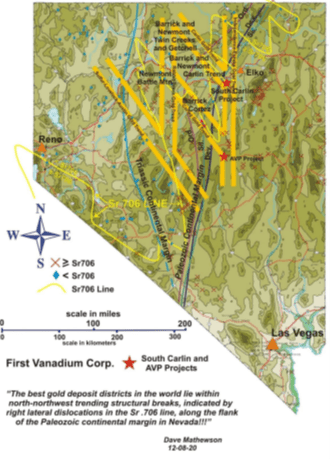

First Vanadium Options Gold Property from Mathewson in Battle Mtn – Eureka Gold Trend, Nevada

First Vanadium Corp. (TSX-V: FVAN) (OTCQX®: FVANF) (FSE: 1PY) is pleased to announce that it is selectively strengthening its gold portfolio in Nevada by signing an Option Agreement exclusively with Dave Mathewson for a property he has held and planned to drill himself for a number of years in the Battle Mountain – Eureka Gold Trend. The option of the AVP Property will further strengthen Dave Mathewson’s position and engagement in First Vanadium Corp. with additional stock in the Company and will spearhead and supervise the exploration on both AVP Property and the Carlin Vanadium-Gold Project.

Paul Cowley, President & CEO states, “We are very pleased to add this high-quality opportunity from Dave Mathewson who obviously has a proven eye for good gold prospects in Nevada. The terms are modest to manage, still allowing us to focus the bulk of our treasury on drilling the Carlin Vanadium-Gold Project. The Company plans to conduct a ground magnetics and gravity survey in early spring on AVP, followed by reverse circulation drilling in 5-10 holes in 1,500m (5,000ft) this summer. Drilling in the 1980’s on AVP suggests mineralization remains open in almost all directions and according to Dave Mathewson, may represent the tip of the iceberg.”

Mr. Mathewson is a renowned Nevada gold specialist and former Newmont Mining Corporation Regional Exploration Manager. Mr. Mathewson was instrumental in several significant gold discoveries in the Rain and Railroad Mining Districts in the southern portion of the Carlin Gold Trend. During the 1990’s while at Newmont, Mr. Mathewson led the team which discovered the Tess, Northwest Rain, Saddle, and South Emigrant gold deposits in the Rain District, which total over 4 million ounces of gold. In 2009, he was a founder of Gold Standard Ventures Corp. (GSV-TSX and NYSE) and served as its Vice President of Exploration until 2015. During this period, his exploration team discovered the North Bullion gold, Bald Mountain gold and copper, and Sylvania silver and copper deposits, as well as acquired the Pinion gold deposit, all in the Railroad District.

The AVP claim group, comprised of 40 unpatented lode claims, is located 23 kilometres southwest of Eureka, Nevada, within the southern extension of the Battle Mtn – Eureka Gold Trend and is specifically on the southern extension of the Cortez-Gold Bar Trend. The Battle Mtn – Eureka Gold Trend rivals the Carlin Gold Trend in gold production and prospectivity. Access around the entire AVP Property is easily obtained via existing roads and 2-track trails. The prospect area covers a 3.6 kilometre north-south stretch of the Mahogany range margin which exhibits silicified limestone but much is covered by a generally thin veneer of post-mineral gravel.

In the early 1980’s, Bear Creek Exploration, the exploration arm of Kennecott, drilled 10 shallow (152m, 500ft) vertical holes in 9 sites over an area of about ½ square kilometre. Bedrock was encountered in all holes from depths of 12.2m (40ft) to a maximum of 126.5m (415ft). Four of the drill holes encountered favorable limestone host with significantly anomalous gold. One hole encountered 16.8m (55ft) of 0.5g/t Au (0.015ozAu/st), including 1.5m (5ft) of 1.23g/t Au (0.036ozAu/st). No follow-up drilling has been done since.

AVP Transaction

The Company has signed a five-year option agreement with Nevada Gold Ventures, LLC exclusively owned by Dave Mathewson, whereby the Company has the option to acquire a 100% interest in the AVP Property by completing the following cash payments and share issuances to Nevada Gold and incurring the following exploration expenditures on the property:

- a) On signing of an Option Agreement, pay US$25,000;

- b) On receipt of approval from TSX Venture Exchange issue 250,000 First Vanadium common shares;

- c) On or before the first anniversary of TSX-V approval, spend US$250,000 in work commitments and issue an additional 250,000 common shares;

- d) On or before the second anniversary of TSX-V approval, spend an additional US$250,000 in work commitments and issue an additional 250,000 common shares;

- e) On or before the third anniversary of TSX-V approval, spend an additional US$250,000 in work commitments and issue an additional 250,000 common shares;

- f) On or before the fourth anniversary of TSX-V approval, spend an additional US$250,000 in work commitments, issue an additional 500,000 common shares and pay US$25,000, and;

- g) On or before the fifth anniversary of TSX-V approval, spend an additional US$1,000,000 in work commitments.

Nevada Gold will retain a 3% Net Smelter Return Royalty on any mineral products derived from the AVP Property. First Vanadium will have the right to purchase up to a 2% NSR for US$1.0 million for each 1% NSR prior to commencing commercial production, leaving Nevada Gold with a 1% NSR. The proposed transaction is subject to the acceptance of the TSX-V.

About First Vanadium Corp.

First Vanadium has an option to earn a 100% interest in the Carlin Vanadium Project, located in Elko County, 6 miles south from the town of Carlin, Nevada and Highway I-80. The Project lies in the Carlin Gold Trend. Approximately 9 million ounces comprised of multiple gold deposits, including past producing mines, are present near the FVAN property (5-15km). The Carlin Vanadium-Gold Project also hosts the Carlin Vanadium deposit.

MORE or "UNCATEGORIZED"

Koryx Copper Intersects 338.61 Meters At 0.38% Cu Eq Including 230.61 Meters At 0.45% Cu Eq and Multiple 2 Meters Intersections Over 1.00% Cu Eq

Significant copper and molybdenum intersections include: HM09: 13... READ MORE

Aya Gold & Silver Reports Q1-2024 Results; Maintains Guidance; Zgounder Expansion on Track

Aya Gold & Silver Inc. (TSX: AYA) (OTCQX: AYASF) is pleased t... READ MORE

Silver Mountain Delivers Positive Preliminary Economic Assessment For Its Reliquias Project, Peru; Pre-Tax NPV 5% Of C$107 million, Pre-Tax IRR Of 57%, And Payback Of 1.8 Years

Key Highlights – Preliminary Economic Assessment Pre-Tax Net Pr... READ MORE

ARIS MINING REPORTS Q1 2024 RESULTS WITH SEGOVIA GENERATING $13.8 MILLION IN OPERATING CASH FLOW

Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) announces its ... READ MORE

Orla Mining Reports First Quarter 2024 Results

Orla Mining Ltd. (TSX: OLA) (NYSE: ORLA) announces the results fo... READ MORE