net present valuediscounted at 10% (“NPV10%“) and a 51.2% pre-tax internal rate of return (“IRR”), $474 millionafter-tax NPV10% and a 46.7% after-tax IRR at a gold price of $2,250/ounce (“oz”).

- Initial capital costs estimated at $226.5 million(including a 20% contingency), with a short pre-tax payback of 3.1 years.

- Robust operational profile

- 1.23 million ounces gold recovered over a 10.5-year life of mine (“LOM”) with average annual gold production of 117,300 ounces.

- LOM strip ratio of 4.7 to 1, mined grade of 1.50 g/t Au (0.048 oz/tonne) and estimated gold recovery to concentrate of 84%.

- LOM operating costs (1) estimated at $875/oz of gold produced, cash costs (2) estimated at $1,189oz of produced gold

- Economics incorporate significant development work completed in 2024

- The PEA incorporated the Updated Mineral Resource Estimate (“MRE”) completed in September 2024 that reported an 18-per-cent increase in Indicated Mineral Resources and an 11-per-cent increase in Inferred relative to the previous MRE, based on the inclusion of 8 additional drill holes; and

- Metallurgical test work demonstrating the amenability of the mineralized material to conventional flotation and the generation of a low mass pull, high grade concentrate.

- Significant growth potential

- The scope of the PEA was limited to the open pit mineral resource in the Central Area of the Project, a 1 km square area that:

- represents only a portion of the largely underexplored 7 km long east-west gold corridor, covering a 10 km2prospective area; and

- does not include the Main Pit’s underground mineral resource and the open pit mineral resources outside of the Central Area along the gold corridor that account for approximately 15% of the Project’s current mineral resources.

- All deposits and target zones remain open along strike and at depth, with significant potential for resource expansion.

- The scope of the PEA was limited to the open pit mineral resource in the Central Area of the Project, a 1 km square area that:

“This PEA readily demonstrates the potential for a robust economic open pit mining operation at Fondaway Canyon. In addition, there remain multiple avenues to pursue in 2025 to further improve the economics beyond the current enviable level. There is significant potential to increase the mineral resource within the current minable shape, along strike, and dip, and to optimize the mining and processing of the gold.” stated Mike Sieb, President.

“I have been a committed supporter of the Company for over a decade and a firm believer of the considerable potential of the Fondaway Canyon gold project since acquiring the rights to it in 2020. I am elated as to the potential valuation of the mining operation reported in this PEA as well as the incredible upside for Getchell Gold Corp. and its shareholders that it represents. Our years of effort have been rewarded, with the PEA sharing a glimpse of the ultimate valuation of the Project able to be realized.” stated Bob Bass, Chairman.

Notes on the PEA:

The PEA is preliminary in nature, includes Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that PEA results will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

All amounts are in United States dollars unless otherwise specified. Base case parameters assume a gold price of $2,250 per ounce. NPV is calculated as of the commencement of construction and excludes all pre-construction costs. All figures are displayed on a 100% ownership basis.

(1) Operating costs consist of mining costs, processing costs and mine site G&A.

(2) Cash costs consist of operating costs plus treatment and refining charges and royalties.

(3) AISC consists of cash costs plus sustaining capital (excluding closure costs).

The PEA was prepared by Forte Dynamics Inc., of Fort Collins, Colorado (“Forte Dynamics”) as the lead consultant in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Forte Dynamics was the lead study manager for mine planning, design parameters, and operating and capital cost estimates. The PEA was supported by Forte Analytical Inc. (metallurgical studies, process design, process facilities, and plant site infrastructure) and APEX Geoscience Ltd. (mineral resource estimate). The effective date of the PEA is January 15, 2025, and a technical report for the Project including the PEA will be filed on the System for Electronic Document Analysis and Retrieval (SEDAR) within 45 days of this news release.

PEA Overview and Financial Analysis

The PEA contemplates an open pit operation using contract mining and processing 2.9 million tonnes per annum (“mtpa”) or 8,000 tonnes per day. The mill feed will be trucked from two open pit deposits in the Central Area, which hosts approximately 85% of the Mineral Resources currently defined at Fondaway Canyon.

| Table 1: Economic Parameters | ||||

| Key Assumptions | ||||

| Base Case Gold Price | $2,250/oz | |||

| Production Profile | ||||

| Total Tonnes Processed (mt) | 30.3 | |||

| Total Tonnes Waste (mt) | 143.4 | |||

| Strip Ratio | 4.7 | |||

| Mill Feed Grade | 1.50 g/t Au | |||

| Mine Life | 10.5 years | |||

| Throughput (mtpa) | 2.9 | |||

| Gold Recovery | 84 % | |||

| LOM Gold Production (ounces) | 1,231,408 | |||

| LOM Average Annual Gold Production (ounces) | 117,300 | |||

| Unit Operating Costs | ||||

| LOM Average Operating Costs (1) | $ 875/oz gold | |||

| LOM Average Cash Costs (2) | $ 1,189/oz gold | |||

| Capital Costs | ||||

| Initial Capital Cost | $226.5 million | |||

| Table 2: Project Economics Summary | ||||

| $2,250/oz Gold Price | $2,500/oz Gold Price | |||

| Pre-Tax | After-Tax | Pre-Tax | After-Tax | |

| NPV5% ($M) | $ 761 | $ 668 | $ 990 | $ 849 |

| NPV8% ($M) | $ 622 | $ 543 | $ 821 | $ 701 |

| NPV10% ($M) | $ 546 | $ 474 | $ 727 | $ 618 |

| NPV12% ($M) | $ 479 | $ 414 | $ 646 | $ 547 |

| IRR | 51.2 % | 46.7 % | 63.9 % | 57.0 % |

| Payback | 3.1 years | 3.2 years | 2.6 years | 2.8 years |

| LOM Cash Flow | $1,080 million | $953 million | $1,379 million | $1,190 million |

| Table 3: Economic Sensitivity to Gold Price | ||||

| Gold Price (US$/oz) | $2,000 (Low Case) | $2,250 (Base Case) | $2,500 (High Case) | $2,750 (Spot Price) |

| Pre-Tax NPV10% | $ 365 M | $ 546 M | $ 727 M | $ 908 M |

| Pre-Tax IRR | 38.2 % | 51.2 % | 63.9 % | 76.4 % |

| Pre-Tax Payback | 3.5 years | 3.1 years | 2.6 years | 2.4 years |

| After-Tax NPV10% | $ 322 M | $474 M | $ 618 M | $ 760 M |

| After-Tax IRR | 35.5 % | 46.7 % | 57.0 % | 66.9 % |

| After-Tax Payback | 3.6 years | 3.2 years | 2.8 years | 2.6 years |

Mine Plan and Minable Resource Estimate

The open pit optimization model yielded a series of nested pit shells that prioritize the extraction of the most economically viable and most economically robust material shown below. The mine will be developed in consecutive phases to manage the operating stripping ratio and to provide consistent mill feed. The final pit limit and 3D gold grade block model encapsulated within the pit is shown in Figure 1.

The pit shell selected as the optimal pit shell contains a total tonnage of 173.7 Mt including 11.7 Mt of Indicated Mineral Resource at 1.73g/t, and 18.7 Mt of Inferred Mineral Resource at 1.36g/t to be processed for 1.47 Moz of contained gold.

Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. There has been insufficient exploration to define the Inferred Resources tabulated above as an Indicated or Measured Mineral Resource, however, it is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. There is no guarantee that any part of the Mineral Resources discussed herein will be converted into a Mineral Reserve in the future.

The production schedule is based on a nominal rate of 8,000 t/d processed (2.9 Mt/y) and the average LOM stripping ratio is 4.7:1 waste-to-processed material, using a 0.5 g/t Au cut-off grade. The annual production schedule is shown in Figure 2.

Metallurgical Testing and Recoveries

A conceptual flotation plant was designed, with the facility processing oxide and sulfide mineralization. The PEA utilized recoveries estimated across the material types for an average gold recovery to concentrate of 84%.

Determination of the appropriate recovery value was based on historical test work completed in conjunction with a scoping level metallurgical study carried out through 2024 to advance the project by developing a conceptual process flowsheet for the oxide and sulfide material. The 2024 metallurgical test work was conducted on coarse reject material partitioned at various gold grade thresholds (i.e. average grade: 1.50 g/t Au, high grade: 5.0 g/t Au, and low grade: 0.5 g/t Au), and average grade split drill core material all sourced from the Company’s most recent drill campaigns.

The recent scoping level metallurgical study evaluated several processing options following the test work on deportment of gold which indicated that much of the gold was refractory and associated with pyrite. Both oxide and sulfide minerals can be readily floated to produce a concentrate containing about 84% of the contained gold. With additional test work, the concentrate may be upgraded to reduce concentrate weight and increase the gold grade of the concentrate. Additional metallurgical test work is recommended for Fondaway Canyon to optimize the flotation process and to confirm the process design, costs, and final recovery.

Mineral Processing

A processing throughput of 8,000 tpd was selected aimed at maximizing gold recovery in conjunction with minimizing concentrate mass pull (which must be confirmed with additional test work), and on minimizing capital expenditure and operating costs.

The process flowsheet will consist of three stages of crushing followed by ball mill grinding, rougher flotation, and two stages of cleaner flotation to produce a high value concentrate. The reagents, namely xanthate, AP 404 and AF 65 will be added to the mill.

A review of the CAPEX and OPEX for various processing options indicated that the most promising approach at this stage of the study is to produce a gold-rich concentrate (± 20 g/t Au) and ship/sell it to a processing facility in Nevada.

Capital Costs

An initial capital expenditure of $226.5 million (including 20% contingency) has been estimated to construct the Project. Due to the use of contract mining and the 10 years life of the plant, sustaining capital has not been considered in this study. Maintenance is considered to be within the operating expenses. The capital cost estimate is based on an open pit mining and flotation mill operation processing 2.9 mtpa utilizing contract mining. Capital costs are based published industry averages in the US and are shown in the table below.

| Table 4 Order of Magnitude Capital Cost Estimate | |

| Capital Costs $M | |

| Process Capital Cost Mine Model | $ 131.7 |

| Preproduction and Facilities | $ 57.0 |

| Capex summary | $ 188.7 |

| Contingency (20%) | $ 37.7 |

| Total Capex | $ 226.5 |

Operating Costs

The Project is modelled as an open pit mine utilizing contract mining with mined material trucked to a plant for crushing, milling, and flotation concentration. The PEA contemplates the production and sale of a high-grade concentrate to a local 3rd party pressure oxidation refinery for final processing. Costs for transportation, oxidation, leaching, refining, and profit for a 3rd party is included in the operating cost.

Operating costs for the life-of-mine are estimated at $1,077.5 million ($875.0/oz produced). Cash costs over that time are estimated at $1,464.0 million ($ 1,188/oz produced) and include operating costs, refining charges, and royalties.

| Table 5 Operating Cost Estimate | |||

| Operating Costs | $/tonne Mined |

LOM ($M) | $/oz Au

Produced |

| Mining to Process | $ 3.54 | $ 107.4 | $ 87.2 |

| Mining Waste | $ 3.54 | $ 507.4 | $ 412.1 |

| Processing | $ 13.25 | $ 402.0 | $ 369.6 |

| Mine Site G&A | $ 2.00 | $ 60.7 | $ 49.3 |

| Total Operating Costs: | $ 1,077.5 | $ 875.0 | |

| Transportation and Refining | $ 10.00 | $ 303.4 | $ 246.4 |

| Royalties | 3 % | $ 83.0 | $ 67.5 |

| Total Cash Costs: | $ 1,464.0 | $ 1,188.9 | |

Mineral Resource Estimate

The PEA is supported by the 2024 Updated Mineral Resource Estimate (“2024 MRE”) produced by APEX Geoscience Ltd. of Edmonton, Alberta, with an effective date of September 1, 2024.

