Gaia Metals Intercepts 4.11 g/t Gold and 33.0 g/t Silver over 12 m in Drill Hole at the Freeman Creek Gold Property, Idaho, USA

Gaia Metals Corp. (TSX-V: GMC) (OTCQB: RGDCF) (FSE: R9G) is pleased to announce drill results from the Company’s maiden drill program at the Freeman Creek Gold Property, located in Idaho, USA. The program achieved its primary objective of locating and confirming the precious metal mineralized intersection reported from historical rotary drill hole RDH-8 with a 12 m intersection of 4.11 g/t Au and 33.0 g/t Ag in FC20-003, within a wider interval of 1.12 g/t Au and 9.0 g/t Ag over 47.6 m starting from surface.

Highlights include:

- 1.12 g/t Au and 9.0 g/t Ag over 47.6 m starting from surface (drill hole FC20-003), including

- 4.11 g/t Au and 33.0 g/t Ag over 12.0 m

- 0.46 g/t Au and 7.6 g/t Ag over 14.1 m starting from surface (drill hole FC20-002), including

- 2.08 g/t Au and 18 g/t Ag over 2.0 m

- 0.56 g/t Au and 19.3 g/t Ag over 9.0 m (drill hole FC20-001)

President & Director Blair Way commented: “Our reconnaissance drill program at Gold Dyke has given us a much better understanding of the geology and controls on the higher-grade precious metal mineralization present near-surface. This data ratifies our prognosis for mineralisation at the Gold Dyke Prospect and we are very excited to follow-up on the strong intersection in FC20-003, as well as the new high-grade gold-silver discovery in outcrop located to the north. In combination with our surface exploration and drill plans at the Carmen Creek Prospect on the Property, and our plans to advance our Quebec properties, the Company is positioned for an exciting 2021.”

The drill program, comprised of four HQ-sized diamond drill holes totalling 457 m, targeting the Gold Dyke Prospect, which is located entirely on BLM lands, and outside of US Forest Service Lands and other protected areas.

The results of the drill program (see Table 1) support the interpretation that a wide-spread, low-grade gold mineralized envelope is present at the Gold Dyke Prospect, but which also contains a high-grade component of unknown extent. This is further supported by area geochem which outlines an extensive 800 m by 700 m gold soil anomaly (see news release dated October 13th, 2020). The high-grade precious metal mineralization present in drill hole at Gold Dyke is indicated to be primarily associated with quartz veining rich in sulphide (pyrite, galena, sphalerite) hosted within heavily altered metasediments (Figure 1).

Table 1: Summary of mineralized drill hole intersections at the Gold Dyke Prospect

| Hole ID | From (m) | To (m) | Interval (m)1 | Au (g/t) | Ag (g/t) | Au(Eq)2 | |

| FC20-001 | 0.0 | 37.0 | 37.0 | 0.22 | 6.8 | 0.32 | |

| incl. | 4.0 | 13.0 | 9.0 | 0.56 | 19.3 | 0.83 | |

| FC20-002 | 0.9 | 15.0 | 14.1 | 0.46 | 7.6 | 0.57 | |

| incl. | 3.0 | 5.0 | 2.0 | 2.08 | 18.0 | 2.33 | |

| 26.0 | 26.5 | 0.5 | 3.88 | 4.0 | 3.94 | ||

| 40.0 | 41.0 | 1.0 | 1.60 | 0.5 | 1.61 | ||

| FC20-003 | 0.4 | 48.0 | 47.6 | 1.12 | 9.0 | 1.25 | |

| incl. | 8.0 | 20.0 | 12.0 | 4.11 | 33.0 | 4.57 | |

| or | 15.0 | 17.0 | 2.0 | 10.91 | 74.5 | 11.96 | |

| FC20-004 | 18.0 | 26.8 | 8.8 | 0.13 | 4.8 | 0.20 | |

| 1. True width of mineralization is not known. | |||||||

| 2. Au(Eq) calculation based on $1,850/oz Au and $26/oz Ag, assumes 100% recovery.

|

|||||||

Figure 1: High-grade drill core intersection in FC20-003

The orientation of the high-grade gold mineralized horizon at Gold Dyke is unconstrained. Although the step-out hole east of FC20-003 returned appreciable gold mineralization (peak of 0.72 g/t Au, FC20-004), it was lower in overall grade. Due to ground conditions at the time of the program, drill holes FC20-003 and 004 where not drilled to their original target depth of ~150 m (see Table 2). A combination of elevation and orientation of the targeted mineralized horizon resulted in drill hole FC20-004 possibly missing the extension of the high-grade zone returned from FC20-003 (4.11 g/t Au and 33 g/t Ag over 12 m).