| Table 6 Fondaway Canyon Global Mineral Resource Estimate | ||||||

| Classification | Au cutoff (g/t) |

Category | Tonnes | Au

(ounces) |

Au (g/t) |

Au (opt) |

| Indicated | 0.3 | Open Pit (OP) | 13,518,000 | 648,000 | 1.49 | 0.043 |

| Inferred | 0.3/1.75 | OP + UG | 44,829,000 | 1,670,100 | 1.16 | 0.034 |

The PEA solely utilized the open pit mineral resources of the Central zone as a basis for the economic model. The PEA did not include the additional 335,000 Inferred mineral resources reported outside of this zone, consisting of the Central zone’s underground and all other open pit Inferred resources reporting along the Fondaway canyon gold corridor.

| Table 7 Fondaway Canyon Mineral Resource Estimate* by Zone | |||||||

| Classification | Zone | Au cutoff (g/t) |

Category | Tonnes | Au (ounces) |

Au (g/t) |

Au (opt) |

| Indicated | Central | 0.3 | Open Pit | 13,518,000 | 648,000 | 1.49 | 0.043 |

| Central | 1.75 | Open Pit | 37,983,000 | 1,334,900 | 1.09 | 0.032 | |

| Mid Realm – South Mouth | 0.3 | Open Pit | 2,516,000 | 77,000 | 0.95 | 0.028 | |

| Inferred | Silica Ridge – Hamburger Hill (HH) | 0.3 | Open Pit | 2,977,000 | 139,000 | 1.45 | 0.042 |

| Central / Silica Ridge – HH | 0.3 | Underground (UG) | 1,353,000 | 119,200 | 2.74 | 0.080 | |

| Total Inferred: | 0.3 / 1.75 | OP & UG | 44,829,000 | 1,670,100 | 1.16 | 0.034 | |

*Notes on the 2024 Mineral Resource Estimate are provided below.

Oxide Cap

In addition, the 2024 MRE delineated a significant near surface oxide cap to the mineral resource in Table 89.

| Table 8 Fondaway Canyon Mineral Resource Estimate* by Type | |||||||

| Classification | Type | Au cutoff (g/t) |

Category | Tonnes | Au

(ounces) |

Au (g/t) |

Au (opt) |

| Indicated | Oxide | 0.3 | Open Pit (OP) | 1,902,000 | 75,500 | 1.23 | 0.036 |

| Sulphide | 0.3 | Open Pit | 11,616,000 | 572,500 | 1.53 | 0.045 | |

| Inferred | Oxide | 0.3 | Open Pit | 3,848,000 | 129,200 | 1.04 | 0.030 |

| Sulphide | 0.3/1.75 | OP + UG | 40,981,000 | 1,540,900 | 1.17 | 0.034 | |

The full documentation for the 2024 MRE will be reported within the forthcoming PEA.

Notes on the Mineral Resource Estimate:

- Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. There has been insufficient exploration to define the Inferred Resources tabulated above as an Indicated or Measured Mineral Resource, however, it is reasonably expected that the majority of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. There is no guarantee that any part of the Mineral Resources discussed herein will be converted into a Mineral Reserve in the future. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. The Mineral Resources herein were estimated using the Canadian Institute of Mining, Metallurgy and Petroleum standards on mineral resources and reserves, definitions, and guidelines prepared by the CIM standing committee on reserve definitions and adopted by the CIM council (CIM 2014 and 2019).

- The Mineral Resources Estimate is underpinned by data from 527 reverse circulation and diamond drillholes totaling 55,870m of drilling that intersected the mineralized domains.

- The mineral resource is reported at a lower cut-off of 0.3 g/t Au for the conceptual open pit and 1.75 g/t Au for the conceptual underground extraction scenario. The lower cut-off grades and potential mining scenarios were calculated using the following parameters: mining cost = US$2.70/t (open pit); G&A = US$2.00/t; processing cost = US$15.00/t; recoveries = 92%, gold price = US$1,950.00/oz; royalties = 1%; and minimum mining widths = 1.5 metres (underground) in order to meet the requirement that the reported Mineral Resources show “reasonable prospects for eventual economic extraction”.

- Original Au assays were composited to 1.5 m with 12,553 composites generated overall in the mineralized domains including 10,632 composites generated for the Central Zone, 1,267 for the Mid-Realm / South Mouth Zone, and 654 for the Silica Ridge / Hamburger Hill Zone.

- Grade interpolation was performed by ordinary kriging (OK) using 1.5 metre composites (block size of 3m x 3m x 3m).

- A density of 2.74 g/cm3 was used for the mineralized zones.

- The mineral resources estimate is categorized as indicated or inferred and classified based on data density, data quality, confidence in the geological interpretation and confidence in the robustness of the grade interpolation. The indicated category was defined by a search ellipse extending 55m along the major axis, 40m along the minor axis, and 10m vertical. In addition, a minimum of 3 drill holes were required, reporting 9 samples with a maximum of 3 samples per drill hole. The inferred category was defined using a search of up to 120 m and requiring at least 1 sample per drillhole from a minimum of 2 drillholes.

- High-grade capping supported by statistical analysis was completed on composite data for each zone and was established at 32 g/t Au for the Central Zone, no Au cap for the Mid Realm – South Mouth Zone, and 10.0 g/t Au for the Silica Ridge – Hamburger Hill Zone.

- The MRE blocks that make up the oxide component of the In Pit resource are within the overall conceptual pit shape defined by the parameters for the unoxidized material.

- The number of metric tonnes was rounded to the nearest thousand and gold ounces was rounded to the nearest hundred, and any discrepancies in the totals are due to rounding effects. Metal content is presented in troy ounces (tonnes x grade (g/t) / 31.10348).

- The author is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political or marketing issues or any other relevant issue not reported in the technical report that could materially affect the mineral resource estimate.

The Qualified Persons

The independent and qualified person for the mineral resource estimate, as defined by NI 43-101, is Michael Dufresne, P.Geol., P.Geo., from APEX Geoscience Ltd.

The qualified person overseeing the minable resource estimate used for the economic analysis is Jonathan R. Heiner, SME-RM, from Forte Dynamics, Inc.

The qualified person overseeing the metallurgical testing and mineral processing is Deepak Malhotra, SME-RM, from Forte Dynamics, Inc.

The qualified person overseeing the overall Preliminary Assessment and the economic analysis is Donald E. Hulse, SME-RM, from Forte Dynamics, Inc.

The Qualified Person (as defined in NI 43-101) who reviewed and approved the scientific and technical information in the news release is Scott Frostad, P.Geo., VP Exploration at Getchell Gold Corp. and is non-independent.

About Getchell Gold Corp.

The Company is a Nevada focused gold and copper exploration company trading on the CSE: GTCH, OTCQB: GGLDF, and FWB: GGA1. Getchell Gold is primarily directing its efforts on its most advanced stage asset, Fondaway Canyon, a past gold producer with a large mineral resource estimate. Complementing Getchell’s asset portfolio is Dixie Comstock, a past gold producer with a historic resource, and the high-grade Star (Cu-Au-Ag) projects.

For further information please visit the Company’s website at www.getchellgold.com or contact the Company at info@getchellgold.com.

MORE or "UNCATEGORIZED"

Eloro Resources Announces Closing of Bought Deal LIFE Private Placement for Gross Proceeds of C$17 Million

Eloro Resources Ltd. (TSX: ELO) (FSE: P2QM) is pleased to announce the closing of its previously an... READ MORE

Minera Alamos Updates Resources and Reserves for the Pan Gold Mine in Nevada

Minera Alamos Inc. (TSX-V: MAI) (OTCQX: MAIFF) is pleased to announce updated Mineral Resource and M... READ MORE

Ero Copper Reports Fourth Quarter and Full Year 2025 Operating and Financial Results

Ero Copper Corp. (TSX: ERO) (NYSE: ERO) is pleased to announce its operating and financial results f... READ MORE

Rare Element Resources Announces Results of Oversubscribed Rights Offering of Common Shares

Rare Element Resources Ltd. (OTCQB: REEMF) is pleased to report that its previously announced... READ MORE

TRX Gold Reports Record Q2 2026 Production and Company Update

TRX Gold Corporation (TSX: TRX) (NYSE American: TRX) is pleased to announce preliminary resu... READ MORE