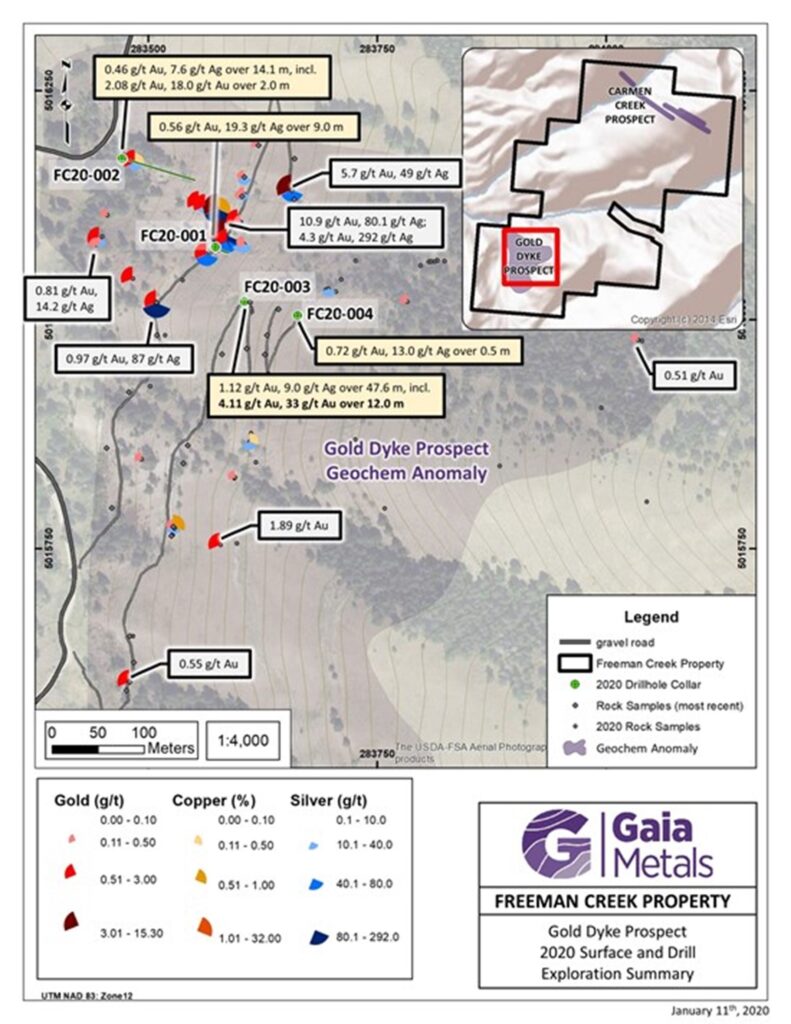

When considered with the results of the recent surface sampling completed during drill access construction (see news release dated January 7th, 2021), the high-grade mineralized horizon may also trend near surface in a general northeast-southwest direction. This is supported by surface sample results in outcrop of 5.7 g/t Au and 49 g/t Ag, and 0.97 g/t Au and 87 g/t Ag located approximately 130 m northeast and 95 m west, respectively, of drill hole FC20-003. Both of these outcrop areas remain to be drill tested by the Company (Figure 2).

Table 2: Attribute summary for 2020 drill holes

| Hole ID | Core Size | Strike (°) | Dip (°) | Total Depth |

| FC20-001 | HQ | n/a | 90 | 148.5 |

| FC20-002 | HQ | 110 | 55 | 145.4 |

| FC20-003 | HQ | n/a | 90 | 78.3 |

| FC20-004 | HQ | n/a | 90 | 84.7 |

As next steps, the Company intends to incorporate the surface and drill data from Gold Dyke into an updated geological model for the area and refine pad locations for a follow-up phase of drilling. In addition, an IP-resistivity survey is being considered due to the strong association of sulphide in the mineralized quartz veining. The Company is fully permitted to carrying out a follow-up phase of drilling at Gold Dyke in 2021, pursuant to its declared Notice of Intent on file with the BLM.

Figure 2: 2020 drill hole locations and core analysis summary

QA/QC Analytical Procedures

A Quality Assurance / Quality Control protocol following industry best practices was incorporated into the program and included systematic insertion of quartz blanks and certified reference materials into sample batches, as well as collection of quarter-core duplicates, at a rate of approximately 5%. No check analysis by a secondary lab has been completed. All drill core samples were collected as half-split core, apart from quarter-split duplicates.

All samples, including quartz blanks and certified reference materials, were shipped by ground to SGS Canada Inc’s laboratory in Burnaby, BC for multi-element analysis (including Ag) by sodium peroxide fusion and ICP-MS finish (code GE_IMS90A50), and Au analysis by fire assay and AAS finish (code GE_FAA30V5). Overlimits for Au (>10 g/t) and Ag (>200 g/t) were determined by gravimetric analysis (codes GO_FAG30V and GO_FAG37V, respectively).

Qualified Person

Darren L. Smith, M.Sc., P. Geo., Vice President of Exploration for the Company and Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

About Gaia Metals Corp.

Gaia Metals Corp. is a mineral exploration company focused on the acquisition and development of mineral projects containing base and precious metals, including platinum group elements, and lithium.

The Company’s flagship asset is the Freeman Creek Gold Property, located in Idaho, USA. The Property hosts two major advanced targets; the Gold Dyke Prospect, with a historical drill intercept of 1.5 g/t Au and 12.1 g/t Ag over 44.2 m (RDH 8), and the Carmen Creek Prospect, with surface sample results including 25.5 g/t Au, 159 g/t Ag, and 9.75% Cu.

Additional assets include the wholly owned Corvette Property, and the FCI Property (held under Option from O3 Mining Inc.) located in the James Bay Region of Quebec. The properties are contiguous and host significant gold-silver-copper-PGE-lithium potential highlighted by the Golden Gap Prospect with grab samples of 3.1 to 108.9 g/t Au from outcrop and 10.5 g/t Au over 7 m in drill hole, the Elsass and Lorraine prospects with 8.15% Cu, 1.33 g/t Au, and 171 g/t Ag in outcrop, and the CV1 Pegmatite Prospect with 2.28% Li2O over 6 m in channel.

In addition, the Company holds the Pontax Lithium-Gold Property, QC; the Golden Silica Property, BC; and the Hidden Lake Lithium Property, NWT, where the Company maintains a 40% interest, as well as several other assets in Canada.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE